Trump’s About to Drop the Biggest Crypto of 2025💰

It’s called World Liberty Financial ($WLFI) and it could be a top 10 coin by year-end.

This isn’t just another memecoin. It’s a Trump-backed DeFi project tied to a US-regulated stablecoin.

Here’s what it is, how to buy it early, and the altcoins set to pump 🧵👇

1/x $WLFI is built around USD1, a US dollar stablecoin already at $2.2B market cap.

It’s fully backed by treasuries & USD, regulated under the new Genius Stablecoin Bill, and designed for cross-chain use.

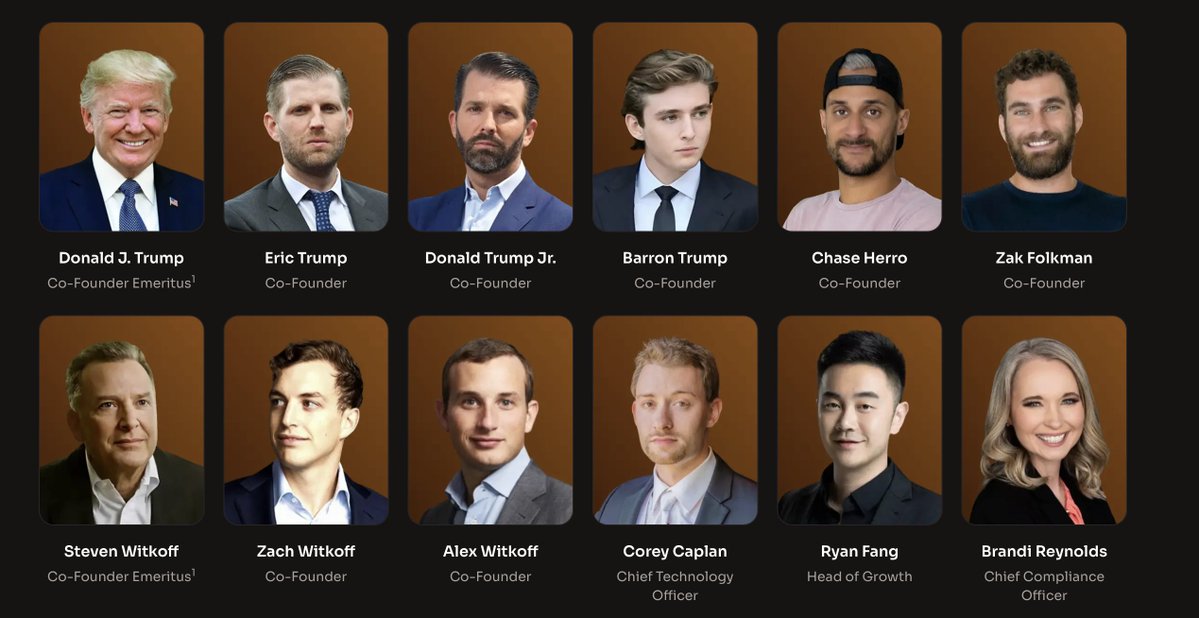

Trump is listed as honorary founder and his sons are all involved.

2/x USD1 launched big:

🔹$2B minted on BNB Chain in a single deal with Abu Dhabi’s MGX fund.

🔹 Instantly became the 5th largest stablecoin without retail involvement.

It’s designed for institutional adoption, and every large deal mints more USD1 on-chain.

3/x USD1’s market cap could explode. The US needs buyers for treasuries.

USD1 gives institutions a crypto vehicle to buy treasuries + strike side deals.

Two or three more MGX-sized deals could push it into the top 3 stablecoins.

I’m targeting $100B+ cap by late 2025.

4/x $WLFI is the governance and DeFi backbone for USD1.

Holders can vote on proposals, stake, and earn adoption incentives.

If $TRUMP is the “fun” coin, $WLFI is the official Trump DeFi play with real utility and in my view, it should command a higher valuation.

5/x The ICO rounds sold out fast.

🔹 Round 1: $0.015 ($1.5B valuation)

🔹 Round 2: $0.05 ($5B valuation)

Both sold out by March 2025.

Initially “no intrinsic value” + non-transferable. Those clauses are now gone.

TGE expected late Sept / early Oct 2025.

6/x Right now, WLFI trades pre-market on Whales Market at $0.23 ($23B valuation).

Pre-market trades are collateral-based IOUs, no tokens move until launch.

If price doubles, sellers can return 2x your collateral instead of tokens, effectively capping you at around 2x before TGE.

7/x Even capped, a ~2x in 2 months is strong.

But if you want uncapped upside, the better move might be positioning in related altcoins now.

Here’s my WLFI beta play list ⬇️

8/x Large caps:

✅ $ETH - Most stablecoins are on EVM chains, USD1 is no different. Trump family openly praises Ethereum.

✅ $BNB - $2B USD1 already minted on BNB Chain. Undervalued vs other blue chips.

✅ $TRUMP - Likely sympathy pump alongside WLFI hype.

9/x DeFi integrations:

✅ $AAVE - Backend for WLFI’s lending markets. Proposal passed: 20% of fees to WLFI DAO, 7% WLFI supply to Aave DAO.

✅ $TRX – Justin Sun invested $30M into World Liberty. USD1 already runs on Tron.

10/x Smaller plays with direct ties:

✅ $BLOCK - WLFI adviser-founded launchpad pairing projects with USD1 liquidity. ~$190M FDV.

✅ $DOLO - Lending protocol, CTO is also WLFI’s CTO. WLFI multisig already borrowing USD1 here.

✅ $AOL – Solana microcap, adviser overlap with WLFI. Pivoting to USD1 adoption on Solana. High risk.

11/x Other mentions:

✅ $PLUME - RWA L1 with USD1-backed stablecoin. Light integration.

✅ $SUI - Odd USD1 connections via IDO promos.

12/x My plan:

🔹 Hold $ETH, $BNB, $AAVE, $BLOCK, $DOLO, small $AOL.

🔹 Let hype build into WLFI’s Q4 launch.

🔹 Take profits as crypto Twitter catches on.

By then, latecomers will rotate into these plays and we’ll already be positioned.

13/x $WLFI has the Trump brand, real DeFi utility, and political tailwinds.

Even at $23B pre-market, it’s below $TRUMP memecoin’s $73B peak.

I expect a top 10 market cap post-launch, but I’m playing both $WLFI and the beta plays for max upside.

55.79K

417

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.