This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

VIRTUAL

Virtuality Lab price

BoePMY...Aeuk

$0.000024415

-$0.00060

(-96.08%)

Price change for the last 24 hours

How are you feeling about VIRTUAL today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

VIRTUAL market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$24,415.40

Network

Solana

Circulating supply

1,000,000,000 VIRTUAL

Token holders

2449

Liquidity

$34,639.41

1h volume

$5,229.75

4h volume

$38,396.75

24h volume

$7.48M

Virtuality Lab Feed

The following content is sourced from .

tesnguyen.eth

How to attract a $1B project to launch on @virtuals_io Genesis? 🧵 👇

—

Once again, I want to thank @VaderResearch for everything he’s contributed to the Virtuals ecosystem.

ALL-IN $VADER IS NEVER WRONG! 🧢

tesnguyen.eth

A very insightful and meaningful post from @VaderResearch 🫡

I think you should read the full piece. As for me, here’s a quick summary:

How to attract a $1bn project to launch on @virtuals_io Genesis?

• The goal is to launch a few standout projects with $50M–$1B FDV potential, not just many small ones.

• Right now, teams give up 50% of tokens but get no funding, which turns quality builders away.

• A possible fix is milestone-based upfront fundraising. It adds some risk, but if it brings $1B projects, it's worth it.

—

I also have a few suggestions for Virtuals, based on what $VADER shared. I’ll write about them in a separate post.

110

0

tesnguyen.eth

A very insightful and meaningful post from @VaderResearch 🫡

I think you should read the full piece. As for me, here’s a quick summary:

How to attract a $1bn project to launch on @virtuals_io Genesis?

• The goal is to launch a few standout projects with $50M–$1B FDV potential, not just many small ones.

• Right now, teams give up 50% of tokens but get no funding, which turns quality builders away.

• A possible fix is milestone-based upfront fundraising. It adds some risk, but if it brings $1B projects, it's worth it.

—

I also have a few suggestions for Virtuals, based on what $VADER shared. I’ll write about them in a separate post.

Vader

How to attract a $1bn project to launch on Genesis?

One of the keys to Genesis’ success is for retail to

Invest in $30m FDV worth projects at $200k FDV

Earning 10x to 150x on a regular basis is crazy

And creates strong virality & word of mouth growth

Most startups fail - applies to Genesis launches too

Most Genesis projects will be sub $500k FDV in 1y

Yet 3-4 winners will make up for all the losses

My biggest regret is not buying $VIRTUAL (used to be called $PATH) at $10M FDV right after having a call with @everythingempty in Dec 2023

You always regret missing out on a 500x more than

Experiencing one position go down 99%

Missing out on $500 > Losing $1

Since the name of the game is to attract

Projects with $1bn FDV potential

Then the success metric should not be

The number of projects that successfully launch

It should be

The number of projects that exceed $50m FDV

During the Dec 24-Jan 25 Virtuals wave

5 projects exceeded $100m FDV; AIXBT, GAME, LUNA, VADER, AIXCB

3 more exceeded $50m FDV; SEKOIA, ACOLYT, TAOCAT

Fast forward today; TIBBIR exceeded $100m FDV

And will likely flip AIXBT eventually as TIBBIR is a very strong cult coin whose holder base is completely out of touch with reality (they're gonna hate me for this but I think this is what makes TIBBIR bullish)

IRIS exceeded $100m FDV at launch day

But we haven’t heard much from the team since then (which frankly disappointed me)

And the price action followed the lack of communication/leadership

MAMO and AXR exceeded $50m FDV

MAMO will likely remain above $50m FDV given extremely low float, legit product/team and close CB ties

And AXR is currently the best performing project out of Genesis so far (surpassing BIOS and IRIS recently)

SOLACE and BIOS hit $40m FDV but were down bad last week

Looking at other projects, most of them are stuck at FDVs below $5m

So what is the missing piece?

Why aren’t $1bn potential teams launching on Virtuals?

