This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

DAI

Dai Stablecoin price

0x6b17...1d0f

$0.0052200

+$0.000042969

(+0.83%)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about DAI today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

DAI market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$231.59M

Network

PulseChain

Circulating supply

44,365,151,087 DAI

Token holders

0

Liquidity

$1.71M

1h volume

$18.14K

4h volume

$67.98K

24h volume

$1.32M

Dai Stablecoin Feed

The following content is sourced from .

Most people only look at the price chart…

But that’s not the full story.

Look at $INJ even during a tough market, it kept growing.

It kept launching new projects.

It kept building real use cases.

It kept showing strength.

That’s the power of fundamentals.

Price is just one piece of the puzzle. Don't ignore the rest.

@injective @Injective_Hub

【MemeX Renaissance】Building a digital pyramid in the lightning era

@MemeX_MRC20 — A century-old brand on the blockchain

■ My insight: This project is playing "time arbitrage." While others use AI to generate 1000 NFTs in a minute, they require creators to first replicate the "Mona Lisa" for three months to qualify for creation — a contemporary digital art Shaolin Temple.

Three major time paradoxes:

🗝️ 【Creation Time Bonds】

Collateralize unfinished works to obtain DAI loans

But interest rates increase over time

Magical realism: Some lock themselves in VR studios to repay loans

🌌 【Emotional Time Machine】

Anger points from 2021 can now be exchanged for new coins in 2024

The community is crowdfunding to build a "cross-temporal emotional hedge fund"

Latest proposal: Freeze FUD emotions until the bull market thaws

☯️ 【Anti-Liquidity Pool】

Each transaction adds a 24-hour cooling-off period

The more transactions, the higher the fees

Resulting in the emergence of a "holding coin meditation" subculture

The mystery of digital mummies:

✔️ Achieving "digital immortality" through multi-signature contracts

✔️ Spontaneous meme repair guilds have emerged

✔️ A certain collectible triggered hidden attributes due to being inherited by 32 generations

@KaitoAI @Wanamaker_X #Yap #MemeX $M #KaitoYap

OpenLedgerHQ: The "Ant Group" model of on-chain business: This is the real reason a16z is betting on it—financialized AI labor force

@OpenLedgerHQ The most attractive part is not the technology, but turning AI agents into:

• Collateralizable on-chain assets (buy quality agents with Dai)

• Securitized cash flows (NFTs of agent revenue rights)

• Leverageable credit vehicles (using historical data for lending ratings)

My projection:

Phase One: As mentioned in the tweet, agents help projects save money.

Phase Two: The emergence of "agent hedge funds" that package AI investment portfolios from different industries.

Ultimate form: The revenue rights of AI agents become underlying assets in DeFi, triggering a "computing power subprime crisis."

Warning:

When an agent's on-chain resume shows "has served the Luna ecosystem"—should its NFT badge be priced at a premium or go to zero?

