1. Since the post yesterday, the E/B exchange rate has risen by 1 point;

2. Today, when I opened the market, some of the key altcoins that were previously traded showed decent rebound strength and structure.

$XRP

The MACD on the 12-hour level has returned to the 0 axis, the RSI has bottomed out and broken upwards before pulling back, and the candlestick structure follows suit;

Many altcoins have shown similar indicator patterns resonating with XRP, for example, $DOGE has performed even better than XRP, but currently, the daily level has not provided a definitive breakout signal yet.

From a trading perspective:

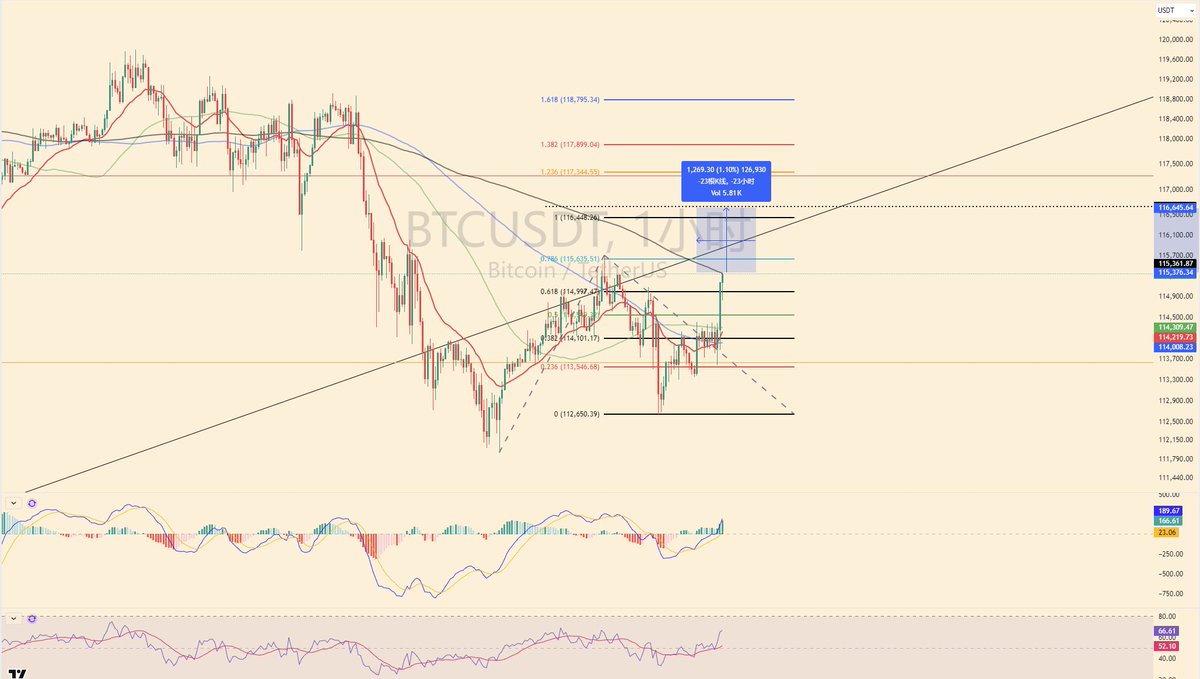

1. The short position on Bitcoin at 119 was not closed at 112, but was closed at 115;

2. The difficulty of shorting is high, and the price action is more exhausting than expected;

3. Bitcoin and Ethereum still lack reasons to go all in on longs at this position, in the short term, I will start testing longs on some altcoins (the position ratios vary greatly).

Glancing at the market, let's get to the conclusion first: the level of fluctuation is not significant, and there are no opportunities for large trades. I opened a few small positions with a few hundred USDT stop-loss just to get a feel for it.

Three points:

1. Here, Bitcoin is more or less following the US stock market. Despite Bitcoin rising by 1% today, altcoins have not significantly outperformed Bitcoin's increase. Even if there is a breakthrough here, there will be structural pressure at the 1% level above;

2. For short-term trading, we need to wait for a signal candle with an upper or lower wick, preferably a 1-hour closing candle to be somewhat effective. However, this requires closely monitoring the market, which can be exhausting, and the accuracy is still not high (the smaller the level, the more unstable it is);

3. The performance of altcoins indicates that overall sentiment is cooling down from a frenzy, and we still need to continue observing for slightly larger opportunities.

52.19K

21

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.