This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

USDe

USDe price

0x5d3a...ef34

$0.99949

+$0.00019986

(+0.02%)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about USDe today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

USDe market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$66.42M

Network

Mantle

Circulating supply

66,455,591 USDe

Token holders

0

Liquidity

$29.10M

1h volume

$99.35K

4h volume

$8.94M

24h volume

$13.35M

USDe Feed

The following content is sourced from .

Ethena’s $9.5B USDe could now challenge USDC’s number 2 spot by 2027

USDe’s market cap surged from approximately $5.33 billion on July 17 to over $9.3 billion by August 4, marking a nearly 75% increase and propelling it into the number three slot among all stablecoins, behind only USDT and USDC.

The sudden rise has positioned Ethena’s synthetic dollar among top-tier stablecoins while also raising questions about whether a delta-neutral, crypto-native asset can sustain such momentum in a market historically dominated by fiat-backed coins.

The jump in market cap reflects more than just investor enthusiasm. Over the span of less than 30 days, more than $3.1 billion in new USDe was minted. This influx correlates with positive funding rates in the perpetual futures markets and a sharp uptick in attention around Ethena’s ENA token buyback program.

Rapid ascent of USDe

The speed of USDe’s growth stands out in the stablecoin landscape, drawing parallels to USDC’s ascent, which crossed the $10 billion threshold in March 2021. At ~$9.25 billion, USDe is now at a similar scale to that milestone.

USDC market cap growth (Source: CoinMarketCap)

Unlike incumbents USDT and USDC, which are backed by traditional banking instruments like T-bills, USDe operates fully on-chain via a synthetic structure. It is underpinned by a delta-neutral strategy that combines long spot positions in digital assets such as BTC, ETH, or SOL with offsetting perpetual short positions.

The resulting basis or funding yield is passed on to stakers who convert USDe into sUSDe. Ethena has pitched this model as offering attractive returns and sidestepping traditional financial intermediaries. As the project’s founder, Guy Young, has noted, USDe aims to offer a risk profile distinct from fiat-tethered stablecoins.

The basis trade mechanism that powers USDe’s yield has proven lucrative in bullish or volatile market conditions, where perpetual funding spreads widen in favor of short sellers. This dynamic was a key driver of USDe’s July growth.

However, the sustainability of this yield is less clear. Funding rewards that once exceeded 60% annualized have fallen below 5% as more capital has crowded into the trade.

Ethena’s own documentation identifies “funding risk” as a primary concern, flagging that the strategy is highly sensitive to shifts in market structure, especially if funding flips negative or counterparty stability on major exchanges is compromised.

USDe leaves established stablecoins in the dust

Market data reinforces the scale of USDe’s recent ascent. Per CoinMarketCap and DefiLlama, USDe now ranks third among stablecoins by market capitalization, trailing only USDT’s ~$164 billion and USDC’s ~$64 billion.

Notably, this growth has also led to USDe surpassing rebranded competitors such as USDS (formerly DAI), illustrating the reshuffling within decentralized stablecoin rankings.

While still $50 billion behind USDC, USDe’s current size is equivalent to half of USDC’s market cap during its November 2023 dip to $24 billion.

If USDe were to maintain an 8.4% monthly growth rate, assuming USDC remains flat, it could surpass USDC within two years.

The model’s reflexivity has also drawn analytical interest. Young outlined how the growth of USDe inadvertently drives demand for USDT: “For every unit of shorts Ethena adds to the market, a unit of Tether demand is created… a $1 increase in USDe leads to a ~$0.70 increase in USDT when USDe is backed purely by perpetual positions.” This market interplay suggests that USDe’s growth may indirectly strengthen the very incumbents it seeks to disrupt, underlining the complexity of its systemic interactions.

USDe’s recent trajectory demonstrates the potential for a non-fiat-backed stablecoin to achieve meaningful scale. Its rapid ascent highlights both the power and the limitations of crypto-native yield structures.

Yet, it also brings back memories of algorithmic stablecoin Luna UST, which rocketed to over $60 billion in market cap before losing its peg and effectively crashing to zero.

