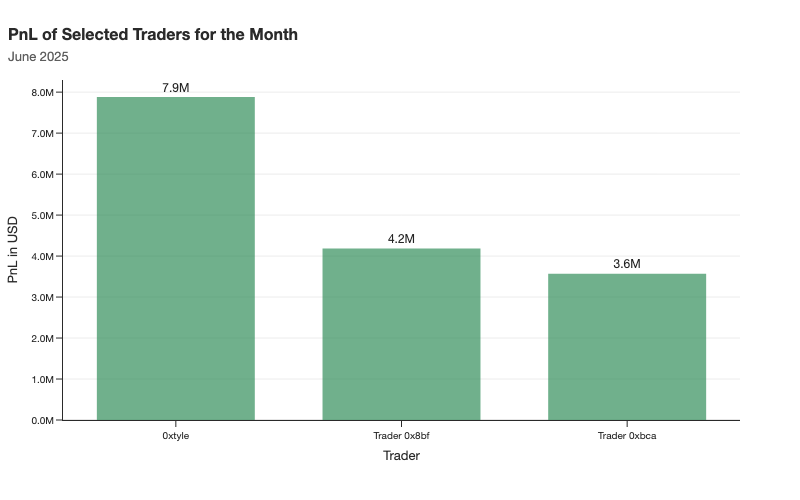

1/ 10 days ago, we dropped the June 2025 Top Traders Report 📊

Despite flat majors, three Hyperliquid traders managed to extract millions from the chop:

