This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

CSR

Cyberscooter price

2gqtbp...pump

$0.0000025089

+$0.000000000049654

(--)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about CSR today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

CSR market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$2.50K

Network

Solana

Circulating supply

998,400,724 CSR

Token holders

305

Liquidity

$4.79K

1h volume

$0.00

4h volume

$0.00

24h volume

$0.00

Cyberscooter Feed

The following content is sourced from .

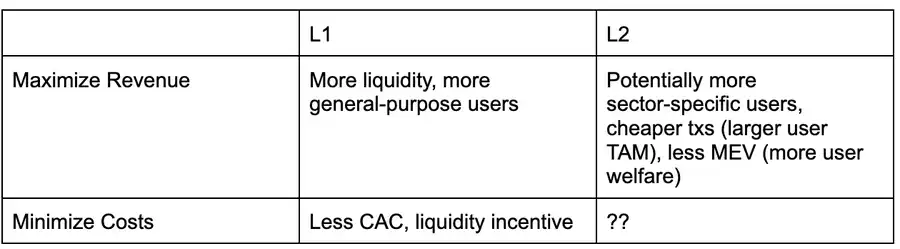

The hidden war between L2 and L1, who can be the winner of dApp revenue?

Original Title: The L2 vs L1 Battle that Nobody is Talking AboutOriginal Author: 0x taetaehoho, Chief Security Officer, EclipseFND Original compiler: zhouzhou, BlockBeatsEditor's note: L2 has an advantage over L1 in terms of operational costs, as L2 only pays for the cost of a single sequencer, while L1 pays for the security of all validators. L2 is uniquely positioned for speed and MEV reduction, and enables innovative economic models to maximise dApp revenue. Although L2 cannot compete with L1 in terms of liquidity, its potential in the dApp economy will drive the crypto industry's transformation from infrastructure to a profit-driven, long-term business model. Here's the original text (edited for ease of comprehension): Here's a decision matrix from a dApp perspective that analyses whether to deploy to L1 or L2 in the current environment, assuming that both support similar types of applications (i.e., L1/L2 are not tailored for a specific application type). Aside from the relatively low MEV (Maximum Extractable Value) due to the centralisation of block producers, L2 has not yet taken full advantage of other benefits. For example, despite the potential for lower transaction costs and faster throughput, Solana is still ahead of L2 in the EVM ecosystem in terms of performance and transaction costs. As Solana continues to increase throughput and advance MEV tax regimes such as ASS and MCP, L2 will need to explore new ways to help dApps maximise revenue and reduce costs. My current view is that L2 is structurally superior to L1 and can execute dApp revenue maximisation strategies more quickly. One of the key roles of the execution layer in maximising application revenue is how fees/MEV are allocated. Currently, MEV tax or fee sharing is only possible with "honest block proposers", i.e., proposers who are willing to follow prioritisation rules, or share revenue with the app according to preset rules. Another way is to allocate a portion of the base fee of EIP 1559 to the dApp that the user interacts with, a mechanism that Canto CSR and EVMOS seem to employ. At the very least, this will allow dApps to increase their ability to bid on their own MEV yields, making them more competitive in the deal inclusion market. In the L2 ecosystem, if a block proposer is run by a team (i.e., a single block proposer), then it is inherently "honest" and can guarantee the transparency of the block construction algorithm through reputation mechanisms or TEE (Trusted Execution Environment) technology. Currently, there are two L2s that have adopted fee sharing and prioritisation block construction, and Flashbots Builder is able to provide similar functionality to the OP-Stack ecosystem with minor changes. In the SVM (Solana Virtual Machine) ecosystem, Jito-like infrastructure can redistribute MEV revenue to dApps on a pro-rata basis (e.g., in terms of CUs, Blast uses a similar mechanism). This means that L2 can enable these features sooner while L1 is still working on MCP and built-in ASS options (which Solana may be working on, but there are no CSR-like renaissance plans in the EVM ecosystem). Because L2 can rely on trusted block producers or TEE technology, there is no need to enforce OCAproof, so the MRMC (Revenue, Cost, MEV Competition) model of the dApp can be adjusted more quickly. But the advantage of L2 is not just the speed of development or the ability to redistribute fees, they are also subject to fewer structural constraints. The survival conditions of the L1 ecosystem (i.e., the conditions under which the validator network is maintained) can be described by the following equation: total number of validators × validator operating costs + staking capital requirements × capital costs < TEV (inflation + total network fees + MEV tips) From a single validator's perspective: validator operating costs + staking capital requirements × capital costs > inflation