While short-term momentum has propelled it to the forefront, whether it can maintain velocity amid compressed funding, custodial risk exposure, and regulatory scrutiny remains uncertain.

For now, Ethena’s synthetic dollar sits as a contender among giants, its future tied closely to the volatile mechanics it leverages.

The post Ethena’s $9.5B USDe could now challenge USDC’s number 2 spot by 2027 appeared first on CryptoSlate.

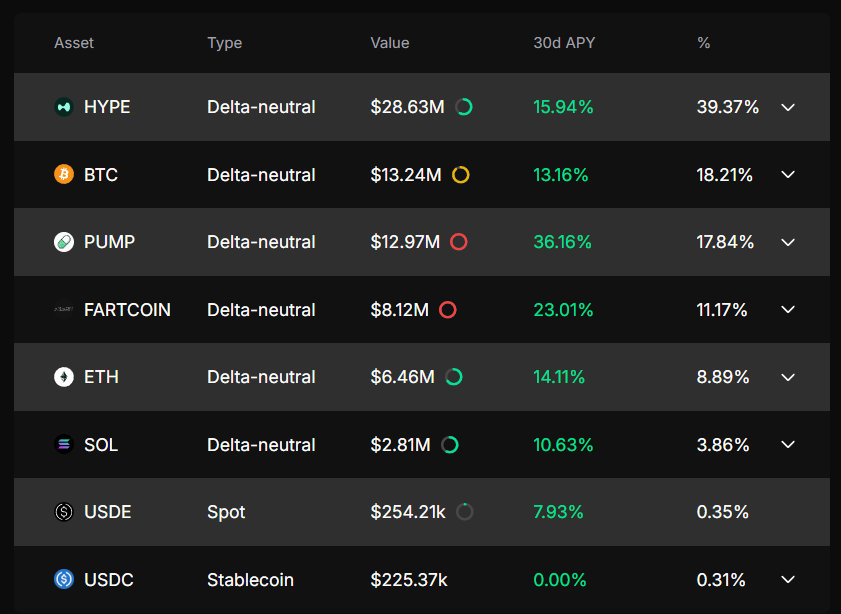

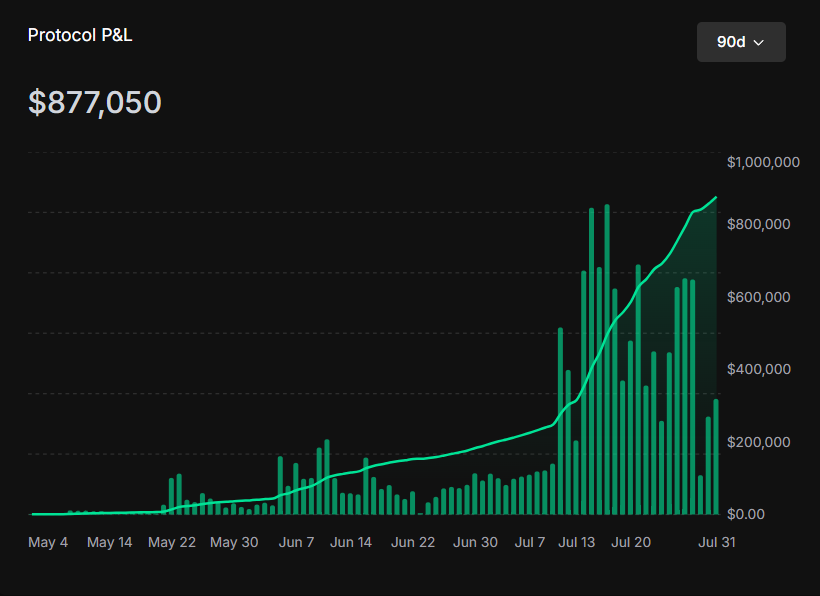

The market's bleeding, but the farming doesn't stop

@liminalmoney for example, thrives with high market volatility thanks to funding rates on @HyperliquidX going crazy

The team has done quite a job in polishing the protocol and adding all the possible customization levers