🏆 @0xtyle (?) +$7.8M

🥈 0x8bf +$4.2M

🥉 0xbca +$3.6M

Here’s what stood out👇

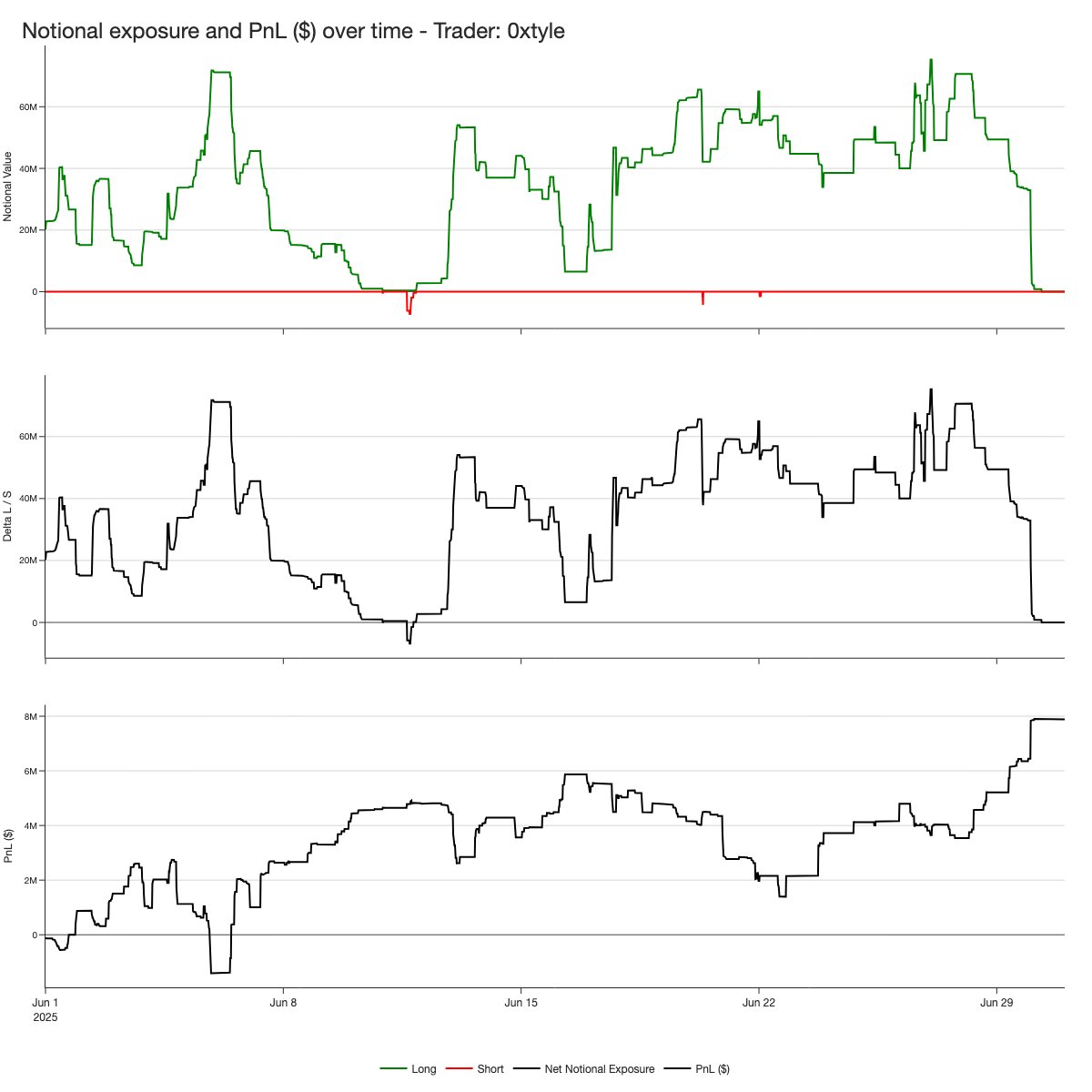

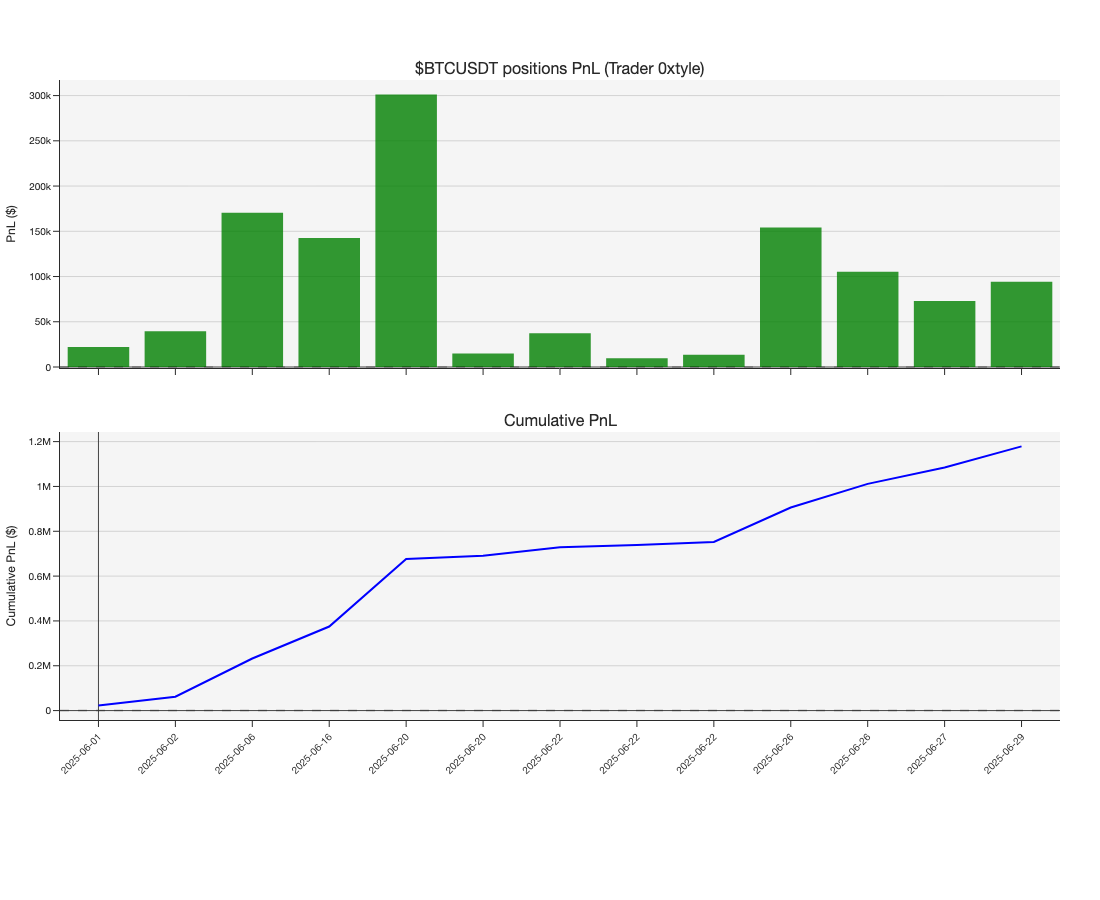

3/ 0xtyle was mostly long and aggressive.

He often held >$60M notional exposure and saw a massive mid-month drawdown, dropping from +$6M to just under +$2M.

