After wandering around the @HyperliquidX eco & trying to maximize my exposure to some of the top dApps/protocols, I've figured that @liminalmoney is worth interacting with & looking out for

Why?

That's exactly what we'll be covering in this 🧵 on @liminalmoney 👇

Now that @kinetiq_xyz is live, here's exactly what I'm doing and making the best of it (with a complete video guide):

Started off by staking HYPE for kHYPE on Kinetiq (likely counts towards kPoints but can use others like @prjx_hl or @HyperSwapX to swap HYPE + other assets for kHYPE)

Now, how I split those (Assuming you're putting in $1K):

👉 $250: LPing HYPE/kHYPE on @prjx_hl

👉 $150: Borrowing HYPE against kHYPE (borrow 80% of your lending amount) on @felixprotocol, @HypurrFi, @hyperlendx, or @0xHyperBeat

👉 $300-500: Keeping some aside to lock into @ValantisLabs

👉 $200-500: Staking in @0xHyperBeat in wHYPE vault

PS: You can also hold some funds in kHYPE and/or use borrowed hype to farm protocols like @hyperunit if you want to stick to a few rather than too many

Found this to be the best possible way to get exposure while farming various dApps at once (Assuming all you have is $1K)

While there's a lot more that I'm doing, I've covered most of it in the video below, and if you're farming and interacting with @HyperliquidX eco as well, let me know what you're doing with your kHYPE in the comments 👇

Links/referrals:

- @kinetiq_xyz:

- @prjx_hl: (10% bonus points)

- @felixprotocol:

- @HypurrFi: (Extra 5% points)

- @hyperlendx:

- @0xHyperBeat:

- @ValantisLabs:

Complete breakdown video with steps 👇

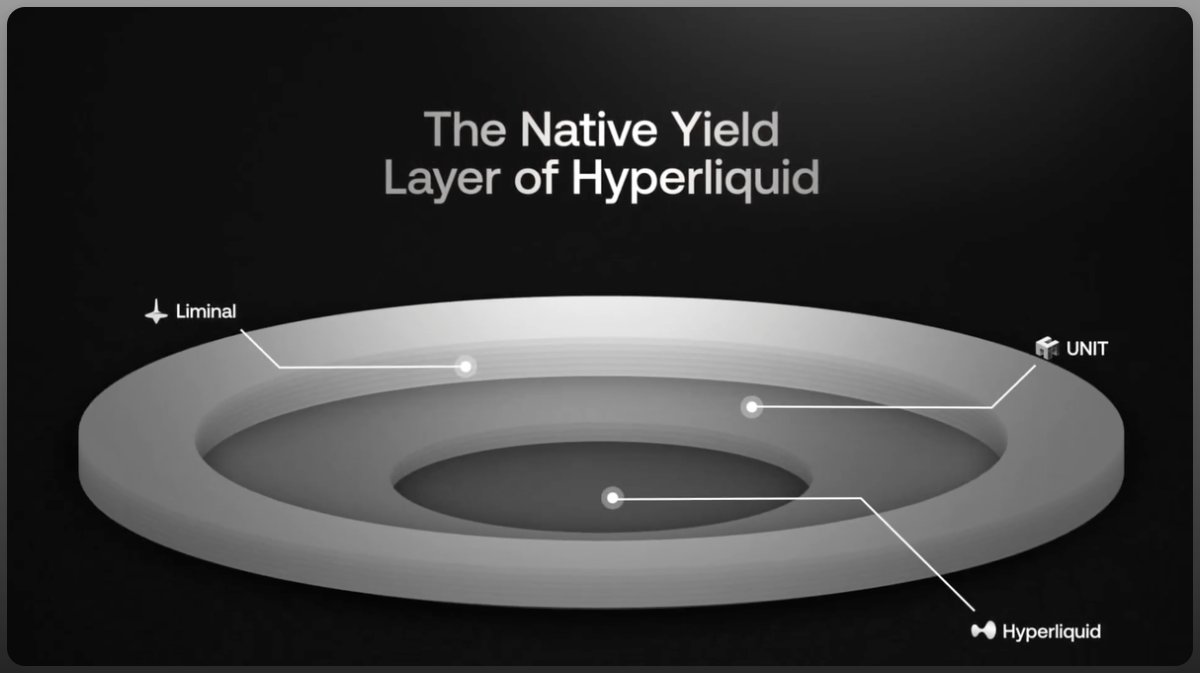

At its core, @liminalmoney is a DeFi protocol that allows users to earn yield from perpetual funding rates, with no market exposure.

