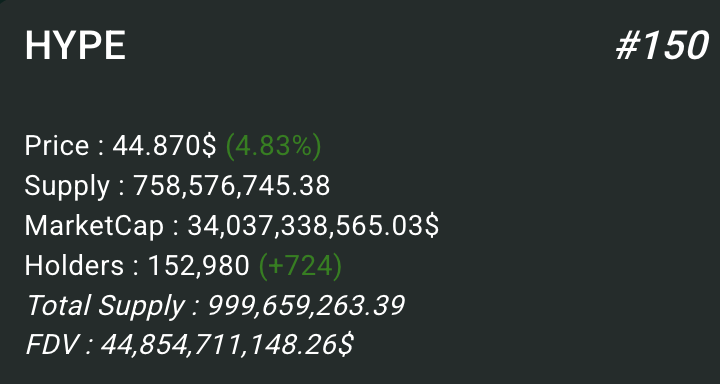

(1/11) Hyperliquid Valuation Framework: Update 🧵

It has been about 6 months since I initially posted my valuation framework for $HYPE. A lot has changed since then, but also much has remained true.

I am as bullish on $HYPE as I have ever been.

Let's walk through some numbers👇

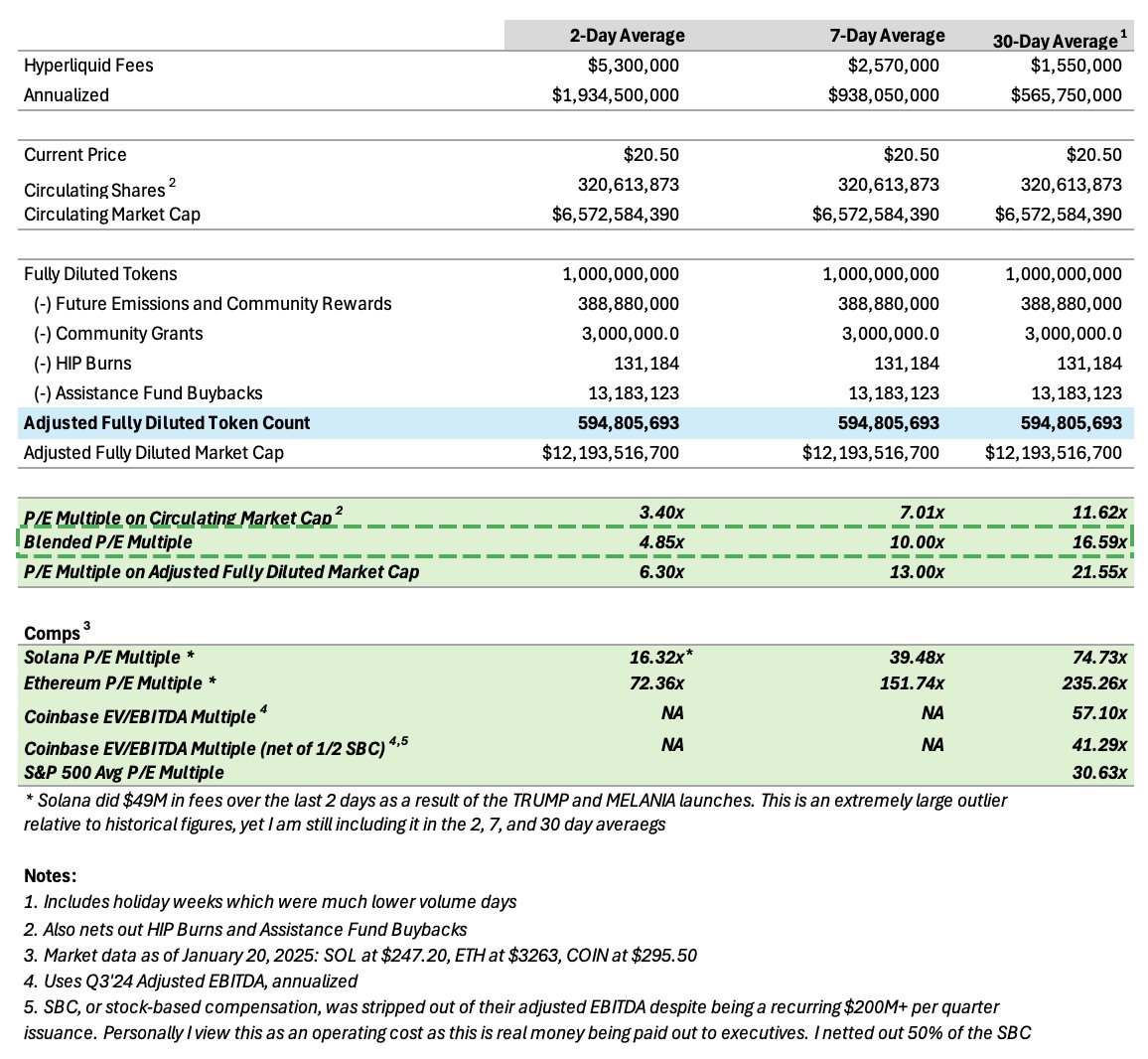