Still, he recovered and closed the month with +$7.8M in profits.

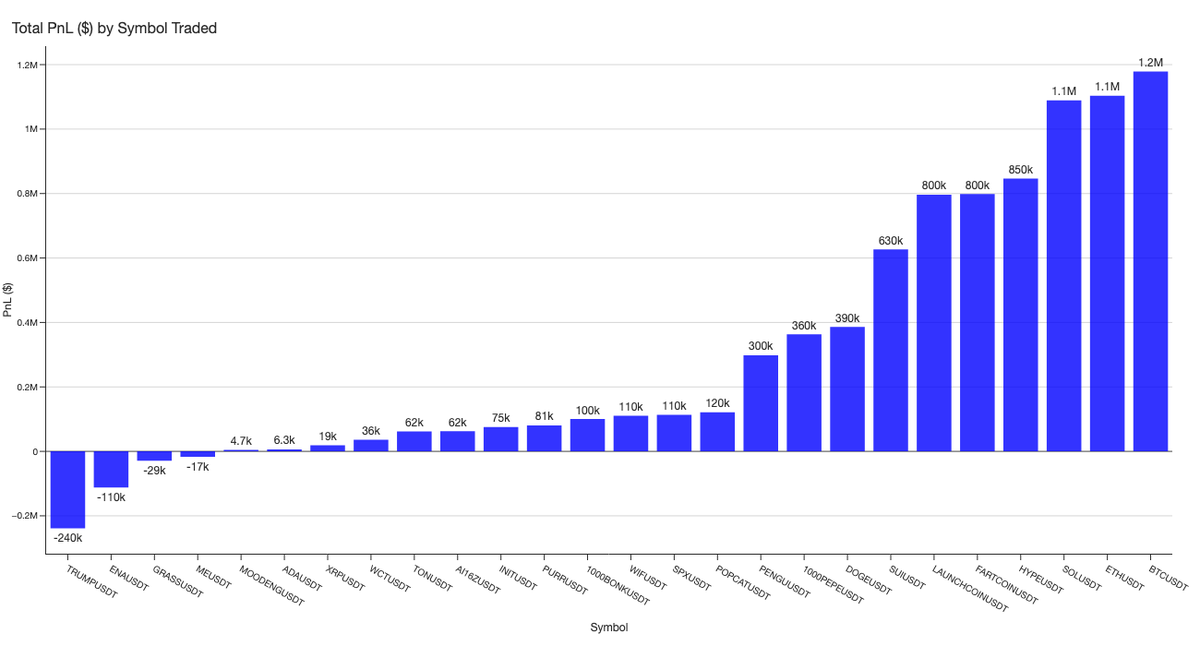

4/ He traded 26 symbols and lost money on only four.

The majors ($BTC, $ETH, $SOL) alone made up $3.4M — 43% of his total profits.