Built directly on @HyperliquidX’s infrastructure, it offers secure, automated, and high-performance access to one of the most consistent sources of yield in crypto.

The magic lies in being delta-neutral.

Most people try to farm funding rates manually, going long on one exchange & short on another. But it’s complex, gas-intensive, and prone to errors.

@liminalmoney automates this by using a delta-neutral strategy that captures funding rate spreads passively.

Here’s how it works under the hood:

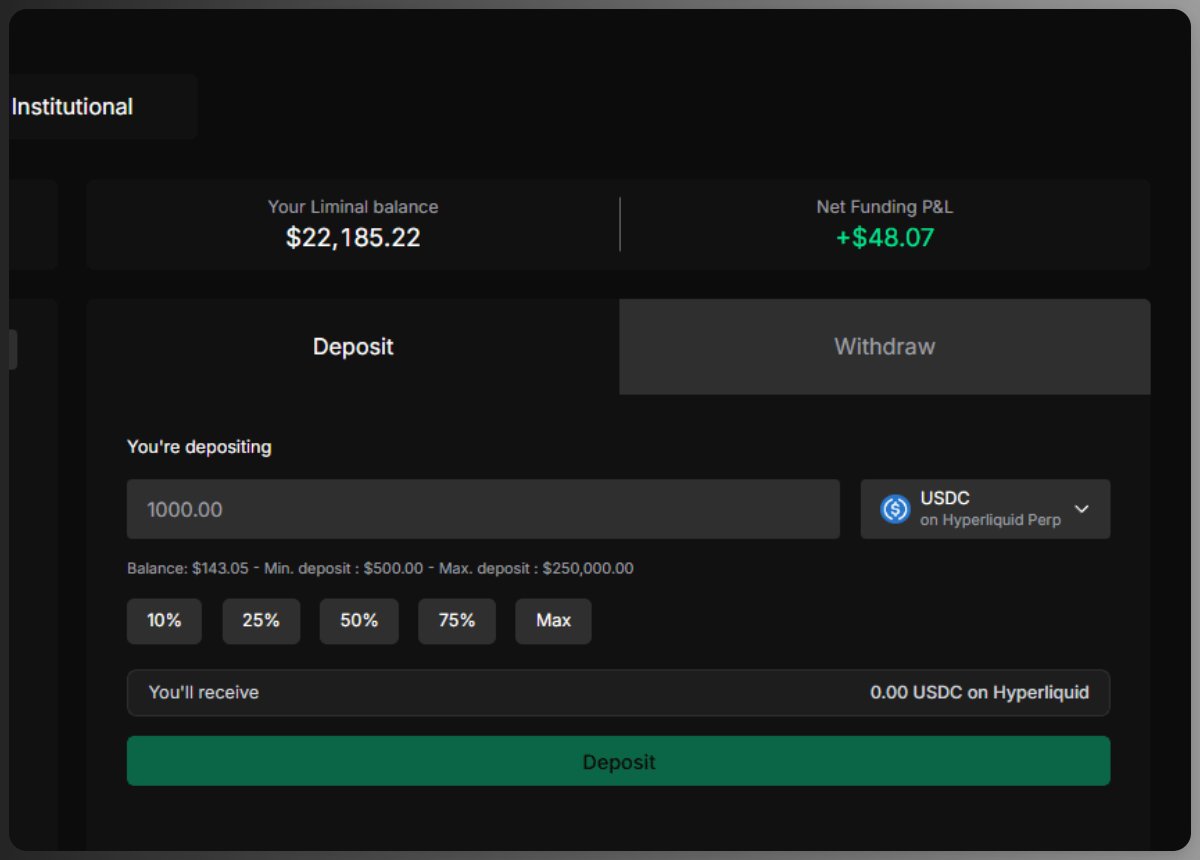

✦ Users deposit stablecoins (like USDC)

