If I had to pick just one narrative to focus on, it’d be institutional-grade DeFi.

That’s why I’m sharing @Terminal_fi, the BlackRock-backed marketplace for institutional asset trading.

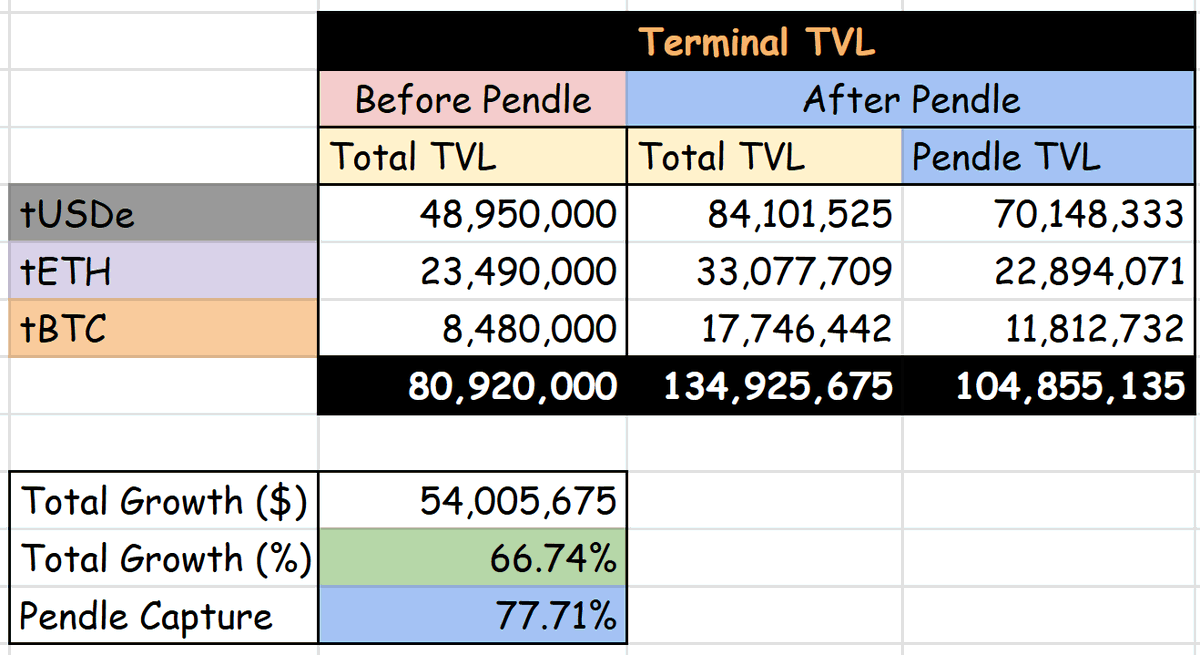

Terminal has grown to $137M in TVL over days, with ~67% of inflows from @pendle_fi. 🧵

Terminal Finance serves as the bridge between TradFi and onchain yield.

It is the native marketplace for @convergeonchain.

Converge is a new institutional chain that’s onboarding serious names like Ethena, Maple, Ondo, and Centrifuge.

Terminal runs an AMM based on Uniswap v3, but it’s optimized for yield-bearing assets like sUSDe.

Instead of holding them directly (which creates impermanent loss over time), Terminal uses redeemable tokens like rUSDe to peg value and extract yield cleanly.

This design means LPs don’t suffer from yield-derived impermanent loss.

LPs can keep tight tick ranges and remain capital efficient.

At the same time, they still capture the full yield, which is redirected either back to them or into Roots rewards, depending on how they LP.

Roots are Terminal’s native points system.

Tracking happens weekly, with distributions every Thursday.

The earlier and longer you deposit, the more Roots you’ll stack.

Terminal doesn’t reward extractors.

No double-dipping PT and YT in the same pool.

No referral farming without real deposits.

They’re tracking this stuff, and both of these will lead to reduced rewards.

This means more rewards for real participants.

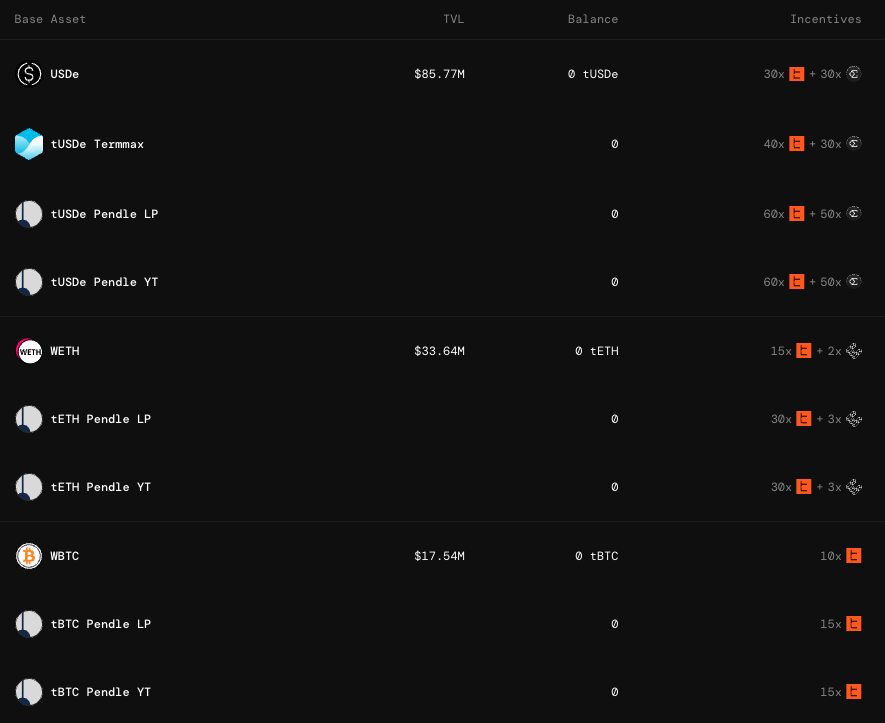

Terminal x Pendle is one of the clearest ways to position for RWA upside.

There’s no new Converge token coming.

$TML will be the only native token.

Let’s farm Roots together. We’re early to institutional-grade DeFi.

Follow @PendleIntern for best Pendle x Terminal strategies.

Peepo took institutional-grade DeFi under his wing.

@syrupsid

@crypto_linn

@Rightsideonly

@rektdiomedes

@chutoro_au

@_SmokinTed

@web3_alina

@JiraiyaReal

@GLC_Research

@yieldinator

@hzl123331

@twindoges

@poopmandefi

@CryptoShiro_

@arndxt_xo

@enijoshua_

@splinter0n

@eli5_defi

@cryptorinweb3

@Hercules_Defi

@thelearningpill

@belizardd

@0xDefiLeo

@YashasEdu

@Neoo_Nav

@0xCheeezzyyyy

@cryppinfluence

@cchungccc

21.07K

146

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.