Market Selloff Dynamics + Bottoming

The goal of this write up is to give you a bit of insight on how I spot HTF pivot points in markets. We want to understand the psychology behind risk unwinding and use that to our advantage to potentially spot bottoms.

1. Low Conviction Sells First

- When uncertainty hits, sellers dump what they least desire i.e., lower conviction coins will top first and bleed early.

- Think about it logically. If you're in a pinch and needed cash irl, you're not going to sell your prized possessions, you're gunna sell the crap you never use.

- Likewise, traders will sell what they’re least emotionally invested in to build cash when uncertain or want to decrease risk.

- It’s not a coincidence that this has happened every HTF top this cycle. Alts don't rally after, they rally during. They also top weeks before BTC even shows an ounce of weakness.

- It’s an early warning. Smart traders de-risk before the crowd even knows what's happening.

2. Risk vs. Quality

- Let's go back to the earlier metaphor. People will hold onto their quality prized possessions for as long as they possibly can. It's not until they're desperate that they will part with them.

- The most desirable coins, more often than not, will attempt to hold their gains for as long as possible. This is why BTC always looks fine and you see dozens of "Why is everyone panicking, BTC looks great" tweets weeks before sell offs.

In selloffs:

a) Junk sells early

b) Quality sells late

c) Everything sells eventually

Watch the order of events. It’s a map of stress flow.

3. Reflexivity Kicks In

- Early weakness causes more weakness.

- Once a whale starts to unload into exhausted demand they begin to induce weakness. Classic signs of distribution, absorption, exhaustion, trend loss etc.

- A character shift in a risk asset will make the first order of experienced traders reassess.

- "I didn't sell top, but the character of the trend has shifted. Time to reduce exposure/close"

- “If this is nuking, what else am I exposed to?”

Suddenly:

Rebalancing triggers more selling

This is reflexivity.

A feedback loop of diminishing risk appetite.

4. Volatility: The Dance

Before many big selloffs in BTC, markets go quiet. Volatility drops. Trends become ranges. Complacency peaks.

Then, boom.

Let's talk a bit about balance and imbalance.

- Balance is achieved once the market begins to agree on what's expensive and what's cheap. It's a dance. Equilibrium.

- Equilibrium is calm. What's known is known. Speculation diminishes. Volatility compresses.

- The dance continues until one party gets bored, tired or wants to go to the bar to get another drink. i.e. buyers or sellers get exhausted; changes to supply/demand.

- Equilibrium is damaged- and once it breaks: Imbalance.

- Price displaces violently. Value becomes unclear; volatility explodes. The market craves balance and will actively seek it.

- Price often returns to areas where recent balance was formed- hvn, orderblock, composite value etc.

- This is where you get the sharpest bounces.

"First test, best test"

- Subsequent tests will provide diminishing reactions. Things become structural. Price accepts its new home. Volatility compresses. Balance is found once again.

5. The Flow of a Selloff & Spotting Bottoms

Capitulation isn’t the beginning of the end; it’s the end of the middle.

a) Alts vs. Bitcoin

- This cycle alts often do the bulk of their selling before BTC capitulates.

- Recent example: Fartcoin sold off 88% from its top before the late February BTC capitulation. Since this is true, we can begin to use it as an edge when looking for exhaustion (bottoming)

- The strongest alts will begin to show relative strength (exhaustion) earlier as BTC is still being hyper-volatile and looking for new balance.

- In order words, look for good alts to begin to achieve balance as BTC is in the later stages of imbalance.

As participants, our goal is to spot these divergences:

“Has momentum shifted?”

“Is volatility compressing?”

"Is the velocity of selling diminishing?"

“Is it holding while BTC makes new lows?”

Signs of bottoming in Q2:

- Momentum loss (Fartcoin)

- SFP/Deviation (Hype/Sui)

- Higher lows vs BTC’s lower lows (Pepe)

In short: alts front-load their pain, then decrease in velocity as BTC bottoms.

Remember this how we spot "good" alts.

The weak stay weak.

The strong start whispering before the market speaks.

b) Bitcoin vs. SPX

Now a little exercise for you all

Combine all the concepts in this thread and maybe the following begins to make sense:

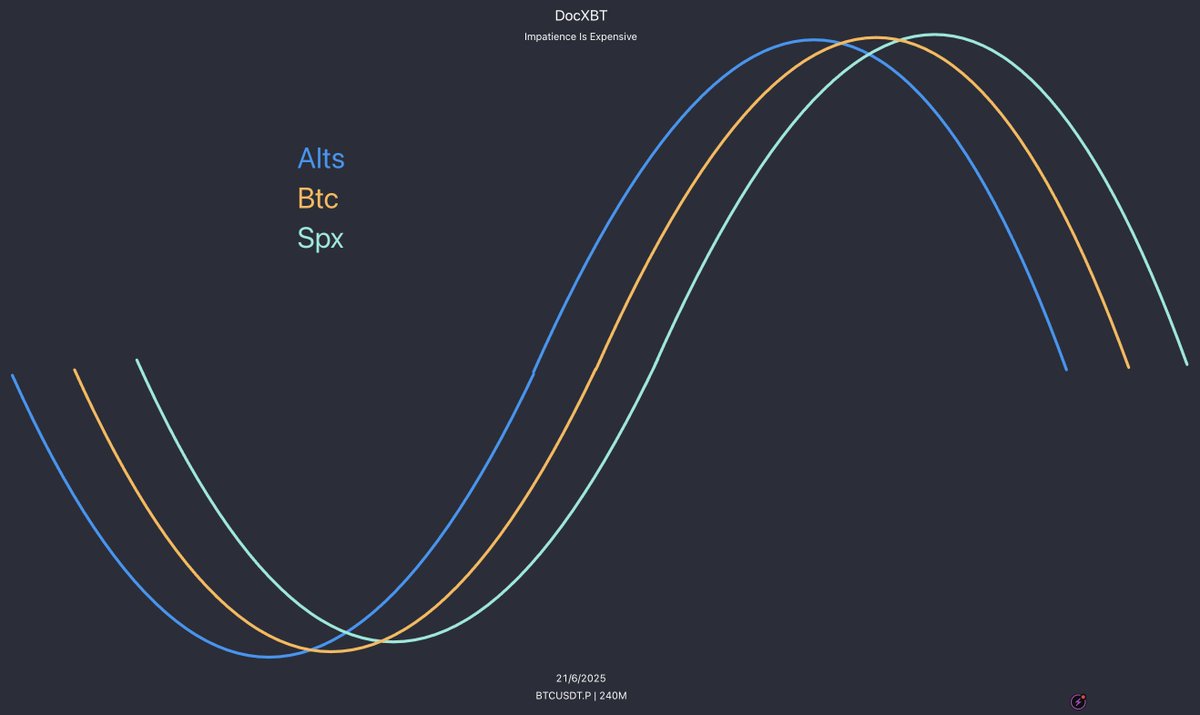

Summer '23: BTC topped before SPX, bottomed earlier

Summer '24: BTC topped before SPX, absorbed the macro related SPX crash at range low

So far in '25: BTC topped before SPX, absorbed a 20% SPX crash at range low

TL;DR

Bottoms are a process, not a moment.

Alts First

Bitcoin Next

SPX Last

Watch for the structure, not just the sentiment.

and it begins...

692

54.13K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.