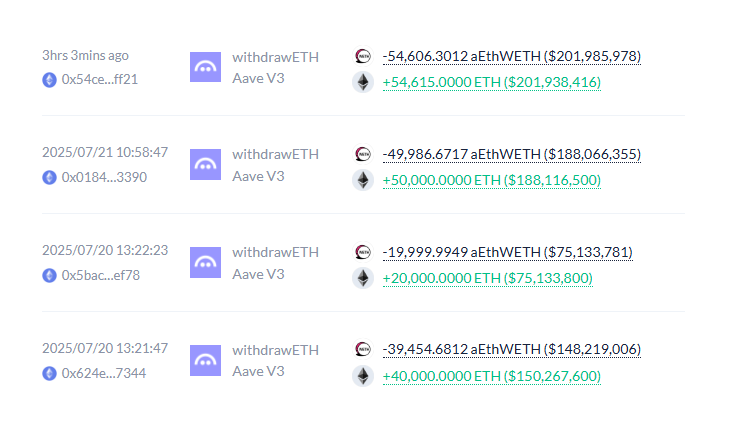

What happens when Justin Sun withdraws 600M of $ETH from Aave?

• ETH Borrow & Lend rates spike ⬆️

• The backbone of DeFi, LST looping, is temporarily unprofitable

• The market stETH / ETH rate depegs ~0.3%

How DeFi's biggest moves can suddenly spook leverage loopers 👇

To understand this we need to start with the basics.

RedStone has been the leading oracle for LSTs & LRTs since early days.

We wrote a beefy report with 300k+ views about just that in 2023.

There are two main types of LSTs.

1. Rebase LSTs, like Lido's stETH.

2. Reward Bearing LSTs, like RocketPool's rETH.

Then stETH gets wrapped to create wstETH.

It turns from a Rebasing LST (stETH) to a Reward Bearing LST (wstETH).

There are 2 mainstream rates for Rewards token, i.e. wstETH

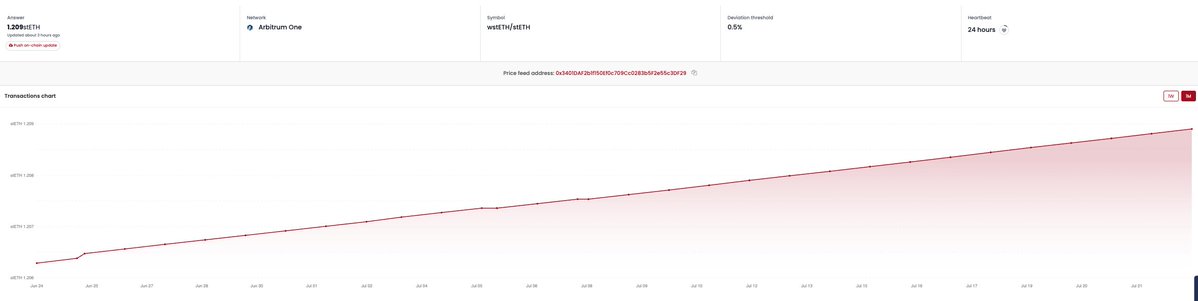

1. Fundamental contract exchange rate - derived from Lido contract wstETH / stETH rate (NOT dependent on market trades)

-> Example on Arbitrum: (steady growth pattern)