#Kaito #Cookie #Openledger @KaitoAI

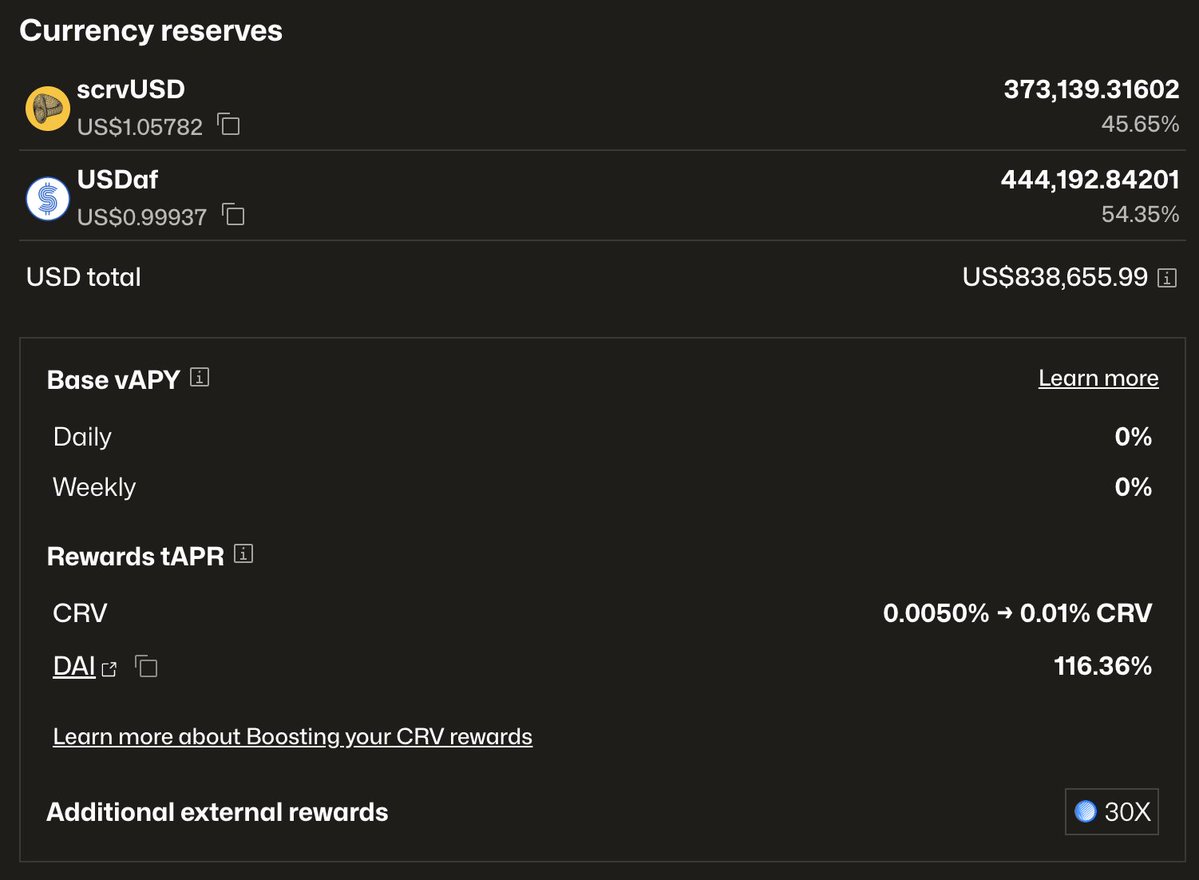

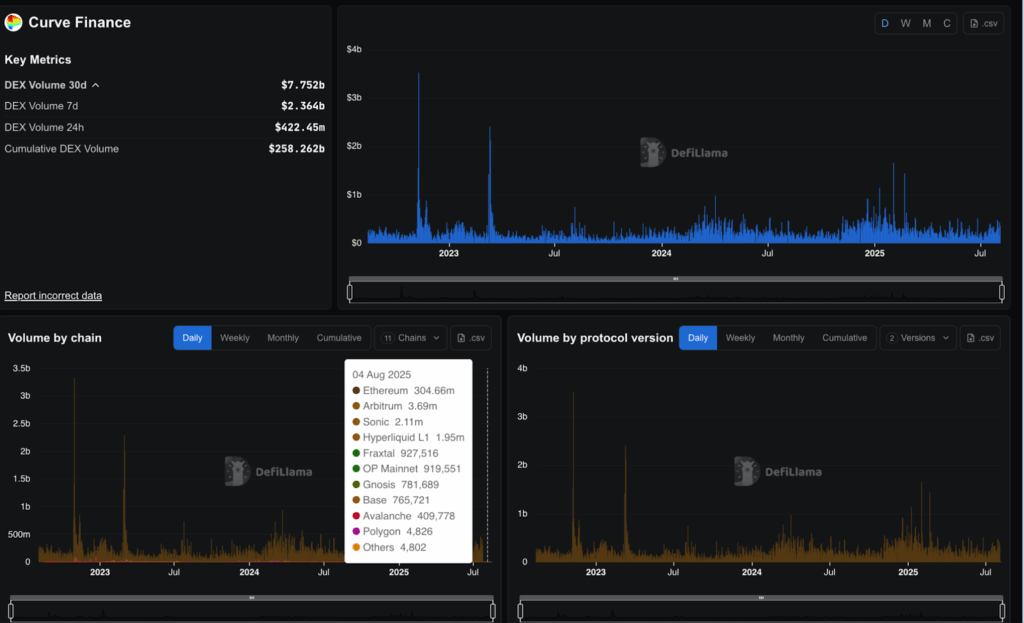

Curve Finance Swaps on Arbitrum Could Vanish in Coming Months: Here’s Why

Key Insights:

