Altcoins Hold Steady As Bitcoin Faces Heavy Sell Pressure: Here’s Why

Bitcoin has been fluctuating, whales are offloading, and exchange inflows are rising; yet altcoins have been on a steadier path, not collapsing.

The market-wide dip earlier today, looked uneven. While BTC dropped below $116K, the total altcoin market cap still sits strong above $1.44 trillion. Let’s break down what’s really happening behind the scenes.

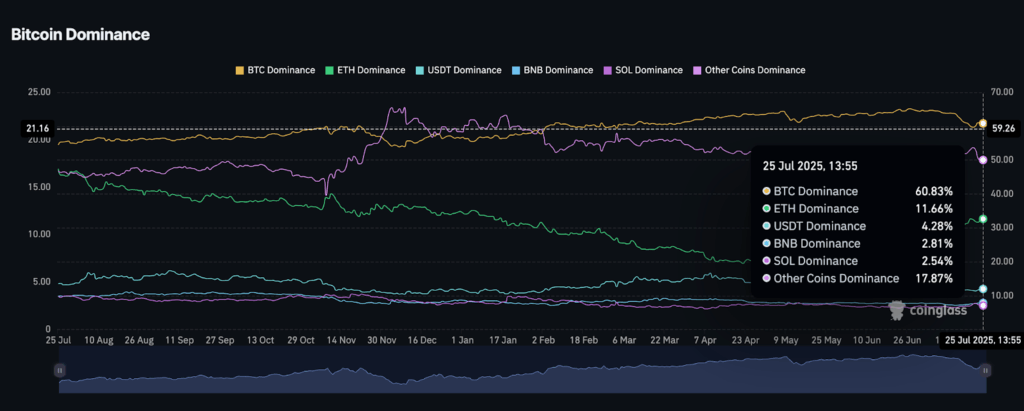

Bitcoin Dominance Drops As Altcoins Grow

The latest CoinGlass chart shows BTC dominance fell to 60.83% on July 25, down from 62.1% a few days ago. Ethereum, meanwhile, is holding steady at 11.66% dominance.

Solana clocks in at 2.54%, and the “Other Coins” category rose to 17.87%, the highest in weeks.

This tells us altcoins are not bleeding as badly as Bitcoin. In fact, some are gaining ground. The relative dominance shift suggests capital is rotating rather than exiting crypto entirely.

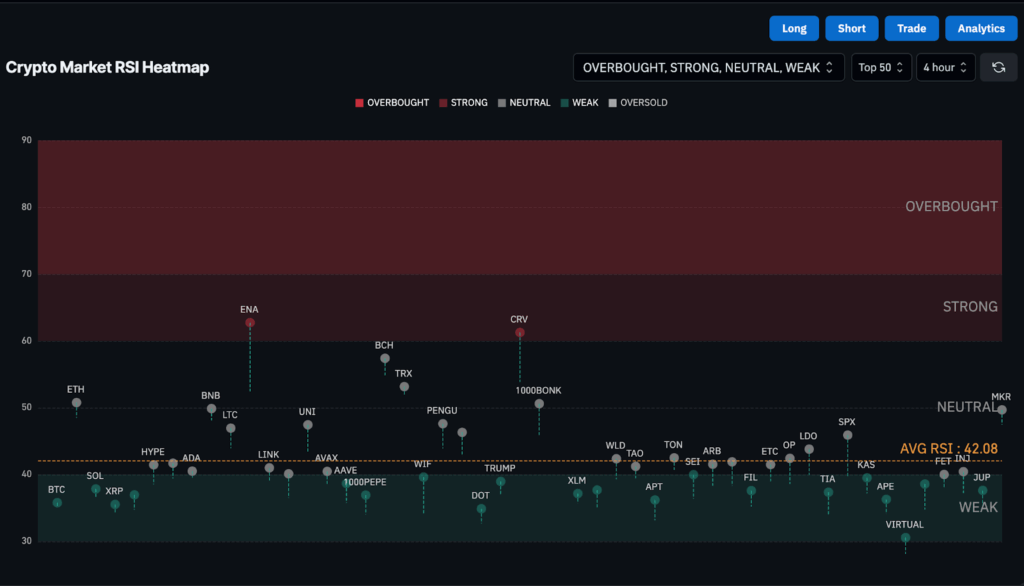

The RSI heatmap supports this. On the 4-hour chart, Bitcoin’s RSI is below 40, firmly in weak territory. SOL and XRP are also weak. ETH, TRX, and BNB are still in the neutral band near 50.

This resilience signals that traders are holding exposure to altcoins despite Bitcoin’s weakness.

Altcoins are showing hidden strength. Capital is consolidating but not fleeing the crypto market.

