1/6 🧵New Coin Metrics Weekly State of the Market Report

Markets held steady as investors digested the Fed’s decision to pause rate hikes and ETF flows resumed momentum.

Full breakdown from @coinmetrics – link in replies.

Highlights:

– The SEC approved in-kind creations/redemptions for spot $BTC and $ETH ETFs, aligning crypto with traditional commodity ETFs and lowering transaction costs.

– @Tether_to reported $4.9B in Q2 profit, with $USDT supply topping $157B and U.S. Treasury exposure exceeding $127B - more than Australia or Germany.

– @krakenfx is reportedly raising $500M at a $15B valuation ahead of a 2026 IPO, joining a growing crypto IPO pipeline.

– Nasdaq-listed biotech firm @180LifeSciences rebranded as @ETHZilla_ATNF, raising $425M to deploy a fully on-chain Ethereum-native corporate treasury.

Read the full report for a data-driven look into crypto’s shifting institutional and macro landscape.

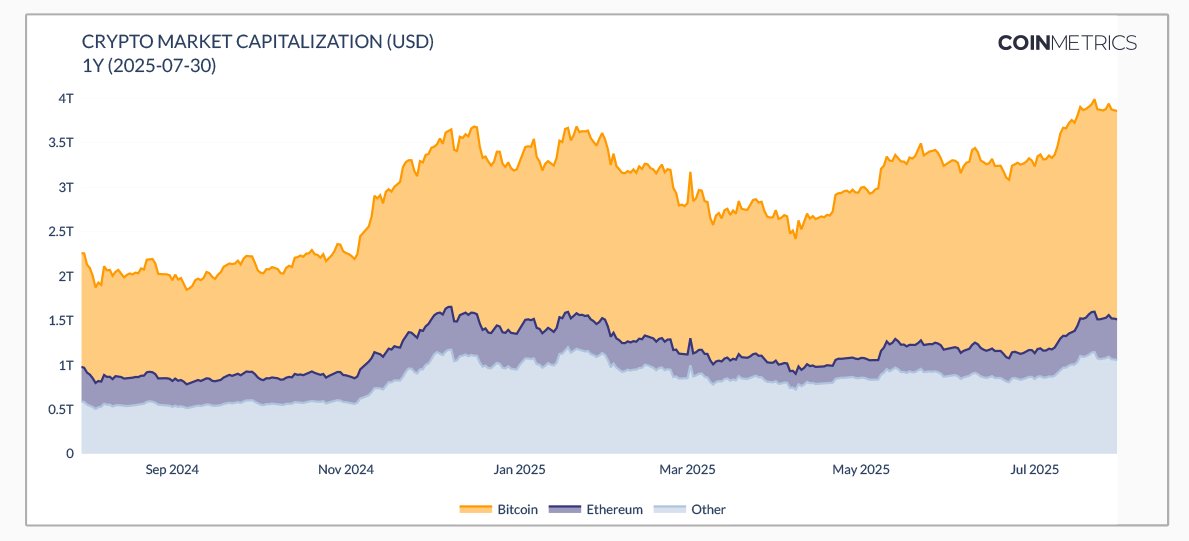

2/6 Current Cryptocurrency Market Cap.

Total MC remained relatively flat, closing slightly lower at $3.85T, down from $3.88T the prior week. $BTC ’s Market Cap dropped slightly to $2.34T from $2.36T, while $BTC dominance remained steady only dropping slightly to 60.7% from 60.8%.

CM State of the Market >>

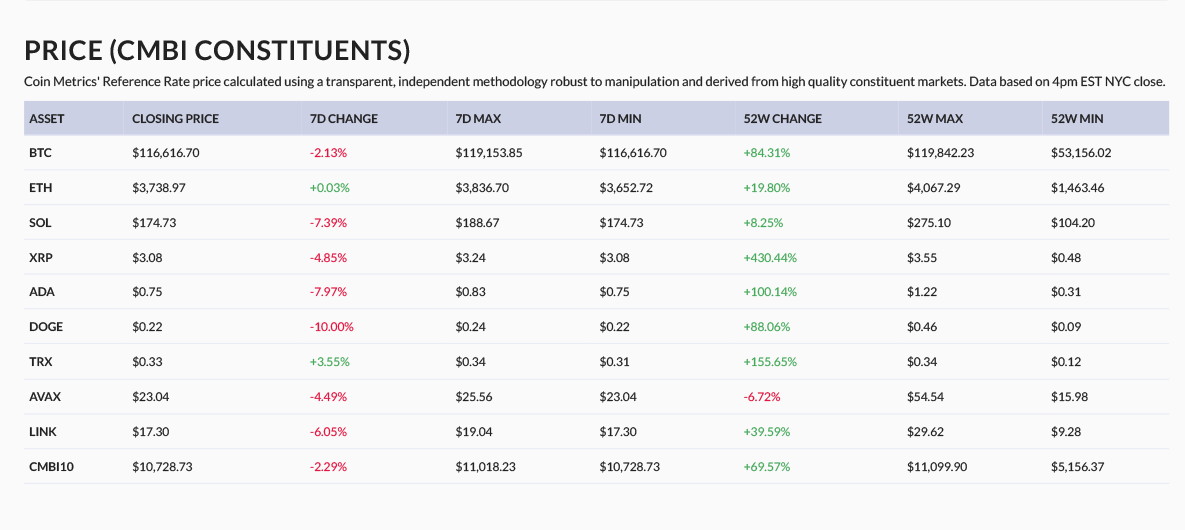

3/6 7-day week-over-week change in top cryptoasset prices based on @coinmetrics Reference Rates.