Numbers are pretty good too, especially for delta-neutral strategies ↓

$PUMP and $UFART are currently capped due to the high APY they're rocking

The total revenues of the protocol are about to reach $1M, while the TVL just passed $70M

Annualized revenues for Liminal would be around $3.5M right now, and this calculation takes into account the much slower starting phase too

▶️ It could easily rise to an annualized of $8-10M if you count this week alone

This should be quite the incentive to use it and farm it as much as possible:

- Good APYs for a very low risk play

- Killer tokenless protocol

Worth using it

"When Ethena launches @convergeonchain with @Securitize, I think there could be further growth"

This is one @arbitrum chain we'll be watching closely and perfectly timed move from @ethena_labs

Heechang

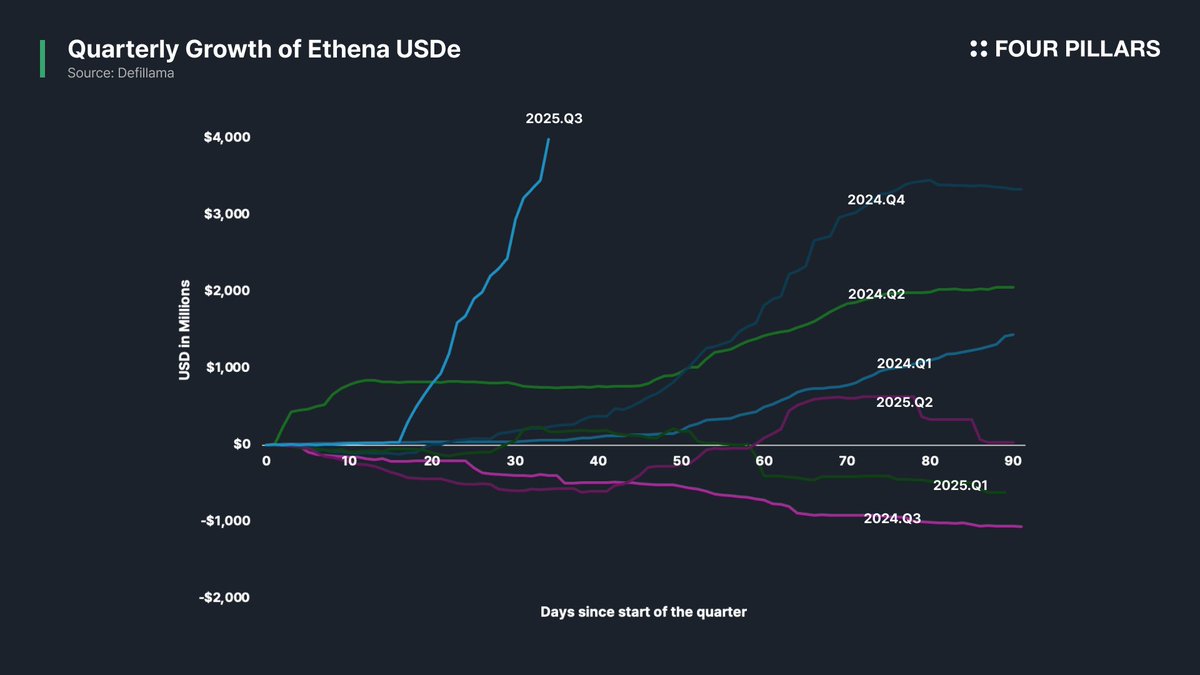

Ethena is experiencing the fastest growth in Q3 2025

It's up $4.02 billion this quarter, and we still have 60 days left in this quarter.

Compared to other stablecoins like USDT, USDC, and USDS, Ethena has low transfer volume compared to its market cap. The transfer volume-to-mcap ratios are: USDC at 22.75, USDC at 18.74, USDT at 7.6, and USDe at 6.1 according to @RWA_xyz .

This suggests that people hold USDe primarily for yields or farming rather than using it in the onchain ecosystem.

When Ethena launches @convergeonchain with @Securitize, I think there could be further growth.

