Recently, my friends have been asking me various questions about RWA and why I want to get involved in Onchain stock. Let me share a little story with you.

In 2021, when I was studying at NTU, I was thinking about how to more "elegantly" bring quality US stock assets onto the blockchain. Unfortunately, my thinking at that time was completely limited to synthetic assets or the derivatives model of CFDs/Perps. From 2022 to 2023, the overall regulation was also very strict, so I couldn't proceed.

In 2022-2023, I saw the cross-chain communication ideas of the Wormhole/Layerzero projects, which inspired me for onchain2onchain communication. In 2024, I observed how BTCFi projects like Merlin/Solv are solving the problem of communication between public chains without smart contracts and those with smart contracts, and unlocking Bitcoin's liquidity to other chains.

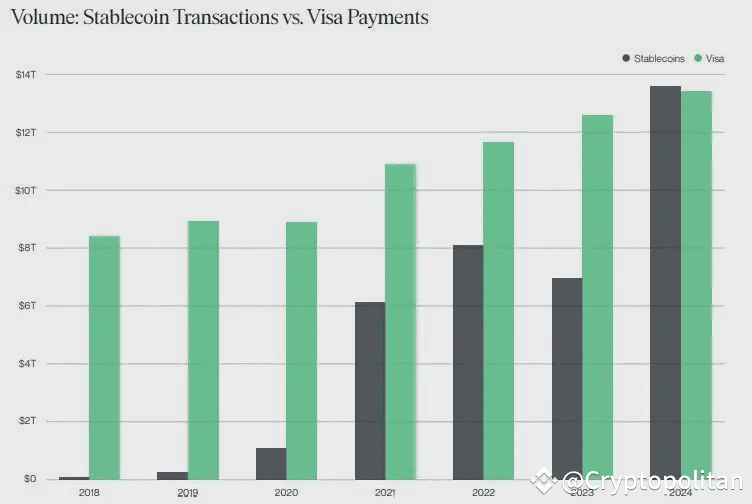

In 2024, the on-chain transaction volume of stablecoins surpassed that of Visa, and stablecoins are continuously encroaching upon and reshaping the market share of traditional banks. Due to the weakness of traditional financial facilities in underdeveloped countries and the zero customer acquisition cost of stablecoins, they can reach users that traditional banks are unwilling to engage with.

Moreover, the more permissionless model of stablecoins has made me realize that stablecoins can reshape traditional banks and their downstream clients. What has already been reshaped includes central banks (stablecoins), commercial banks (asset management companies), and payments (stablecoin payment companies), among others. In the future, stablecoins will gradually reshape more downstream clients of traditional banks.

For a while, I was asking myself a soul-searching question—are stablecoins stable because they equal 1 dollar or because of proof of reserve?

Later, I realized that USDX is stable at 1 dollar because it has done a good job with proof of reserve, which is why it is a stablecoin.

So, can Onchain stock be approached in this way?

So in April, Stablestocks Lab officially launched the project. We are bringing the liquidity of high-quality assets onto the blockchain, enabling stablecoin holders to access the world's best assets and providing these users with financial services that can only be experienced in traditional private banking.

7.2K

42

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.