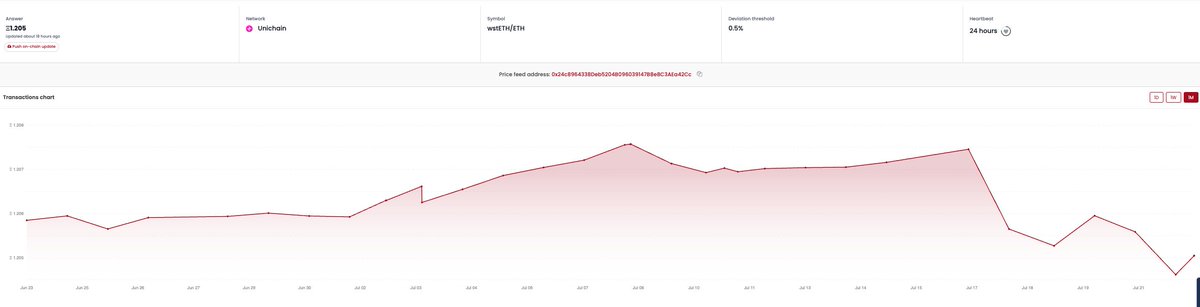

2. Market rate - derived from trading venues like Uniswap or Balancer for wstETH / stETH rate (IT IS dependent on market trades)

-> Example on Unichain: (steady growth pattern, apart from the high volatility period)

As you can see on images below, we've seen prolonged market rate discount vs the fundamental rate.

Roughly 1.205 stETH - 1.209 stETH = 0.004 stETH (~15 USD)

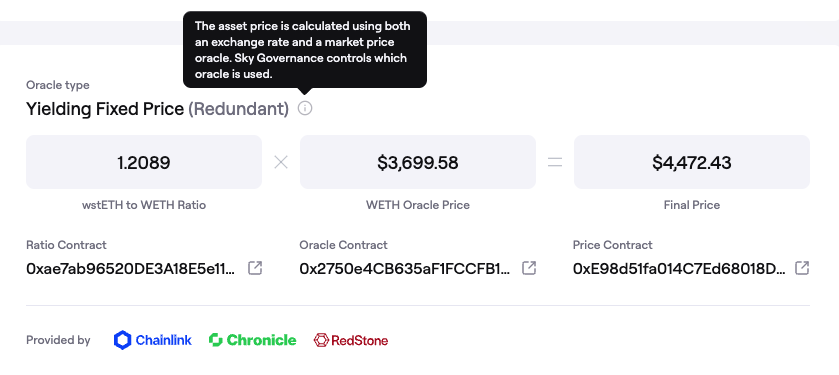

The vast majority of lending protocols opt for Fundamental exchange rate, and for one more assumption explained in tweets below.

Aave, Morpho, Euler, Fluid, Spark (per screenshot) - all of them.

They do so for a reason. To avoid fanning the fire 🔥

Why is it so?

