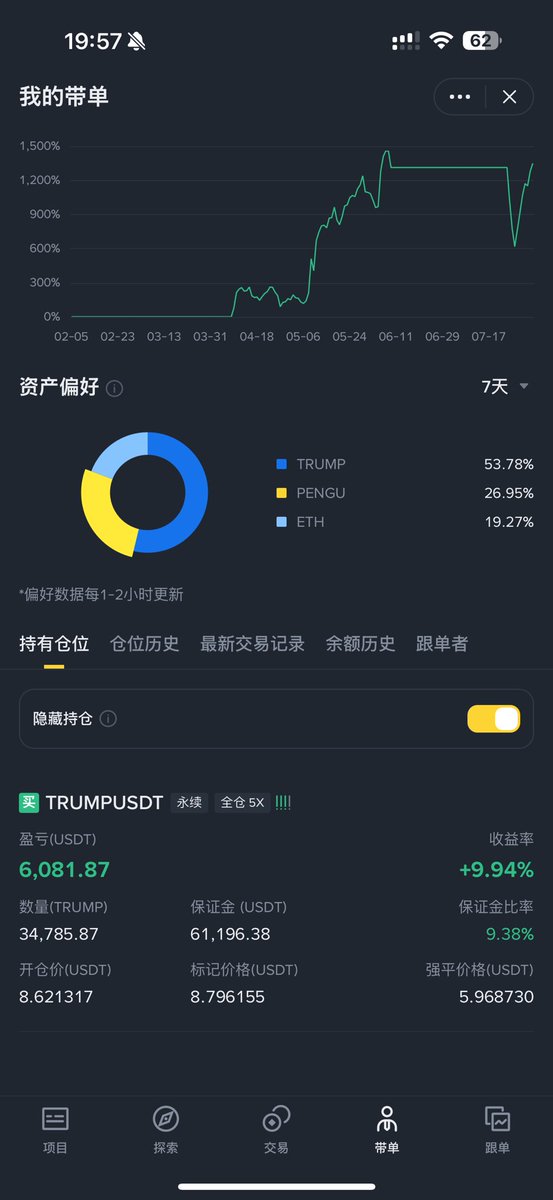

Don't look at how much you earn in seven days, that's because you lost a lot last week.

I shorted ETH and PENGU two days in advance, and as a result, I lost 30% near the highest point, and lost 55% at most. But it still fell this week.

Looking at the beautiful short-term rising yield curve, it is really pleasing to the eye, but in the big cycle, it is a shocking retracement.

Now there are no empty orders, I found a similar fall, and there is a little more Trump, or take the daily level to be comfortable, I don't need to look at the small level fluctuations, just look at the hourly line structure and think about whether the current position and mood are appropriate, just do it.

On the contrary, US stocks are easier to do than the currency circle, and the liquidity is also very good. The currency circle has really not made any money in the past two weeks, and of course it has not lost a penny. But U.S. stocks are indeed quite profitable.

But U.S. stocks, taxes are paid. Thinking about my 17w Hong Kong dollar principal to pay nearly 400,000 yuan in tax, I gritted my teeth!

Show original

141.35K

226

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.