Lets look at the evolution of Virtuals' launchpad

Virtuals Launchpad V1 was a pumpdotfun fork for agents

The main BUILDER problems with V1 were

1️⃣ Limited marketing support from Virtuals

2️⃣ Snipers buying at ~$50k FDV (instead of Virgens)

3️⃣ $12k required to buy 50% of your token supply

4️⃣ Lack of funding to cover operational expenses

Fast forward to Genesis 4 months later, most of these problems are solved

1️⃣ Kaito yapping + virality from wildly successful Genesis ROIs

2️⃣ Diamond hand Virgens buying at $200k FDV, snipers buying at >$4m FDV

3️⃣ $200 required to buy 50% (if the raise is successful)

Except for one...

FUNDRAISING

Teams give 50% of their token supply

Leverage the marketing, community and all other valuable ecosystem benefits Virtuals provide

But don’t raise a penny in exchange

Sharing trading fees with builders is GREAT

But volume during a bear is typically low

Still could be sufficient for many teams if combined with token liquidations for treasury building

Yet there are some options to solve the fundraising problem upfront to give more certainty for teams

But this usually comes with TRADEOFFS

One tradeoff is bad actors can abuse this

Remember a dev that defined raised funds as “guaranteed profits”

So ideally Virtuals should monitor teams and distribute funds raised on a milestone-based basis rather than distributing it all in one go

Another big tradeoff is that it will push up the entry FDVs for Virgens

And thus potentially lower ROIs

When the raise is at $1m FDV instead of $200k FDV

$1bn is not a 5000x anymore (it is a 1000x)

But on the other hand, your allocation is higher

So instead of turning $20 into $100k

You are now turning $100 into $100k

Changing the entry FDV might open pandora's box

As projects will try to negotiate the entry FDVs

But despite all the tradeoffs, if providing upfront fundraising

Could attract $1bn potential teams

It is worth taking the risk

Post inspired by a quick convo with @Defi0xJeff in SG

CAP STAYS ON 🧢

257

0

hansolar.🕯️

Not-so-daily Vol 2025-06-26

Lots to agree with in this post from Cav.

'Summer lull' thesis feels like a late-bear thesis after getting shook up from the war.

Contrast to the backdrop of a weakening dollar.

Trump wanted tariffs and he got them.

Trump now wants lower rates.

He'll probably get that too.

Positioning (l/s ratio 2:1)

- Long BTC and HYPE

- Short Alts; SOL, TRUMP, WLD, VIRTUAL, KAITO, SEI

Will be adjusting long:short ratio as we approach resistance and support, but want to accumulate more longs over the summer🫡

🕹️ Currently trading mostly on @Lighter_xyz

Closed beta. Early. Points. ZK-tech. (still) 100% apy LP-Vaults. Backed by big names.

Use link to join the party. DM for access as I'm running short on codes. Only serious players apply.

