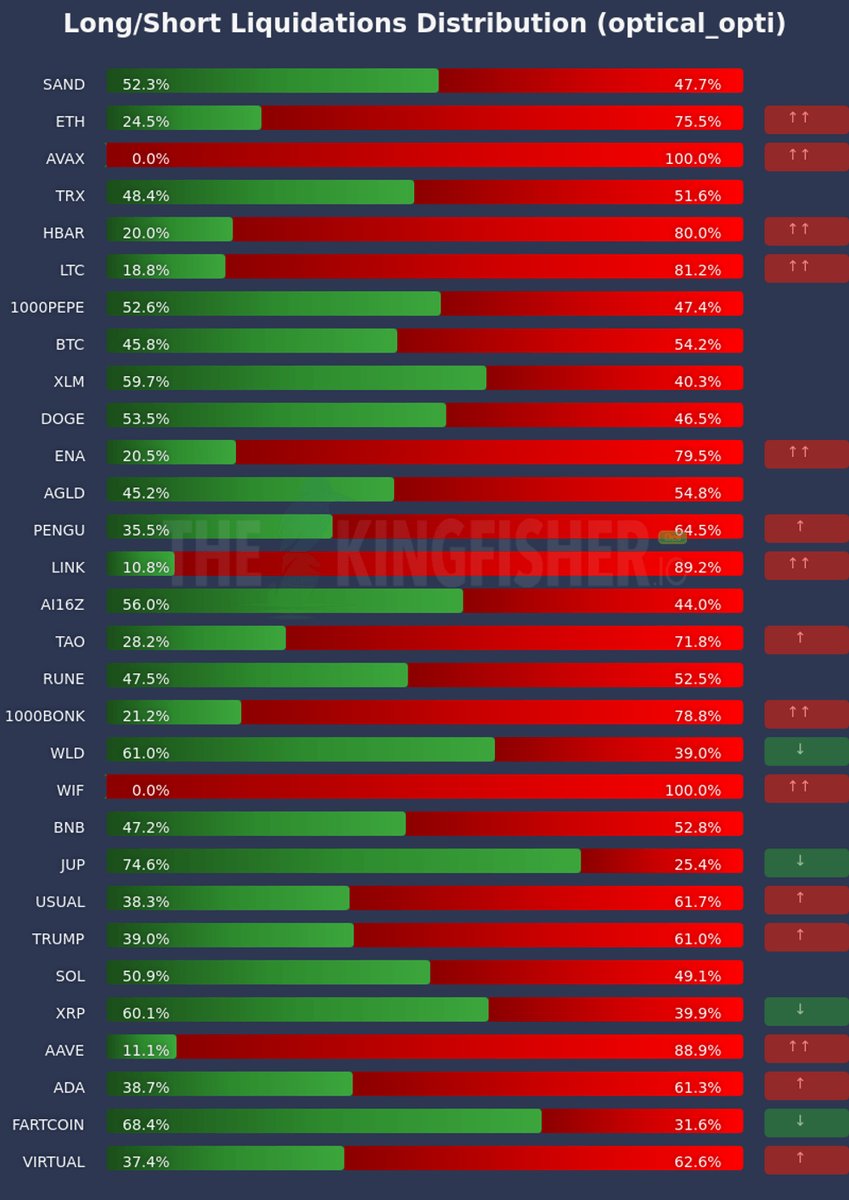

Alright, let's cut through the noise. Most traders are glued to price action, missing the real mechanics. We're looking at liquidation distributions. This isn't just data; it's where the pain is, and often, where price is *pulled*.

🚨 $BTC Liquidations: We're seeing 45.8% long liquidations and 54.2% short liquidations. This is relatively balanced, suggesting no immediate massive catalyst from short term liq hunting. However, the bulk gravitates towards shorts, which could mean upward pressure if those levels are tested.

Now look at $AVAX. That's 100% short liquidations. That's a massive target. If price starts to climb, it can be absolutely brutal for those holding shorts. Expect volatility if that level gets attacked.

Compare this to $LINK, which is sitting at a hefty 89.2% short liquidations. That's a big magnet building up if price pushes higher.

On the flip side, $AAVE is showing 88.9% long liquidations. This tells us where the selling pressure is likely to be absorbed or where price could find some choppy support if it dips.

This raw data shows who's getting wiped out and where. Smart money uses this to anticipate moves retailers can't see. Don't get caught in the crossfire. See this flow before it hits: thekingfisher . io

Don't get REKT! ☠️

Master liquidation maps, anticipate the next big move, and join the winning team.

Learn, track, and discuss:

Access the alpha:

Liq Map Guide:

🚨 Signals & announcements :

💬 Community Chat:

48.17K

98

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.