With all the companies globally buying up Bitcoin as part of their treasury holdings, projects that are able to allow them to capture some sort of yield for them could succeed --> Either some CeDeFi protocol or BTCFi project.

Think this will come in a more centralised manner in the future, but for now projects are still targeting more niche use cases like reusable security and on-chain yield.

We can see how Bitcoin’s $1 trillion “digital gold” is graduating towards more prime-time collateral.

Enter @satlayer, which turns every BTC into reusable security for DeFi, RWA credit, yield-bearing stables & even AI infra, all this done without leaving the Bitcoin main chain.

TLDR

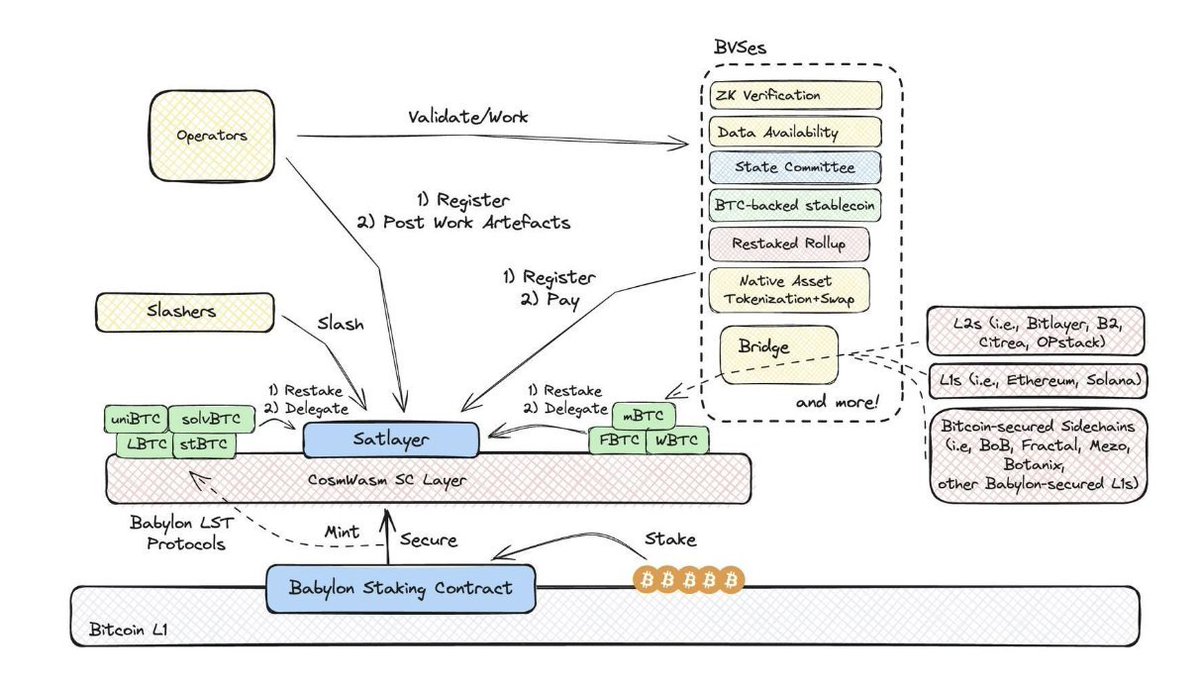

SatLayer is a Bitcoin restaking layer on @babylonlabs_io that lets BTC holders delegate wrapped/LST BTC to Bitcoin Validated Services (BVS), earn 4 different yield streams, and keep self-custody.

According to @DefiLlama, its TVL just hit an ATH 3,447.71 BTC (~$408m) from 405,658 restakers.

What exactly is SatLayer?

A shared-security marketplace where anyone can restake BTC to secure external dApps via fully programmable slashing. Similar to @eigenlayer but for the “no 2nd best asset” token.

Bitcoin is morphing from “store-of-value” to the global reserve asset of crypto’s new economy (treasuries, DeFi, RWAs and stablecoins). SatLayer makes BTC fully programmable, unlocking liquidity and security for ETH DeFi, @SuiNetwork, @berachain and @plumenetwork.

