This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

PST

Piastri price

DBw3Fk...uhNf

$0.00031267

-$0.00004

(-12.37%)

Price change for the last 24 hours

How are you feeling about PST today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

PST market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$312,672.25

Network

Solana

Circulating supply

999,994,916 PST

Token holders

1437

Liquidity

$69,690.93

1h volume

$15,906.12

4h volume

$112,319.75

24h volume

$1.11M

Piastri Feed

The following content is sourced from .

Nick P 🐈🏆 reposted

Nick P 🐈🏆

People have to choose the good and stubborn ~ $Huma I don't know when the currency price is the "bottom".

Anyway, I bought 300,000 pieces at $Huma 0.038 and sold them at 0.051, but I took them all back at 0.050, and I didn't make any money or lose so far

I'll try harder to yap @humafinance, though

YAP was relatively late, and it was hard to get 75

🔥 Target Top 10 !!

Yesterday Richard's AMA, I threw up a question about 'what they plan for the second half of the year'

That's the point for me, not the price or the incentives

As long as the business is doing well and can continue to grow, the above problems are not a problem

A quick remark about RIchard @DrPayFi replied:

⭐️ This year's goal is to stake 200,000 users on the platform

⭐️ The place of the greatest pressure – the growth of the ecology (the borrowed part)

- Because regulatory compliance takes time

- There are several major customers in the US/Middle East/Asia

⭐️ Recently, there have been more places to promote

- Merchant credit card payment lending, currently working with a top partner

- Work with 10b asset partners to build PST into the Dai of the Solana ecosystem

#慢慢地一起長大

Show original

16.79K

31

Nick P 🐈🏆 reposted

Nick P 🐈🏆

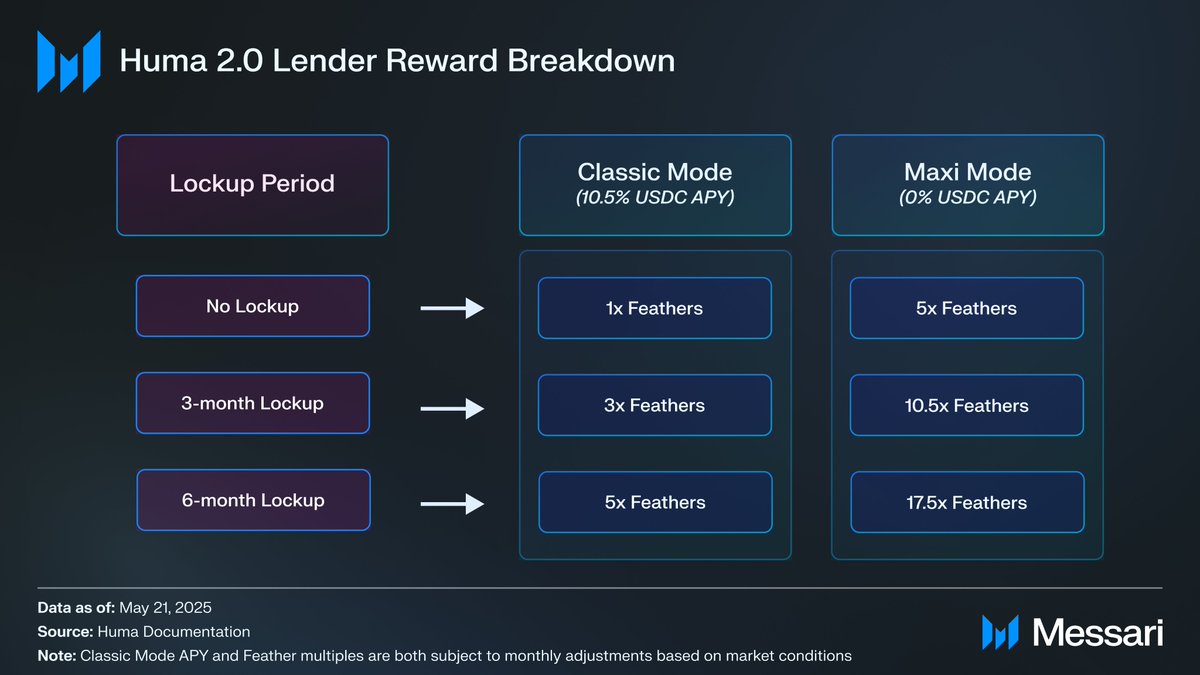

『 Huma Feather Annualization !? How to participate!? 』

According to actuary@ZLiao3 the number of feathers this season is 3b

Deposit 10,000 USDC – 5,800 feathers per day

- If you select Maxi 6 months lock up

- FDV $500m, 1% of the token is allocated to feathers

It can be calculated that 6 months of Maxi staking = 35% 🔥 APR

↳ This number is too fragrant for stablecoin wealth management !