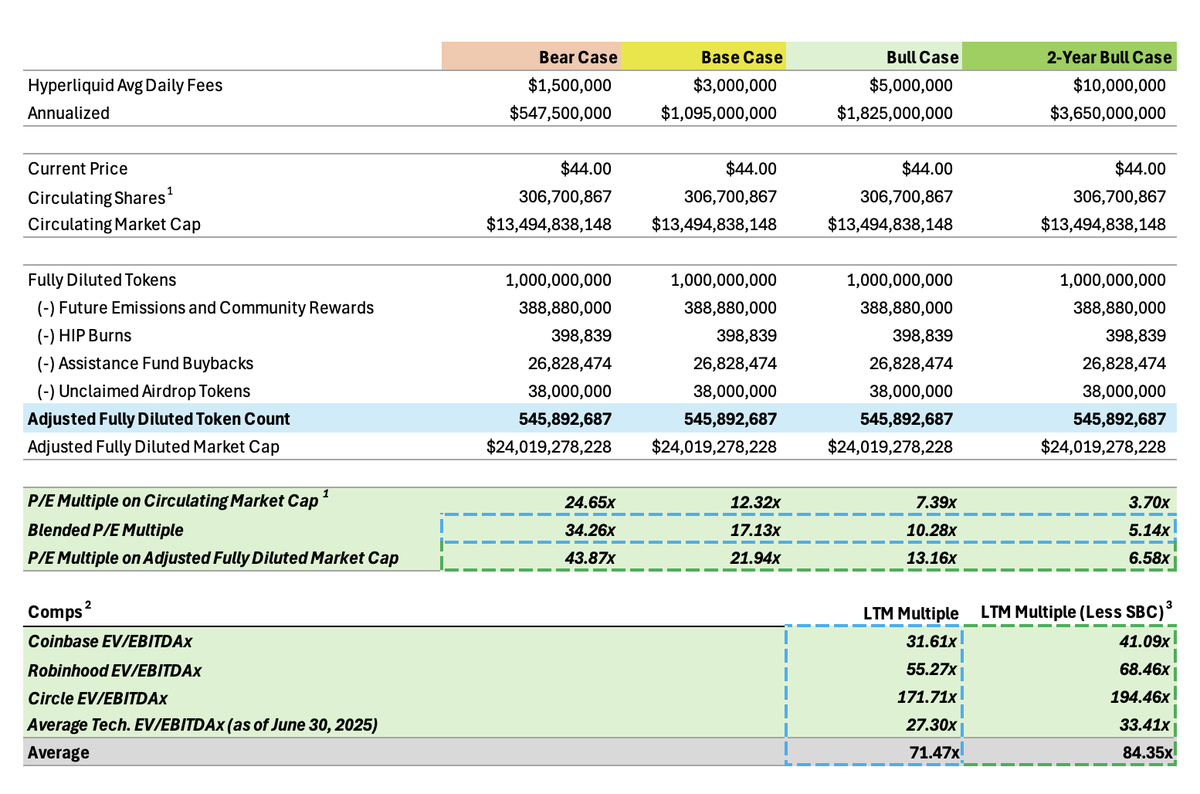

(2/11) Revenue Underwriting --

The hardest part of valuing $HYPE is underwriting an annual revenue (cash flow) number that you can be comfortable with. Hyperliquid is a startup, growing extremely fast. So you would think to include growth in your number. But it is also in a cyclical industry, where bear market volumes can be ~50% lower.

