An Alt Season on the Horizon? – Summary in Korean

0. Summary

- Repetitive behavior patterns of retail investors, such as the Wealth Effect and Catch-up Trade, suggest that we have either entered or are very close to the third alt season.

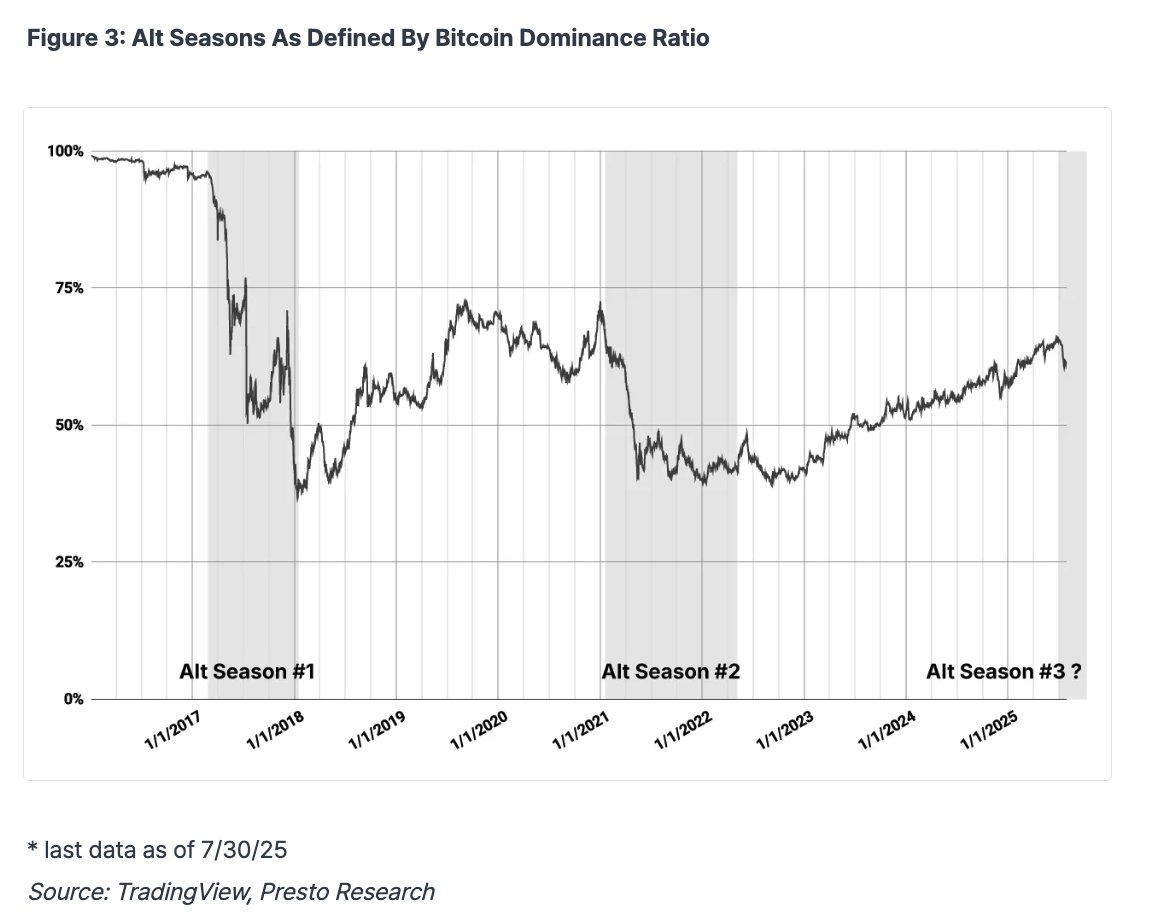

1st Alt Season: 2/27/17–1/15/18

2nd Alt Season: 1/4/21–5/9/22

- The characteristic of this alt season is that it is centered around mature large-cap assets. This is a structural change due to growing network effects and increased institutional participation.