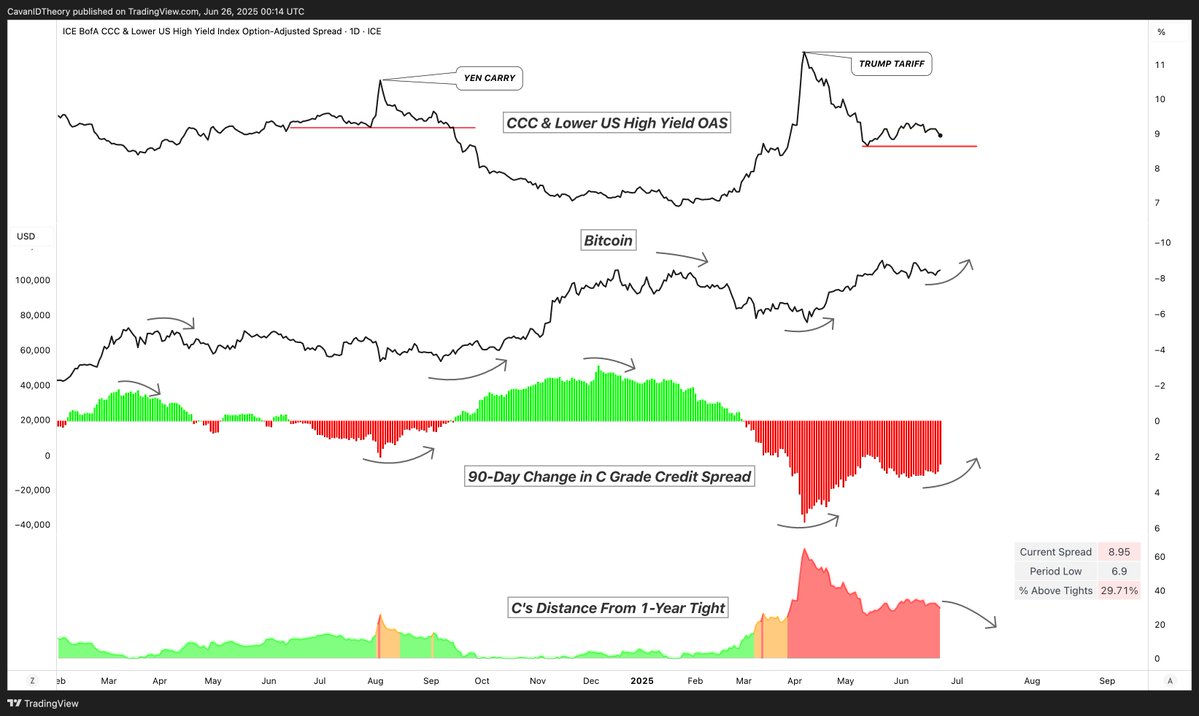

Cav

The Summer Offensive

The dollar is breaking lower

HY and C's contracting and still have lots of fuel post-blowout

Trump has captured the fed and is telling you where rates are heading

Bessent is running Yellenomics

Big bootyiful bill gonna pass

The most successful businessman on the planet could not stop the train

Equities are heading into price discovery while positioning is offside

CT consensus is "summer chop" and "alts are dead"

Well my friends, we may just have the Big Beautiful Backdrop to send the coins so much fucking higher into the second half of this year

This is the Summer Offensive, not summer chop

4.19K

0

zagen 扎根 | Searching & Researching

Just finished reading this article from @VaderResearch and summarized the reasons why virtuals are not attractive for medium-sized and large projects/currently lack medium-sized and large projects (10m 50m):

The team's upfront funding options are insufficient, and the current Genesis mechanism requires the team to "give up" 50% of the token supply without raising funds, limiting working capital. Sluggish trading volumes in a bear market can reduce fee revenue, making it difficult for teams to stay afloat.

Probably that's why MAMO chose to launch in the conventional way. The benefit of medium to large projects is that they tend to deliver a complete product at the initial stage, rather than developing slowly after Genesis Launch, which will leave Virgen with a window of nothing to do, especially in the bear market phase where there is a lack of quality project launches.

Vader and the two solutions proposed in the comment section:

1. Allow teams to choose the FDV threshold for launch, such as providing multiple launch thresholds such as 200K, 1M, 5M, etc., and the corresponding fundraising mechanism; This mechanism is ideal, but the specific numerical design is not an easy task.

2. Based on the team-based build process, the team will be given shares in stages according to milestones, rather than all at once according to time. I couldn't agree more with this, as it is more likely to push the team to build in public, rather than delaying the development progress to unlock and run away.

It has always been believed that genesis is a small team-friendly, virgens as VC launch channel, but large teams are also very important for the liquidity and emotions that the entire ecosystem can bring. I don't think these two suggestions will affect the launch experience for small teams (if you are real builder).

Vader

How to attract a $1bn project to launch on Genesis?

One of the keys to Genesis’ success is for retail to

Invest in $30m FDV worth projects at $200k FDV

Earning 10x to 150x on a regular basis is crazy

And creates strong virality & word of mouth growth

Most startups fail - applies to Genesis launches too

Most Genesis projects will be sub $500k FDV in 1y

Yet 3-4 winners will make up for all the losses

My biggest regret is not buying $VIRTUAL (used to be called $PATH) at $10M FDV right after having a call with @everythingempty in Dec 2023

