GM,

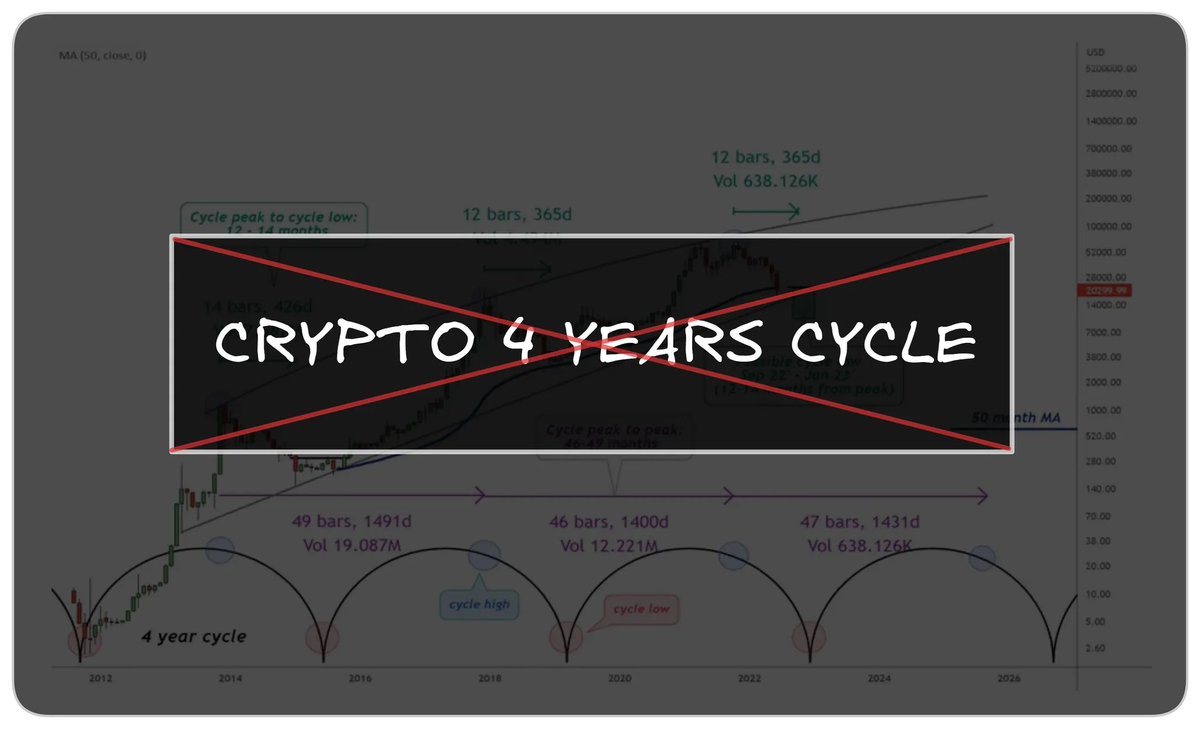

A lot of people ask me whether the 4-year crypto cycle still exists. I won’t answer that right away because I’d rather walk through the evidence with you and let us find the answer together.

This week, I had some deep conversations with serious crypto veterans. And one recurring idea kept coming up: the 4-year cycle is dead.

If you’re still waiting for a magical halving pump or praying for another 100x bull season, chances are the market has already moved on without you.

Because crypto no longer runs on a single clock.

Crypto now runs on four simultaneous cycles, each with its own logic, tempo, and reward system:

[1] Bitcoin Super Cycle

I’ve been tracking capital flows closely and it’s becoming clear that the halving narrative has weakened.

BTC is no longer a hype coin. It’s an institutional allocation asset.

🔸Retail is slowly exiting

🔸Meanwhile, ETFs, public companies, and macro funds are steadily buying

Look at MicroStrategy or BlackRock. They’re playing a 10-year game, not a 10-month sprint.

→ We’ve entered a multi-decade cycle:

🔸Lower volatility

🔸Slower but consistent upside

🔸20–30% annualized ROI, similar to prime-era tech stocks

Retail can’t stomach that timeline. So they rotate out—and miss the magic of compounding.

[2] Meme Cycle – Attention is the New Capital

Memecoins don’t follow tech cycles. They follow emotional liquidity.

When narratives dry up, memes thrive.

But the game has changed:

🔸From organic chaos to industrial-grade coordination

🔸Studio-made trends, bot-optimized entries, community-farmed exits

If you’re an average retail trader?

🔸Your edge is shrinking. The window is closing.

🔸This game now favors those with capital, speed, and community networks.

[3] Tech Narrative Cycle

ZK, AI infra, Layer 2s... these narratives don’t die, they just go quiet while builders keep building.

If you only chase memes, they’ll look dead. But if you follow Gartner’s Hype Cycle, this is rock bottom, the best time to accumulate.

The pattern is clear:

🔸At the idea stage → overpriced

🔸At the execution stage → undervalued

Those who buy during the death valley and hold for 2–3 years, through silence, ridicule, and capital drought, tend to 10x.

[4] Narrative Micro-Cycles

These are 1–3 month rotations. Every few weeks, a new hype train pulls in:

🔸RWA → DePIN → AI Agents → MCP → A2A → ???

Each narrative has a 30–90 day shelf life—just enough time for capital to front-run attention.

The cycle is predictable:

Concept → Funding → Amplify → FOMO → Overvalue → Rug or Retreat

But here’s the alpha: if new micro-narratives build on top of old ones (e.g. MCP stacking on AI Agents), they can snowball into super narratives, like DeFi Summer 2020.

Right now, I’m tracking the AI infrastructure stack closely:

🔸 MCP Protocol

🔸A2A communication

🔸Distributed compute + data + inference

If these pieces loop into a cohesive flywheel, we may be heading into AI Summer next.

So does the 4-year cycle still exist?

I don’t think so.

This market no longer moves in a single, unified rhythm.

It’s a stack of overlapping games, each with its own players, timeframes, and win conditions.

🔸Some narratives play out over decades

🔸Others live and die in two weeks

🔸Some reward deep research

🔸Others reward instincts and timing

My advice?

Don’t blindly wait for halving. Don’t FOMO into meme tops.

→ DCA in when markets are silent, prices are low.

→ DCA out when capital and attention return.

You don’t need to catch exact tops or bottoms, just need to understand the cycle you’re in and play accordingly.

That’s how you stay ahead of 90% of the market.

Show original

7.51K

119

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.