gains + transaction fees + MEV earnings In other words, L1 wants to reduce inflation or reduce fees (by integrating with dApps There is a hard constraint - validators must remain profitable! This limitation will be more pronounced if validator operating costs are high. For example, Helius points out in his SIMD 228 related article that if inflation is reduced according to the proposed issuance curve, at 70% stake, 3.4% of current validators may exit due to declining profitability (assuming REV maintains volatility levels in 2024). REV (MEV Share in Staking Yield) is extremely volatile: On the day of the TRUMP event, the REV share was as high as 66% · On November 19, 2024, the REV share is 50% • Currently, at the time of writing, the REV share is only 14.4% This means that in the L1 ecosystem, there is a ceiling on reducing inflation or adjusting fee allocations due to the pressure on validator monetisation, and L2 is not subject to this, allowing more freedom to explore strategies to optimise dApp revenue. OLANA validators are currently facing higher operating costs, which directly limits the "shareable profit margins", especially as inflation falls. If Solana validators have to rely on REV (MEV share in staking yield) to remain profitable, then the total percentage that can be distributed to dApps will be severely limited. This presents an interesting trade-off: the higher the operating cost of validators, the higher the overall take-rate of the network must be. From the perspective of the network as a whole, the following formula must be met: total network operating costs (including capital costs)< The situation is similar for total network REV + issuance Ethereum, but with less impact. Currently, the APR (Annualized Yield) of ETH staking is between 2.9% -3.6%, with about 20% coming from REV. This also means that Ethereum's ability to optimise dApp monetisation is also subject to validator monetisation requirements. This is where L2 comes in in a natural way. On L2, the total cost of operation of the entire network is only the cost of operating a sequencer, and there is no capital cost because there is no staking capital requirement. Compared to L1, which has a large number of validators, L2 requires a very small profit margin to maintain breakeven. This means that while maintaining the same profit margin, L2 can allocate more value to the dApp ecosystem, which can greatly increase the revenue margin of dApps. L2's network cost will always be lower than L1's size because L2 only needs to "borrow" L1's security (taking up part of L1's block space) on a regular basis, and L1 must bear the security cost of all of its block space. L1 vs L2 Battle: Who Will Dominate the dApp Economy? By definition, L2 cannot compete with L1 in terms of liquidity, and since the user base is still largely concentrated in L1, L2 has struggled to directly compete with L1 at the user level (although Base is changing this trend). But so far, very few L2s have truly played to their unique strengths as L2s – the characteristics that come with the centralisation of block production. On the surface, the most discussed advantages of L2 are: mitigating malicious MEV and increasing transaction throughput (some L2s are exploring this direction), but more importantly, the next major battleground in the L1 vs L2 battle will be the dApp economic model. Advantages of L2: Non-OCAproof TFM (Non-Strong Composability TFM) Advantages of L1: CSR (Contract Self-Operated Income) or MCP (Minimum Consensus Protocol) + MEV Tax This competition is the best thing for the crypto industry because it directly brings: dApp revenue is maximised, cost is minimised, and developers are incentivised to build better dApps. Changing the incentives in the crypto industry from the infrastructure token premium (L(x) premium) of the past, to a long-term crypto business driven by profits. Combined with the clarity of DeFi regulation, token value capture at the protocol layer, and the entry of institutional capital, the crypto market has entered an era with "actual business models" as the core. Just as we've seen an influx of money into infrastructure over the past few years, driving innovation in areas such as applied cryptography, performance engineering, consensus mechanisms, and more, today's competition between chains will bring about a massive shift in the industry's incentive structure and attract the brightest minds to the crypto application layer. Now, it's the real starting point for the massive adoption of crypto! Link to original article