$TRX (+3.55%) and $ETH (+0.03%) were the only assets to post weekly gains.

Most others saw red: $DOGE (-10.00%), $ADA (-7.97%), $SOL (-7.39%), $LINK (-6.05%), $XRP (-4.85%), $AVAX (-4.49%), and $BTC (-2.13%).

CM State of the Market >>

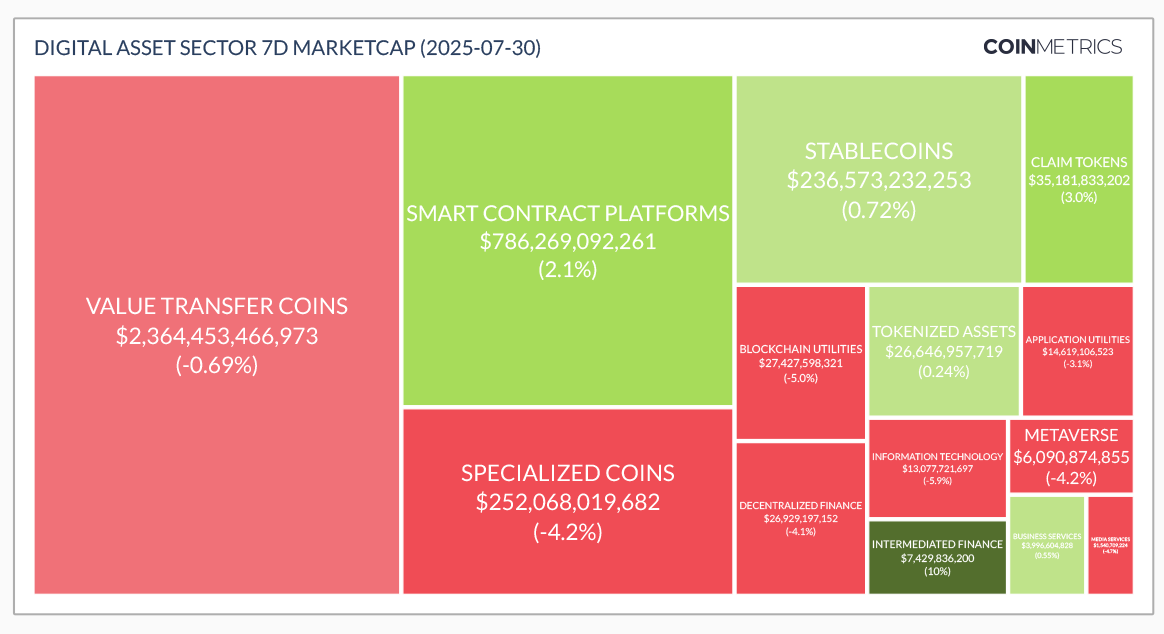

4/6 Digital asset sector performance was mixed last week across categories tracked by @coinmetrics.

Intermediated finance (+10%) led the gainers, followed by claim tokens (+3.0%), smart contract platforms (+2.1%), stablecoins (+0.72%), business services (+0.55%), and tokenized assets (+0.24%).

Decliners included information technology (-5.9%), blockchain utilities (-5.0%), media services (-4.7%), specialized coins (-4.2%), metaverse (-4.2%), decentralized finance (-4.1%), application utilities (-3.1%), and value transfer coins (-0.69%).

