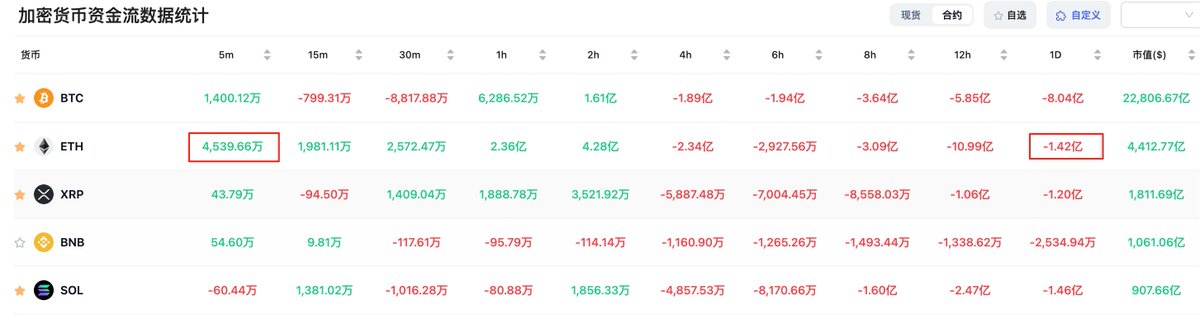

From the perspective of capital flow, ether is indeed more sought after at present. Looking back at the state of BTC when it changed banks, the recent ups and downs of ether may fluctuate more, and the amplitude is definitely larger than BTC. Buying dips and selling high to reduce costs may be a better strategy, after all, BTC has also experienced several pullbacks of more than 30% before it flew away.

From a macro point of view, although the panic caused by non-farm payrolls has been repaired in a short period of time, the problems that have arisen have not disappeared, and the distrust at the bottom of the market still exists.

Like last year, it may be a better option for the United States to detonate from the outside, after all, no one can step down due to excessive infighting. Japan has always been a very suitable tipping point, and just today Shigeru Ishiba made another statement that he could not fulfill the tariff agreement. And India's international status has plummeted since losing the 5.7 air battle, and in the past few days, the Russian crude oil issue has even been added to the level of humiliating tariffs by the United States. Although India has always been relatively abstract, it does have its own independent diplomatic capabilities, so there are also variables here.

Ethereum rebounded to 3735 in the morning and has now returned to the key level of 3660, but the BTC is not strong and the rebound is weaker than expected and dragged back, and the current two integer marks of 114 and 113 are very critical, and if it falls below, it may go down again. Although the market was repaired yesterday, the overall mood was more sensitive, and the slightest disturbance began to play the game of running fast at all.

17.84K

23

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.