Want high yield, full liquidity & max airdrop exposure on $HYPE staking?

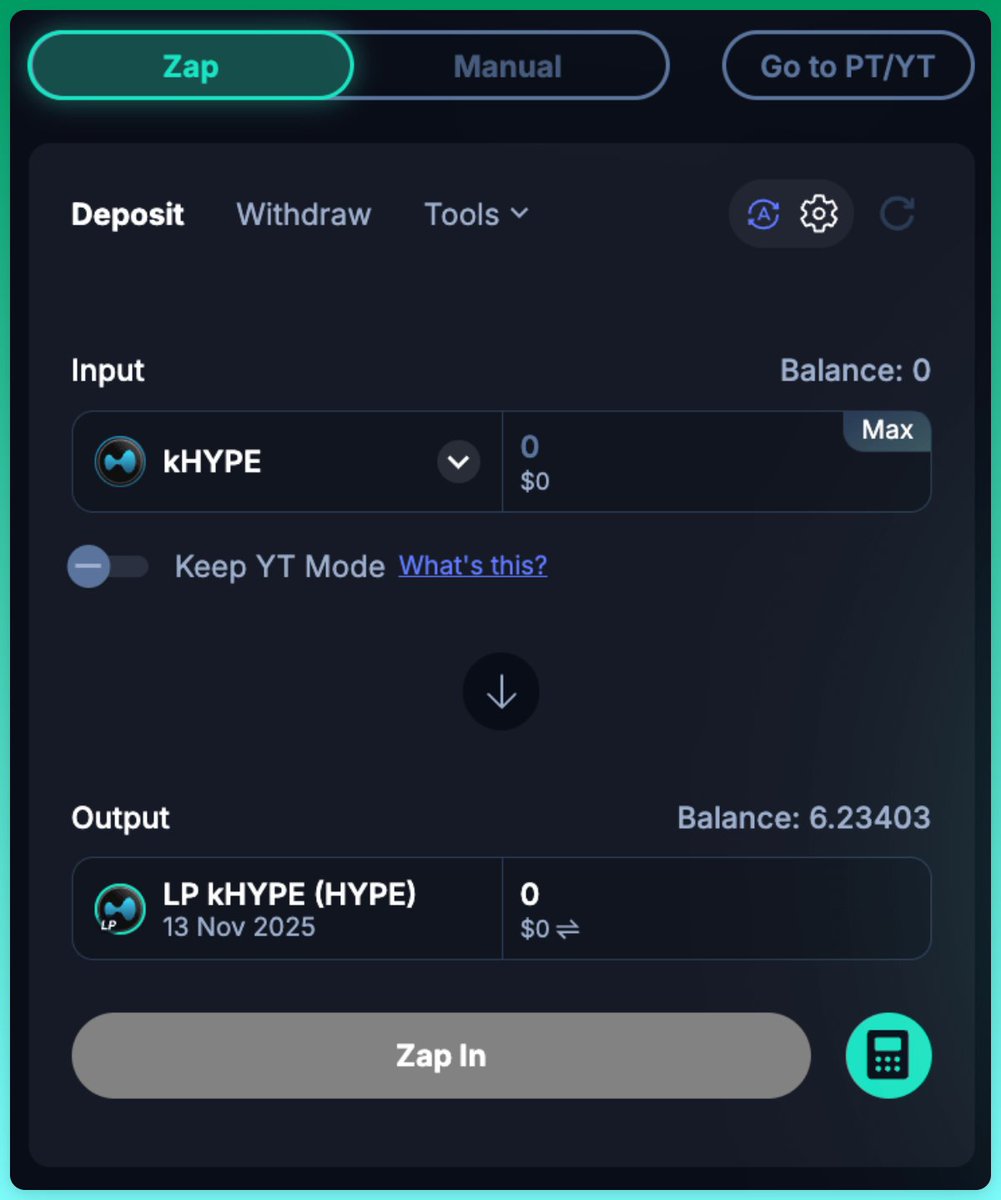

Let me break down how to use @pendle_fi to supercharge your $kHYPE yield with PT-kHYPE, YT-kHYPE, and LP strategies 👇

A 🧵:

Staking your HYPE usually meant giving up liquidity.

