Learn one DeFAI a day | Using good tools to speed up research by half on INFINIT

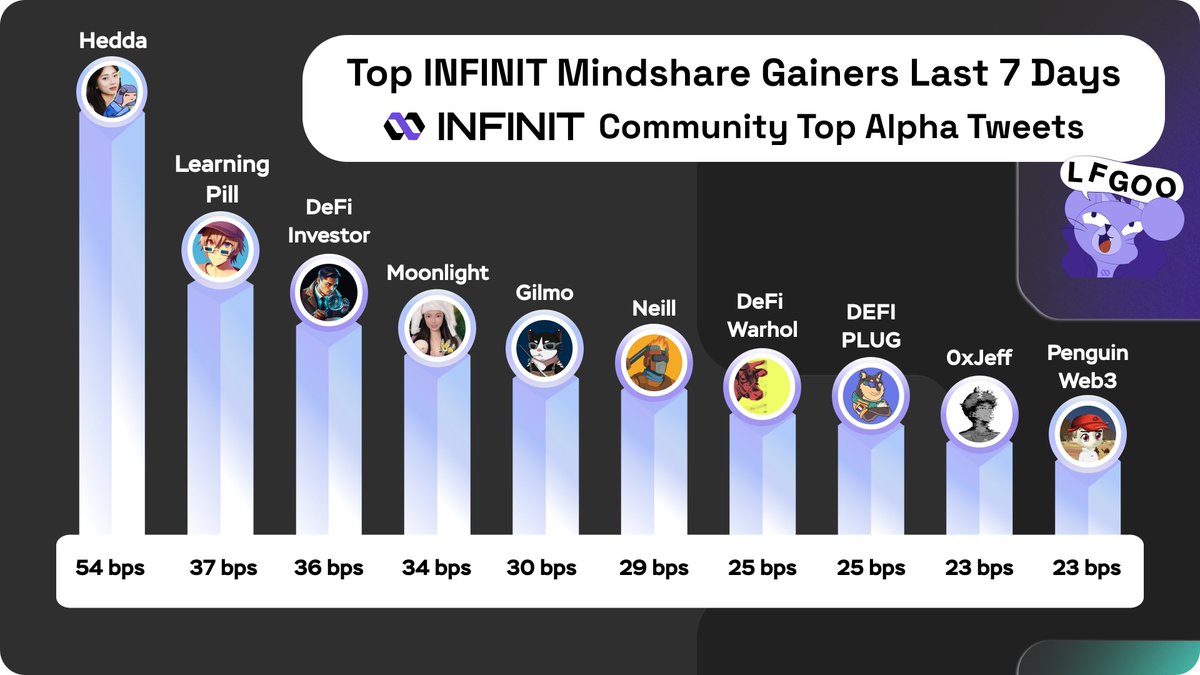

Thanks to @naoi_eth for the graphic, I just realized how high I am on the INFINIT leaderboard.

Today, I’ll introduce an ultimate way to use INFINIT. First, know that the Research Agent in INFINIT understands Pendle very well (because of the collaboration).

➤ I’ll guide you to use Pendle + INFINIT to analyze market trends.

Pendle @pendle_fi essentially operates as a market for trading future yield rates, allowing users to split interest-bearing assets into principal tokens (PT) and yield tokens (YT). The price of PT reflects the discounted value of future yield rates, while YT represents the volatility of remaining yields (previous articles have introduced this, feel free to check them out).

- If PT is heavily discounted, it indicates that the market expects higher future yield rates (or weaker demand, requiring higher returns to compensate for the discount period).

- If the price of PT is close to its nominal value, it suggests that the market believes future yields will stabilize, indicating lower risk.