Personally, my view has been that Hyperliquid's rapid user growth, inflows, and other catalysts will outpace any reduction in volume from a bear market. We saw this come true over the last 6 months on the growth front, where avg. daily revenue figures have risen substantially. Regarding bear market volumes, I do not think any near-term bear markets for $BTC will be as bad as they have been in the past due to ETF flows and the current crypto-friendly state of US politics.

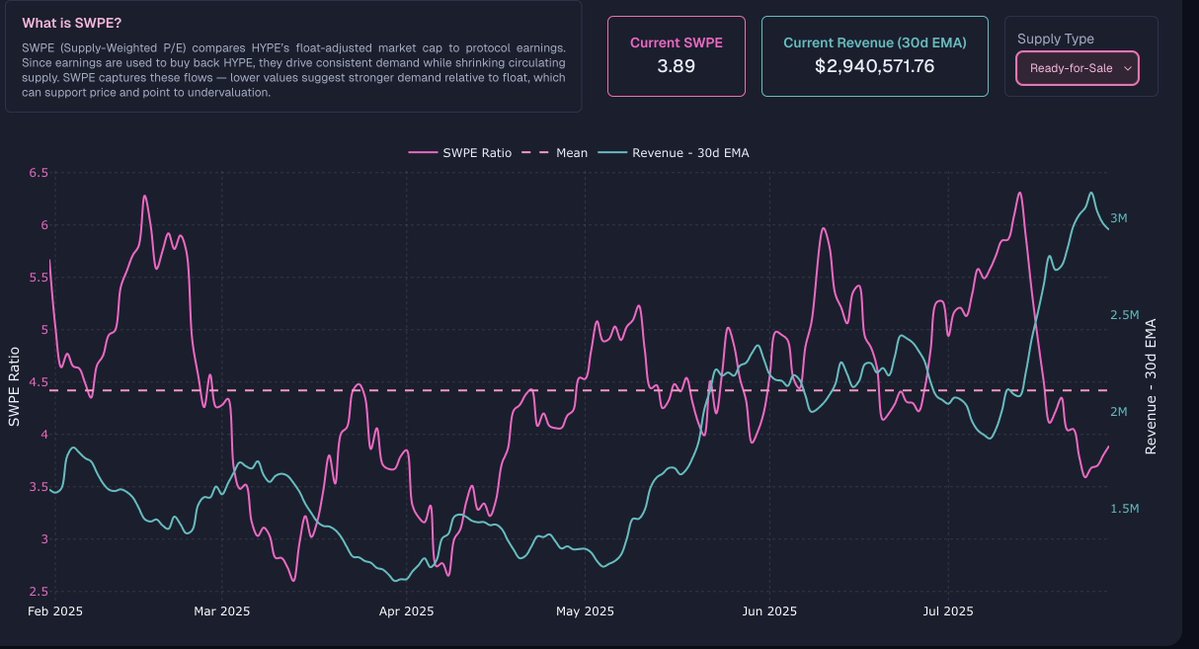

Of course, still a factor to consider and revenues could very well take a ~50% hit for a couple of years, so we will be conservative and use recent average bull market volumes for our go-forward base case ($3m) i.e. no growth.

(4/11) $HYPE Bull Case --

Let's talk about the bull case. I think this is where most people really get it wrong. They try to look at current figures and then discount them b/c we are in a bull market. Have they ever once stopped to think about how big the TAM is of this market? Perps are the highest TAM market in crypto alongside stablecoins. Hyperliquid today accounts for ~10% of that market, depending on how you are doing your calculations. And with regards to spot CLOB market, it's currently even less. The amount of white space here is astronomical. HyperEVM as well, is still in its infancy. Not to mention HIP3 and all of the exotic types of perps we will see in the future that will expand Hyperliquid from crypto perps to perps for anything you can dream of -- equities being my favorite, pre-IPO private companies, prediction markets, forex, commodities, and more

Perpetual futures are the single best financial instrument on this planet, and Hyperliquid is the AWS of perpetual futures, with incredible scaling capacity, all decentralized and transparent. Trad-fi and the rest of the world are still early to understand perps, but the quality of product is evident and I believe has a lot of room to take over traditional markets