But what if you could earn yield, stay fully liquid, and never manage validators again?

That's exactly what @kinetiq_xyz offers, a liquid staking layer of @HyperliquidX

Let's dive into why $kHYPE is a game-changer for stakers & DeFi users on Hyperliquid

A 🧵👇

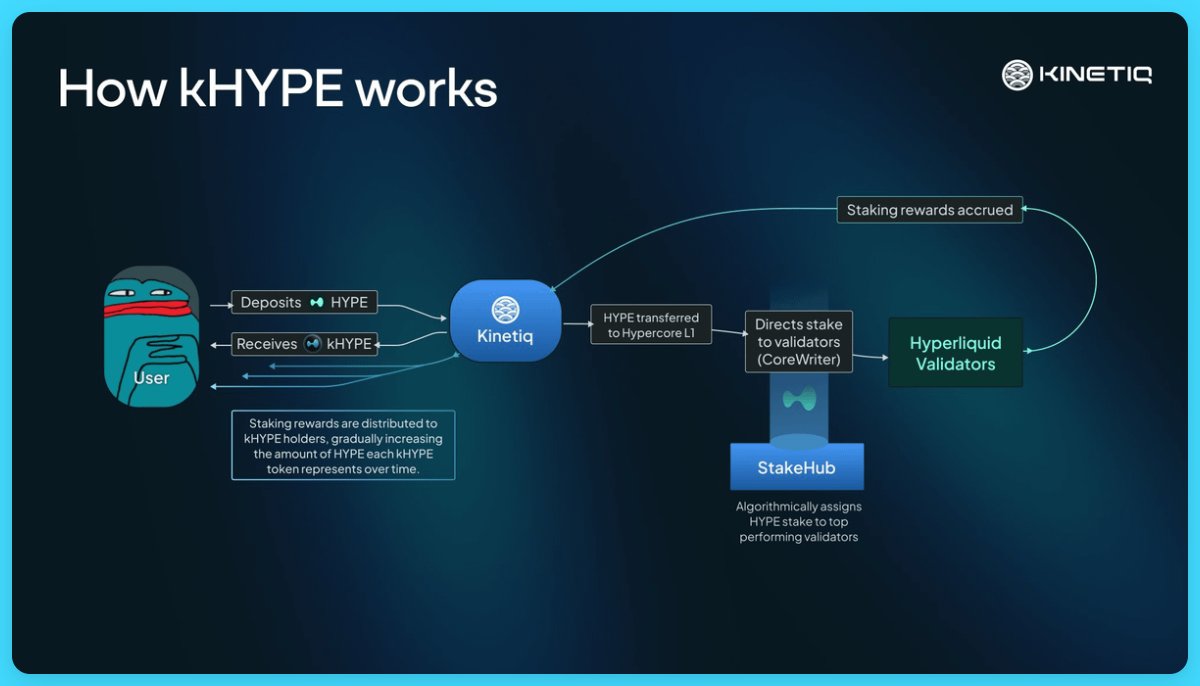

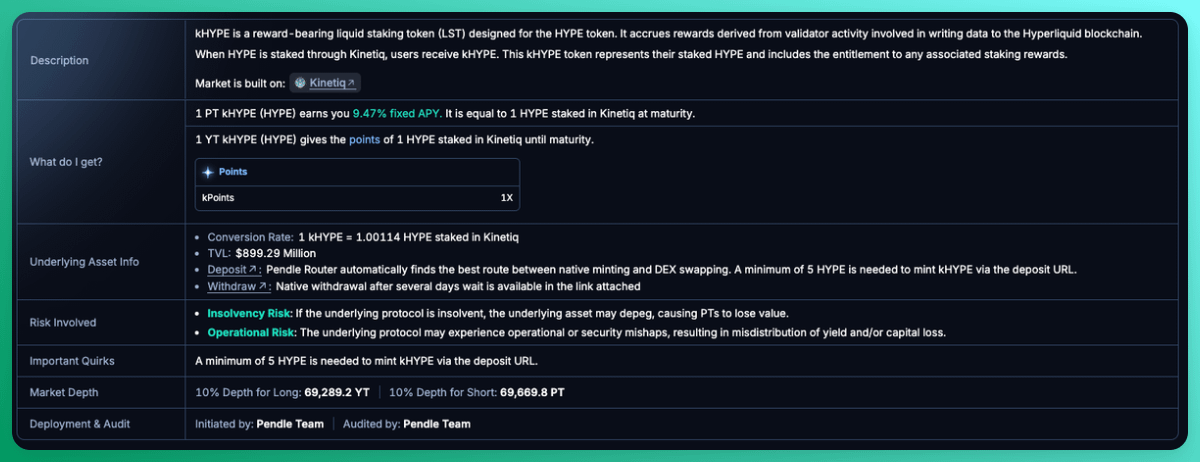

To start, @kinetiq_xyz turns staked $HYPE into $kHYPE, a liquid staking token that earns passive rewards (~2–3% APY), accumulates kPoints, and can be used across DeFi protocols on @HyperliquidX

But @pendle_fi takes it a step further

To begin with, what exactly does @pendle_fi do here?

It splits any yield-bearing asset (like stETH, aUSDC, etc.) into two parts:

🔹 PT (Principal Token)

🔹 YT (Yield Token)

This simple split opens up a whole world of opportunities in passive yield, speculation, & market-making.

Let’s decode both sides.