You always regret missing out on a 500x more than

Experiencing one position go down 99%

Missing out on $500 > Losing $1

Since the name of the game is to attract

Projects with $1bn FDV potential

Then the success metric should not be

The number of projects that successfully launch

It should be

The number of projects that exceed $50m FDV

During the Dec 24-Jan 25 Virtuals wave

5 projects exceeded $100m FDV; AIXBT, GAME, LUNA, VADER, AIXCB

3 more exceeded $50m FDV; SEKOIA, ACOLYT, TAOCAT

Fast forward today; TIBBIR exceeded $100m FDV

And will likely flip AIXBT eventually as TIBBIR is a very strong cult coin whose holder base is completely out of touch with reality (they're gonna hate me for this but I think this is what makes TIBBIR bullish)

IRIS exceeded $100m FDV at launch day

But we haven’t heard much from the team since then (which frankly disappointed me)

And the price action followed the lack of communication/leadership

MAMO and AXR exceeded $50m FDV

MAMO will likely remain above $50m FDV given extremely low float, legit product/team and close CB ties

And AXR is currently the best performing project out of Genesis so far (surpassing BIOS and IRIS recently)

SOLACE and BIOS hit $40m FDV but were down bad last week

Looking at other projects, most of them are stuck at FDVs below $5m

So what is the missing piece?

Why aren’t $1bn potential teams launching on Virtuals?

Lets look at the evolution of Virtuals' launchpad

Virtuals Launchpad V1 was a pumpdotfun fork for agents

The main BUILDER problems with V1 were

1️⃣ Limited marketing support from Virtuals

2️⃣ Snipers buying at ~$50k FDV (instead of Virgens)

3️⃣ $12k required to buy 50% of your token supply

4️⃣ Lack of funding to cover operational expenses

Fast forward to Genesis 4 months later, most of these problems are solved

1️⃣ Kaito yapping + virality from wildly successful Genesis ROIs

2️⃣ Diamond hand Virgens buying at $200k FDV, snipers buying at >$4m FDV

3️⃣ $200 required to buy 50% (if the raise is successful)

Except for one...

FUNDRAISING

Teams give 50% of their token supply

Leverage the marketing, community and all other valuable ecosystem benefits Virtuals provide

But don’t raise a penny in exchange

Sharing trading fees with builders is GREAT

But volume during a bear is typically low

Still could be sufficient for many teams if combined with token liquidations for treasury building

Yet there are some options to solve the fundraising problem upfront to give more certainty for teams

But this usually comes with TRADEOFFS

One tradeoff is bad actors can abuse this

Remember a dev that defined raised funds as “guaranteed profits”

So ideally Virtuals should monitor teams and distribute funds raised on a milestone-based basis rather than distributing it all in one go

Another big tradeoff is that it will push up the entry FDVs for Virgens

And thus potentially lower ROIs

When the raise is at $1m FDV instead of $200k FDV

$1bn is not a 5000x anymore (it is a 1000x)

But on the other hand, your allocation is higher

So instead of turning $20 into $100k

You are now turning $100 into $100k

Changing the entry FDV might open pandora's box

As projects will try to negotiate the entry FDVs

But despite all the tradeoffs, if providing upfront fundraising

Could attract $1bn potential teams

It is worth taking the risk

Post inspired by a quick convo with @Defi0xJeff in SG

CAP STAYS ON 🧢

1.04K

0

VIRTUAL price performance in USD

The current price of virtuality-lab is $0.000024415. Over the last 24 hours, virtuality-lab has decreased by -96.08%. It currently has a circulating supply of 1,000,000,000 VIRTUAL and a maximum supply of 1,000,000,000 VIRTUAL, giving it a fully diluted market cap of $24,415.40. The virtuality-lab/USD price is updated in real-time.

5m

+0.00%

1h

-18.78%

4h

-76.46%

24h

-96.08%

About Virtuality Lab (VIRTUAL)

VIRTUAL FAQ

What’s the current price of Virtuality Lab?

The current price of 1 VIRTUAL is $0.000024415, experiencing a -96.08% change in the past 24 hours.

Can I buy VIRTUAL on OKX?

No, currently VIRTUAL is unavailable on OKX. To stay updated on when VIRTUAL becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of VIRTUAL fluctuate?

The price of VIRTUAL fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Virtuality Lab worth today?

Currently, one Virtuality Lab is worth $0.000024415. For answers and insight into Virtuality Lab's price action, you're in the right place. Explore the latest Virtuality Lab charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Virtuality Lab, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Virtuality Lab have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.