Going back to the bull case, Hyperliquid was doing ~$1m in fees per day when I wrote this first valuation framework in February. (I wrote it right after the TRUMP token launch, so recent fees were elevated). But on run rate, it was about $1m. That figure today is more like $2.5-3.0m We have done about 2x+ growth in just 6 months. Users and inflows have grown substantially as well. I'll post some charts later in this thread as I believe those are the North Star of valuing and understanding Hyperliquid's potential. But I think if you are an investor and you aren't thinking about what is the true bull case of a business that is as young and fast-growing as Hyperliquid, you are doing yourself a disservice

Hyperliquid is currently doing ~5% of volume vs. all CEX's today. It is not crazy to imagine that this figure gets up to 25% in the next couple of years. If that happens, avg daily fees should rise from ~$3m per day to ~$15m per day. I don't have a good reason for why this wouldn't be possible, given the quality of product, team, and all the catalysts to come. Also, the more Hyperliquid grows, the better the product becomes as liquidity deepens

At $10m of fees/day, we are talking about a 5x free cash flow multiple

(5/11) $HYPE vs. Crypto Tokens --

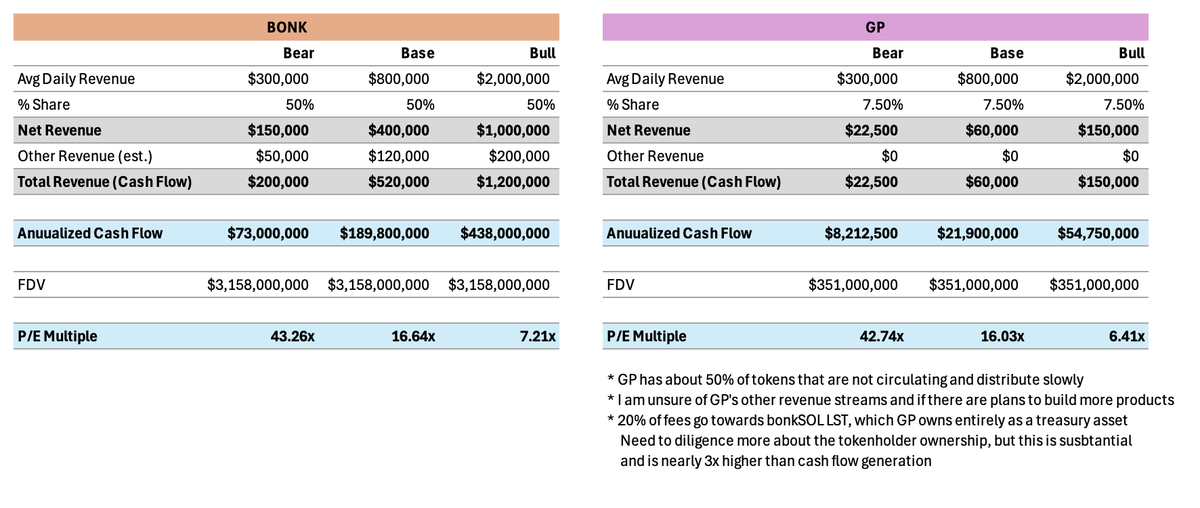

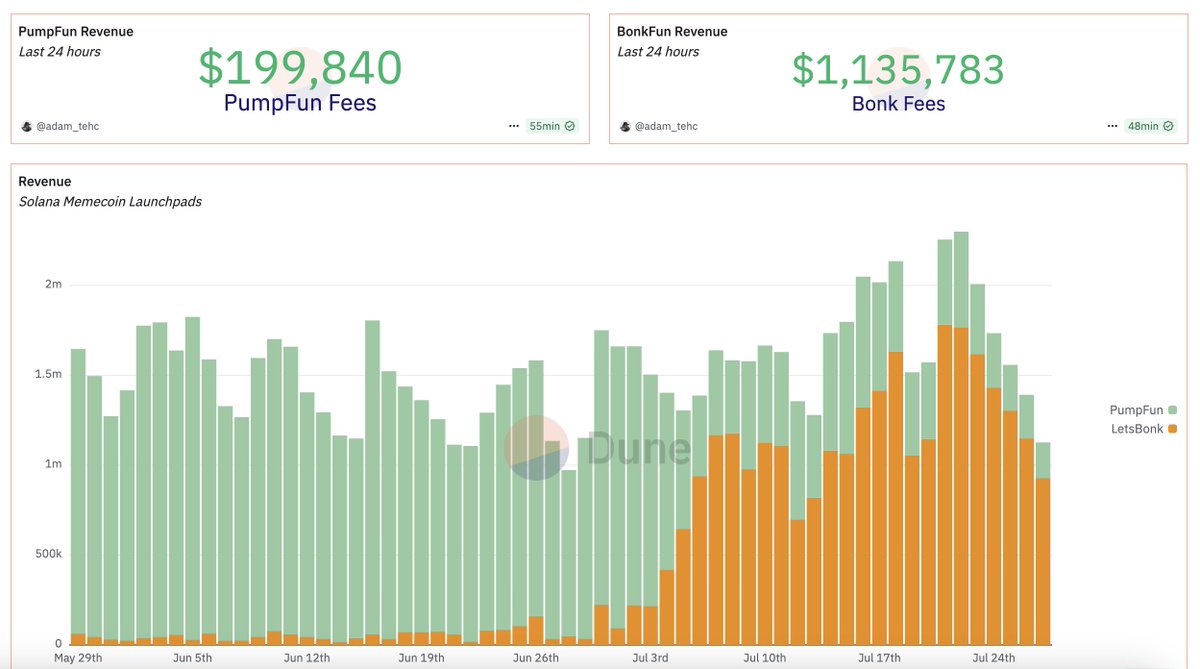

How does $HYPE compare to other tokens in crypto? Well, it's not really even relevant to look at since the comparisons are so abysmal. The only other tokens that we could compare to are $BONK, $GP, and $PUMP, as memecoin launchpads are the only other product in crypto with strong PMF and cash flow generation. Yes, there are DeFi protocols and yes, $SOL makes some money, but the multiples are not even worth looking at as they are 80+ so it's not really relevant.

For the launchpads, here are some comparisons. I have positions in $BONK and $GP, which I believe are the only 2 tokens in crypto outside of $HYPE that are undervalued and trade at attractive multiples. Maybe I will do a separate thread on these, as I just got a lot of new information this morning on tokenomics / cash flow for both.