✦ The protocol opens equal and opposite long/short positions

✦ Market-neutral = no exposure to asset price movements

✦ Funding rate yield flows back to depositors

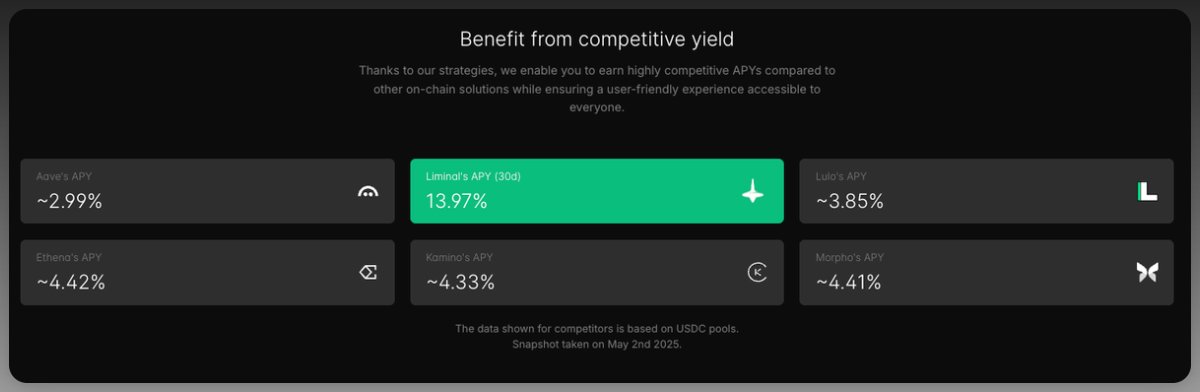

So what makes Liminal different?

✦ Built directly on Hyperliquid

✦ Zero price risk via delta-neutral positioning

✦ Designed for both retail and institutional capital

✦ High transparency and composability

✦ Set-and-forget UX, true passive yield

This model is particularly effective in volatile markets, where funding rate differentials fluctuate significantly.

Whether you’re a DAO, fund, or solo user looking for low-risk returns, @liminalmoney provides a clean, automated path to earn yield with no trading overhead

And since it runs natively on @HyperliquidX:

✦ You get near-zero latency execution

✦ Deep liquidity and tight spreads

✦ Full alignment with one of the most performant perp DEXs in the space

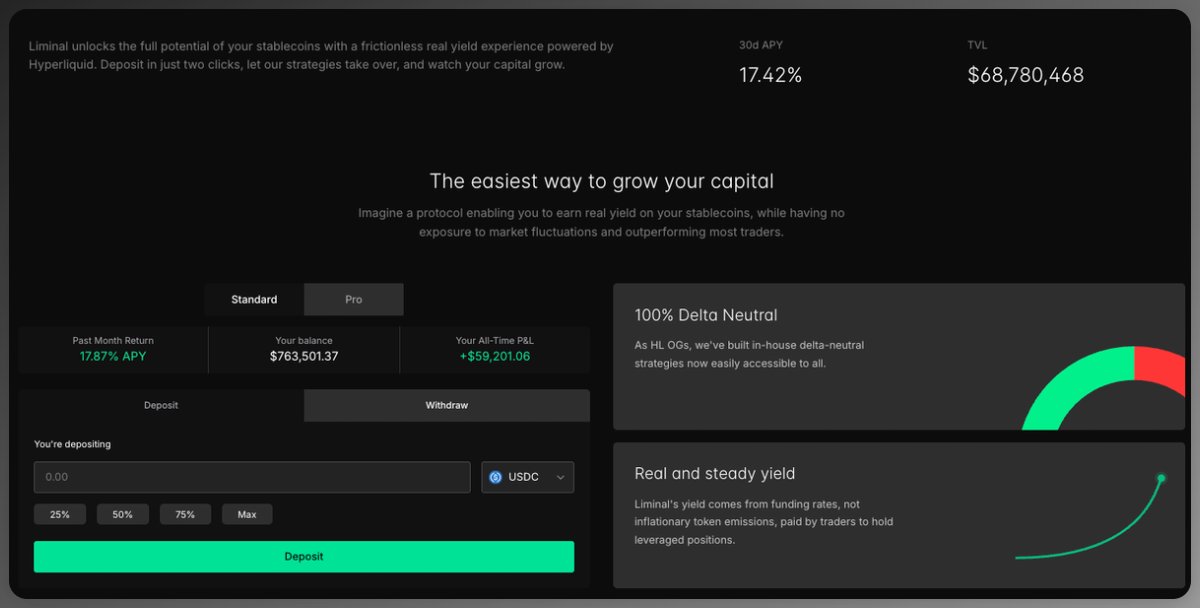

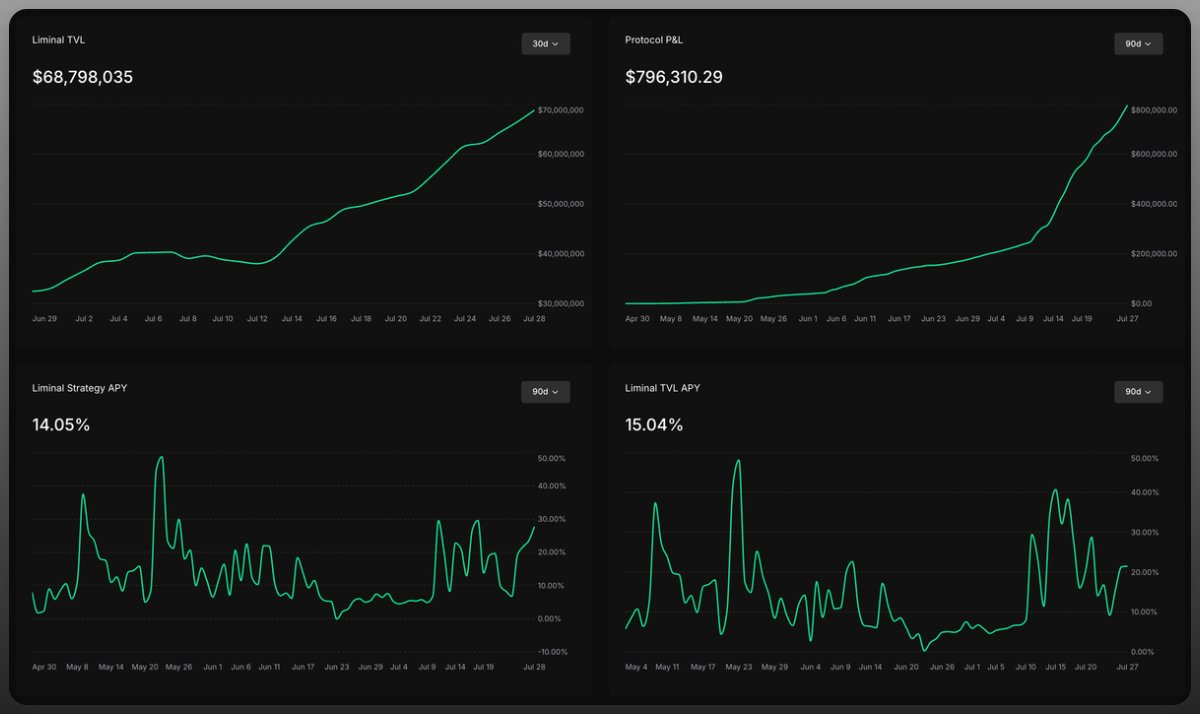

Now, looking at some stats before getting into how we can best use @liminalmoney 👇

