Lads, you can get >15% APR on $weETH with no leverage because of @ether_fi's Summer Pump campaign.

Many cycles ago, before LSTs existed, our yieldcestors primarily lent ETH and borrowed stables to farm in order to get an ETH yield.

It's time to bring this back 🧵👇

Let me explain.

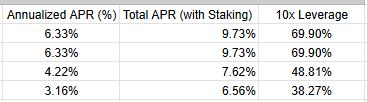

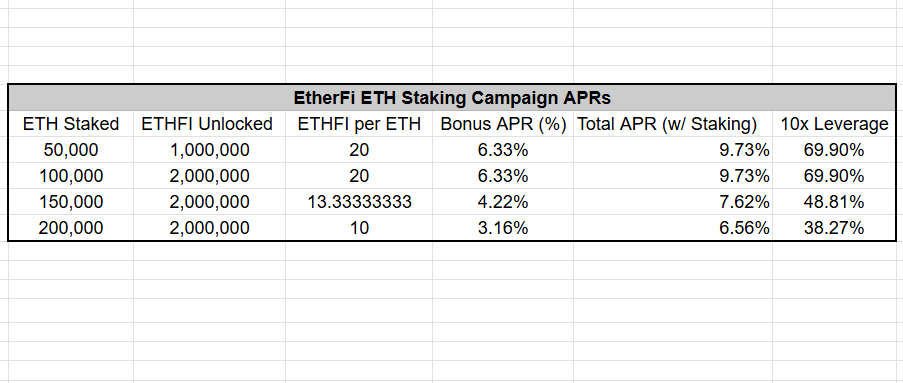

Summer Pump gives a 3–6% additional APR to newly minted weETH.

That makes the net APR 6-9% just for minting weETH.

I walk through the math in this thread here:

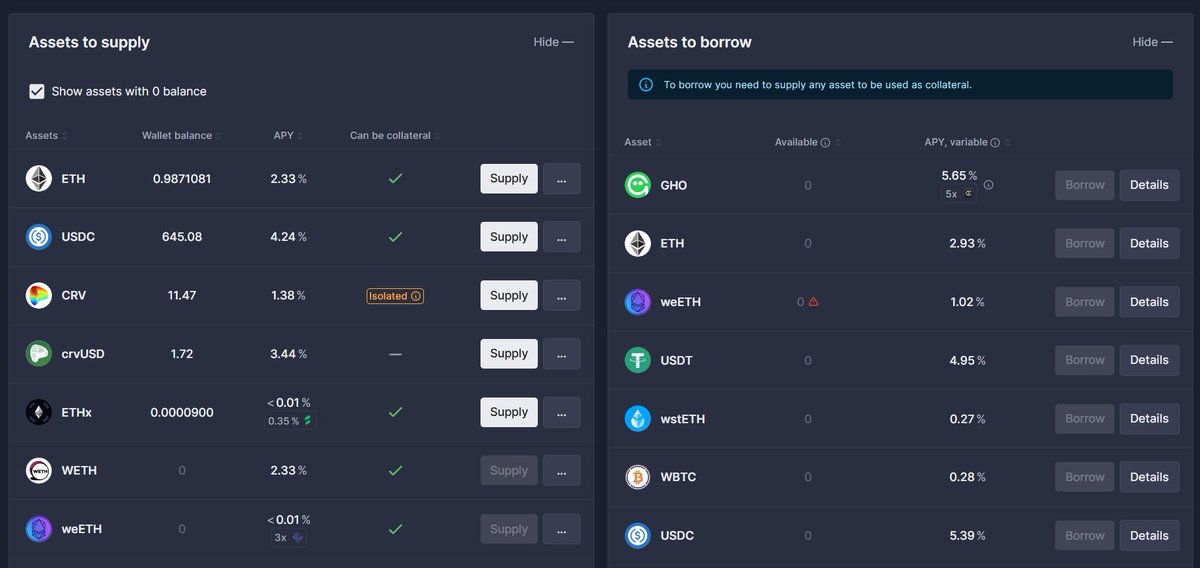

You can leverage weETH for a remarkably high APR (@eulerfinance is an excellent locale for this).

BUT, to avoid leverage, try this:

1) Mint weETH

2) Deposit onto your favorite money market

3) Borrow stables at 50% LTV at ~5% APR

From there, you have a number of options 🧵👇

1) SUPER easy

Deposit borrowed stables into @ethena_labs.

Right now sUSDe is at 12% APY.

The Numbers:

➢ Base weETH APR: 3%

➢ Summer Pump APR: 6%

➢ Borrow Cost: 5%

➢ sUSDe Yield: 12%

The Math:

(3% + 6%) + 50%(12% - 5%)

Net APR: 12.5%

2) Basis but better

sUSDe has a great yield and phenomenal risk profile.

HOWEVER, $RLP from @ResolvLabs gets a leveraged exposure to basis returns by virtue of being a junior tranche.

Its 7-Day APR is 20% annualized.

The Math:

(3% + 6%) + 50%(20% - 5%)

Net APR: 16.5%

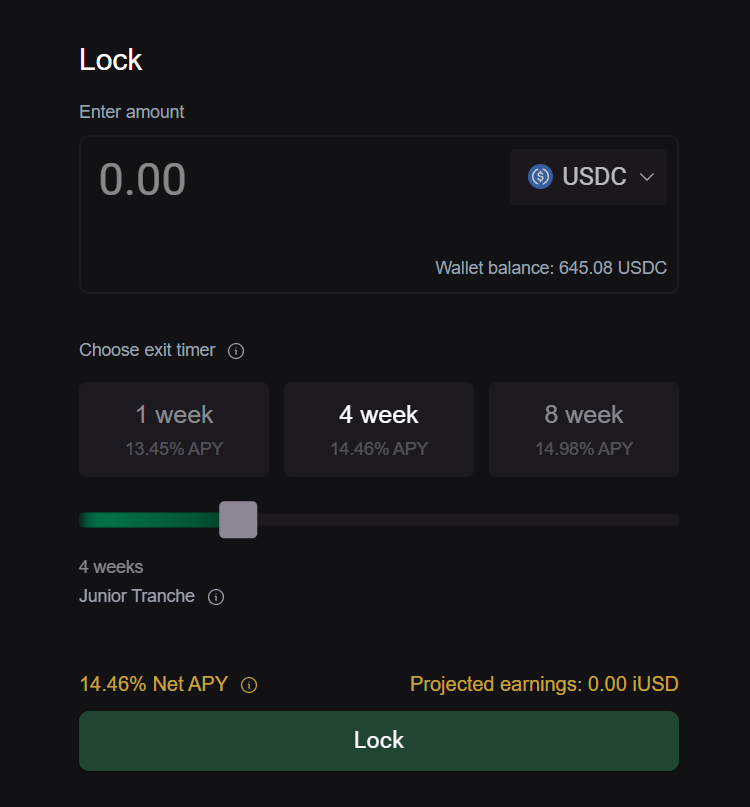

4) Avoid slippage, use USDC-in / USDC-out protocols like @infiniFi_

If you borrow USDC but swap to USDe or USDT, you'll eat slippage when entering/exiting positions.

INSTEAD, consider USDC-denominated yields.

Infinifi has the best one at 13-15% APY.

Net APR:

13% on weETH

The world is your oyster.

The idea is that you mint weETH, lend it (locking in your 6-9% collateral APR), then borrow stables at a lower rate than you farm them.

You avoid leveraging headaches while benefiting from this explosion of stablecoin yields.

That's it! Thanks for reading.

Note: EtherFi Ambassador

44.49K

102

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.