This morning, I was reviewing my staked SOL looping positions on @KaminoFinance.

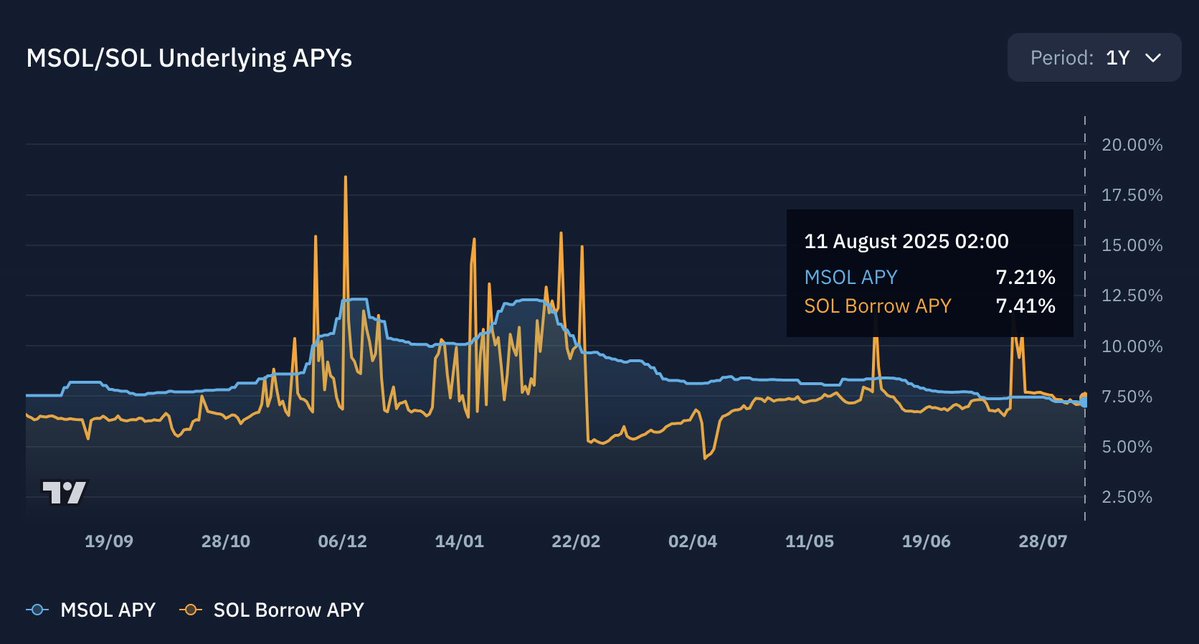

If you're looping with JUPSOL/SOL, jitoSOL/SOL or mSOL/SOL, the borrow rate for SOL has recently been higher due to bullish markets. We normally see greater borrowing demand, and hence higher rates to borrow in bullish uptrends.

Meaning, looping won't make sense until SOL borrow rates drop back below the underlying yield for the SOL LSTs acting as collateral in these loops (7.95% for JUPSOL and mSOL, 7.03% for jitoSOL).

Depending on how looped up your position is, you ought to take a look at it. I simply deleveraged my position to around 1.1x so I'm earning a great yield with just the SOL LST and ready to loop back up whenever SOL borrow rates drop and looping becomes profitable again.

You want the orange line (SOL borrow APY) back below the blue line (SOL LST APY, in this example mSOL).

Show original

46.84K

9

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.