1/

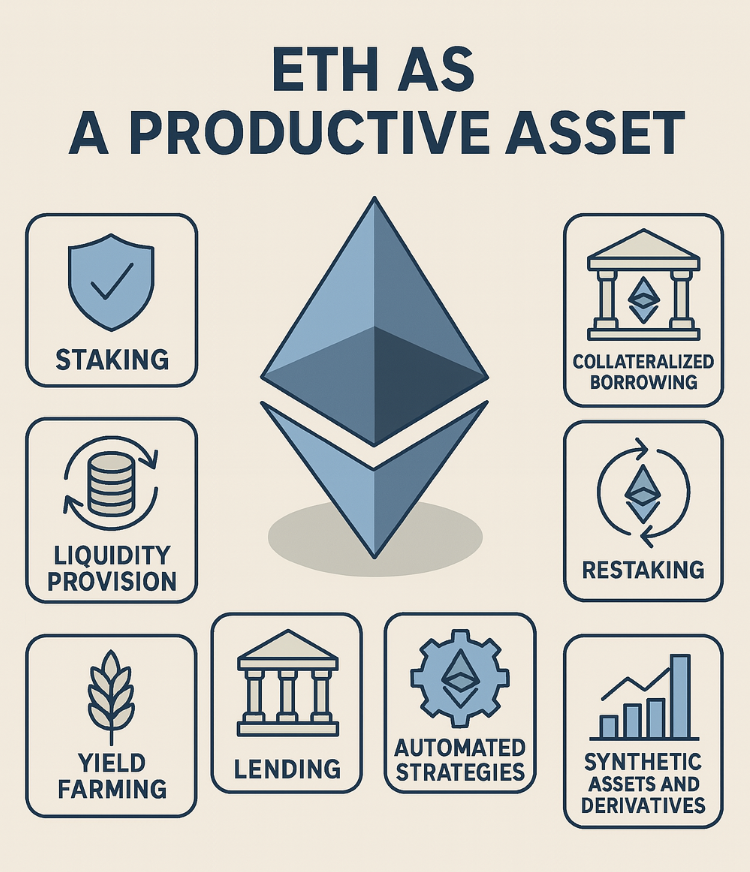

📢 Ethereum isn’t just programmable—it's productive.

$ETH is no longer idle capital. It can generate sustainable, onchain yield across DeFi and staking strategies.

Here’s the ULTIMATE guide to ETH yield—10 powerful ways to put your ETH to work 🧵👇

2/

🔒 1. Native Staking

Secure Ethereum. Earn passive yield.

32 ETH for solo validators

Or use Lido / Rocket Pool

💸 Yield: ~3–5% APY

Liquid staking tokens (like stETH) unlock DeFi composability.

3/

💰 2. Lending ETH

Lend your ETH to earn interest from borrowers.

Collateralized, non-custodial, and capital-efficient.

📊 Yield: 1–5% APY

🏦 Platforms: Aave, Compound, MakerDAO

4/

⚖️ 3. Collateralized Borrowing

Use ETH to borrow stablecoins (DAI, USDC), then reinvest them.

📈 Strategy: Loop into farming, staking, or LPs

⚠️ Risk: Liquidation from price drops

📊 Indirect yield: 5–20%+ depending on deployment

5/

💧 4. Liquidity Provision

Provide ETH to DEXs and earn trading fees.

Pairs: ETH/USDC, stETH/ETH, etc.

📉 Beware impermanent loss!

📊 Yield: 5–20%+

🔁 Platforms: Uniswap, Curve, Balancer

6/

🌾 5. Yield Farming

Stake ETH or LP tokens in farms to earn protocol rewards.

Often used with governance tokens.

📊 Yield: 10–100%+ (but volatile!)

🧪 Platforms: Convex, Balancer, Aura, Yearn

7/

🔄 6. Restaking (ETH2.0+)

ETH secures Ethereum AND more.

Stake again to secure AVSs (middleware, oracles, etc).

💸 Extra yield on top of staking

📊 Yield: 5–15%+

⚙️ Platforms: EigenLayer, Symbiotic

8/

🤖 7. Automated Vault Strategies

Set-and-forget smart vaults that optimize ETH yield.

Autocompound and rotate strategies for you.

📊 Yield: 5–20%+

⚙️ Platforms: Yearn, Sommelier, Instadapp, Harvest

9/

🧮 8. ETH-backed Stablecoin Minting

Use ETH/stETH to mint stablecoins like eUSD or mkUSD.

Then earn yield by holding or farming them.

📊 Yield: 5–15%+

🏗 Platforms: Lybra, Prisma, Gravita

10/

📈 9. Derivatives & Structured Products

ETH options, futures, and synthetic assets = extra yield.

Covered call vaults, options premiums, LP hedging.

📊 Variable returns

🧪 Platforms: Ribbon, Opyn, Panoptic, Synthetix

11/

🔗 10. ETH Yield Stacking

You can combine these:

Stake ETH → get stETH → lend or LP it → restake it → mint stablecoins → farm → loop

💥 ETH becomes superfluid productive capital

Total blended yield: potentially 10–30%+

57.91K

415

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.