This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

Circle

Circle price

0x7140...9ba3

$3.4928

+$3.4927

(+3,608,484.08%)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about Circle today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Circle market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$349.28M

Network

BNB Chain

Circulating supply

100,000,000 Circle

Token holders

4104

Liquidity

$2.13M

1h volume

$2.11M

4h volume

$197.72M

24h volume

$197.72M

Circle Feed

The following content is sourced from .

Why is "the Fed not cutting interest rates" more beneficial to the US stock and crypto markets in the long run?

Author: Dr.PR

At present, the market is generally focused on "when to cut interest rates", but what is really worth paying attention to is that the Fed maintains high interest rates, which may be a more favorable macro pattern for the US stock and crypto markets in the long term. This view, while counterintuitive, points in the same direction from historical experience, fundamental structure, to fiscal-driven implicit easing.

1. High interest rates ≠ bear markets: History tells us that structural bull markets are often born in high-interest rate environments

Fed federal funds rate vs. S&P 500 (circa 1994–2000)

From 1994 to 2000, for example, the Fed raised the federal funds rate from about 3% to 6% in 1994, and after this rate hike cycle, the US stock market ushered in one of the strongest technology bull markets in history:

the S&P 500 index rose from about 470 points to 1500 points from a 2000 high;

The Nasdaq returned more than 25% annualized between 1995 and 2000, driving the substantial earnings cycle before the "dot-com bubble";

Corporate earnings, technological innovation and return on investment are dominant, not monetary easing itself.

This means that as long as the economy does not have a hard landing, high interest rates are not the culprit of suppressing the stock market.

Second, the essence of the current "no interest rate cut" is confidence in the economy

As of July 2025, the Fed's federal funds target rate range is 4.25%-4.50%. Although it has not eased significantly, it is important – it has not raised interest rates again.

Behind this is the reality that a "soft landing is being realized":

Core PCE inflation fell from a high of 5.4% in 2022 to a range of 2.6%-2.7% by mid-2025;

GDP growth remains between 1.5% and 3% annualized;

the unemployment rate is stable at 4.1%, and the labor market is resilient;

The overall EPS of US stocks in 2025 is expected to be in the range of 250-265, and profitability is recovering.

In other words, the essence of not cutting interest rates is that the Fed believes that there is no need to bail out the market because the market is repairing itself.

3. Real "easing" is being driven by finance, not money

Although nominal interest rates have not moved, the current macro liquidity structure of the United States as a whole has shifted to "fiscal-led stimulus".

Annual growth trend of U.S. federal debt

The U.S. fiscal deficit in 2024 exceeded 6.4% of GDP, one of the highest since the war;

As of July 2025, the total U.S. federal debt has exceeded $36.7 trillion;

The net issuance of U.S. bonds in Q3 2025 is expected to exceed $1 trillion;

The "Big Beautiful Bill" led by the Trump camp includes large-scale tax breaks and industrial subsidies, which is expected to increase the fiscal deficit by about $3 trillion over 10 years.

Even if the Fed remains on hold, such fiscal spending is constituting a de facto "hidden release".

Fourth, high interest rates purify the market structure and strengthen the logic of the strong

Although the high-interest rate environment has increased the difficulty of financing, it is "good" for large companies:

Apple holds more than $130 billion in cash, Alphabet has more than 90 billion, and Meta has nearly 70 billion;

At 4%-5% interest rates, this cash generates billions of dollars in interest income on its own;

Small and medium-sized enterprises are marginalized in financing costs, and market share is further concentrated in giants;

High cash flow buybacks drive EPS upward, and the valuation structure is more stable.

This not only explains why the "Big Seven Technology Stocks" still dominate the market capitalization rankings, but also why index assets continue to hit new highs even when interest rates are high.

5. Crypto market: from speculative games to structural asset allocation

Crypto assets were once seen as "speculative products spawned by zero interest rates", but in the past two years of high interest rate environment, the market structure has undergone profound changes:

1) ETH/BTC has become the allocation target of "digital cash flow" and "digital gold"

Ethereum ETH Staking Yield Trend (Annualized)

The annualized rate of return on Ethereum staking is maintained at 3.5%-4.5%, which has the attributes of treasury bonds.

BTC has become a core reserve asset in several U.S.-listed companies such as MicroStrategy.

ETF launches, re-pledge mechanisms, on-chain governance financial income, etc., make ETH present a combination of "stable income + asset scarcity".

2) The "spread dividend" of stablecoins becomes an invisible profit pool

Circle made a profit of more than $1.7 billion in 2024 from interest income on U.S. Treasuries;

Tether has earned more than $4 billion from reserve investments in the past year;

The stablecoin ecosystem has become more profitable under high interest rates, enhancing the stability of the entire DeFi infrastructure.