🀆

If you believe :

Solana's strongly supported Payfi + Circle investment concept stock = future potential stock = Huma Finance

You can participate in Huma "Feather Take" in the following ways:

(1) First Look: ( 6/10 6pm GMT+8 )

- Buy $Huma and pledge, subscribe to the staked USDC quota to get feathers

- USDC subscription amount = amount of staked $Huma divided by 25

- Pledge $Huma also motivate feathers to be produced (to be officially announced)

(2) Public Subscription ( 6/11 6pm GMT+8 )

- Participate in the public subscription of USDC quota

- Depending on how many shares are taken by the "first refusal", the rest will be distributed to the public

(3) Other means

- Provide PST/USDC liquidity at @KaminoFinance - 5x feathers

- In @RateX_Dex deposit LP - 2x feathers

- @JupiterExchange Buy PST - 1x Feather ; mPST - 5x feathers

🀆

I think there is a positive correlation between the rise of Huma Finance and the U.S. stock Circle

If Circle continues to rise 📈 tonight

It is believed that Huma Finance will not perform badly 🚀

Circle's share price has risen from 31 to 115, which is almost fourfold

@humafinance @DrPayFi

橘皮乌龙||Leo

Actuarial Huma Season 2 Points, It Seems Still a Good Choice? At the current currency price, the average value per 1,000 is 1.67U, which is about 2.4% annualised per 1x feather. If you choose OG+Maxi for 6 months, you can still get more than 50% APY.

As a staker, my choice is how much to stuff and how much to stuff and how much I can get in the future.

👇👇👇👇👇👇

Let's recap the known conditions: the snapshot date for the first quarter is May 18, with a total feather count of 26.8B. The release in the second quarter after the snapshot has not changed much, and has been around 50M. I probably tested it, and the current daily increase in credits is about 21M, and the average feathers multiplier is 21*30/50=12.6x. Then the score for three months is about 12.6*3*50=1890M.

The part of Huma Institution, the current 6mo in the second season and the third season are still being scored, according to my previous statistics, the score of this part is from mid-May to mid-August, and the total amount is about 386M.

Finally, calculate the new deposit: assuming that at the beginning of June, July and August, the new quota opened is 10M, 15M and 15M respectively, and the average multiplier of feathers is still 12.6x (the average multiplier decreases, but the proportion of mpst is increased), and the total cumulative feather by the end of August is 693M.

To sum up, the total number of feathers in the second season should be around 3B. The variables are the new amount in the future, the average multiplier, and the increase in the total score due to the possible staking $HUMA bonus (similar to ENA, the total score should be higher, but the staker's own multiplier will also be larger).

According to the current 500M TVL, the airdrop is 2.1%, assuming that 1% of it is given to the feather plan, and the rest is used to incentivise the ecology. The total value of the airdrop is 5M, with an average value of 1.67u per 1,000 parts, and an annualised rate of about 2.4% per 1x feather.

20.39K

20

Professor Jo 🐙

Solving the 'slowness' of < finance with blockchain, Huma Finance>

The 'slowness' of conventional finance goes beyond simple inconvenience and becomes an 'opportunity cost'. Huma (@humafinance) proposes a solution to this structural inefficiency with blockchain.

1. Raising the issue of a slow and complex financial system

The first case is overseas remittance. The existing remittance system relies on interbank deposits, which leads to slow processing times and high fees. On weekends or at night, remittances often stop altogether. Huma dug into this point. It bypasses SWIFT and uses stablecoins and on-chain liquidity to implement real-time remittances 24 hours a day, seven days a week.

