My personal $GLXY price target is $54/share (~2x upside from current price assuming no change in $BTC) in the next 6-12 months, sum of the parts valuation below:

Balance sheet = ~$3.3B

Crypto Business lines = ~$6.4B

Data Center Business Lines = ~$11.7B

Total = ~$21.4B / 395M shares = ~$54/share

Sum Of The Parts Valuation

Balance Sheet:

From March 31st they have ~1.3B in liquid crypto, $BTC is up 40% since then + they have ~1B in stablecoins and raised ~$500M in the most recent offering.

That gives us $1.3B*1.4 = $1.82B + $1B stables + $500M from the raise = ~$3.3B

Could get some positive surprises here if they were overweight names like $HYPE + depending on how much they've invested in all the recent treasury companies like $SBET, $BMNR, etc.

Crypto Business Lines:

I personally need to dig deeper here and come up with my own assumptions but Goldman's recent report forecasts a 12% net revenue CAGR from 2024-2028E in all crypto business segments. Assuming no change in crypto prices.

They get $183M of net income (excluding stock based comp) in 2Q 2026 - Q1 2027 and apply a 35x P/E multiple (from this list of comps vs. crypto peers $COIN, $CRCL, $ETOR, and $HOOD, and investment banking peers $JEF, $LAZ, $MS and $PIPR.)

183M * 35 = $6.4B

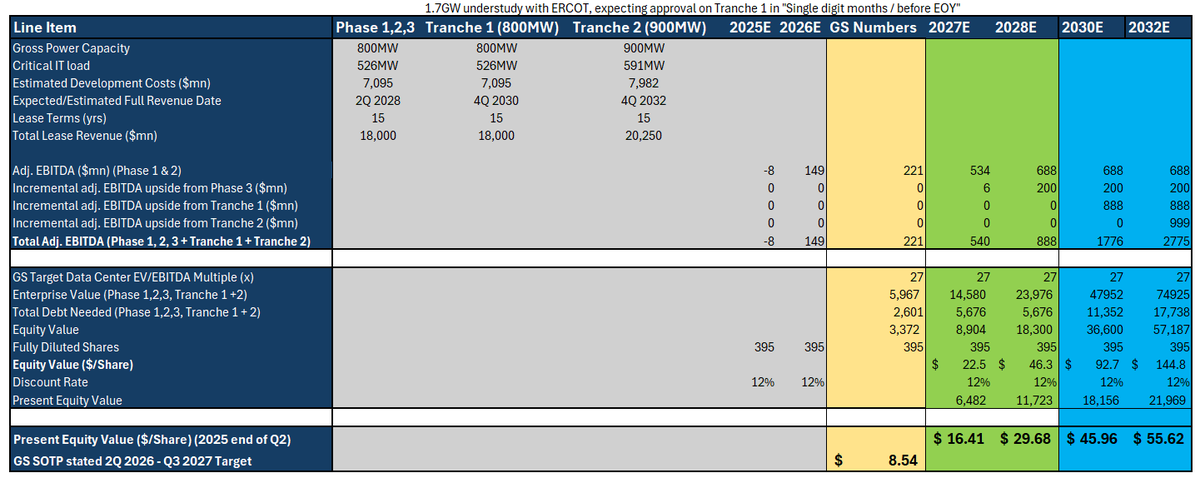

Data Center Business:

I get to $30/share here by assuming Galaxy executes on Phase 1, 2, and 3 of Helios + $CRWV exercises their extra 200MW option (Phase 3).

This will give us $888M in EBITDA for 2028E, then applying Goldman's 27x EV/EBITDA multiple and subtracting the debt gives us $46/share, discounting that back 3.5 years to today = ~$30/share. Can read more about this in the quoted tweets.

Note I exclude approvals/contracting out of Tranche 1 (800MW) and Tranche 2 (900M) that Galaxy has understudy with ERCOT although management has guided to expecting tranche 1 being approved in "single digit months / EOY". I also don't include any new Bitcoin mining site acquisitions which could significantly expand Galaxy's current power pipeline of 2.5GW.

If Galaxy executes on Tranche 1 & 2 + more bitcoin mining site acquisitions this price target could be quite conservative. I believe they will and management has been fantastic so far, that gets me much closer to my "$100/share target in the next few years" provided in my other posts.

Disclaimer:

I am very long $GLXY, this is just my personal opinion and is not financial advice, please do your own research.

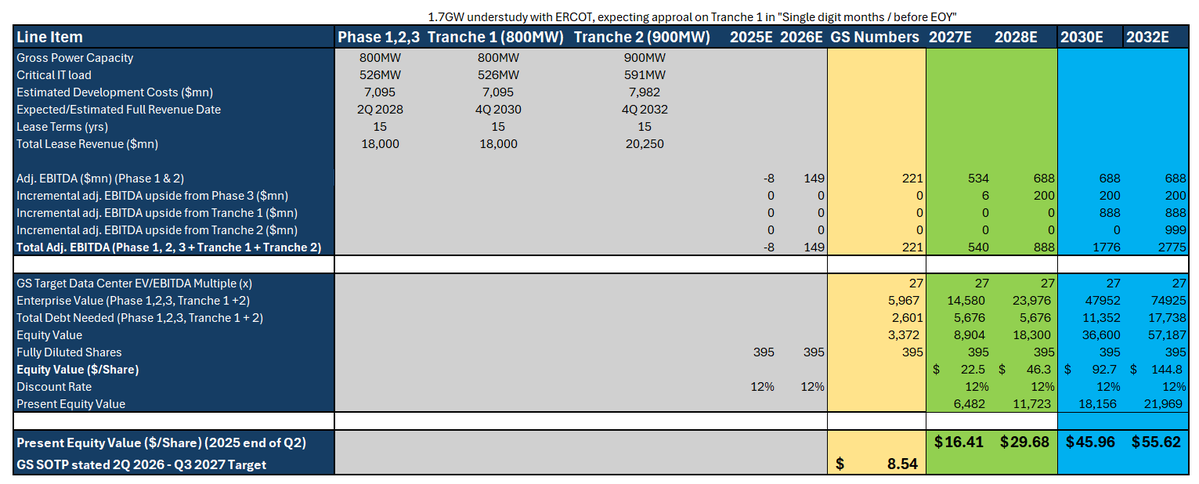

Okay some bullish moon math if $GLXY gets its next 1.7GW approved at Helios and they can contract out the full 2.5GW with a similar deal to the current $CRWV lease.

Looking at $92/share in 2030, and $145/share in 2032, discounted back to today at a 12% rate that is $46 / $55 for Helios alone!

Note this doesn't account for Galaxy's balance sheet of ~$3B in crypto, crypto infra/VC investments and cash + their extensive crypto business lines & subsidiaries/JV's (like @GK8_Security & @AllUnityStable).

@iammoisturized Wrote a post on it here

15.6K

113

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.