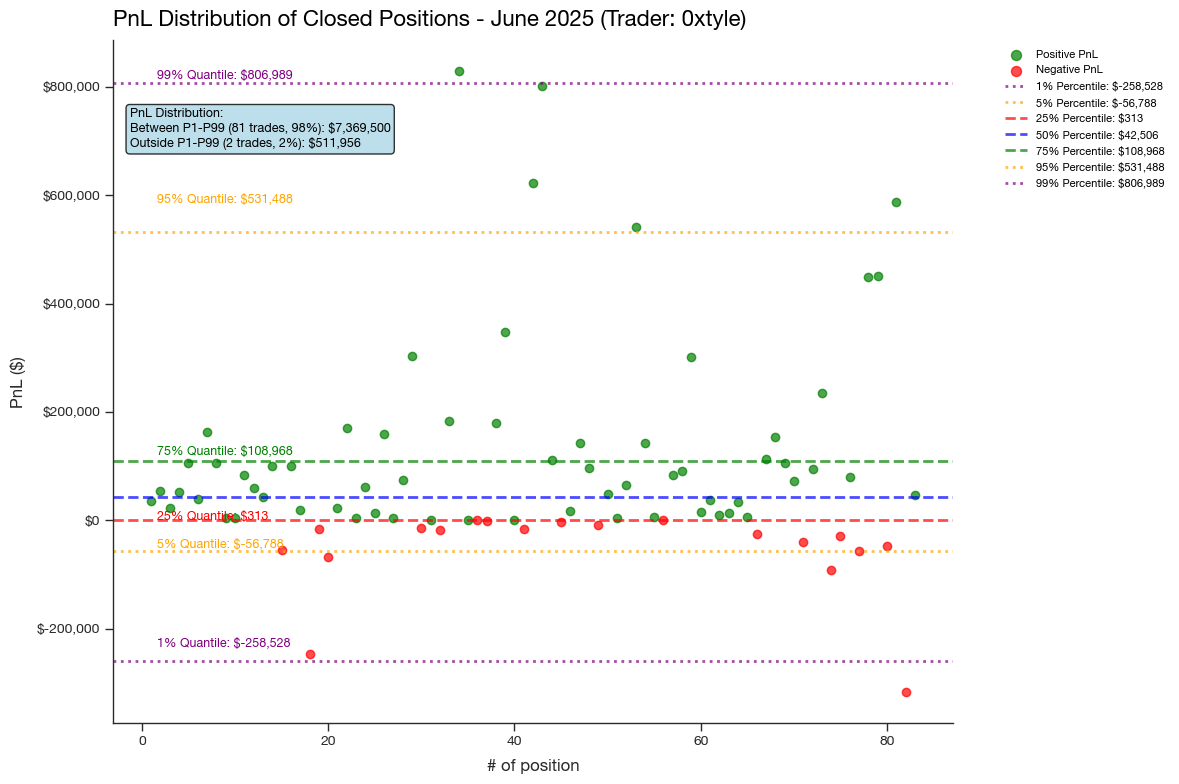

5/ In terms of risk/reward, his PnL distribution was strongly skewed to the upside.

5th percentile loss: -$57k

95th percentile win: +$531k

6/ 0xtyle closed June with a strong 77% win rate—see, for example, every $BTC trade ended in profit.

However, reaching these metrics likely took serious conviction and risk management: an avg profit-to-drawdown of 0.75 means most trades were deeper in the red than the profit eventually realized.

Two examples 👇

7/ $FARTCOIN - Long (+$809k)

He entered at $1.1 and kept adding as the price dropped 18% to $0.9.

At the worst point, he was down over $1.1M before the price reversed.

Eventually, he exited on the way up, turning it into a winning trade.

8/ $HYPE - Long (-$317k)

His largest loss of the month, but it could’ve been much worse.

He scaled in as price dropped 24%, increasing notional from $5M to $16.5M.

At the worst point, the position was down $2.7M before he managed to reduce size and exit near breakeven.

9/ Averaging down with size is inherently risky.

While we don’t know the full extent of his risk management, the outcome is clear: +$7.8M in a flat, volatile month.

Whether he can keep it up is worth watching in the coming months.