- It is no longer realistic to expect all altcoins to rise indiscriminately as in the past. Only projects that have proven true value will attract market interest and capital.

1. Intro

Interest in altcoins has surged dramatically in recent months. Google search trends and the rise in altcoin prices are evidence of this.

In this context, the key question posed by market participants is:

Will there be an alt season in this cycle? If so, in what form will it unfold?

To analyze this, this report will

① Review the price trends and patterns of past alt seasons, and

② Summarize the psychological and structural factors that have repeatedly created alt seasons.

2. Anatomy of Alt Seasons

2.1 Definition and Criteria

- Definition of Altcoin: All virtual assets excluding Bitcoin, including stablecoins.

- Definition of Alt Season: A period of more than 90 days during which Bitcoin dominance falls from a peak to a trough.

→ In other words, a time when BTC's market share decreases and the market cap share of altcoins increases.

📌 Note: The second season (2021–2022) is considered to have ended prematurely with the Luna incident (May 2022). The reason is that the subsequent decline in dominance was due to BTC's drop, not an altcoin rally, and the collapse of Terra/Luna was a turning point that shattered the optimism of the entire altcoin market.

Additionally, at that time, there was significant selling pressure on BTC due to deleveraging (Genesis, 3AC, BlockFi, etc.), and the optimism for altcoins had already disappeared from the market.

