Why you get bitten by crypto highs every time

We started in 2017 and are in the third cycle this time, and the fact that we are still working in this industry means that we have not "graduated" or that we are still in this industry because we like it. Other than that, most of them were "expelled", and the end of investment or industry relocation was repeated.

And as we enter the third cycle, there are characteristics that appear repeatedly, which are that we usually get hit by the high and can't get out. I hope you will analyze these characteristics and escape well this time.

1. I think my portfolio is my asset.

While managing your portfolio, you should maintain a stable or cash of about 10-30% at any point in time. Only then can we respond when necessary. However, the reality is that most of them are entirely invested in alts. And at the high, the alt portfolio sees the light. This is because the portfolio peaks and is shown in dollars or won. And from there, it turns into a bear market, and if it falls step by step, it will go on or rise again, hoping that it will rise again, and then it collapses. An uncashed portfolio is not your asset.

2. Dopamine is a problem.

When you invest in cryptocurrency, dopamine due to high returns explodes, and as you get used to high returns, you melt and get rid of the sell button in your head. Even in the last bull market, I saw a lot of people who jumped into the cryptocurrency single hit and saw tens of millions of won in profits at the peak, and finally held various alts, and their accounts melted and ended up in negatives. Dopamine is also good, but I need to marinate my brain in dopamine and soak it in seaweed so that it doesn't melt the selling button.

3. Cashing is cashing out when withdrawing from K-Bank.

Usually, I think that cashing is held as a stable on Binance or @Bybit_Official, or in won by Upbithumb. This is not wrong. Normally, if you hold it in such a state, the addiction of your fingers and dopamine will cause you to buy and sell. I'd rather invest in representative technology stock tokens like @xStocksFi from Bybit and make it difficult to get out, or withdraw from Upbit and withdraw from the bank to another bank, which makes it a little more troublesome and prevents you from investing quickly.

4. Don't be swayed by your surroundings, go at your own pace

As the peak approaches, various posts such as posts, profit certification articles, and vehicle and real estate purchase certification articles are posted. The first thing you need to realize when investing is that other people's seeds are just other people's seeds. Usually, the part where jealousy arises the most is when people similar to you succeed. Even if Elon Musk earns 1 trillion won in one day, he doesn't feel much excitement because I think he is different from me. However, when Mr. Kim, who is sitting next to him, suddenly says that he has earned hundreds of millions of won, he becomes anxious. It will be hard, but just congratulate and ignore it. This is because quick recognition keeps my seed and balance. Now, Kim Dae-ri, who is sitting next to me, also thinks that Elon Musk is a success that has nothing to do with me. You can invest at your own pace and successfully call the seed.

5. Reduce noise

In a bull market, it is necessary to reliably reduce the noise of information. In fact, it is true that many people make profits from alt singles, but in the end, you need to adjust your portfolio in time, take a position, and focus on selling on your shoulders as much as possible. To do so, you need to reduce noise. In addition to YouTubers, influencers, and accounts whose followers increase exponentially while repeating the next pick, even if you don't have many followers, you should find an account that quietly reads market trends and constantly warns you of highs and market transitions in between.

May you all fight for it!

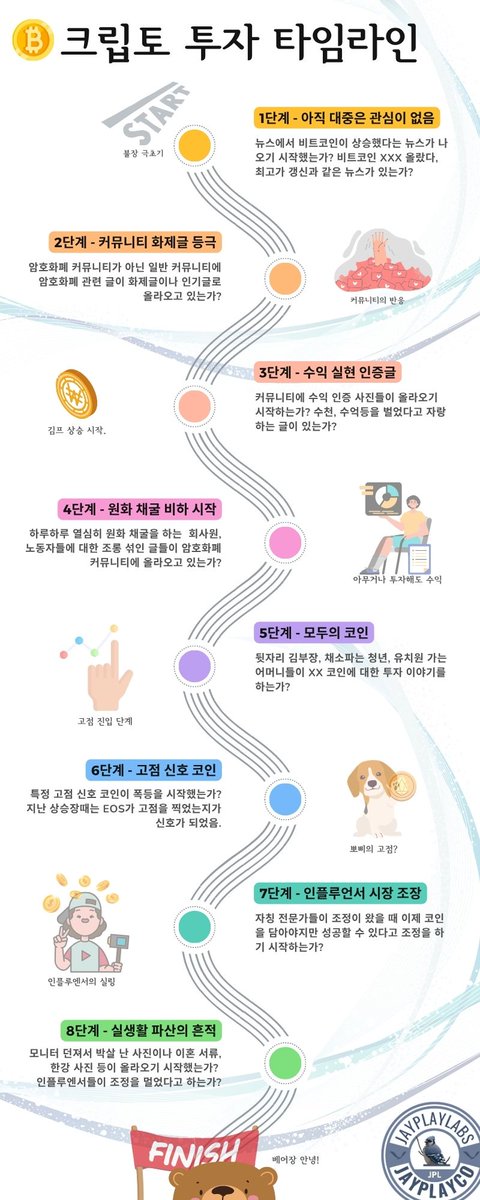

High Point Signal Reader

These are the articles that are always posted once in the early days of the bull market, but the parts that Dan has summarized before are good, and I will share again an infographic of how it will change along with additional things to check. Be sure to prepare for the moments when you think it's a high point and fight!

1. Talk to friends you haven't been in touch with and ask them what they should buy.

2. People who are not interested ask me if I have made a lot of money from people who know if I am crypto (usually the reality is that I still can't earn money because I am still alt)

3. My crypto portfolio keeps wanting to take screenshots on my smartphone (this is a clear high signal)

4. Mothers pushing strollers talk about Doji while taking a walk.

5. I went to a café on a weekday and the elderly talked about cryptocurrencies

6. TV keeps breaking the highest point of Bitcoin and is dangerous.

7. Poppy Rising or Heading Towards a High (EOS)

8. Some people make fun of Ethereum (or other coins) staking interest as being in order of intelligence

9. The number of channels analyzing charts on YouTube is increasing, and the number of subscribers is soaring.

10. There are a lot of people who do it after a few days of stamping a certain coin. (Anyway, in the bull market, it's circulation pumping, so you can buy anything...)

11. I suddenly feel like I'm really good at investing. (The most risky. 99% of investors say that I am not good at investing, but most of them are driven by the market, and 1% read the market... ha ha)

12. The tendency to invest in high-risk investments is increasing around (more people are buying coins after renting taxes, loans, etc.)

13. I feel that I am mining won. When you think, "I need to earn xxx million won.." (It's a clear high signal)

14. I took public transportation (bus, subway), but fewer people watched webtoons and videos, and more people turned on charts and upbeats.

15. Kobak's popular post has more than 3-5,000 views

16. Life worries in the blinds Crypto stories are pushed to smartphones.

17. While having lunch in Seoul, not Gangnam, we talk about crypto at two or more tables.

18. Binance, @Bybit_Official, etc. will have a longer period of USDT/C interest rates exceeding 20%. (Usually, when this phenomenon occurs, there is at least a short-term adjustment.) Recently, there has been a slight change in the market due to the fact that funds are parked in the form of xStocks.

19. GIMP continues to exceed 10% (This part seems to have changed a little due to USDT deposits and withdrawals on Korean exchanges)

20. It feels good to just keep looking at your cryptocurrency portfolio, and if it's a single bungle, you're getting close to the high, so it's a moment when you need to clean up your portfolio.

I hope this is a time when everyone can increase their seeds and earn the amount they are aiming for.

2.15K

13

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.