10/ Briefly on the others:

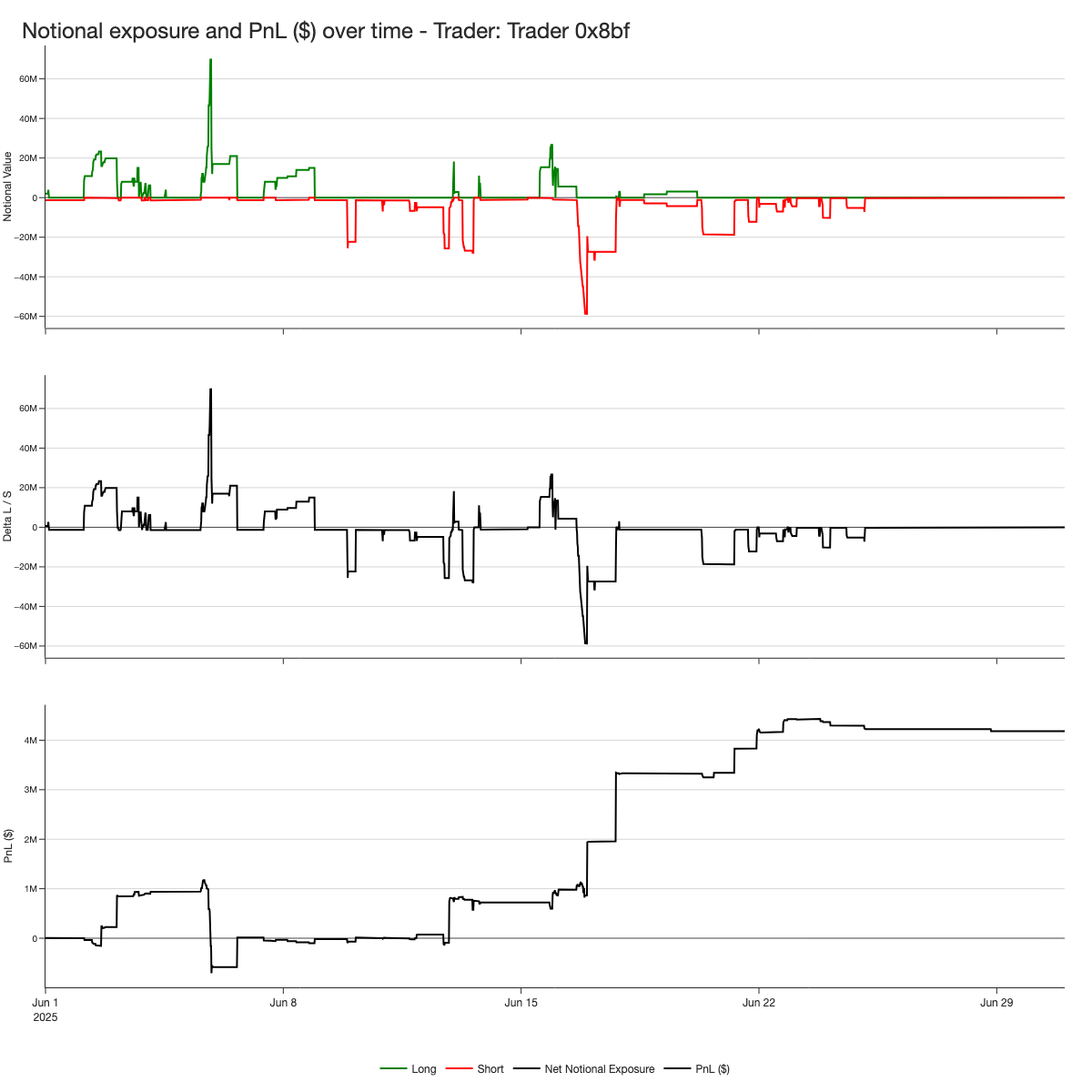

0x8bf was fast, tactical, and aggressive: 193 trades, 55% win rate, profit factor 2.8

Flipped short mid-month and recovered early losses.

Focused mostly on $BTC, $ETH, $SOL, and $AVAX.