2.2 Segmentation Analysis

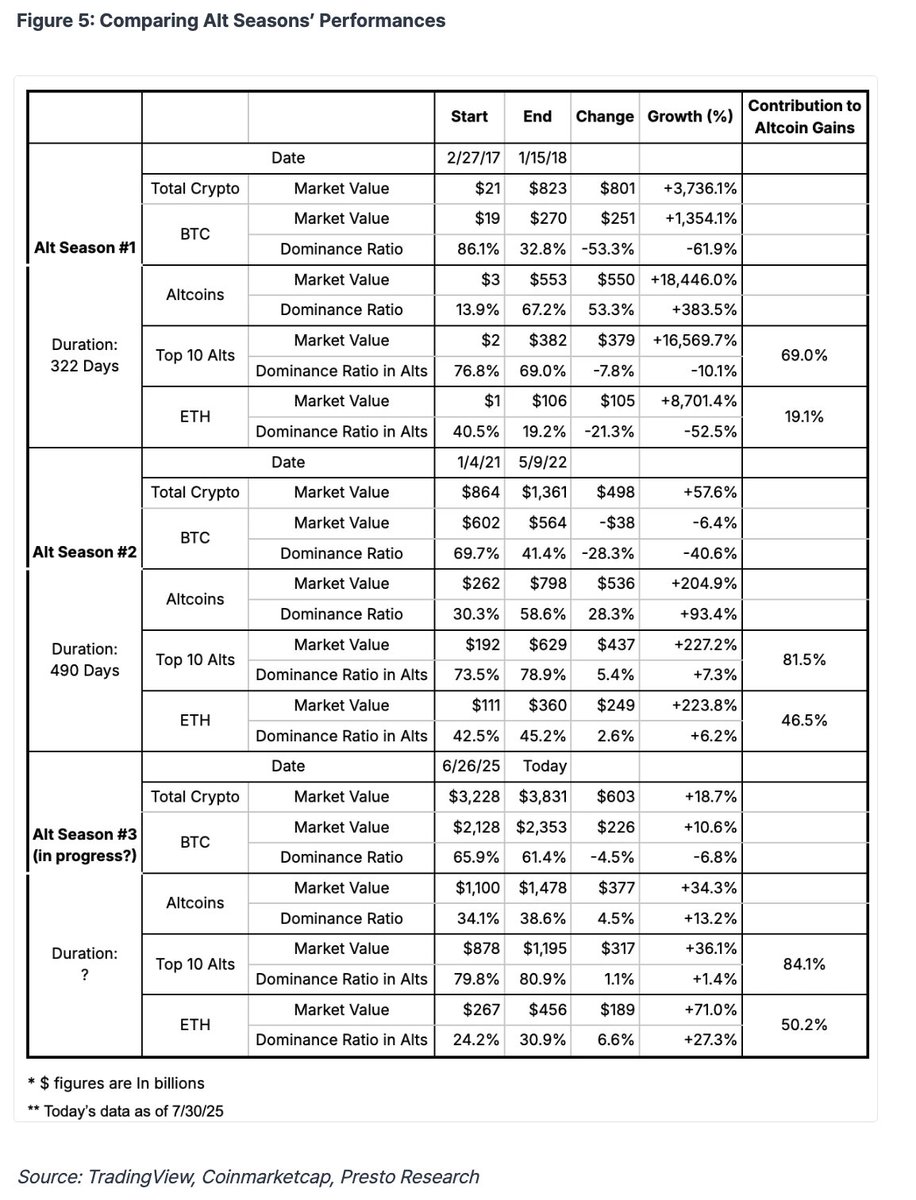

Altcoins are classified into ETH, the top 10 by market cap, and others to analyze the importance of each season.

-> The analysis shows that as seasons repeat, the contribution of ETH and top altcoins to the overall alt rise is increasing.

This reflects (1) the direction in which network effects are concentrated, and (2) the tendency for institutional capital to flow into more reliable assets.

In other words, the alt market is gradually shifting from being 'everyone's market' to a market centered around a few leading assets.

This trend leads from

1st season (ICO pumping),

2nd season (still somewhat based on real use),

3rd season (centered on a few assets with proven utility, RWA, DeFi), showing a gradual polarization and maturation.

2.3 No Overheating Signals Yet

The Crypto Fear & Greed Index from CMC is not yet in the overheating zone.

