I learned a decade ago to focus on customers, not competitors, as a principal engineer at @awscloud. Amazon built one of the best companies in the world, an e-commerce and cloud juggernaut that delights customers every day with the everything store and almost free 2-day shipping.

Over the last couple years, I've been asked: why not launch @MoonwellDeFi on Ethereum mainnet? After all it has $100B TVL in DeFi, and @Base is relatively small in comparison. For context, most mainnet TVL is either ETH whales (people who were in the ICO) or large DeFi funds.

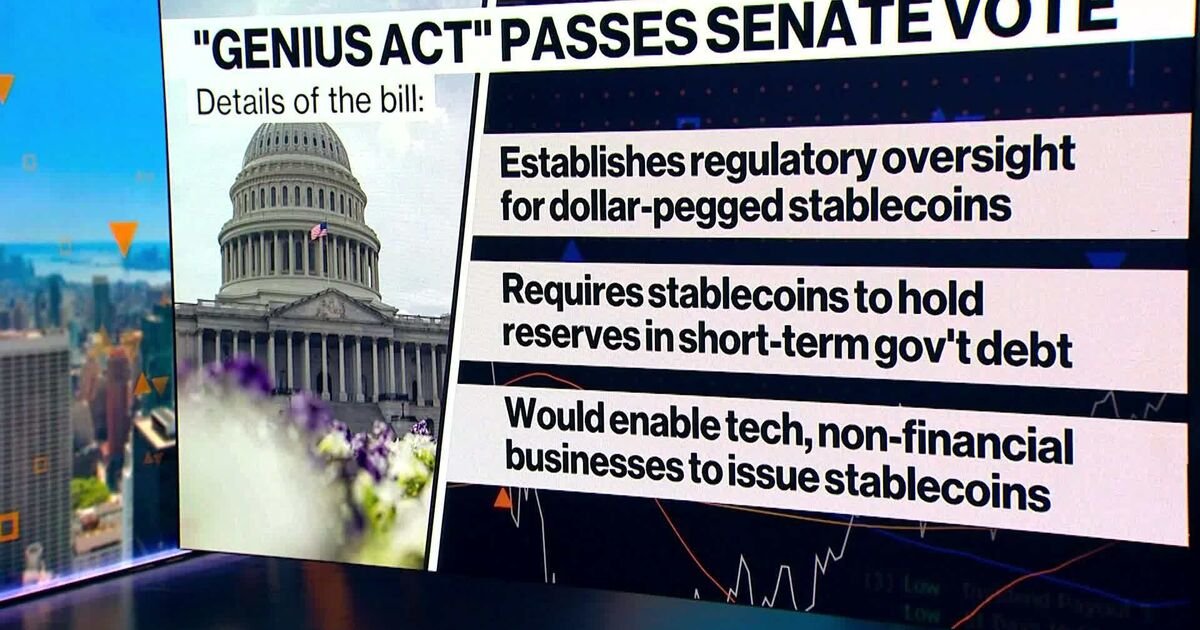

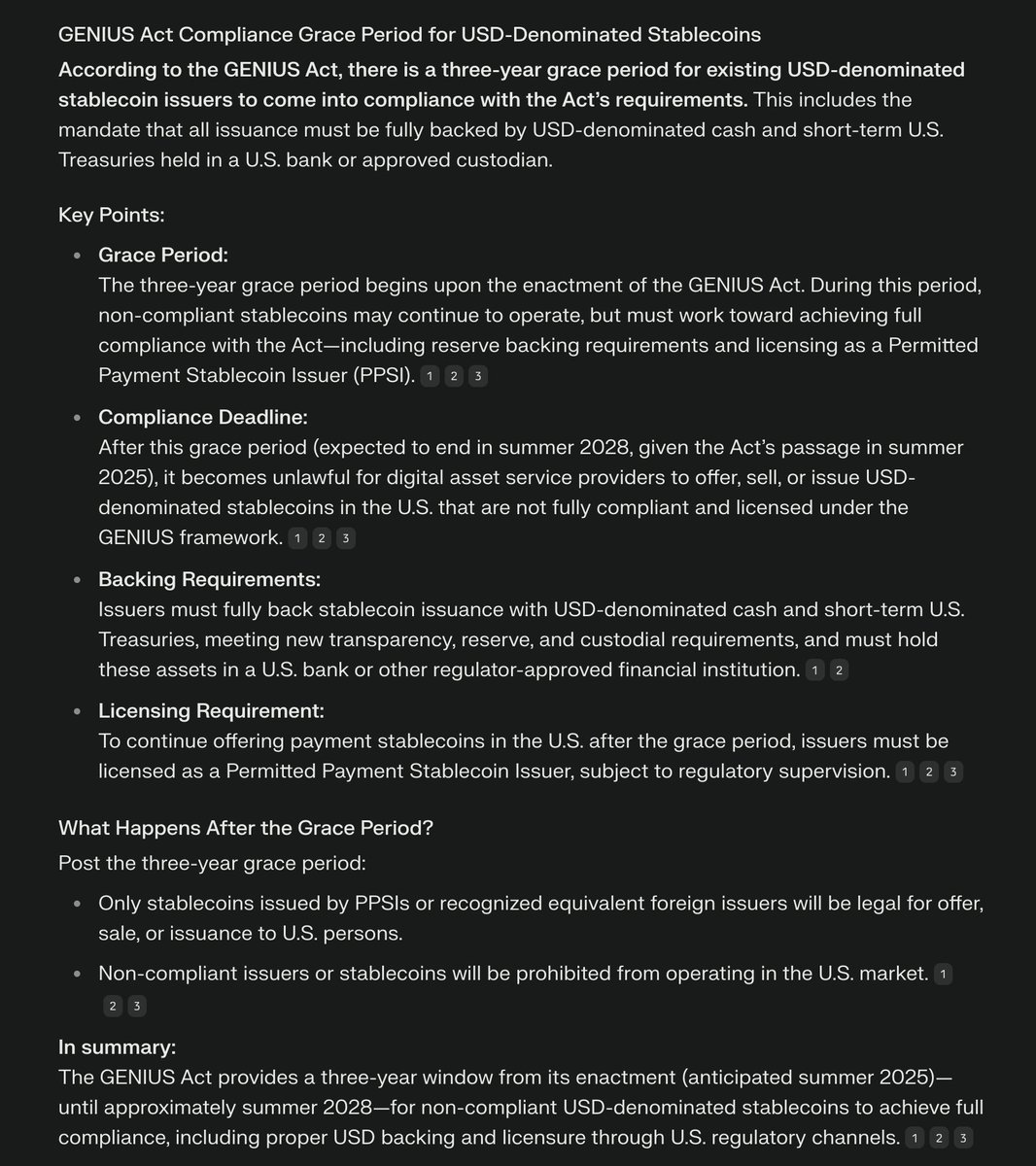

There's a big reason why we never launched on mainnet: it's a side quest on the way to the bigger prize: bringing the $100 trillion in the US capital markets onchain. With the passage of the GENIUS act last week in the US, the entire DeFi landscape changed overnight. 🇺🇸💥🔥

In just days the biggest players in the DeFi world, @Aave and @MakerDAO took notice. They both have stablecoins backed by user deposits in collateralized debt positions that will be prohibited to operate in the US in just 3 years. Oof, that has to hurt.

DeFi on mainnet is largely a game played by billionaires and whales. What started as a level playing field where incentives were visible onchain has devolved into a game of private pricing deals for hedge funds and whales, likely raising anti-competitive and free market concerns.

The two biggest protocols in all of Ethereum DeFi not only have a non-compliant stablecoin that will be illegal in 3 years, they have no credible way to get to compliance without becoming CeFi institutions themselves or simply abandoning their stablecoin efforts completely.

Now that you understand how the entire DeFi world changed a week ago, you might see why this was announced two days ago. @Base was largely ignored by the biggest projects until regulatory clarity and the @Coinbase @Circle partnership made it impossible to ignore. Long $COIN $CRCL

217.77K

272

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.