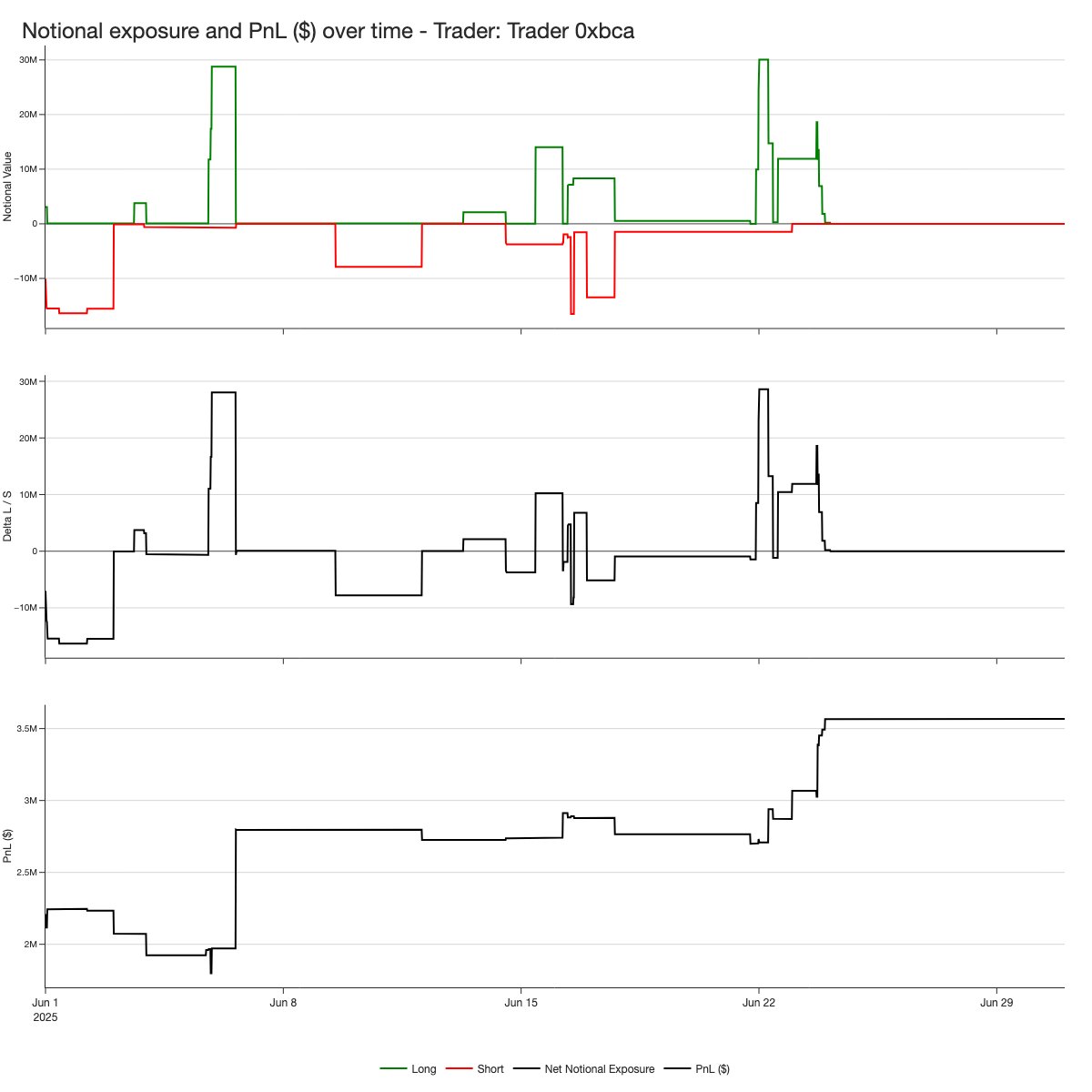

11/ 0xbca took a more defensive route: 22 trades, 54.5% win rate, profit factor 5.5

Maintained hedged exposure, flipping net long/short.

$BTC and $SOL made up nearly all of his $3.6M PnL.

12 /

Full stats, trade breakdowns, and execution patterns are in the full June report in our profile.

40.4K

19

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.