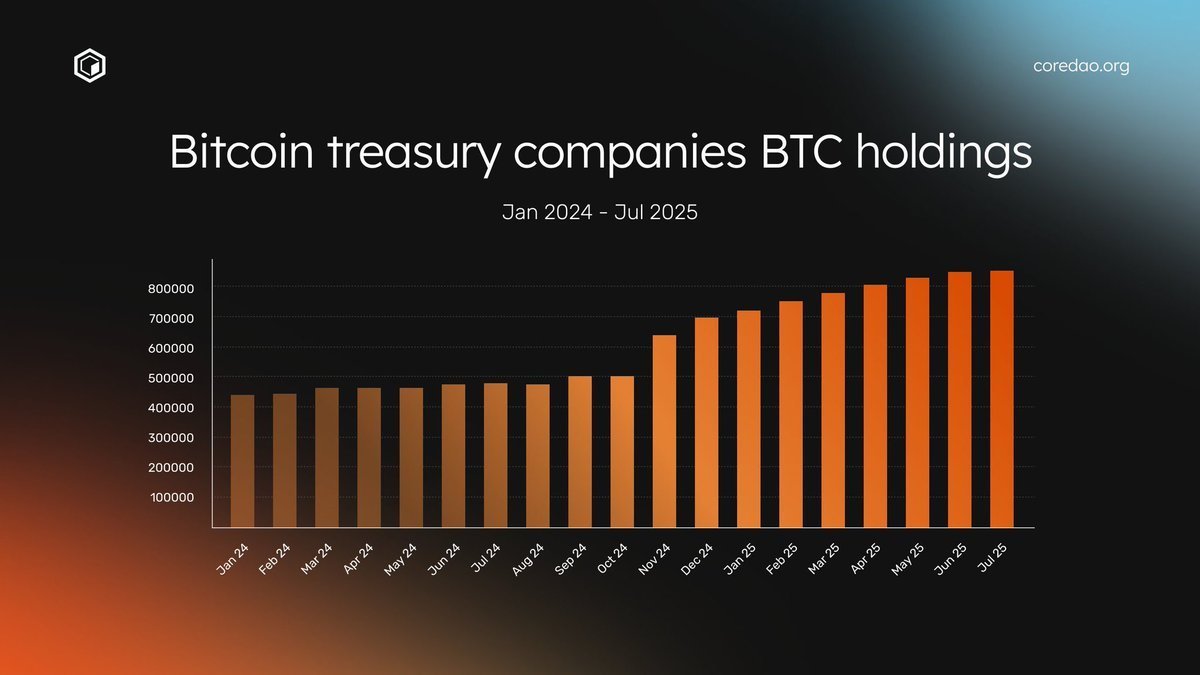

Since I wrote a thread in July, the rise of Bitcoin treasury companies has continued, all promising to be the next @MicroStrategy.

But they're not @saylor. To attract investors and deliver returns beyond financial engineering, they need something new.

There's only one path forward: trustless Bitcoin staking via @Coredao_Org. This not only offers passive yields but also significant upside through the yielded $CORE tokens.

"What do you mean?"

Some will stake their Bitcoin just to earn extra $CORE. However, the savviest treasuries will stake both $BTC and $CORE to earn 6% in yields.

This means Bitcoin treasury companies will eventually transform into $CORE treasury companies—either by buying $CORE directly or by borrowing against their staked Bitcoin to purchase and stake more $CORE.

FYI: Bitcoin treasury holdings have surpassed 800K $BTC. And upside is still crazy.

2.73K

11

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.