🚨Why Selling in August is a Big Mistake🚨

Markets look shaky. FUD is everywhere. But if you sell now, you could miss the best setup of the year.

Here’s why I’m staying patient and what I’m doing instead 🧵👇

1/x The fear is real:

🔸 Tariff headlines

🔸 Weak job data

🔸 Liquidity dip

🔸 ETF outflows

But zoom out, none of this changes the bigger picture. In fact, it’s setting up a perfect Q4 storm.

Let’s break it down.

2/x Tariffs are just noise. Trump’s tariff pause now ends August 7. But he always uses tariffs as leverage, this is the same China playbook.

Markets might wobble short-term, but once the news is out, the uncertainty fades. Don’t panic sell on headlines.

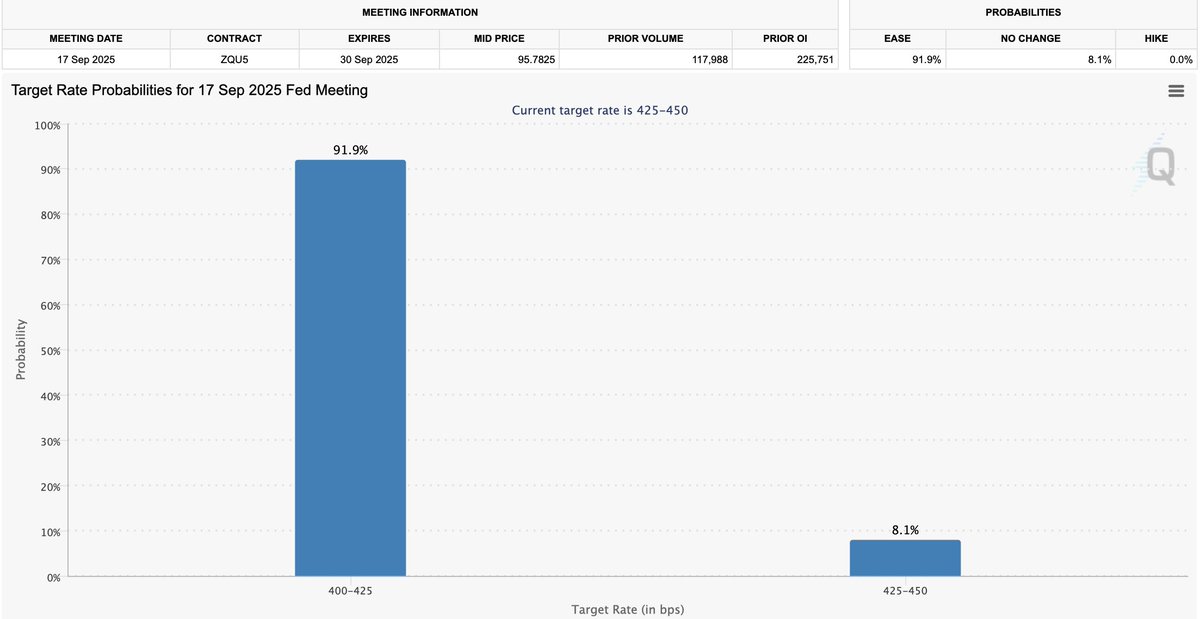

3/x The recent weak jobs report actually boosts the odds of Fed cuts.

May & June job growth was revised down by 258K. That’s massive.

Markets went from 39% to 86% odds of a September rate cut. Easing is back on the table.

4/x The Treasury might pull $500B to refill its General Account, and yes, that could cause short-term chop.

But it’s not a liquidity collapse. It would still form a higher low on global liquidity charts.

But by Q4, we could get:

🔹 Rate cuts

🔹 QT pause

🔹 SLR exemption

August is the shakeout. September is the setup.