$PUMP I had longed but cut my position. I think they are losing this war and honestly deserve it. I always thought their business model was ripe for disruption with little MOAT and I am glad a non-extractive team like BONK is beginning to win the memecoin war (all metrics are suggesting this is the case).

(6/11) Trad-Fi Pitch --

One of the most important things about $HYPE is its pitch to trad-fi. Everyone is talking about how this cycle is the cycle of trad-fi, and it is very true. We are looking at ~$50-100B of inflows between $BTC and $ETH since launching the ETFs 1.5 years ago. These are record setting for ETFs, and trad-fi interest is certainly here.

Now the question is -- what asset is most attractive to trad-fi? Well, how about the only token in the history of crypto that actually generates substantial cash flow with a sustainable, defensible business model?

A Bloomberg analyst gave us the amazing meme: "What is the underlying of a Hyper Liquid?" While it was funny, he posed a great question, and it's a question Trad-Fi has been asking about crypto forever. And now we finally have an answer, and not a weak one, it's a home run.

The world of trad-fi doesn't even know about $HYPE yet, likely due to the team not marketing at all. Any other team would have had 1000 calls with investors already, Jeff and co. are built different. But don't be fooled, Trad-Fi will discover $HYPE soon enough. And when they do, the flood gates will open. Personally I think this happens around when $SONN launches. They are heavy hitters on Wall St. and will be marketing $HYPE around with the help of Paradigm and Galaxy Digital. The pitch has never been easier to anyone who actually understands finance. And that is where the money lies today.

Another important catalyst is that $SONN has $300M of dry powder to buy $HYPE once the vehicle launches. Everyone has gone crazy about SBET's $5B ATM for $ETH, which is equivalent to around $25B in $BTC purchasing power. For reference, $300M of purchasing power on $HYPE is equivalent to $9B of $ETH purchasing power, or $48B of $BTC purchases. Yes, $48 Billion. For reference, $BTC is on record pace for flows this year and has only taken in $15B YTD. I think the $300M will get front run but will also be a massive catalyst to propel the $SONN flywheel.