Guy @gdog97_ recently appeared on the bidclub podcast to talk about Ethena / ENA. I think most people missed it, so here's a quick summary/highlights of new info:

Growth:

Aiming to scale to $30–50B USDe (or equivalent) USDe supply before aggressively monetizing.

On track to exceed $12B by Q3; internal goal is $15B+ by year-end.

Opex is only ~10m/yr, TINY compared to CRCL, and cash reserves are sufficient to meet needs without using protocol revenue.

Revenue forecast:

Up to 400m a year with a 20% take rate (would make Ethena the second largest revenue-generating protocol behind Hyperliquid, which has an associated token).

New products:

We all know about Ethereal perps DEX launching with Converge chain soon.

We know about stablecoinX DAT equity formerly launching later this year.

iUSDe launching to allow tradfi asset managers to buy USDe in a regulatory safe wrapper.

THE BIG ONE:

With HIP-3 launching on Hyperliquid soon™, people will be able to launch their own perps markets.

There are (external) teams planning to launch USDe paired perps - this could be very big - the yield from holding positions in these perps can significantly offset funding fees. Guy estimates that it could quickly net Ethena an additional 100m in revenue.

Secondary to the above, they may well start doing the carry trade on Hyperliquid (they currently don't, which is partially why funding is often higher than CEXs) - they would isolate the higher risk by launching a NEW stable product - something like hUSDe - which would likely have higher yield than USDe, but be isolated from causing contagion if Hyperliquid blew up for whatever reason.

Other bullish stuff:

With rate cuts coming, and Spark (SPK) having more flexibility in deploying USDS/DAI to maximize yield, Guy forecasts up to 30-50% of that stable could end up being backed by USDe.

The team has seen interest from tradfi funds in the stablecoin X DAT, and they realize they need to pitch it and sell it to see the flows come in.

I could not be more bullish on ENA.

USDe price performance in USD

The current price of usde is $0.99949. Over the last 24 hours, usde has increased by +0.02%. It currently has a circulating supply of 66,455,591 USDe and a maximum supply of 66,455,591 USDe, giving it a fully diluted market cap of $66.42M. The usde/USD price is updated in real-time.

5m

+0.00%

1h

+0.06%

4h

+0.08%

24h

+0.02%

About USDe (USDe)

Learn more about USDe (USDe)

What is Ethena (ENA): is synthetic dollar USDe a DeFi revolution?

From decentralized exchanges exploring revenue sharing to Bitcoin Layer 2s establishing themselves as viable scaling solutions, the DeFi landscape is continuing to innovate and offer exciting alternat

25 July 2025|OKX|

Beginners

Ethena Labs' USDe Surpasses DAI to Become Third-Largest Stablecoin: A Game-Changer in DeFi

Ethena Labs' USDe: A New Leader in the Stablecoin Market Ethena Labs has emerged as a transformative force in the decentralized finance (DeFi) ecosystem, with its synthetic stablecoin, USDe, achieving

31 July 2025|OKX

Ethena’s USDe Stablecoin Surges to $7.3 Billion: A Game-Changer in DeFi and Institutional Adoption

Ethena’s USDe Stablecoin: A New Contender in the Stablecoin Market Ethena’s USDe stablecoin has emerged as a transformative force in the cryptocurrency market, achieving a remarkable $7.3 billion in m

31 July 2025|OKX

Ethena's USDe Stablecoin Surges to Third-Largest Market Cap Amid Regulatory Hurdles

Ethena's USDe Stablecoin: A Rising Star in the Crypto Market Ethena's USDe stablecoin has rapidly ascended the ranks to become the third-largest stablecoin by market capitalization, surpassing DAI wit

30 July 2025|OKX

USDe FAQ

What’s the current price of USDe?

The current price of 1 USDe is $0.99949, experiencing a +0.02% change in the past 24 hours.

Can I buy USDe on OKX?

No, currently USDe is unavailable on OKX. To stay updated on when USDe becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of USDe fluctuate?

The price of USDe fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 USDe worth today?

Currently, one USDe is worth $0.99949. For answers and insight into USDe's price action, you're in the right place. Explore the latest USDe charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as USDe, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as USDe have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.