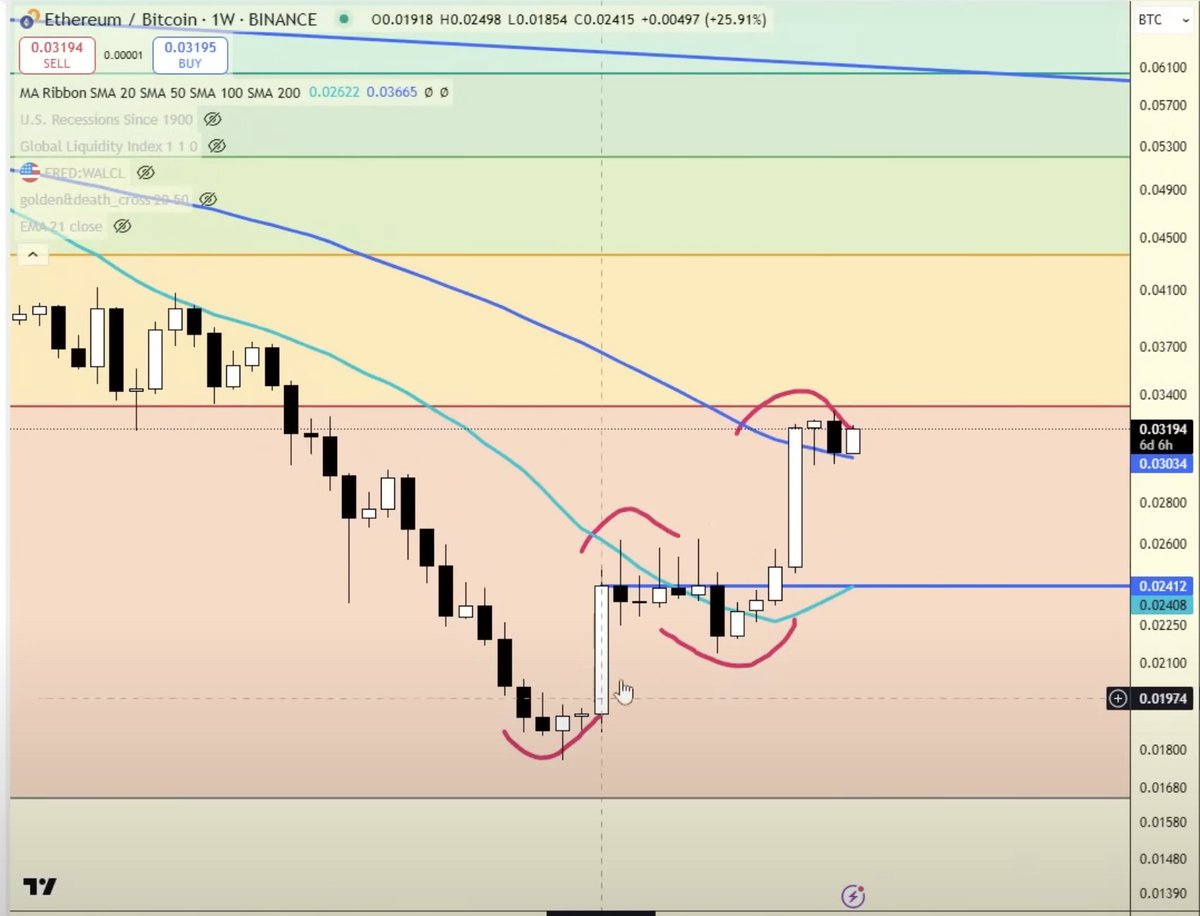

8/x $ETH, $XRP, $SOL outlook:

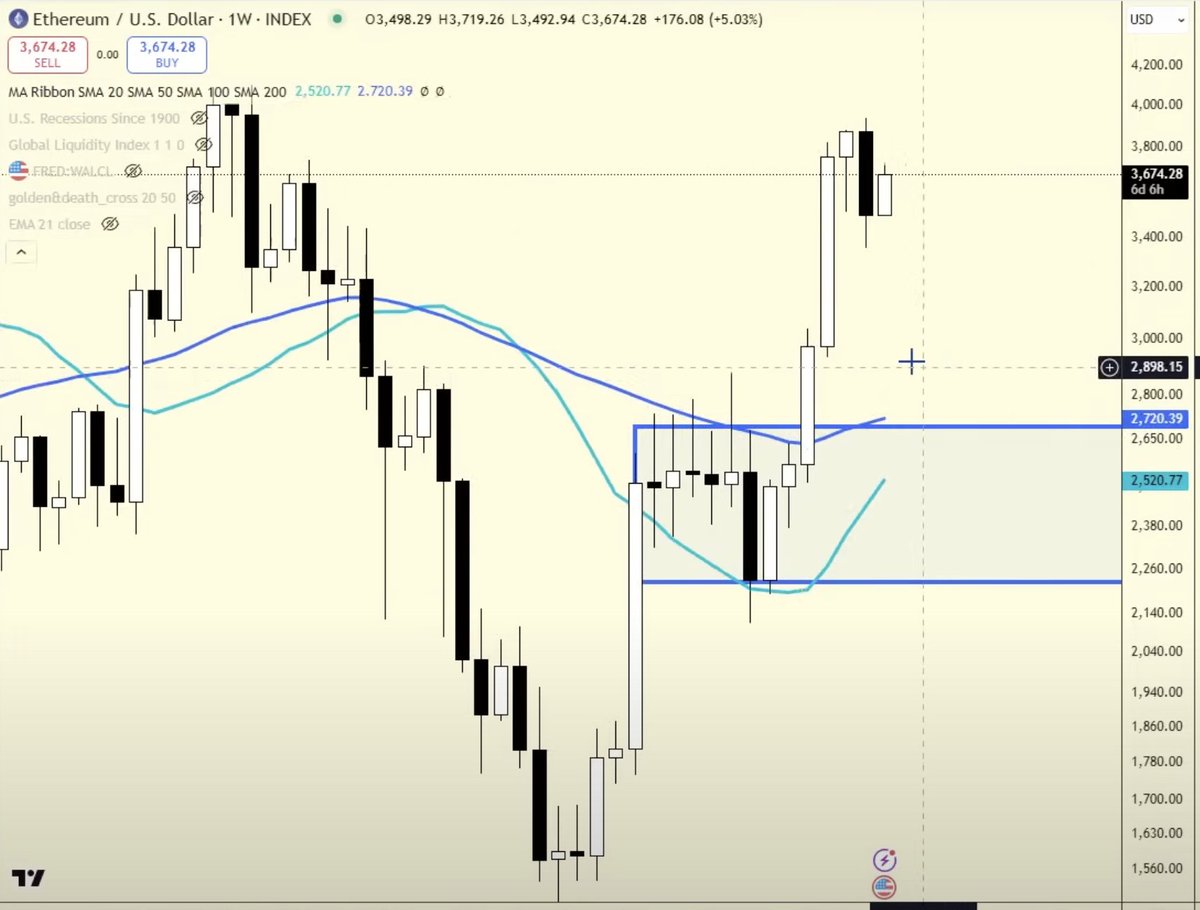

🔹 $ETH looks solid as long as we stay above $2.7K.

🔹 $XRP needs to hold 0.000022 BTC and is still a buy between $2–$3.

🔹 $SOL has a must-hold $BTC ratio is 0.0012. That gives a USD floor around $110–$130. Still early on all three.

10/x My strategy right now is simple:

🔹 Stack $BTC, $ETH, $XRP, $SOL, $ADA.

🔹 Rotating into large caps near support.

🔹 Use grid bots to auto-buy dips and take profits.

No need to trade every move, let the bots work the chop while you position for Q4.

11/x Don’t get shaken out now.

Rate cuts, QT pause, and SLR easing are all on the horizon.

Stay focused, stay patient and if you want to automate your dip buys and sell targets:

Copy all my trading bots here 👉

What are you buying this month? Drop your choices below!👇

411.25K

2.33K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.