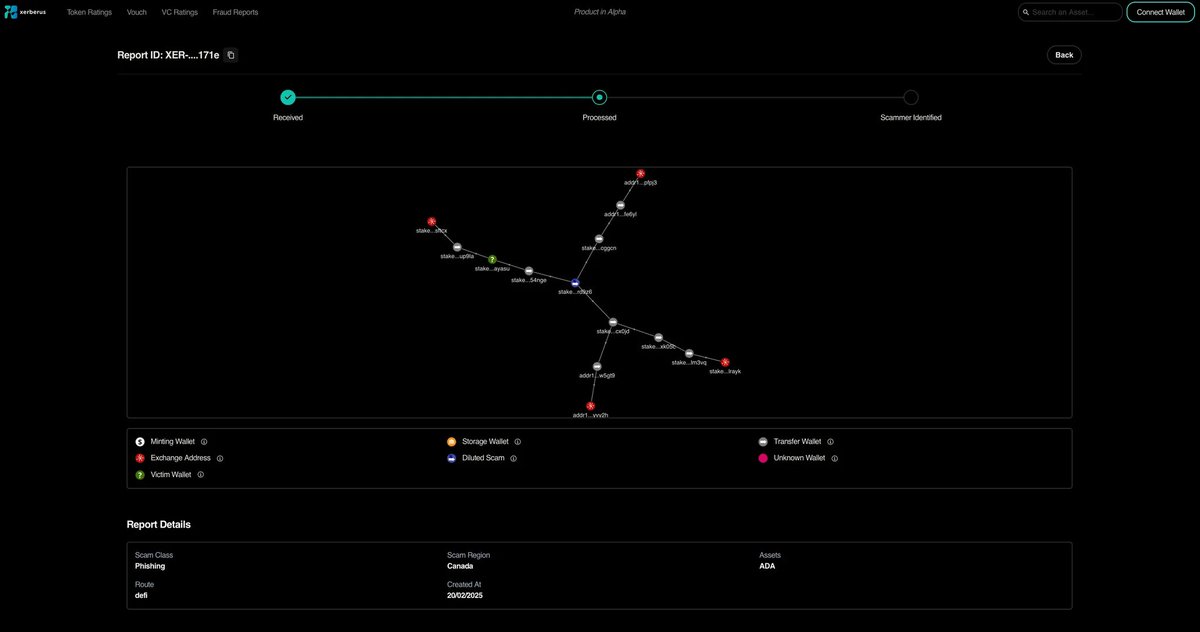

What Kills Crypto People think most losses in crypto come from bad trades. But that’s not true. In 2025 alone, attackers stole about $2.4 billion through hacks. Another $4.6 billion disappeared in rug pulls. Add it all up, and over $30B has evaporated since this industry began. Most people who lose money in crypto don’t lose it because they bet on the wrong token at the wrong time. They lose it because the system itself fails. Luna wasn’t bad luck. Neither was FTX. They were failures of risk. In traditional finance, there are layers of defense against this. Rating agencies. Credit checks. Insurance. They’re not perfect, but they stop most of the obvious disasters. Crypto has none of that. What it has instead is Twitter threads after the fact. That’s the hole @Xerberus_io is trying to fill. Their idea is simple: AI generates risk ratings for tokens, and the community checks them. If you find a mistake and you’re right, you get paid. Instead of relying on agencies that...

Show original

14.72K

160

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.