The second is card payment. We think that the payment is done when we swipe the card, but it takes a few days before the actual seller receives the money. This is because it goes through several stages such as card companies, networks, and acquirers. Huma simplifies this complex settlement structure and creates a structure that allows sellers to receive payments in real time.

2. Can the deposited funds be returned to real returns?

The money deposited in conventional finance is almost unprofitable. On the other hand, banks use these funds to make a profit. Deposit margin is a typical example. The same is true for crypto. It is said that depositing will generate profits, but the interest is mostly based on the inflation of the governance token. Huma is different here.

Huma's payment network runs on the basis of funds entrusted to it by liquidity providers (LPs), and all on-chain fees generated go to LPs as interest (APR). Starting with Solana, it is expanding to other L1s.

Specifically, global payment companies pay a fee of 0.06~0.1% every time they use @humafinance stablecoin liquidity. It is competitive because it is a lower fee than the existing one. This can be expected to be a feasible return of 10~20% per year. The interest structure itself is differentiated in that it is not 'token inflation' but 'real-based return'.

3. Connecting with DeFi — Focusing on PST

Huma is also collaborating with DeFi partners. Of particular note is the PayFi Strategy Token (PST), an LP token that generates profits. You can borrow USDC from @KaminoFinance as collateral for PST, and structure it as PT/YT on a @RateX_Dex like a pendle.

Huma is a team that is trying to break the slow structure of finance and build a real-time payment infrastructure with blockchain. It creates a real-based system that generates profits every day, and distributes those profits to liquidity providers and token holders. This is Solana's PayFi and @humafinance is running as the leader.

Could this practical model lead the next era of crypto? At least we may be participating in the prelude now.