✦ TVL: ~$69M

✦ Protocol PnL: ~$800K

✦ Averge APY: ~14%

✦ TVL APY: ~15%

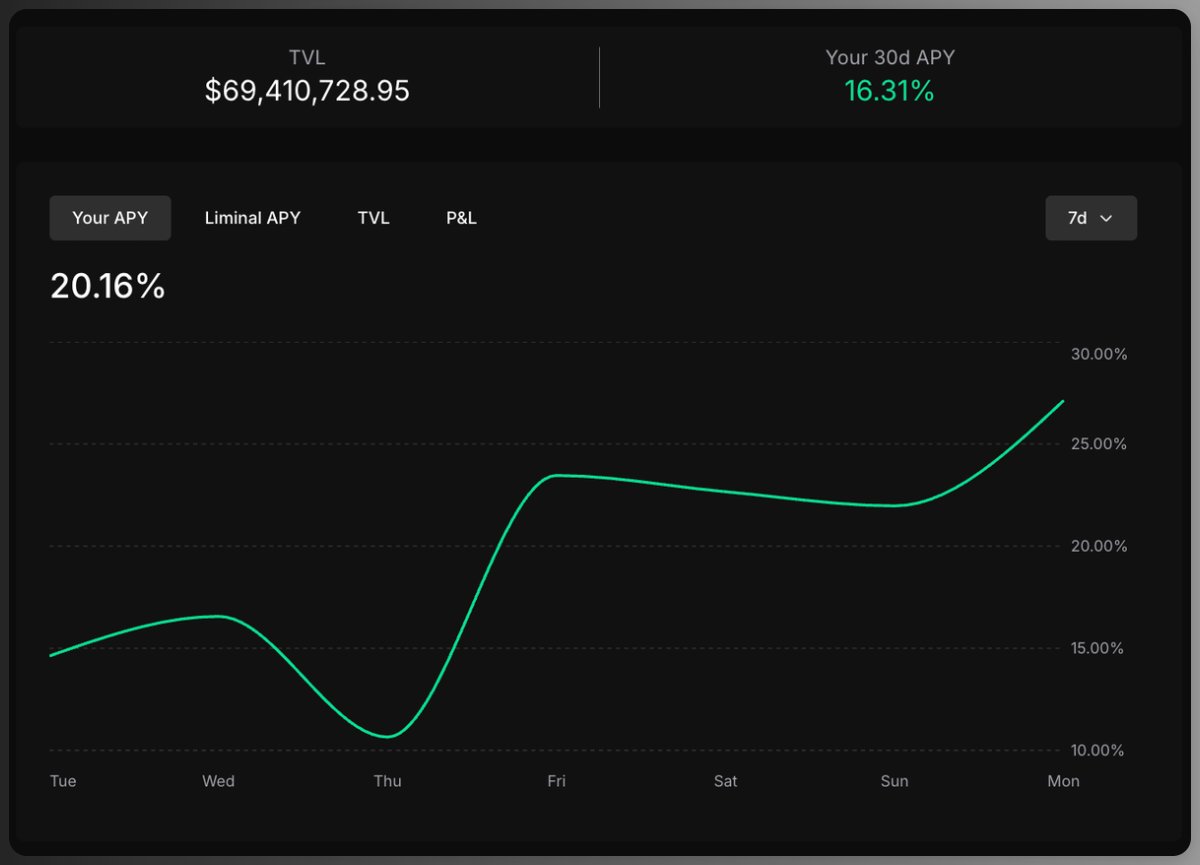

Moving on to how you can use @liminalmoney:

✦ Head here:

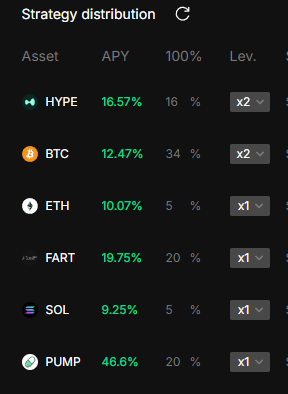

✦ Select your strategy & asset distribution based on preference (my strategy shared below)