(7/11) Distribution --

$HYPE only has 153k holders. This is less than many memecoins on Solana. $SOL for reference has >10million holders. The reason for the lack of holders is distribution, it is currently hard to buy $HYPE. Low distribution makes it hard for price to go up, as many current holders are up a lot of money and don't necessarily need or feel comfortable with trying to participate in continued upside with size. Thus, we need $HYPE to change hands. But it is hard for retail to buy $HYPE in its current state

Coinbase and Binance refuse to list $HYPE for obvious reasons. But many front-ends and FIAT onramps are being built for Hyperliquid. Phantom also recently built a perps product, leveraging Hyperliquid builder codes. This seems like a strong, continued partnership, and I imagine Phantom will allow for users to buy spot $HYPE as well. Phantom perps has onboarded about 15-20k users in just 2 short weeks. Tapping into this distribution network may be a huge catalyst for $HYPE, in addition to the other distribution networks that are underway. The treasury co's like $SONN and $HYPD I think will also serve as great distribution networks, outside of just big trad-fi money. This may take time and will be more prevalent once they are more mature.

(8/11) Hyperliquid Stats --

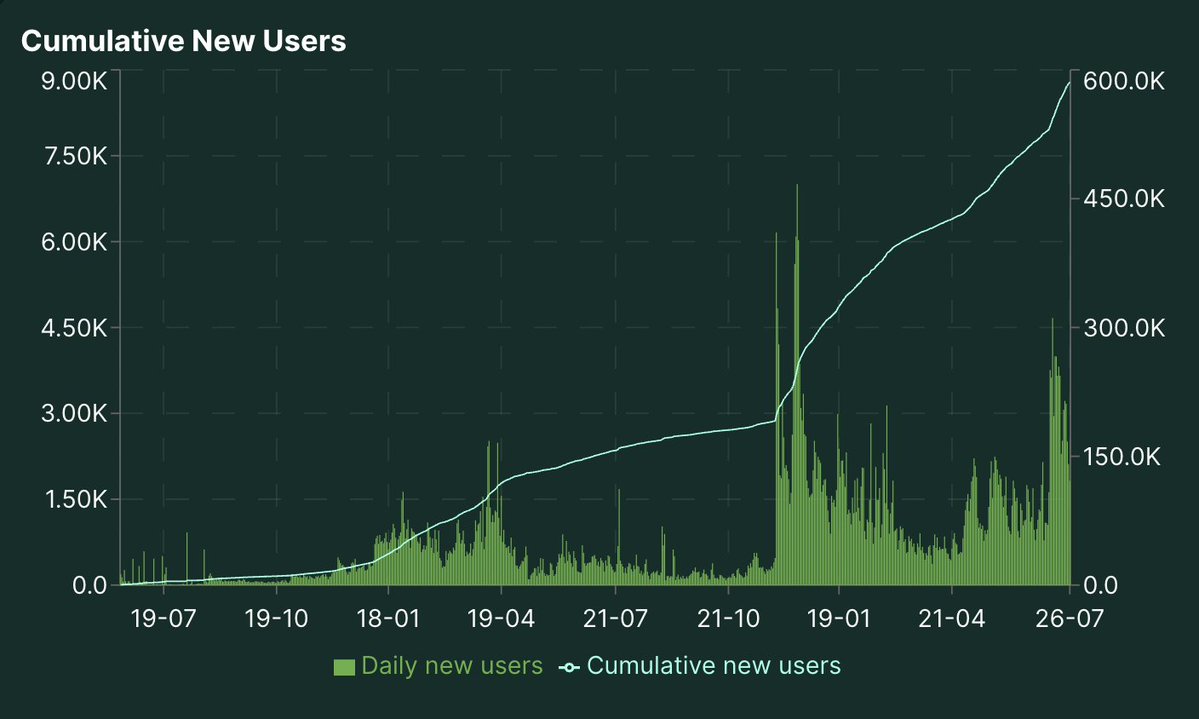

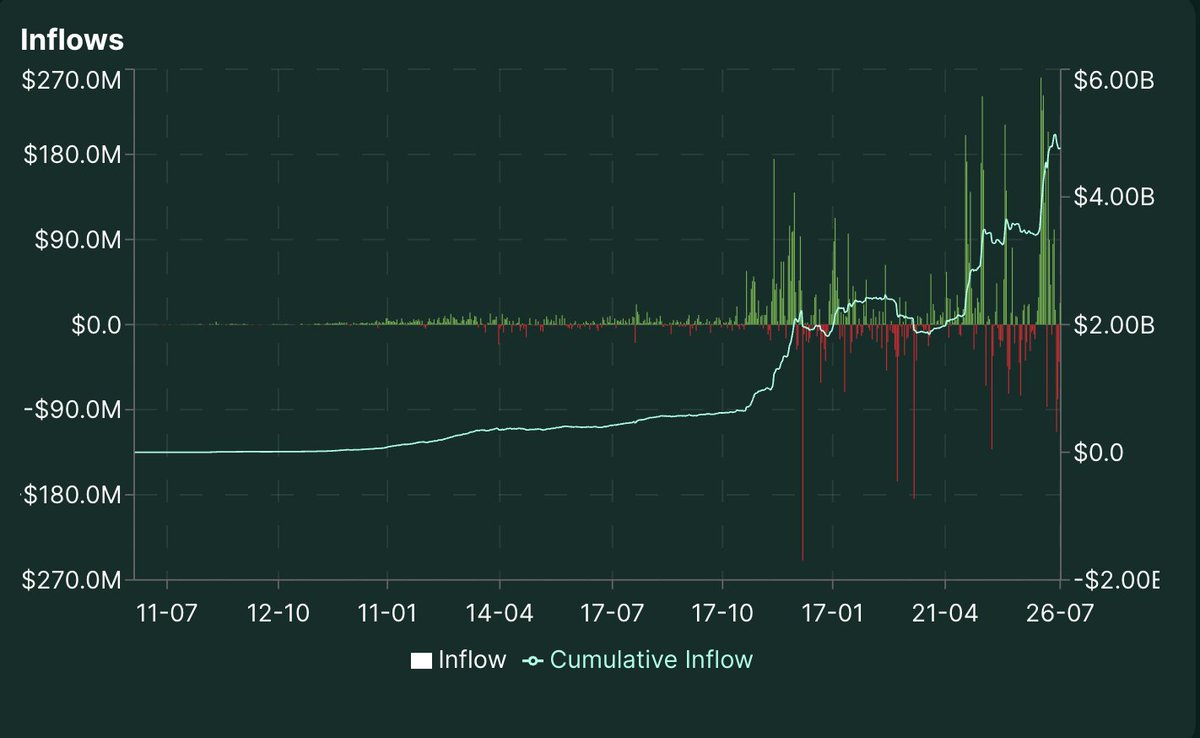

Hyperliquid dashboards are some of the best in all of crypto. Fundamentally, things have never looked better. It is quite astonishing to see where price currently is in the midst of the mammoth growth Hyperliquid has seen of late. I'll just post a few of my favorite charts and let the numbers do the talking as I have rambled enough today

Users growing at rates not seen since TGE, inflows accelerating and at ATHs, OI at ATHs

(10/11) SWPE Ratio --

Lowest SWPE ratio since April. Thanks @skewga_hyper for this awesome graphic