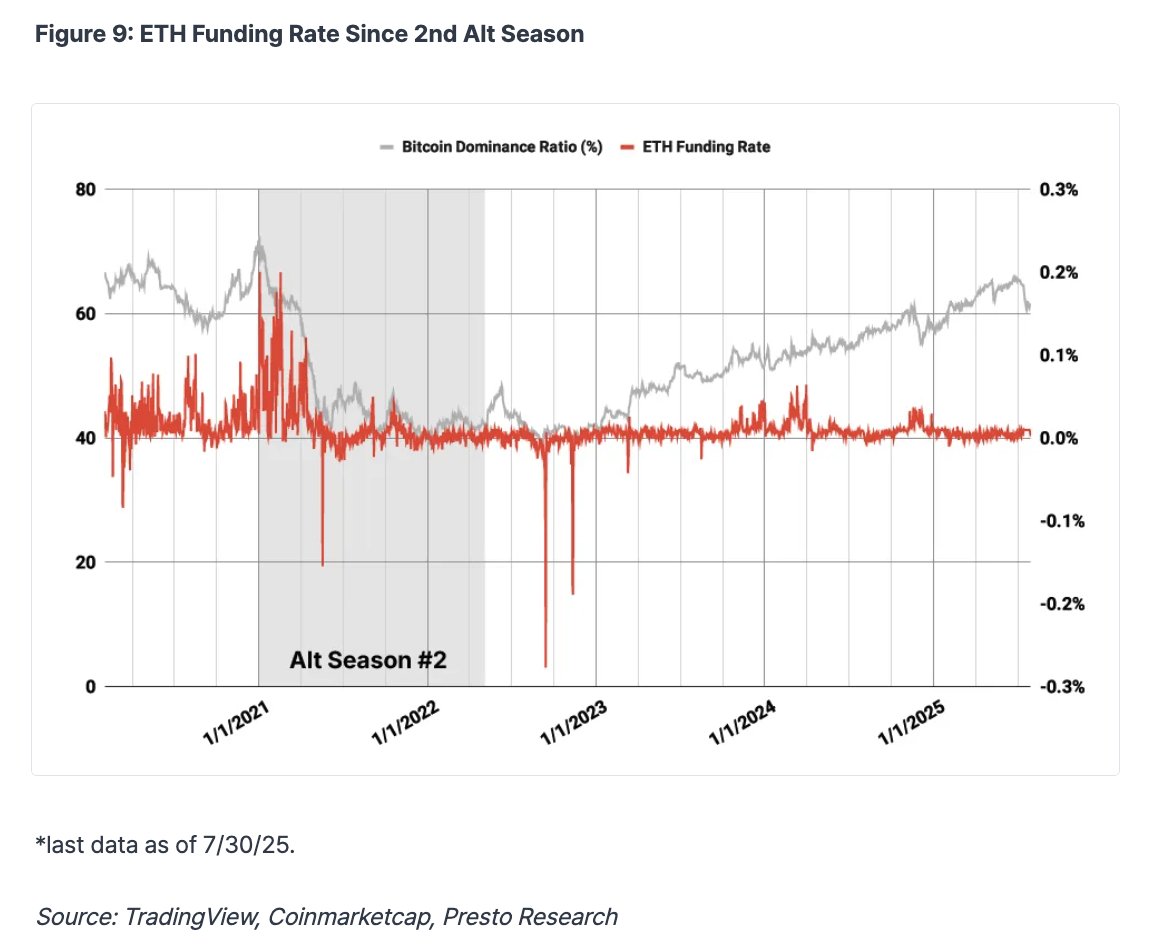

The ETH funding rate is also at a normal level.

→ There is currently no sign of retail overheating in the market.

This suggests that we may still be at the beginning of the cycle rather than the mid-point, indicating that there is significant potential for increased market interest in the future.

3. Psychology of Alt Seasons

3.1 Existing Funds: Wealth Effect

BTC price increase → Improved investor sentiment → Moving to the risk curve's upper end (Altcoin) in search of higher returns.

This trend was particularly evident in the second season, where BTC fell by -6.4%, but altcoins recorded significant gains.

In other words, the alt season can be understood as a derivative phenomenon of Bitcoin's wealth effect.

3.2 New Funds: Catch-up Trade

New retail investors are drawn in by media coverage, shifting their interest to 'lower-priced' altcoins under the perception that "BTC has already risen too much."

A representative psychological bias that emerges at this time is Unit Bias.

→ When the unit price is low, it feels cheaper, leading to the illusion that it can rise more.

→ Example: "BTC is $117,000, but XRP is $3, so maybe XRP is more promising?"

Meme coins exploit this psychology by attracting investors with massive issuance and ultra-low unit prices.

(Example: PEPE = $0.00001148)

→ This behavior pattern is also repeated in traditional markets, where Apple lowered its stock price from $500 to $125 through a 4-for-1 stock split in 2020.

4. Conclusion

4.1 Overall Judgment

While the data so far is insufficient,

considering the decline in Bitcoin dominance and the recovery of investor sentiment, we are very likely at the beginning of the third alt season.

However, it is more likely to be a selective bullish market based on technological maturity and network effects rather than a broad rise as seen in the past.

Therefore, the formula previously used,

"If 75% of the top 50 perform better than BTC, it’s an alt season," may no longer be valid.

4.2 Not All Boats Will Rise Anymore

It seems that the era of indiscriminate alt pumping, where the entire market rises together as in the past, has ended.

While there may still be cases where an altcoin with a market cap of $50M becomes $5B, these will be limited to exceptional cases, and an environment is being created where only truly capable projects can survive.

With the participation of institutional capital, improved selective abilities of investors, and growing fatigue towards pump/dump schemes, 100x tokens are no longer open to everyone.

This ultimately signifies the maturation of the crypto industry and will help dilute the image of "crypto as easy money."

→ Slowly but surely, this industry is moving in the right direction.

Full Report:

Show original

15.09K

16

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.