1/ We’re excited to share our expanded stablecoin coverage, now including base & arbitrum, as part of our chain dashboards

These new sections track data on both major and emerging stablecoins.

Let’s explore the dashs

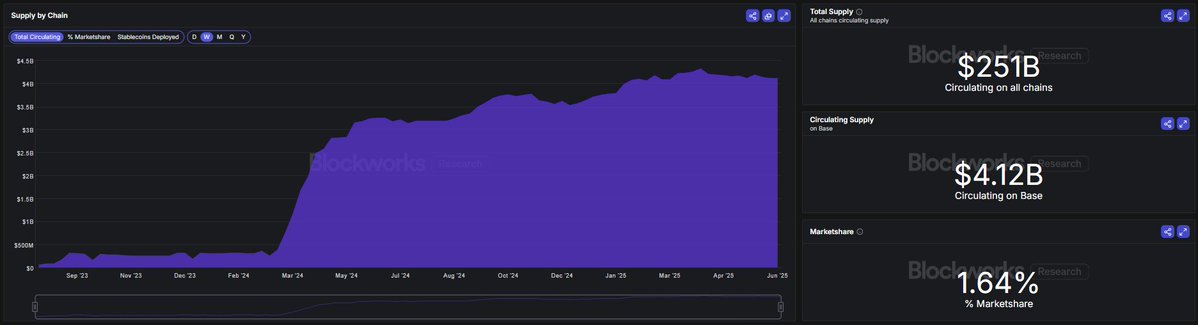

2/ Stablecoin supply on Base has held steady, while Arbitrum is showing early signs of a rebound.

$USDC and $USDT continue to dominate on both chains.

3/ On Arbitrum, both $BUIDL and $USDC experienced notable growth, while $USDT faced a decline in its 90 day circulating supply shift. Meanwhile, Base had substantial rises in $EURC, enhancing its depth of non-USD pegged stablecoins