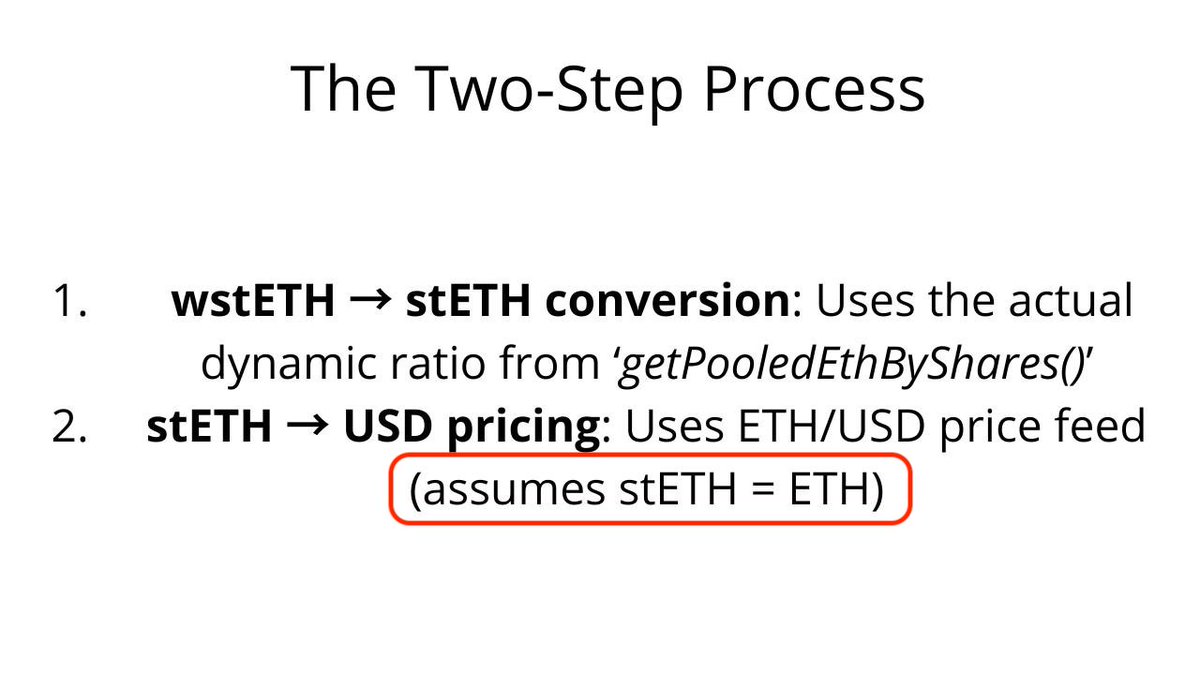

Alright so we have a way to denominate wstETH to stETH.

Now you have 2 ways of approaching stETH to ETH rate.

1. Market rate - again you derive it from DEXes & CEXes trading.

2. Simply assume 1 stETH = 1 ETH (like Aave).

Wait, what? Why would you assume so in the first place?

The logic follows:

- Liquidators won't mind holding stETH as they will end up redeeming ETH eventually

- The premium they make via liquidating the position is going to offset potential risk of ETH depreciating in value throughout the time of waiting for stETH redemption.

Okay and now, why it's widely preferred than using stETH / ETH market rate?

Well, if you use market rate, you'd start liquidating leveraged wstETH / ETH positions and cause a *liquidations cascade*.

Potentially resulting in death spiral.

Oh man, why so dramatic?

It is needed to ensure ppl understand the size.

There's ~$4.74B wstETH / ETH looped positions on Aave alone.

And Max $230M total 24h volume for stETH in the past 3 months.

That's magnitudes of difference. The market wouldn't handle selling pressure of stETH with the cascade.

By using fundamental rate AND 1 stETH = 1 ETH assumption, when there's large ETH withdrawal on supply side of the lending protocol, the borrow rate for ETH spikes and looping starts to be unprofitable.

But lending ETH gets bonus yield then!

Hence, market forces should bring the equilibrium back close to the previous state.

And it did!

The whole situation cleared after just a few hours.

Here's a good summary by Marc.

About $ETH rates and why there’s no much to worry about

1) Justin moving billions around happens every other week, he always deposit back.

2) instant APY is quite meaningless, the avg borrow rate of ETH stays sustainable, you should enjoy the nice supply yield boost while it last (won’t last long)

3) Aave can and has flatten the interest rate curve to reduce pain for borrowers via risk steward we are the only protocol with quick counter-measure tools to help users.

4) Aave has the largest network of LPs and deepest liquidity of all crypto, this is why this kind of events are quickly solved. When I write this borrow rates back to 3.6%

5) we currently have 10b$ of eth liquidity, this means our $ETH books alone are larger than the whole size of second biggest lending protocol, the larger we grow the less impact an outlier liquidity event have on us, this is an Aave unfair advantage over everyone else, liquidity is king.

6) fixed lending is a great idea and V4 allow this, but the core of a lending protocol must be market floating rates as it’s the most fair model.

7) rates are already back very close to normal, will be back as usual in a few hours, if you read typical concenooor thread telling you Aave, lido, DeFI and eth will die , safely mute them and move on.

Just use Aave.

Okay if that post gets wider attention let me ask a question I haven't received a satisfactory answer for so far.

Why would people lend ETH, when they could do looping instead?

Is it only that some ETH whales are afraid of Lido risk and that the looping logic would encounter a systematic issue?

The post inspired by @0xdoge_bull that's oracles OG and one of the most respected OEV experts. Great one for such discussion.