3) The survival logic of the crypto market has shifted to "cash flow" and "systematic income"

speculative altcoins and memes ebb and flow;

Projects with clear revenue models such as Uniswap, EigenLayer, and Lido have received funding favor.

The market began to evaluate on-chain assets with "ROE, cash flow, and inflation-resistant ability".

The crypto market is completing the leap from "speculating on stories" to "speculating on structures".

6. Conclusion: This is a revaluation of asset logic, not a reincarnation of macro water release

Interest rate cuts can certainly push up asset prices, but if they are not based on real profitability and structural optimization, they will eventually repeat the bubble burst after 2021.

And this time, the US stock and crypto markets are taking a healthier path:

high interest rates but controlled inflation;

Fiscal stimulus continues to stimulate, and corporate profits are repaired;

strong enterprises gain cash flow advantages;

Crypto assets return to economic model competition.

The real slow bull does not rely on the money printing machine, but on the structural reconfiguration of the pricing mechanism and cash flow leverage.

The current "inaction" of the Fed is the most critical background for this structural revaluation to occur.

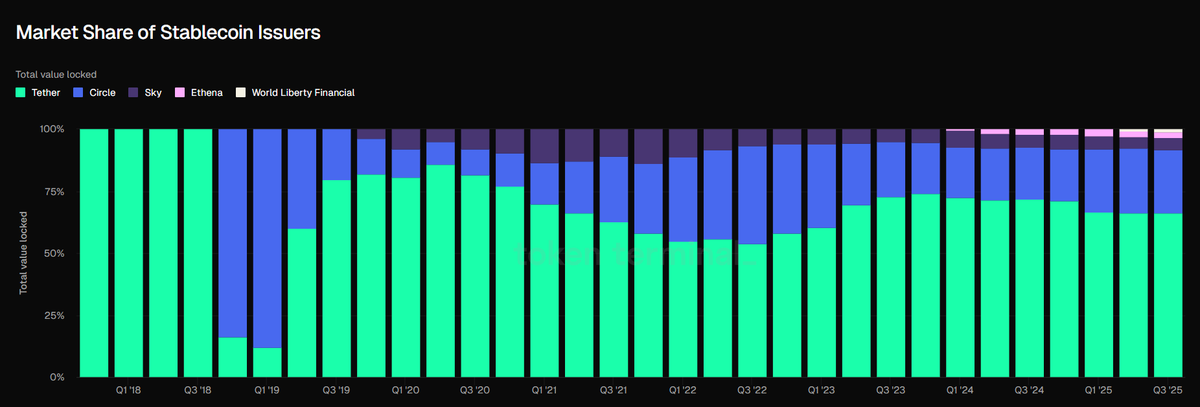

Stablecoin wars are heating up 🥊

Tether still holds the crown with 66% of TVL, but Circle has quietly closed the gap, now controlling over 25%. Everyone else? Fighting for scraps.

Sky, Ethena, and WLF haven’t managed to gain meaningful traction, showing just how hard it is to challenge the top two.

With the rise of real-world assets and yield-bearing stables, this market is about to get even more competitive.

Top Crypto Highlights – Last 12 Hours Recap

1⃣ U.S. stock indexes closed higher, but crypto stocks were mixed:

🔸$BMNR (ETH reserve leader) down 2.06%

🔸$SBET down 5.8%

🔸$STRATEGY down 3.22%

🔸$CIRCLE up 2.07%

2⃣ LetsBONK announced it will use 1% of total protocol revenue to buy back top meme tokens:

🔸$USELESS rebounded to $320M

🔸$ANI back to $77M

🔸$BONK at $3.075B, nearly catching $PUMP

3⃣ $PUMP crashed unexpectedly. A private fund moved $14.3M worth of $PUMP to CEX. Jeff Huang’s 5x long is down over $5M. $PUMP market cap dropped to $3.1B.

4⃣ AI underdog $SAHARA pumped 86% in a day, likely triggered by Korean buy pressure. Market cap hit a new ATH at $1.3B. Community says: “SAHARA owes no one.”

5⃣ $SPK surged 200% in 3 days, MC hit $1.2B. It's a MakerDAO fork with high on-chain yields (up to 30%). Yield farming hype is growing fast.

6⃣ $PENGU topped the charts with a $3.7B circulating cap, surpassing $BONK to become the largest meme coin on Solana. The 4th-anniversary buzz of its NFT collection added fuel.

7⃣ Tron Inc (a $TRX reserve firm) to list on Nasdaq on July 24. $TRX has been correcting for a week, but Sun Yuchen heading to space might boost the narrative.

8⃣ 520K staked $ETH are about to be unlocked. Investors are lining up to exit. $stETH on Lido shows discounts due to large redemptions. ETH may face selling pressure.

9⃣ Trump-backed $WLFI added $2M more in $ETH this week — over 10,000 ETH accumulated in 7 days. What are they preparing for?