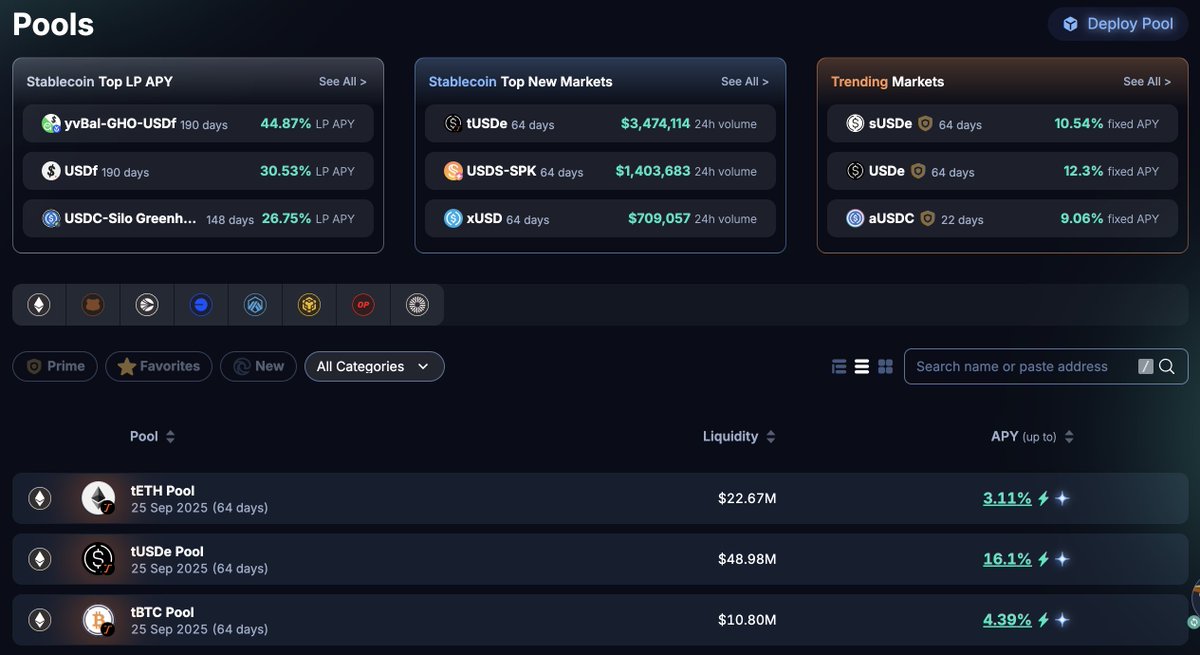

By observing the changes in PT/YT yield rates and TVL across different chains and pools, one can quickly understand market changes.

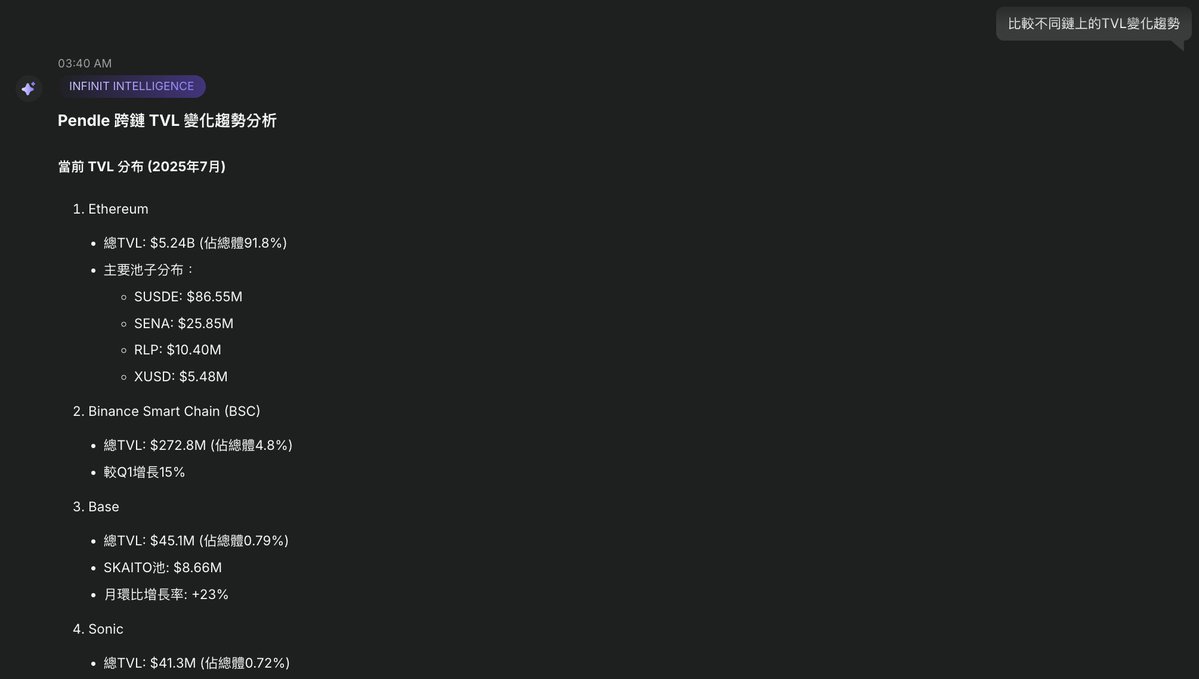

First, let’s ask INFINIT about the current cross-chain market situation for Pendle (it will also recommend what else to ask).

So, here’s a summary of the information provided by INFINIT ⬇️

➤ Ethereum is institution-led, with stable yields at its core.

TVL reaches $5.24 billion (accounting for 91.8% of the entire market).

Daily trading volume exceeds $100 million, with over 100 active pools.

The scale of PT collateral reaches $2.67 billion, with over $2 billion used in Aave as stable collateral.

Users prefer stablecoins sUSDe, tUSDe, tBTC, and long-term yield strategies.

Yield rates are stabilizing, with stablecoin pools maintaining an 8-25% APY.

It’s clear that ETH has become the standard configuration for stable yield markets in DeFi, similar to the government bond market, where institutional versions of E guardians and long-term funds are concentrated, aiming to lock in fixed yields rather than speculating on interest rate spreads. The large TVL in sUSDe indirectly hints at the rise of Ethena.

➤ Base is a rapidly growing high-yield pool, dominated by retail investors.

TVL is about $45 million, with a monthly growth of +23%.

Users are primarily retail and risk-seeking, with pools like SKAITO and yoUSD often yielding over 40%, frequently operating to pursue short-term excess returns.

Base attracts funds willing to take on volatility, driving yields higher but with greater fluctuations.

Using INFINIT, you can directly navigate Pendle, helping us observe the price and interest rate changes of PT/YT across different chains, analyzing the market consensus on yield rates. I also checked the data on Pendle, and it was accurate (no AI hallucinations).

Show original

10.63K

43

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.