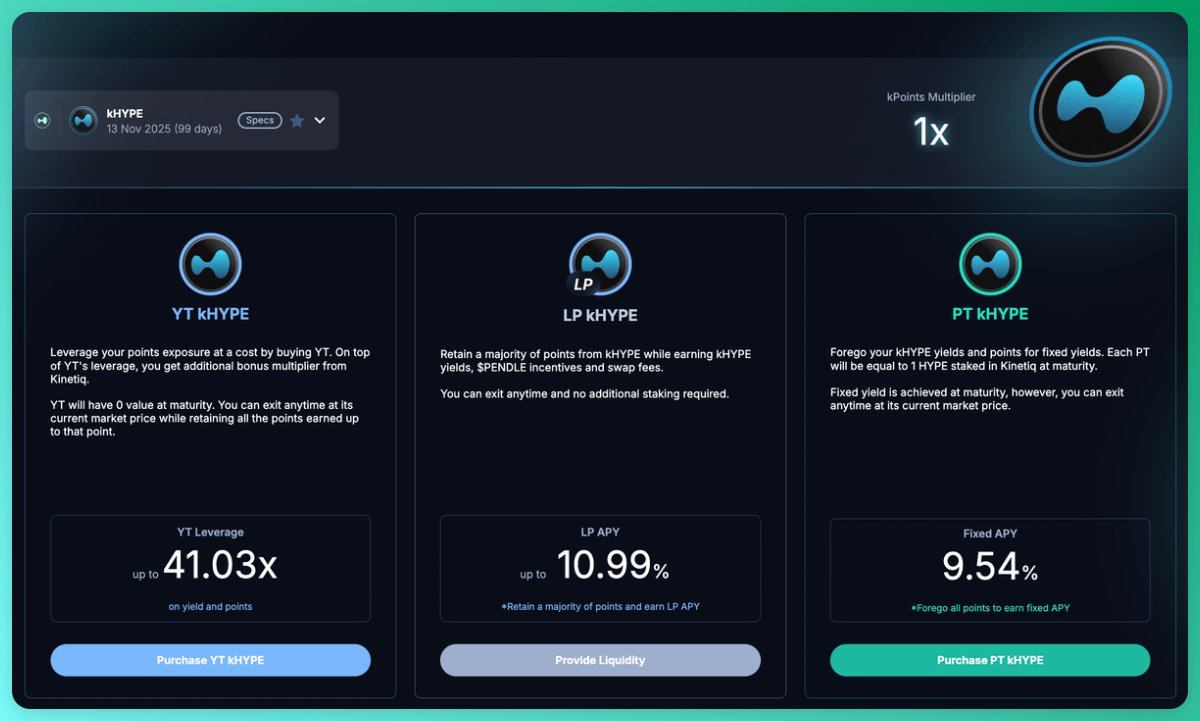

🔹 PT (Principal Token)

→ You buy this at a discount & receive the full principal at maturity

→ You're locking in a fixed yield, no surprises

→ If the yield drops after you enter? You’re unaffected

→ The APY you bought is yours until maturity

→ Perfect for risk-averse strategies

🔹 YT (Yield Token)

This is where things get spicy.

You’re paying an implied APY to access the future yield of the underlying asset.

→ If underlying yield > implied APY, you profit

→ If it underperforms? You take the hit

In essence, you're speculating on future yield performance.

Let’s simplify with examples:

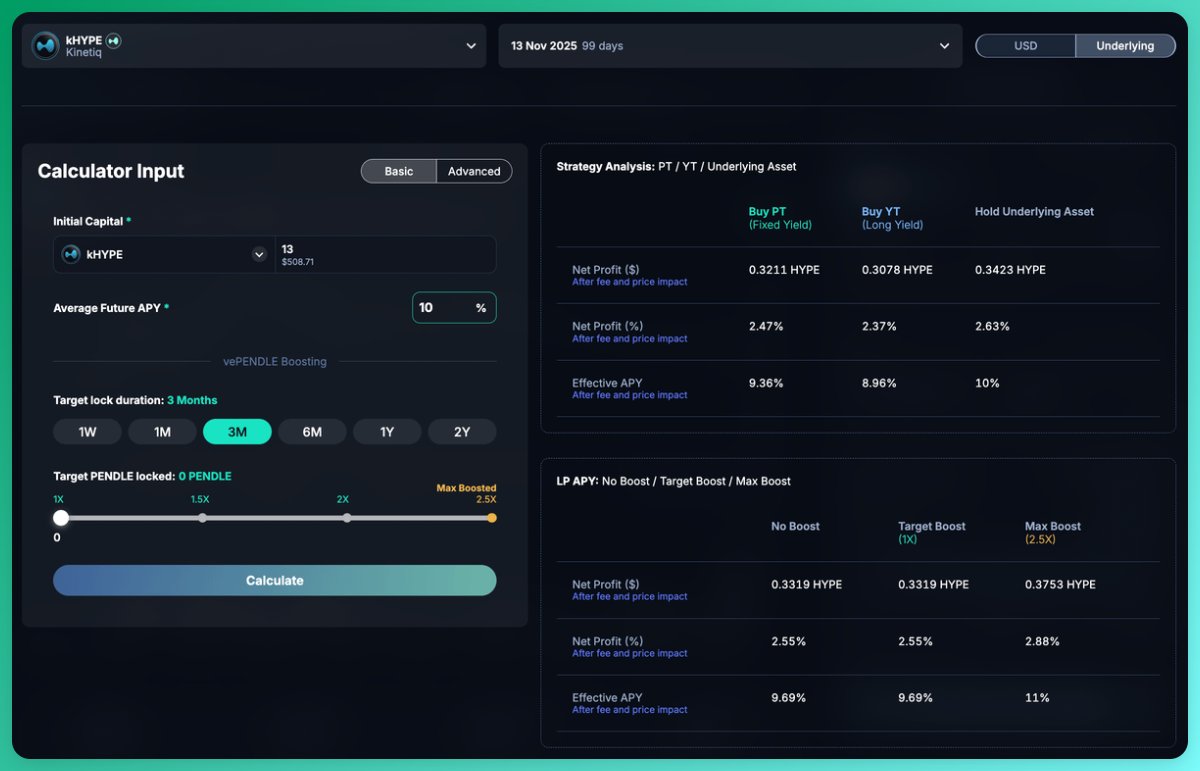

→ If implied yield = 10%

→ Actual yield averages = 20%

→ ROI = +100%

But if actual yield = 5%

→ ROI = -50%

YT is the leveraged directional bet on interest rates or points yield. PT is the bond.

Calculate here:

Now here’s where @pendle_fi shines: It connects both sides of the market.

You don’t need to just buy PT or YT.

You can also LP into these pools and act as the middleman:

🔹 Earn from swap fees

🔹 Capture underlying yields + Pendle incentives

🔹 Get exposure to points meta

But LP yields are variable, unlike PT.

So how do you use this info?

🔹 Expect yield to rise → Buy YT

🔹 Expect yield to fall or want fixed return → Buy PT

🔹 Want passive exposure with rewards → Provide LP

Pendle lets you long, short, or monetize future yield. No oracle risk. Fully decentralized.

There’s also a growing narrative layer:

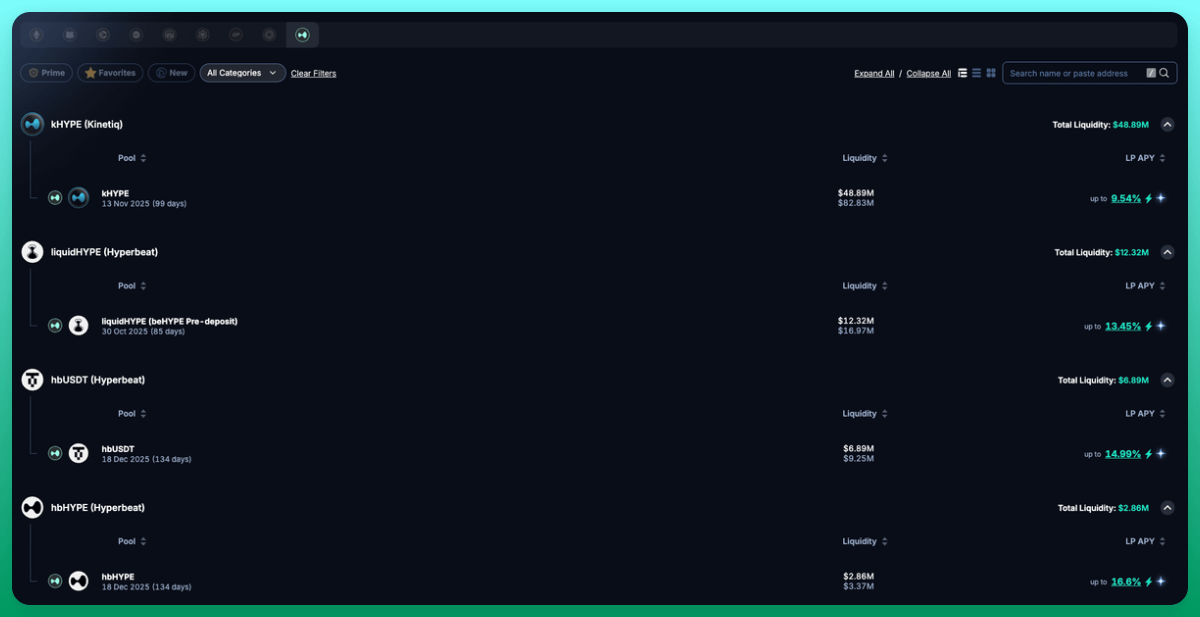

🔹 YT $kHYPE offering 41x+ on kPoints loop

🔹 LPing $kHYPE to earn yields, $PENDLE incentives, and swap fees

🔹 Foregoing your $kHYPE yields & points for fixed yields

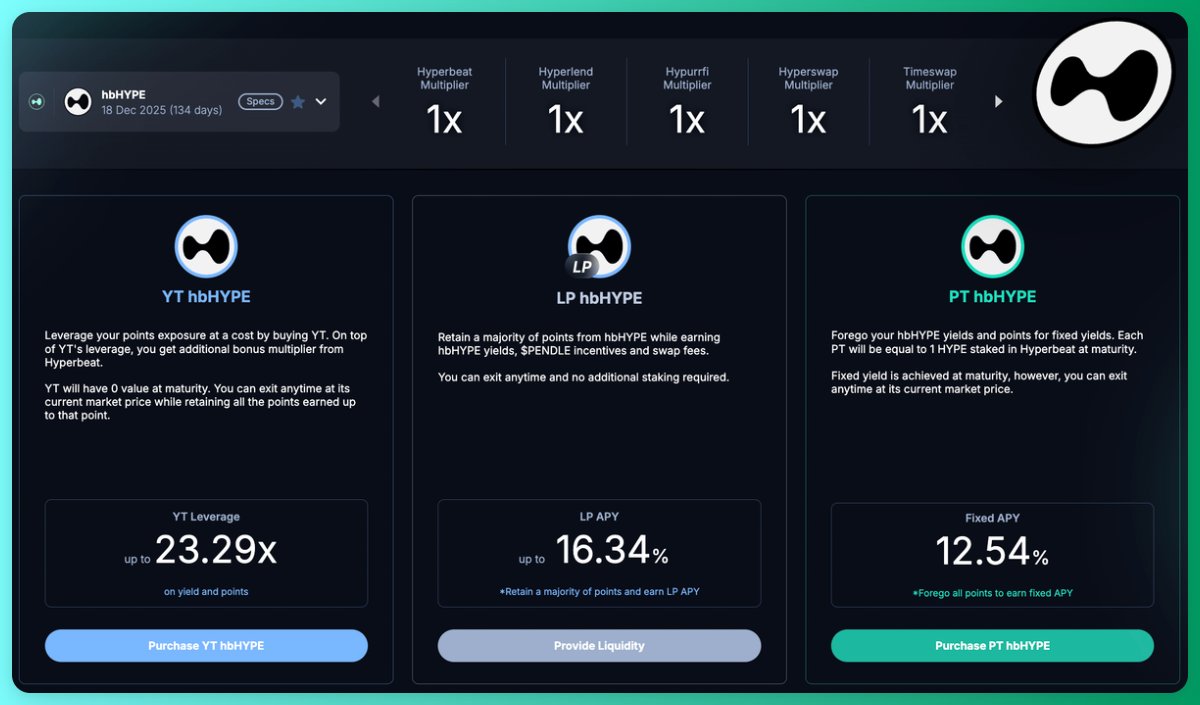

🔹 YT $hbHYPE for additional bonus multiplier from @0xHyperBeat

& More!

Pendle becomes not just a DeFi yield tool, but a meta-trading playground.

In short, Pendle gives users:

🔹 A hedge against yield volatility

🔹 A way to speculate on future yield trends

🔹 A market to fix income on volatile rewards

🔹 A platform to earn via LP & incentives

All trustless. All on-chain.

Pendle isn’t just a niche yield protocol anymore.

It’s the yield curve of DeFi, letting you pick your risk, return, and strategy.

Understanding PT and YT gives you an edge that most DeFi users sleep on.

Now you know. Use it wisely 🧠

With that, we wrap up this 🧵 for the time being, and while I'm sure a lot of you are wondering why we didn't touch much on @0xHyperBeat, that's exactly what we'll be covering next!

In the meantime, if you liked this post & found the same useful, make sure to L+RT this 🧵!

62.3K

79

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.