🔟 $BNB hit a $109.1B market cap ATH — now bigger than Starbucks. Watch for capital rotation into $BNB and ecosystem tokens (DeFi & Meme plays).

🔟1⃣ $ZORA skyrocketed 110% in 24h, 5x in 10 days. Now at $157M MC. Surge driven by BaseApp’s new social + content monetization model triggering massive creator FOMO.

🔟2⃣ $BTC remains strong, but $ETH faces market anxiety (rumors of Justin Sun selling). $SOL dropped hard after touching $200. Altcoins saw a brutal correction overnight.

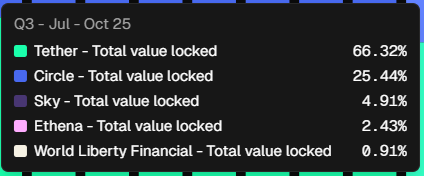

New Projects gained the most smart attention in the last 7D

🥇@TheEtherMachine

🥈@Doodles_UP

🥉@vivabo

4⃣@hypercircleapp

5⃣@kenseionkatana

6⃣@MythicBirbs

7⃣@hydromancerxyz

8⃣@monkerc20

9⃣@PulseInfra

🔟@heurist_assets

Data provide by @getmoni_io

___

Please like/repost to support :))

Degen Radar

$open- Mcap: 1M

CA: C2aEa7v1NWUCyN9SYbWGhtCLRRpzXtbCqqRxz1mKbonk

Axiom:

Opendoor is a real estate tech company with massive short interest,now the target of a retail-fueled short squeeze, just like GME.

$OPEN is a Solana memecoin that mirrors this real-world drama on-chain.

It taps into the energy of WallStreetBets and Solana meme culture to fuel a powerful underdog vs. Wall Street narrative.

It’s not financial advice - Please do your own research and ape with responsibility

Circle price performance in USD

The current price of circle is $3.4928. Over the last 24 hours, circle has increased by +3,608,484.08%. It currently has a circulating supply of 100,000,000 Circle and a maximum supply of 100,000,000 Circle, giving it a fully diluted market cap of $349.28M. The circle/USD price is updated in real-time.

5m

+0.08%

1h

+281.12%

4h

+3,608,484.08%

24h

+3,608,484.08%

About Circle (Circle)

Latest news about Circle (Circle)

Circle to bring USDC and CCTP v2 to Hyperliquid

Circle will bring native USDC and Cross-Chain Transfer Protocol (CCTP) version 2 to Hyperliquid, a...

31 July 2025|Crypto Briefing

Coinbase Reaps Growing Rewards from Circle Ties and USDC Economics: JPMorgan

In the first quarter of this year alone, Coinbase earned roughly $300 million in distribution payments from Circle, and that's just the start.

29 July 2025|CoinDesk

D2X Raises $5M to Expand Crypto Derivatives Exchange for Institutions

CMT Digital, Circle Ventures and Point72 back Amsterdam-based D2X as it targets crypto futures and options

29 July 2025|CoinDesk

Learn more about Circle (Circle)

Circle’s Native USDC Integration on Hyperliquid: A Game-Changer for DeFi and Cross-Chain Interoperability

Circle’s Strategic Move in DeFi: Native USDC Integration on Hyperliquid Circle has made a groundbreaking move in the decentralized finance (DeFi) space by integrating native USDC and launching Cross-C

1 Aug 2025|OKX

USDC Integration Revolutionizes Payments: Circle and FIS Drive Blockchain Adoption in Banking

USDC Payments Bank: Transforming Financial Systems with Stablecoins The integration of USDC stablecoin payments into traditional banking systems is revolutionizing the financial landscape. The partner

30 July 2025|OKX

We've Launched Elite Circle: Crypto's First Tier-Based Rewards and Community Program for Lead Copy and Bot Traders

We've just launched Elite Circle , a first-of-its-kind, tier-based rewards and community program tailored for lead copy and bot traders. This program sets a new benchmark in the crypto trading industr

25 July 2025|OKX

OKX and Circle Jointly Announce Leading-Edge USDC Experience on OKX Wallet and OKX DEX Aggregator

Launching today and continuing until October 5, OKX and Circle's joint 'USDC Zero Network Fee Campaign' enables OKX Wallet’s Smart Account users to enjoy zero network fee transactions The OKX DEX aggr

25 July 2025|OKX

Circle FAQ

What’s the current price of Circle?

The current price of 1 Circle is $3.4928, experiencing a +3,608,484.08% change in the past 24 hours.

Can I buy Circle on OKX?

No, currently Circle is unavailable on OKX. To stay updated on when Circle becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of Circle fluctuate?

The price of Circle fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Circle worth today?

Currently, one Circle is worth $3.4928. For answers and insight into Circle's price action, you're in the right place. Explore the latest Circle charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Circle, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Circle have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.