Curve Finance’s Arbitrum usage has dropped below 2% of its total TVL, raising sustainability concerns.

A new proposal suggests cutting all L2 developments due to low returns across 24 chains.

Ethereum continues to dominate Curve’s fees, volume, and governance focus; L2s are barely holding on.

Curve Finance, a decentralized exchange (DEX) known for stablecoin and low-slippage swaps, might be closing shop on Arbitrum, and possibly other Layer 2 (L2) networks too.

A new proposal on Curve’s governance forum suggests killing off all future L2 deployments. And if you check the numbers, that call isn’t coming out of nowhere.

Arbitrum TVL Is Shrinking Fast

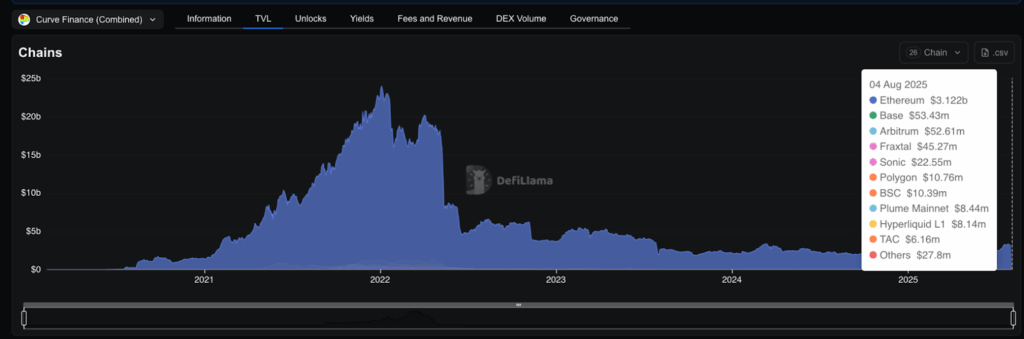

To understand what’s going wrong, start with total value locked (TVL), which shows how much money users have deposited into Curve’s smart contracts.

On August 4, Curve’s TVL on Arbitrum stood at just $52.6 million. For comparison, Ethereum, the original base chain for Curve, had over $3.1 billion. That’s not a typo. Arbitrum now makes up barely 1.6% of Curve’s total TVL, and it’s dropping.

Curve finance TVL by chain- Source: DeFiLlama

Arbitrum is one of the most popular Ethereum L2s, offering cheaper and faster transactions by offloading data from Ethereum’s main chain.

Yet despite its broader adoption, Curve’s presence there is fading. Other chains like Base, Fraxtal, and Sonic aren’t doing much better either.

Curve’s TVL on all L2s combined is less than 3% of its Ethereum TVL. That’s a major warning sign for Curve on Arbitrum and its other L2 deployments.

TVL tells you where the money is parked, but what about activity? Let’s look at Curve’s 24-hour DEX volume on August 4. Ethereum pulled in $304 million. Arbitrum?

Just $3.6 million. Even Sonic, a much newer chain, clocked $2.1 million. That’s not just bad; it’s borderline irrelevant in the bigger picture.

Curve finance DEX volume Source: DeFiLlama

DEX volume measures how much trading actually happens.

Curve specializes in stablecoin swaps like USDC, USDT, DAI, and crvUSD, and typically thrives on high, consistent volume. But Arbitrum isn’t delivering.

When you zoom out to 30-day DEX volume, Curve processed about $7.7 billion overall. The bulk came from Ethereum. Arbitrum didn’t even scratch the surface. Its role as a trading hub for Curve is quickly fading.