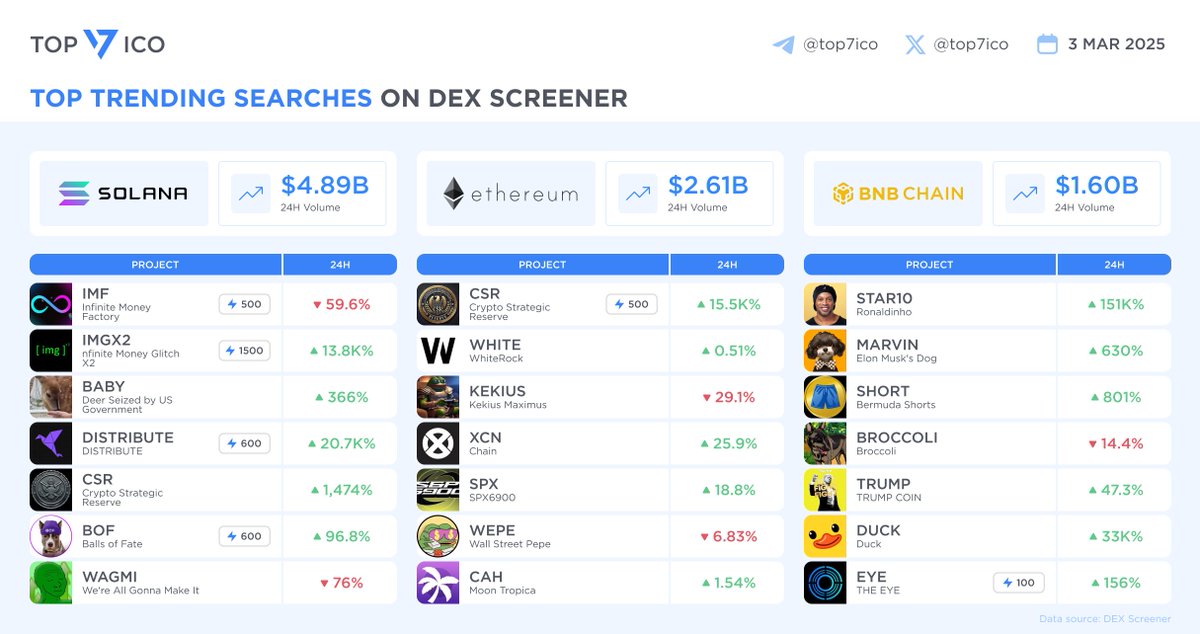

Top Trending Searches on DEX Screener

[Mar 3, 2025]

Discover the hottest trending projects across leading ecosystems like @solana $SOL, @ethereum $ETH and @BNBCHAIN $BNB on @DEXScreener

⚡️Solana

@imf_money $IMF

@img_x2_ #IMGX2

@BabyTheDeer $BABY

@distribute_sol #DISTRIBUTE

@csr_solana $CSR

@BOFCOMMUNYTI $BOF

@WagmiCTOonsol $WAGMI

⚡️Ethereum

@CSRarmy $CSR

@WhiteRock_Fi $WHITE

@KekiusMaxi $KEKIUS

@Onyxethx $XCN

$SPX

@WEPEToken $WEPE

@moontropica $CAH

⚡️BNB Smart Chain

@10Ronaldinho #STAR10

@MarvinDogBSC $MARVIN

@bscwearshorts $SHORT

@FirstBroccoli #BROCCOLI

$TRUMP

@duckmemebsc $DUCK

@TheEyeAnalyser $EYE

Daily | David Sacks sold all of his cryptocurrencies before taking office in government; Coinbase already offers local ETF custody jobs in Hong Kong

Finishing: Jerry, ChainCatcher

Important Information:

Coinbase: BTC is the best choice for strategic reserves, and it can launch a crypto market cap index to maintain fairness and equity

Arthur Hayes commented on Trump's push for crypto strategic reserves, saying 'nothing new'

David Sacks: Before he took office in government, he sold all the cryptocurrency

Coinbase: It has provided local ETF custody in Hong Kong and is in discussions with HSBC for ETF sub-custody scheme

GoPlus: STAR10 tokens present a serious security risk, and the team is free to burn any holder's tokens

ADA rose more than 70% after Trump's "shouting" and became the 8th largest cryptocurrency by market capitalisation

"What are the important events that have occurred in the last 24 hours?"

Coinbase: BTC is the best choice for strategic reserves, and it can launch a crypto market cap index to maintain fairness and equity

Coinbase co-founder and CEO Brian Armstrong commented on social media that "Trump is moving forward with a crypto reserve plan" that BTC may be the best option in terms of asset allocation for strategic reserves, and as the successor to gold, BTC has the simplest and clearest narrative. If one wants more variety, a market capitalisation-weighted index of crypto assets can be done to maintain impartiality. But maybe just choosing BTC is the easiest.

Arthur Hayes commented on Trump's push for crypto strategic reserves, saying 'nothing new'

BitMEX co-founder Arthur Hayes commented on Trump's announcement that he would advance crypto strategic reserves, saying, "Nothing new, just talk. Please let me know when they get congressional approval to borrow or re-raise the price of gold. Without these, they would have no money to buy Bitcoin and altcoins. Of course, I'm not bearish, I'm still bullish. But I'm not going to buy more tokens at this point. "

David Sacks: Before he took office in government, he sold all the cryptocurrency

David Sacks, the American AI and crypto tsar, tweeted, "I sold all of his cryptocurrencies (including BTC, ETH, and SOL) before taking office in government. "

Coinbase: It has provided local ETF custody in Hong Kong and is in discussions with HSBC for ETF sub-custody scheme

According to the Hong Kong Economic Journal, the US-listed cryptocurrency exchange Coinbase announced that it is considering expanding into the Asia-Pacific market, and its Asia-Pacific managing director and director in Australia, John O'Loghlen, said that the withdrawal from the Japanese market the year before last, although Japan has recently relaxed the restrictions on tokens, the types of tokens are still very limited and the platform must have at least 10 actual employees, which is quite challenging from a business point of view.