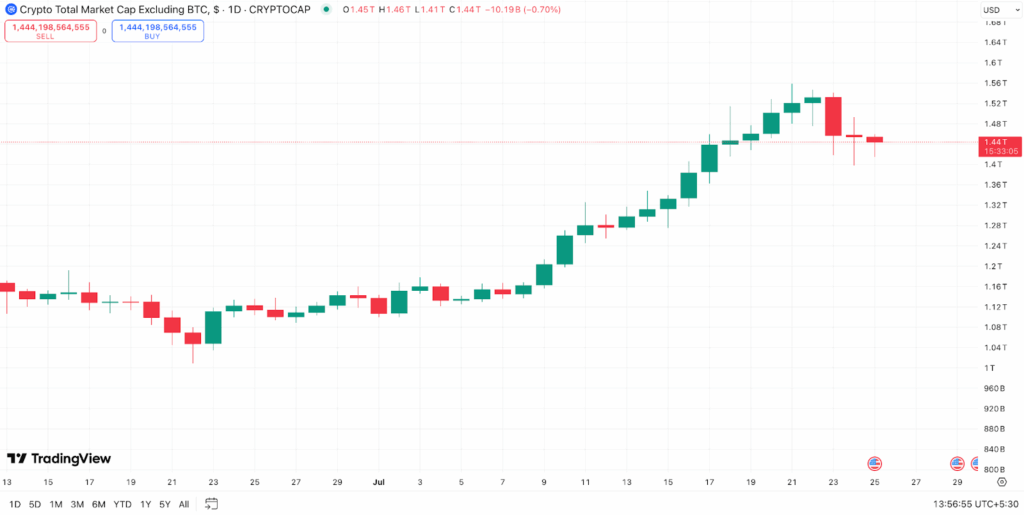

Total market cap excluding BTC (Total2) is still at $1.44 trillion, down marginally on the day. It tapped a high of $1.46 trillion and a low of $1.41 trillion but recovered by close.

This mild dip shows that altcoins are holding the line despite Bitcoin weakness.

Meanwhile, the broader crypto market cap (Total) is at $3.82 trillion, just under the 0.236 Fibonacci retracement level of $3.98 trillion.

Despite falling 2.53% today, the trendline still holds. Unless $3.75 trillion breaks, the correction remains shallow.

Put simply, altcoins are not plunging. They’re cooling off, but still respecting key supports.

This divergence from Bitcoin is crucial.

BTC is being aggressively sold, as shown by rising exchange inflows (more on that next). But Total2 has not yet confirmed a breakdown.

Traders seem to be rotating out of BTC and into selective altcoins, not exiting the market.

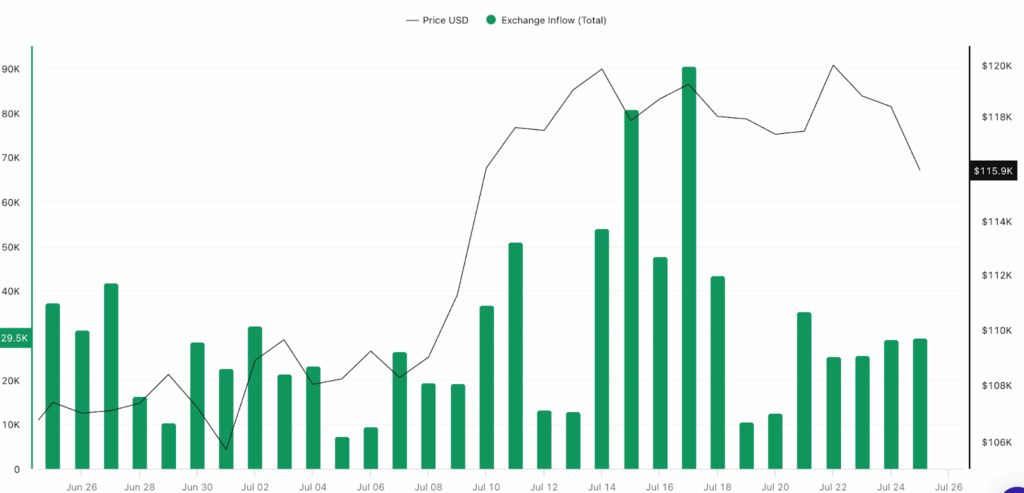

Whales Are Dumping Bitcoin, Not the Whole Market

Bitcoin exchange inflows have spiked sharply. Between July 14–17, daily inflows crossed 80,000 BTC, with a peak near 90,000. On July 24, BTC inflows were still elevated at around 30,000.

BTC price fell from $120,000 to $115,000 over the same period. The inverse correlation is clear: the more BTC is entering exchanges, the more the price falls.

This is typical of whales or institutions preparing to sell. But here’s the twist: altcoin on-chain data doesn’t reflect panic.

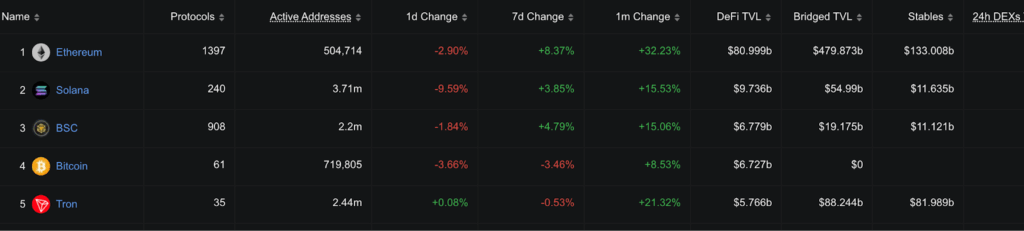

Active addresses for Ethereum are up 8.37% over 7 days and up 32.23% in the last month. Solana active wallets dropped 9.59% in a day, but still rose 15.53% over 30 days. Tron grew 21.32% month-on-month.

DeFi TVL numbers confirm this. Ethereum’s DeFi TVL stands tall at $80.99 billion. Solana is at $9.73 billion with a 15.53% 1-month gain. In contrast, Bitcoin’s DeFi TVL is just $6.72 billion, the weakest among top chains.

So while BTC is being dumped, altcoin networks are showing usage and growth.

This suggests Bitcoin is facing isolated sell pressure, likely from ETFs, Galaxy, or big holders locking profits, not a market-wide exodus.

As long as Total2 holds above $1.44 trillion and the Total market cap doesn’t close below $3.75 trillion, this altcoin’s resilience remains intact.

The post Altcoins Hold Steady As Bitcoin Faces Heavy Sell Pressure: Here’s Why appeared first on The Coin Republic.