It was during my research on the company ZETA that I began to pay attention to the concept of the data flywheel effect. Thank you for the inspiration.

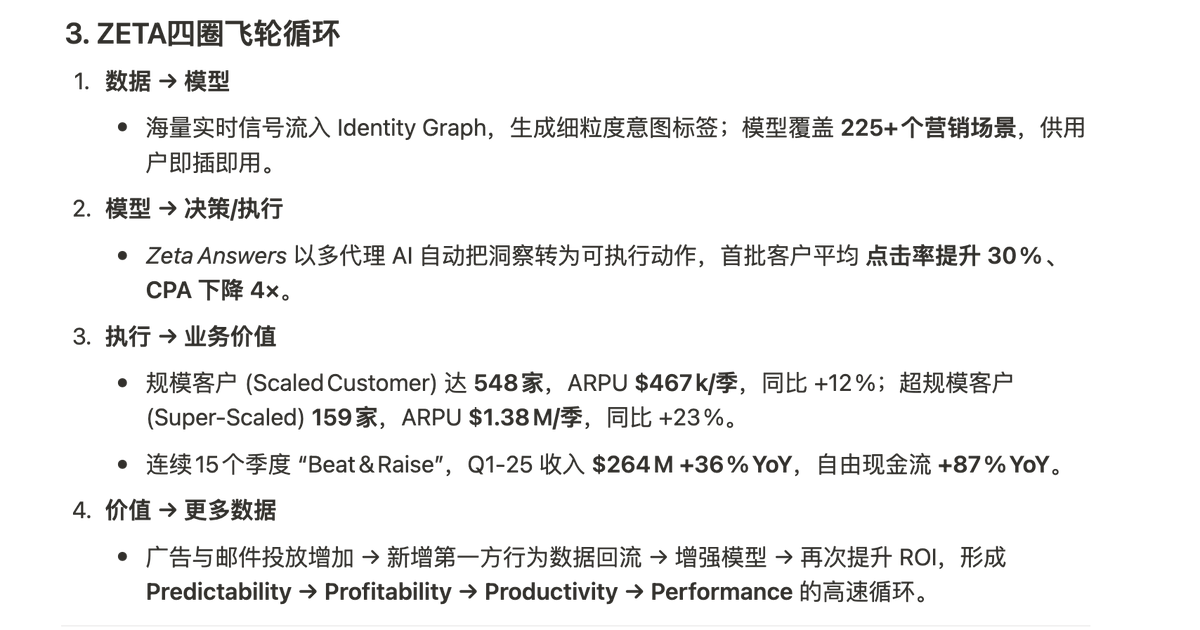

ZETA Data Flywheel Effect:

Utilizing more customer data → Optimizing service effectiveness → Creating higher value for customers → Customers increase investment → ZETA's revenue increases and reinvests in data capabilities, thus the business model enters a virtuous cycle.

From the current situation, there are preliminary signs of this flywheel: ZETA's data cloud scale and AI capabilities are enhanced as the number of customers and activity levels grow, which in turn attracts more customers to adopt its platform.

Mark this. Earnings report on August 5.

Currently, there is a subjective perception gap in the market, mainly due to the lingering impression from last year's short-selling report, concerns about the large amount of equity compensation diluting EPS, not enough profitable quarters, and not yet achieving full-year profitability.

2.55K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.