John O'Loghlen also said that there are no plans to launch a business in Hong Kong at this stage, and if an international platform enters the Hong Kong market, it may need to change the tech stack of the entire exchange, but Coinbase has already started to provide custody for local ETFs in Hong Kong, and is also in talks with HSBC about ETF sub-custodian plans.

GoPlus: STAR10 tokens present a serious security risk, and the team is free to burn any holder's tokens

GoPlus Security warns that Ronaldinho's STAR10 token has a serious security risk. GoPlus has found that token owners can burn any holder's tokens at will. Since ownership has not been relinquished, all tokens are at risk of being burned without warning.

GoPlus Security is calling on the Ronaldinho team to immediately relinquish ownership in order to keep the community safe. At the same time, traders are reminded to be highly vigilant about the coin and BNB Chain is advised to inform users of the associated risks.

ADA rose more than 70% after Trump's "shouting" and became the 8th largest cryptocurrency by market capitalisation

According to CoinGecko data, Cardano (ADA) has risen 73% after Trump said yesterday evening that he would "advance the strategic reserve of cryptocurrencies including XRP, SOL and ADA", reaching as high as $1.148 and now trading at $1.136, becoming the 8th largest cryptocurrency by market capitalisation ($39.8 billion), with FDV tentatively trading at $49.9 billion. $8.12 billion in 24-hour transactions across the network.

"What are some great articles to read in the last 24 hours"

With 7 personnel adjustments and 3 new organisations, can Ethereum's "self-help" be reborn?

Ethereum finally can't sit still......

Trump "bailed out", a glance at the most watched "macro events" and "US currency" this week

This week may be the most critical week for the crypto market.

Trump Specifies Crypto in Strategic Reserve, "US Coin" Spot ETF Enters Acceleration Period?

The latest spot ETF application updates and key timelines.

Rational Return|Does Crypto No Longer Trust Trump?

The effect of "pulling the plate" is obvious, but the market does not seem to have reproduced the enthusiastic cheering for the policy bull market in the past.

Interview with Armani Ferrante, CEO of Backpack: Bridging the gap between the traditional financial system and the crypto world

Backpack has prioritised doing the hardest work, integrating it into the social framework of the major markets.

Trump's "Road to Chief Crypto Market Maker": From MEME to National Strategic Reserves, an Analysis of the Operational Logic of Political Capitalization

The decentralisation of the blockchain provides an excellent and hidden space for the power of centralisation.

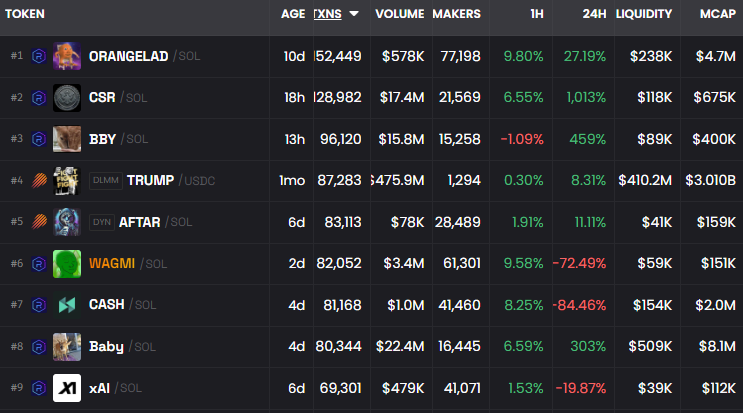

Meme Hot List

According to the market data of GMGN, a meme token tracking and analysis platform, as of 19:50 on March 3:

The top five popular Ethereum tokens in the past 24h are: CSR, SPX, XCN, LINK, and MKR

The top five popular Solana tokens in the past 24h are: YODA, TRUMP, KOINZ, PIPE, and Kairen

The top five popular tokens in the past 24h Base are: VIRTUAL, KAITO, SHAKA, Share, and USD+

CSR price performance in USD

The current price of cyberscooter is $0.0000025089. Over the last 24 hours, cyberscooter has increased by --. It currently has a circulating supply of 998,400,724 CSR and a maximum supply of 998,400,724 CSR, giving it a fully diluted market cap of $2.50K. The cyberscooter/USD price is updated in real-time.

5m

--

1h

--

4h

--

24h

--

About Cyberscooter (CSR)

CSR FAQ

What’s the current price of Cyberscooter?

The current price of 1 CSR is $0.0000025089, experiencing a -- change in the past 24 hours.

Can I buy CSR on OKX?

No, currently CSR is unavailable on OKX. To stay updated on when CSR becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of CSR fluctuate?

The price of CSR fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 Cyberscooter worth today?

Currently, one Cyberscooter is worth $0.0000025089. For answers and insight into Cyberscooter's price action, you're in the right place. Explore the latest Cyberscooter charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Cyberscooter, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Cyberscooter have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.