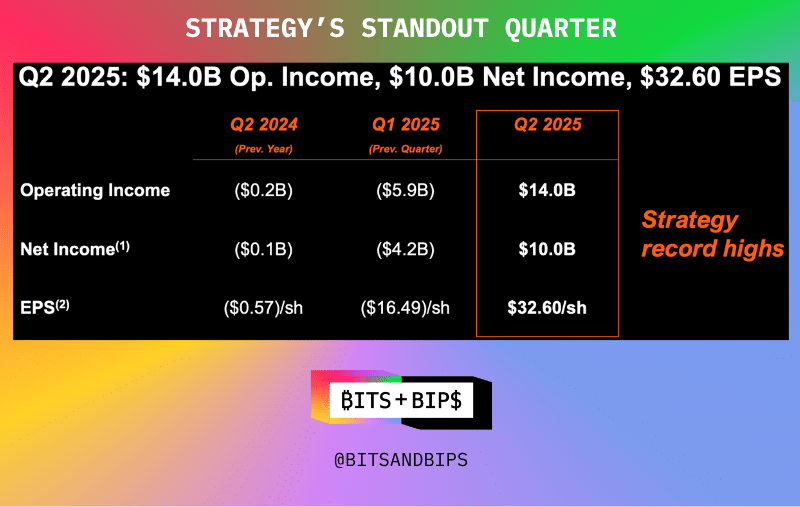

On Thursday, Strategy and Michael @Saylor released a massive earnings report:

🚀 $10 billion profit

🤑 $14 billion operating income

💰 $32.60 EPS

But that’s not all that stood out… 🤔

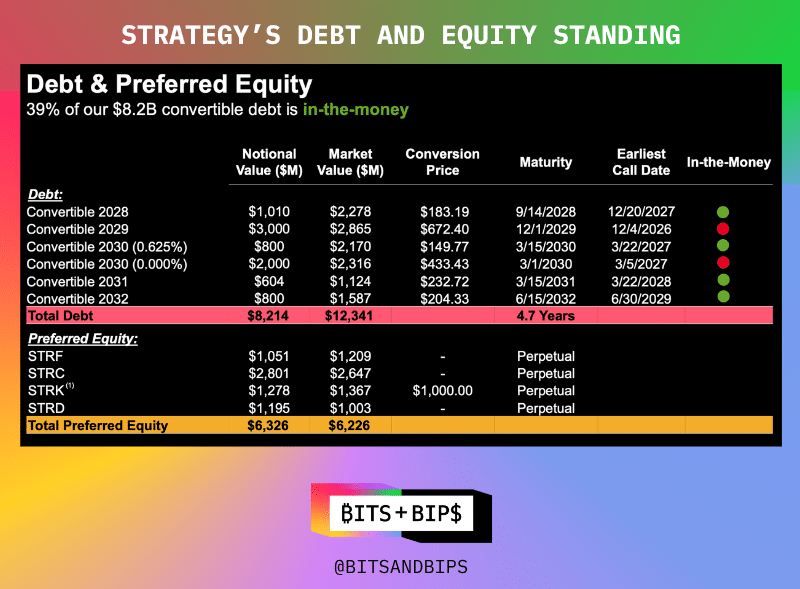

The company also announced a radical new capital markets strategy…

It doesn’t want to take on new debt to fund its bitcoin purchasing strategy.

It can do this because of its ability to tap into the preferred equity market, which provides some key advantages

✅ Less shareholder dilution

✅ No risk of having to sell bitcoin during a market downturn

But other crypto treasury companies are unable to follow this new version of the Saylor playbook, at least for now.

In fact, many crypto treasury companies are leaning heavily into debt

ProCap - $235 million

Twenty One - $485 million

But, this Saylor pivot provides something to shoot for, says Lance Vitanza, Managing Director at TD Cowen 🎯

“It’ll be common for these companies to begin their journeys in the bond market, and hopefully some of them will grow large enough to access preferred equity markets.”

Read the story and watch the full interview with Lance Vitanza by @steven_ehrlich here:

23.52K

156

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.