(11/11) Next Wave of Growth --

I think the next wave of growth for Hyperliquid, in terms of price and cash flow is the following:

- Front-end distribution: builder codes are one of Hyperliquid's best innovations. The bullishness of Phantom Perps launch cannot go understated. Front-ends will also do marketing, whereas Hyperliquid to this day has never done any marketing

- Fiat on-ramp: I have heard this is coming, from a few different sources (not directly thru HL, but HL adjacent apps or front-ends)

- HIP-3: this will be a one of a kind product only possible on Hyperliquid. It will also result in huge token sinks for $HYPE

- $SONN -- this will introduce Wall St. to $HYPE (their mouths will water) and also inject $300M of buy pressure to $HYPE

- Spot collateral for perps trading -- it seems like this is in the works based on testnet deployments and I think would be a huge unlock for the platform and for the $HYPE token to be even more desirable. Would likely see increased volumes and $BTC whales deposit onto HL for this reason as well

- More spot listings. @hyperunit has been working hard and is continuing to list top assets. The $PUMP launch was a massive success and proved how strong of a team we have, between the pre-TGE perps listing from Hyperliquid and the launch directly upon TGE from @hyperunit, quickly getting to the thickest orderbooks. Both of these were a huge onboarding event, as can be seen by the inflows those days

These are just a few of many catalysts and despite writing and rambling on this thread for over an hour there is still so much I didn't even cover. Sorry for the sloppy post but I am tired and just got back from vacation so you will have to deal with my rambles

TL;DR: $HYPE is cheap, you don't have enough, and probably still don't get it

Hyperliquid

135.92K

610

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.