CM State of the Market >>

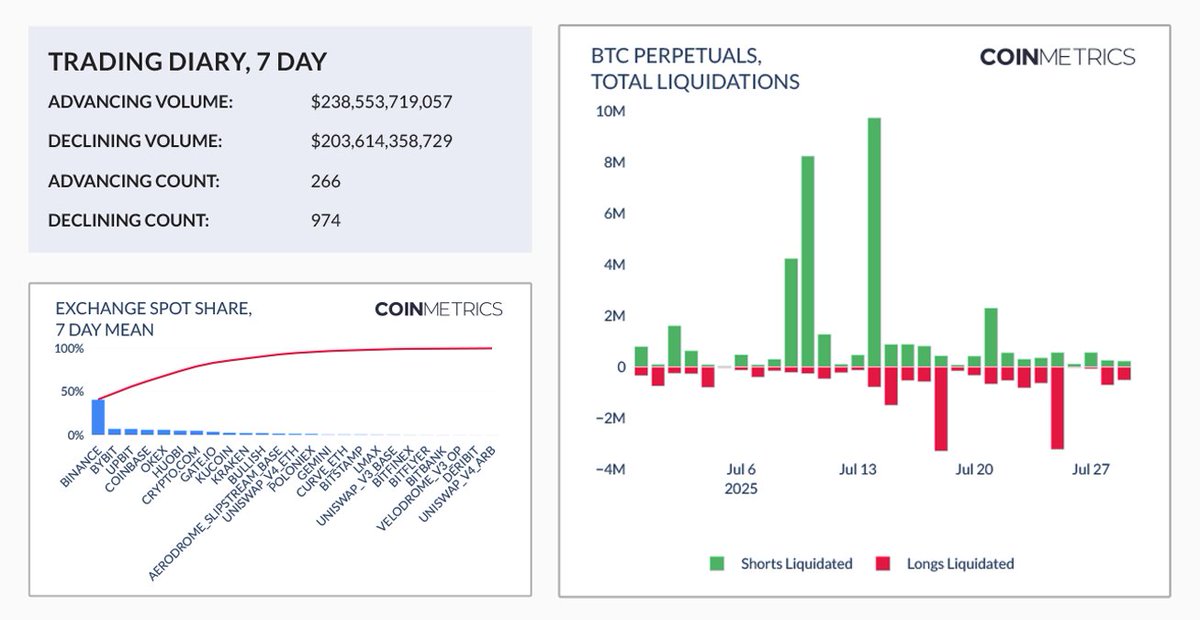

5/6 Crypto markets pulled back last week, with losses seen across a broad set of assets. Of the 1,240 assets tracked by @coinmetrics, 974 declined while just 266 advanced.

Despite this, advancing volume still slightly outpaced declining coming in at $238.6B vs. $203.6B -suggesting fairly even trading conditions.

In derivatives markets, modest $BTC long liquidations were seen as prices softened.

CM State of the Market >>

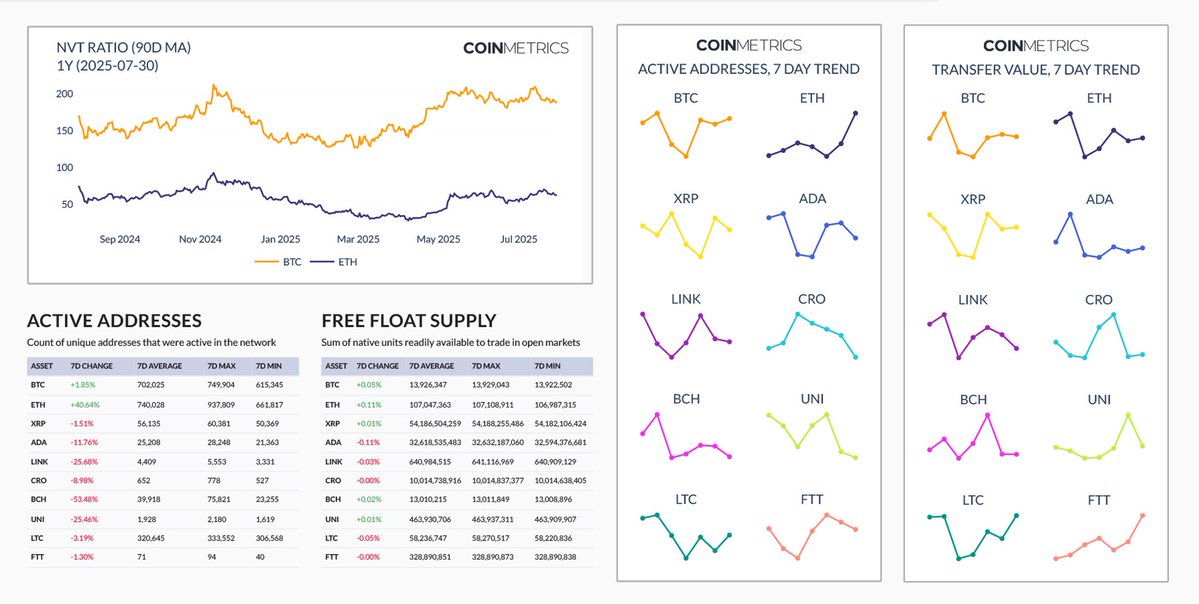

6/6 On-chain activity mainly declined across major crypto networks, according to @coinmetrics network data.

Only $ETH (+40.64%) and $BTC (+1.85%) gained in active addresses over the past week.

Declines were led by $BCH (-53.48%), followed by $LINK (-25.68%), $UNI (-25.46%), $ADA (-11.76%), $CRO (-8.98%), $LTC (-3.19%), $XRP (-1.51%), and $FTT (-1.30%).

CM State of the Market >>

32.35K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.