✦ Deposit USDC

✦ Manage weekly/bi-weekly

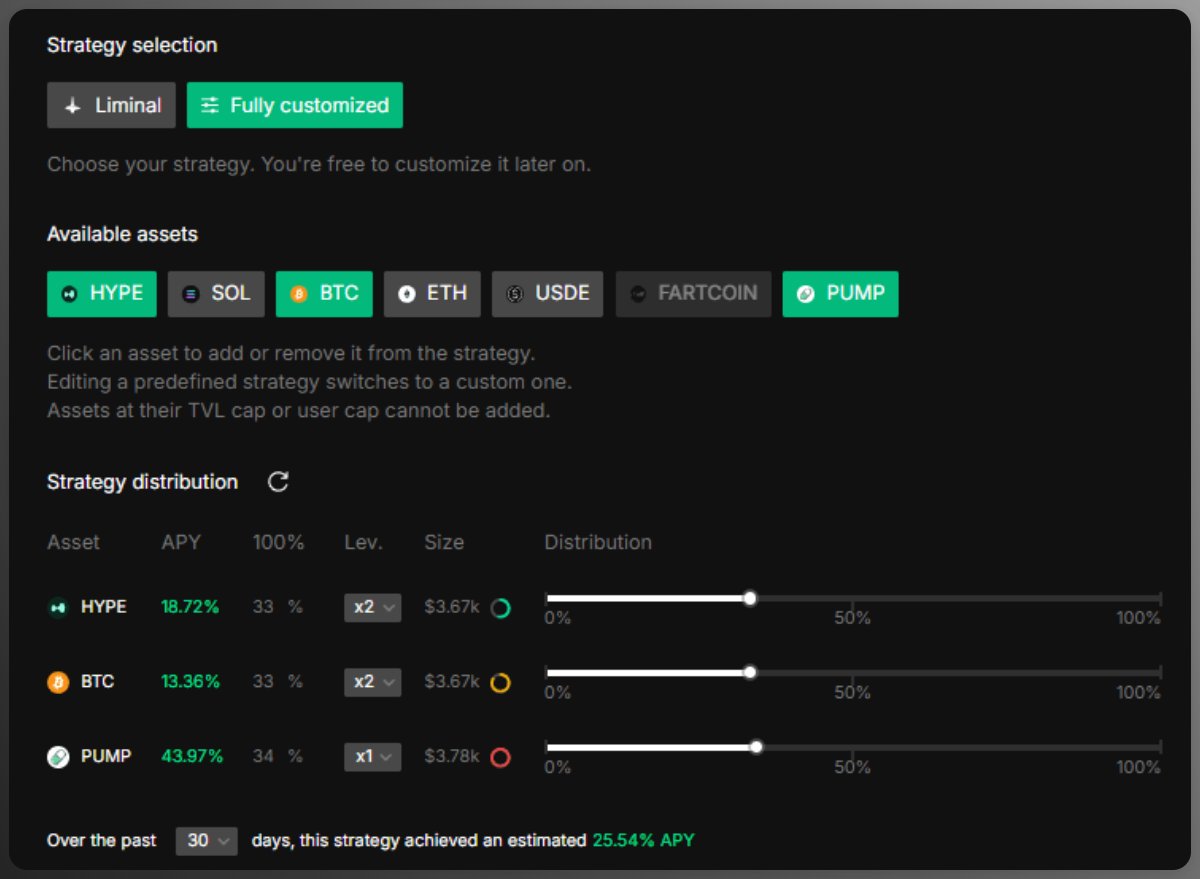

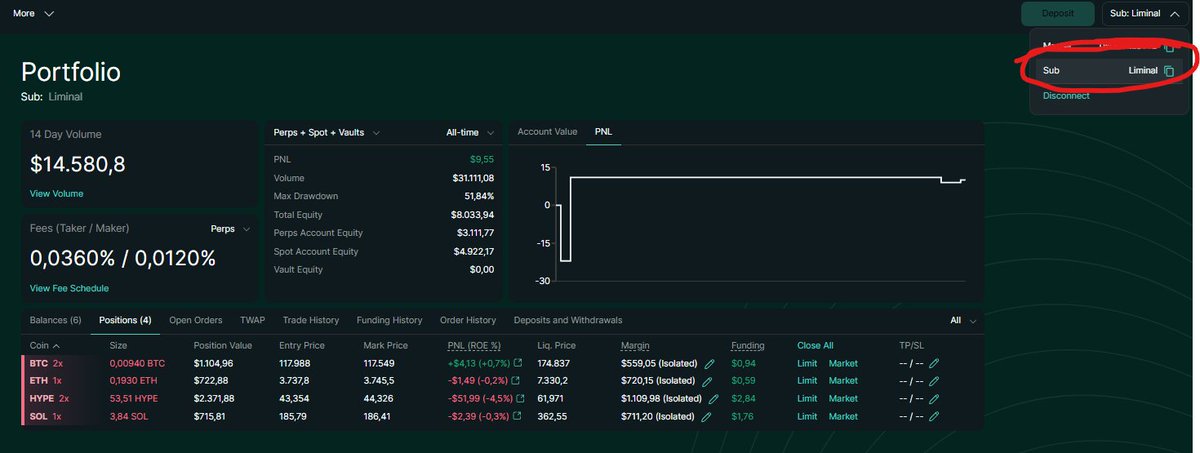

As for the strategy that I'm using and how I split my funds:

✦ 33.33% in HYPE (with x2 leverage)

✦ 33.33% in BTC (with x2 leverage)

✦ 33.33% in PUMP (x1 leverage with high APY)

PS: If filled, choose others like $BTC, $HYPE, or $ETH (as they have higher leverage and APY)

By using this loop, I get:

✦ Close to the highest APY (25.5%+)

✦ Exposure to @HyperliquidX future drop as volume is on your wallet

✦ Exposure to @hyperunit future drop (as $PUMP & $BTC generate Unit fees)

✦ Farm 3 drops (including @liminalmoney) at once

Lastly, it's worth noting that trading under an Institutional wallet is best when you have at least $100K volume on @HyperliquidX. By doing so, you gain:

✦ Complete custody through sub-accounts, ensuring your funds remain safe in case of any issues with the Liminal API

✦ Higher rewards compared to Pro/Standard mode, as volume is on your sub wallet and you get to keep 100% rewards

For more info on this, best to check out this post by @Sakrexer 👇

Realized many are confusing 'Pro' mode with 'Institutional' Mode on Liminal

It is super important to change your custody (top right in the settings) so Liminal does the Funding Strat on your Sub account!

Keep in mind to create a sub account, you will need 100k usd volume on your Hyperliquid Main account. If you are struggling to reach that volume, I suggest just opening a big leverage position (40x btc) and closing it right away to hit the volume in a short time

Why Institutional?

- You have full custody over your wallet, Liminal can't withdraw your money via API

- Volume gets generated on your Wallet and you get 100% of the rewards airdropped to you

- If you don't use a sub account, you basically farm it on a big wallet of Liminal and get the rewards in pro-rata which might be significantly less

When selecting a strategy it's best to pick up a mix of Unit assets (PUMP and FART atm full) and the highest possible leverage (btc x2, hype x2 etc) to maximize your funding rates and volume

Pro tip: Change your specific strategy (% per asset) every 1-2 weeks to create additional volume and potentially farm more $UNIT and $HYPE

Below is a sub account I created 2-3 days ago

With that, I wrap up this 🧵 on @liminalmoney for now. I'll return with similar content on other projects I'm farming in due time, but if you found this useful, please consider:

- Joining Liminal using my code: CORGILL ()

- L+RTing this post

7.49K

48

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.