Show original

29.27K

93

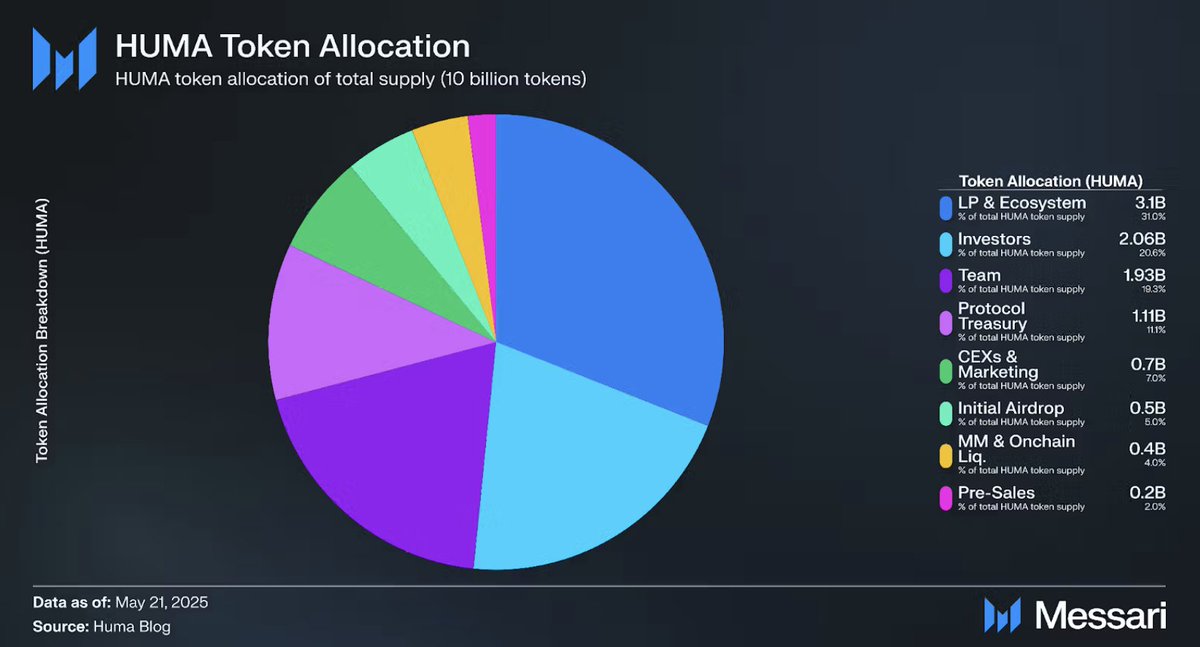

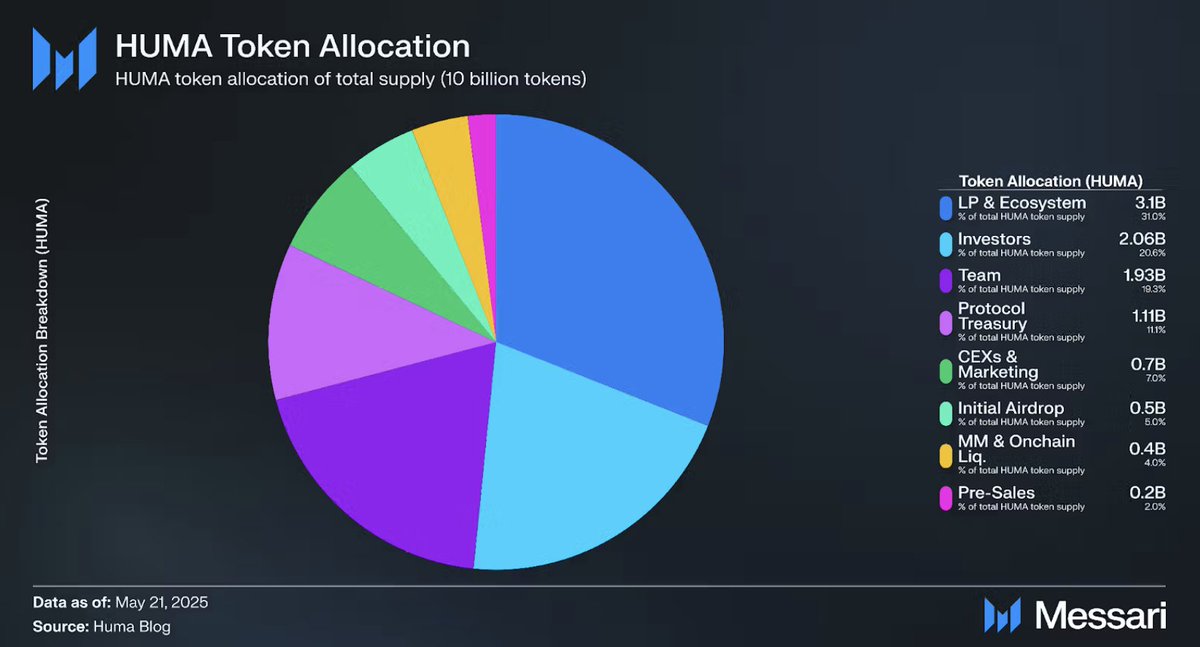

币世王

Messari is also here to share his thoughts on @humafinance and the future of money is bright!

Messari is a leading provider of crypto market intelligence products that help professionals or organisations better understand projects!

Write the main points directly:

Huma Finance is a payment financing protocol that mainly solves the liquidity problem of cross-border payments and credit card settlements. While the process of traditional finance is slow and inefficient, Huma connects funders and borrowers through blockchain to improve efficiency and lower the barrier to entry.

It is now available in two versions:

✦ Huma Institutional is for institutional users, and KYC/KYB is required

✦ Huma 2.0 is open-ended, and retail investors can also participate directly and deploy funds into Huma's pools or some DeFi protocols.

It has issued $2.3 billion in credit lines and $4.5 billion in total trading volume, covering 12 active lending pools across Solana, Polygon, Celo, Stellar, and Scroll. The team also took $46 million in financing behind it, and the team is the type who understands finance and blockchain.

The next goals are to:

✦ Promote same-day settlement of cross-border payments

✦ Better combine DeFi and PayFi

✦ $10 billion in total trading volume by the end of 2025

✦ It will also bring the community in to participate in the construction of the protocol through governance tokens and airdrops

▰▰▰▰▰▰

In summary, this is a project that is putting real-world payment scenarios on the chain, and the follow-up airdrop will be a big move worth paying attention to!

#PayFi @KaitoAI @DrPayFi

Messari

Huma Finance, a PayFi protocol, delivers structured settlement liquidity for cross-border and other payments.

They have originated $2.3 billion in credit, with $4.5 billion in transaction volume.