Proposal To Cut All Curve Finance L2 Work Gains Momentum

These numbers have sparked a serious governance proposal titled “Cut all further or ongoing L2 developments.” In Curve Finance, token holders vote on such proposals using veCRV, its locked governance token.

This post argues that developing and maintaining Curve’s presence across 24 different L2s is a huge time sink with little reward.

Curve community talks about discontinuing L2 development: Source: Curve Finance

According to one comment on the proposal, these 24 L2s combined bring in only $1,500 of daily revenue. That’s just $62 per day per L2.

Curve’s Ethereum pools, in contrast, generate $28,000 per day on a slow day. That means Ethereum alone performs like 450 L2s stitched together. From a resource allocation standpoint, the decision is almost a no-brainer.

Curve Finance Revenue Data Supports This Move

The broader revenue and fee breakdown backs this up. Over the past 30 days, Curve generated $2.72 million in fees and $1.67 million in revenue. Ethereum was the main driver. Since launch, Curve has pulled in a cumulative $171 million in revenue.

Curve finance fees- Source: DeFiLlama

While Curve has three major services: its core DEX, its stablecoin crvUSD, and the lending platform LlamaLend, most of the daily fees still come from the DEX. L2 platforms like Arbitrum barely show up in fee distribution charts. That’s a problem for long-term sustainability and developer incentives.

Curve fees by protocol- Source: DeFiLlama

It’s Not Just Arbitrum; Other Chains Are Bleeding Too

Arbitrum isn’t the only underperformer. Curve’s TVL and trading volume on chains like Polygon, BNB Smart Chain (BSC), and even Base are minimal.

Volume-by-chain data shows Arbitrum falling behind newer players like Sonic, and far behind Ethereum. Gnosis, Avalanche, and Polygon each contribute a tiny sliver of total Curve volume.

Ethereum leads- Source: DeFiLlama

Cumulative fee data makes the contrast even clearer. Ethereum has generated over $319 million in fees for Curve since launch.

Arbitrum? $4.8 million. Polygon? $11.5 million.

Curve Finance on Ethereum is not just dominant; it’s the only chain truly pulling its weight.

If the governance proposal and early signs point to strong support, Curve swaps on Arbitrum could be sunset in the coming months. This won’t mean a total shutdown.

Existing liquidity pools on Arbitrum and other L2s will remain live. But there’ll be no new developments, no added incentives, and likely no future growth.

Instead, Curve appears ready to double down on Ethereum. Governance members are already pushing for deeper crvUSD adoption and tighter integration within the Ethereum ecosystem, where Curve is still a DeFi heavyweight.

In short, Curve Finance may be winding down its L2 experiment. Arbitrum and its peers haven’t delivered on expectations. And unless something changes drastically, Curve swaps on these chains may slowly fade into irrelevance, while Ethereum continues to carry the torch.

The post Curve Finance Swaps on Arbitrum Could Vanish in Coming Months: Here’s Why appeared first on The Coin Republic.

DAI price performance in USD

The current price of dai-stablecoin is $0.0052200. Over the last 24 hours, dai-stablecoin has increased by +0.83%. It currently has a circulating supply of 44,365,151,087 DAI and a maximum supply of 44,365,151,087 DAI, giving it a fully diluted market cap of $231.59M. The dai-stablecoin/USD price is updated in real-time.

5m

+0.11%

1h

+0.44%

4h

+2.67%

24h

+0.83%

About Dai Stablecoin (DAI)

DAI FAQ

What’s the current price of Dai Stablecoin?

The current price of 1 DAI is $0.0052200, experiencing a +0.83% change in the past 24 hours.

Can I buy DAI on OKX?

No, currently DAI is unavailable on OKX. To stay updated on when DAI becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of DAI fluctuate?

The price of DAI fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Dai Stablecoin worth today?

Currently, one Dai Stablecoin is worth $0.0052200. For answers and insight into Dai Stablecoin's price action, you're in the right place. Explore the latest Dai Stablecoin charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Dai Stablecoin, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Dai Stablecoin have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.