Technical Architecture

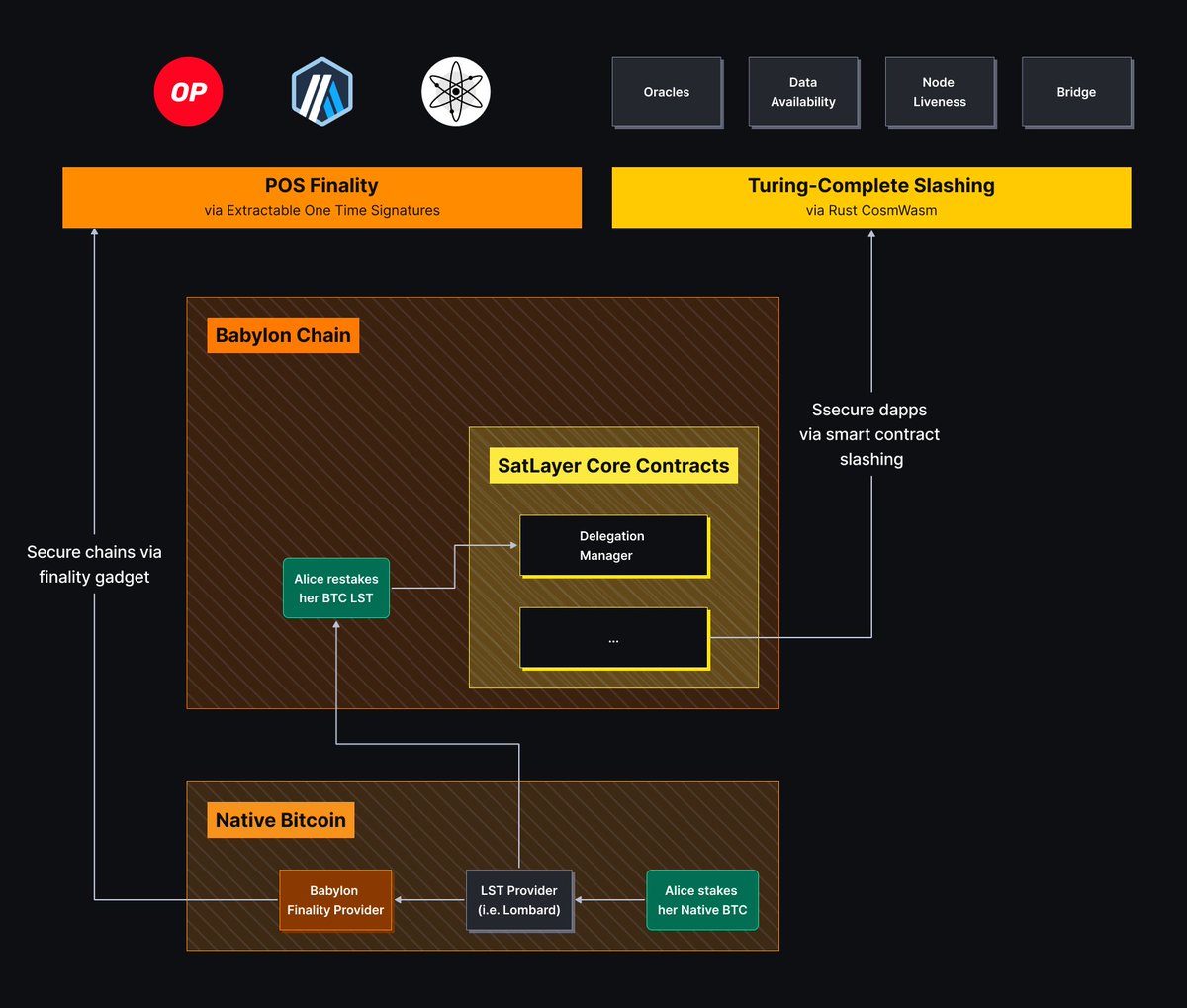

• Babylon PoS base: BTC stays native but becomes slashable via EOTS cryptography

• SatLayer CosmWasm contracts: Turing-complete modules define custom slashing/rewards for any BVS

• Vault factory & asset-specific vaults: Isolate risk per operator/asset and mint liquid restaking tokens (LRTs)

• Programmable slashing engine: Services set % slash, windows & guard-rails and all these are enforced on-chain

Result: Bitcoin security that can underwrite oracles, DA layers, credit vaults, insurance pools, basically anything that needs skin-in-the-game.

Flagship BVS pipelines (real-world revenue)

• “Bitcoin Berkshire” insurance: on-chain funds backed by yield-bearing BTC; premiums flow straight to restakers

• RWA credit backstop: restaked BTC provides instant-liquidity & default protection for Plume’s Nest Credit vaults

• BTC-secured stablecoins: Cap Labs uses SatLayer vaults so Franklin Templeton & Apollo can mint yield-bearing stables with BTC guarantees

• Prime brokerage / liquidity float: restaked BTC absorbs duration risk for AI-compute loans & cross-margin trading

This above essentially allows users to stack yield on their BTC

• Native BTC staking

• Yield from your chosen BTC LST

• L1 incentives (Sui, Berachain)

• SatLayer Sats2 points

• Cash-flow from each BVS (premiums, fees, spreads)

Risks

• Slashing risk: if an operator misbehaves, their delegated BTC will be slashed

• Operator cold-start problem: Services still need reputable operators; weak incentives = weaker security

• Smart-contract & Cosmos stack: SatLayer relies on CosmWasm modules atop Babylon; bugs or mis-configs could hit funds

• Liquidity/exit queues: Vaults use lock-periods, liquidity isn’t instant and needs to undergo a unstaking period

Specific highlights

SatLayer already commands $408m BTC TVL, the largest of any BTC restaking protocol.

They are building with a large vision: to be the bridge between Bitcoin & insurance, RWA credit, stablecoins, infra & AI with fully programmable slashing.

Your BTC is done sitting on the sidelines (or maybe you are sidelined on BTC? ree), perhaps it's time to put it to work.

Disc: friend of the team

12.82K

15

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.