$HUMA token just launched. Here's what to know ⬇️

67.26K

20

Soju 燒酒 | Meteora reposted

Messari

Huma Finance, a PayFi protocol, delivers structured settlement liquidity for cross-border and other payments.

They have originated $2.3 billion in credit, with $4.5 billion in transaction volume.

$HUMA token just launched. Here's what to know ⬇️

0xweiler

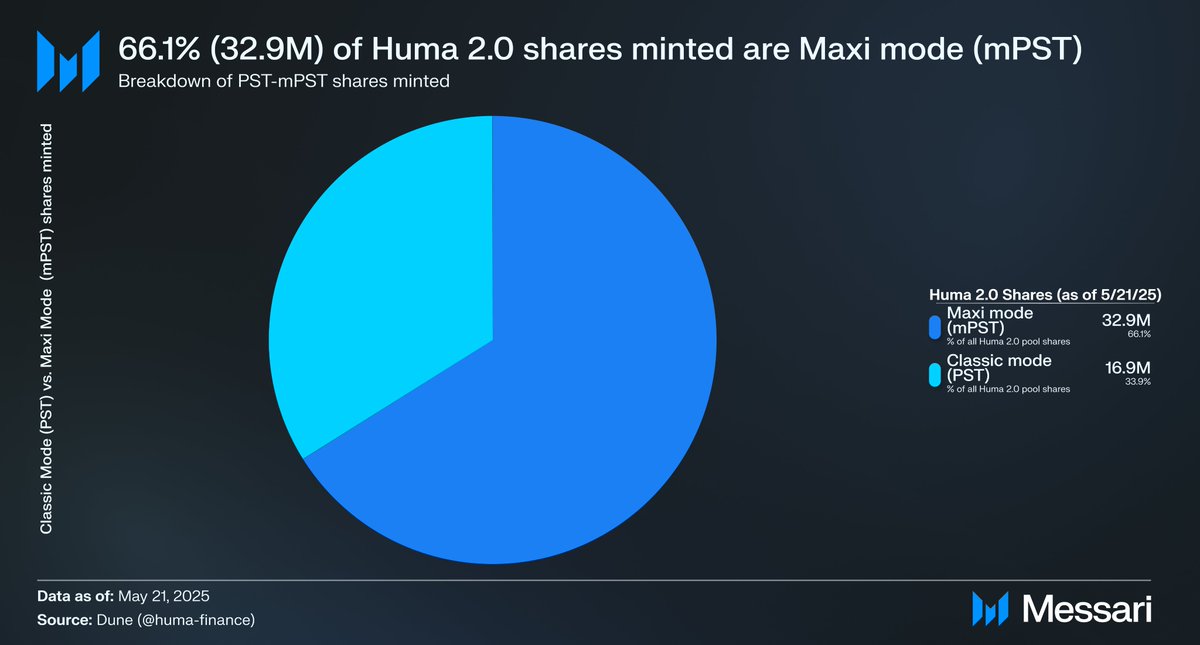

1/ @humafinance's permissionless lending product Huma 2.0 has received $50 million in USDC since its launch on April 9.

Depositors choose between:

▪ Classic Mode (PST): USDC yield + Feather rewards

▪ Maxi Mode (mPST): Feather rewards only, at higher multipliers

Here’s how the capital is split 👇

🔗

57.31K

152

PST price performance in USD

The current price of piastri is $0.00031267. Over the last 24 hours, piastri has decreased by -12.37%. It currently has a circulating supply of 999,994,916 PST and a maximum supply of 999,994,916 PST, giving it a fully diluted market cap of $312,672.25. The piastri/USD price is updated in real-time.

5m

-0.25%

1h

+2.93%

4h

+7.75%

24h

-12.37%

About Piastri (PST)

PST FAQ

What’s the current price of Piastri?

The current price of 1 PST is $0.00031267, experiencing a -12.37% change in the past 24 hours.

Can I buy PST on OKX?

No, currently PST is unavailable on OKX. To stay updated on when PST becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of PST fluctuate?

The price of PST fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Piastri worth today?

Currently, one Piastri is worth $0.00031267. For answers and insight into Piastri's price action, you're in the right place. Explore the latest Piastri charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Piastri, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Piastri have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.