Rough timeline of events here:

1. Justin Sun pulls ETH supply from Aave.

2. Utilization spikes ETH borrow rates on Aave.

3. stETH loopers are now unprofitable, so start de-leveraging.

4. A bunch of this de-levered stETH hits the staking withdrawal queue.

5. stETH depegs 30 basis points as some sell to avoid the queue.

6. Loopers are now forced to either take this 30 bips hit (3% loss on 10x leverage), or lose money on the position until peg re-gains.

All of these stETH oracles use redemption not market rate, so lenders are stuck in the position for potentially ~18 days as thats the ETH unstake queue right now. We may end up seeing some stETH liquidations from interest accrual which will only make the situation worse by de-pegging stETH further.

Limited Lido Withdrawals => Duration Risk => stETH discounted vs ETH

That's what we observed after @justinsuntron withdrawal.

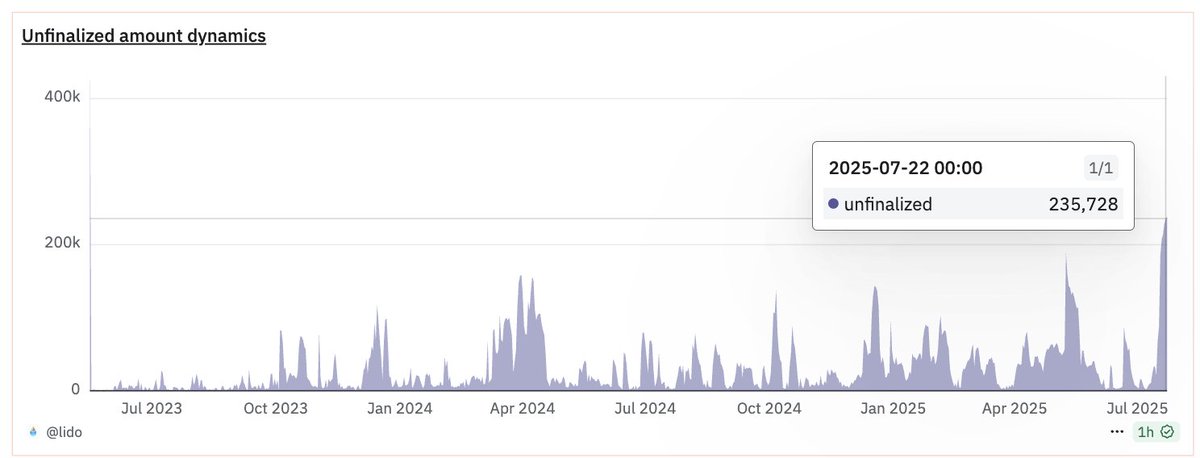

Per Tom's tweet below, Lido's Unfinalized Withdrawal queue is at a new ATH. Some might remember the famous Lido stETH depeg from May 2022, when withdrawals were not enabled yet ->

Withdrawal caps create price gaps, one could say.

Lido's Unfinalized Withdrawal queue is at a new ATH (excluding the first day when they first supported withdrawal)

Over 235k stETH is pending for withdrawal.

In the past 7 days these entities are trying to withdraw:

- 80k stETH by HTX and Justin Sun;

- 7k stETH by Abraxas Capital (0xed0c6079229e2d407672a117c22b62064f4a4312)

- 5.5k stETH by Jump (0x98629555d323324b9415471033f2745c57b608c6)

- 5.4k stETH by Etherefi

(0xf0bb20865277abd641a307ece5ee04e79073416c)

And to close - saying an oracle should use the stETH market rate in that case is contrary to what the vast majority of risk providers agree on.

That would be pouring petrol on a burning building. Literally.

I respect Pyth, but these statements about using stETH market rate to solve the depeg are against what DeFi builders' consensus is now.

I have nothing against @Genia_XBT, but as oracle providers we need to understand the crux of key market dynamics and refrain from simple "using xyz solves it" with no further context or explanation if that's counter to the general trade-off acceptance the industry has been discussing for years now.

Peace!

55.58K

127

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.