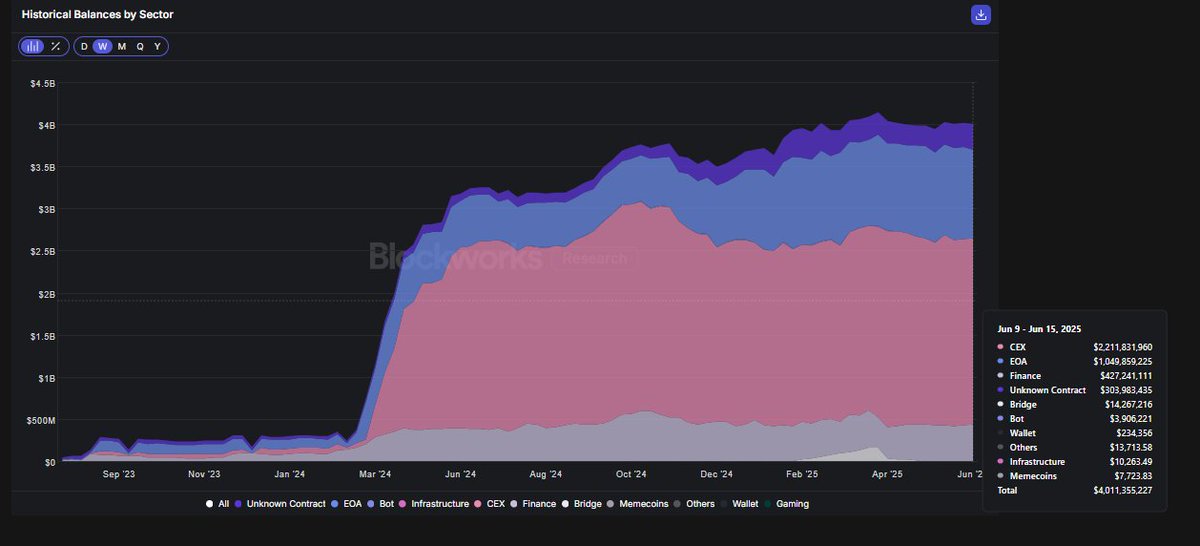

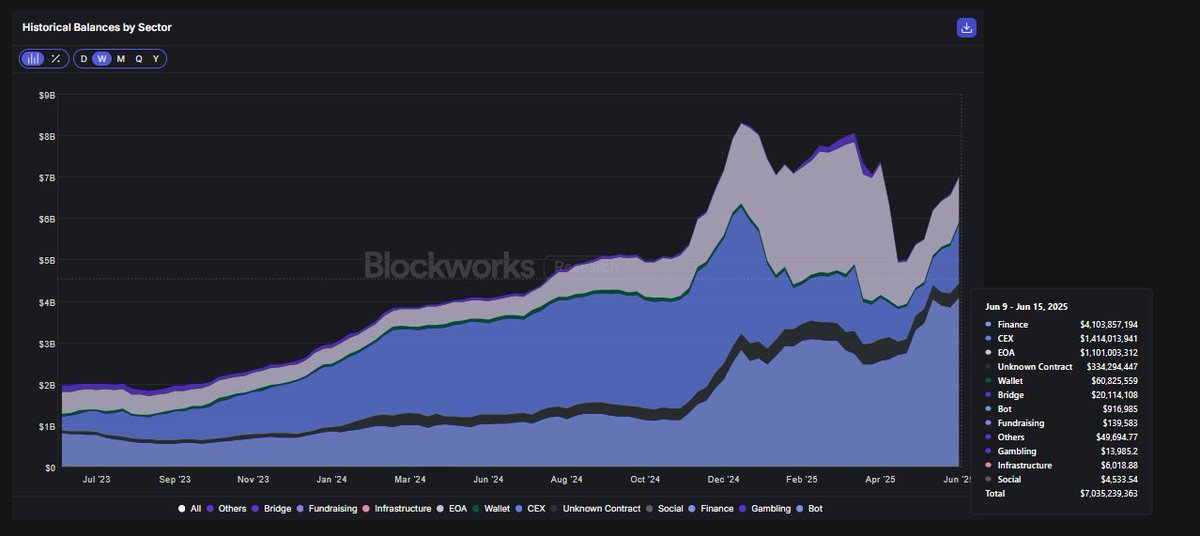

4/ On Base, the majority of stablecoins are stored in centralized exchanges such as @coinbase , whereas on Arbitrum, most are held within DeFi protocols, with the @HyperliquidX bridge standing out as the top holder

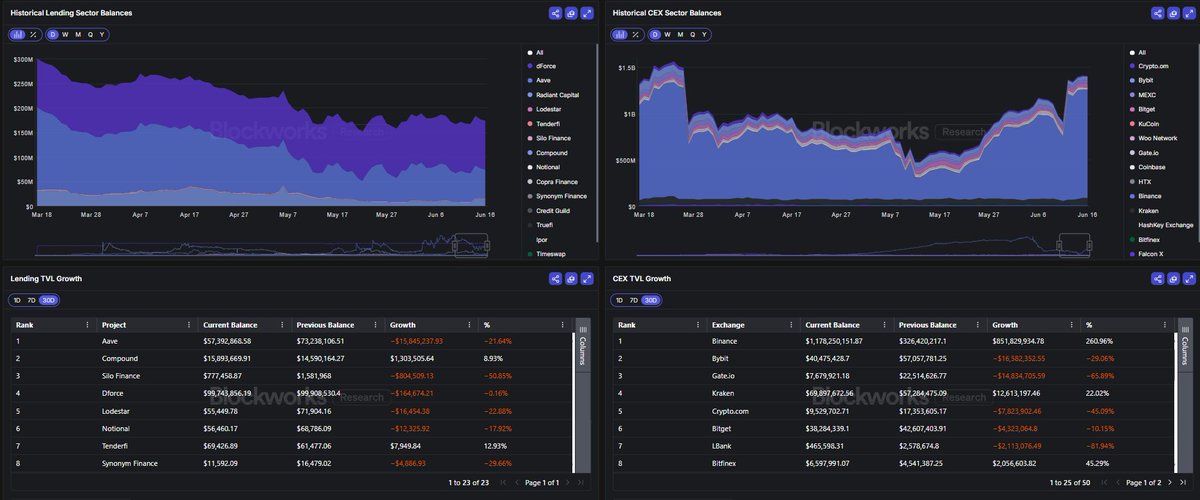

5/ In DeFi, @HyperliquidX continues as the leading powerhouse on Arbitrum. Meanwhile, on Base, @MorphoLabs is driving significant stablecoin growth within the financial sector

6/ There's been notable flows to Binance on both Arbitrum and Base concerning CEX flows.

In lending, AAVE on Arbitrum shows a notable decline over the past 30 days, while Morpho is seeing impressive growth on Base

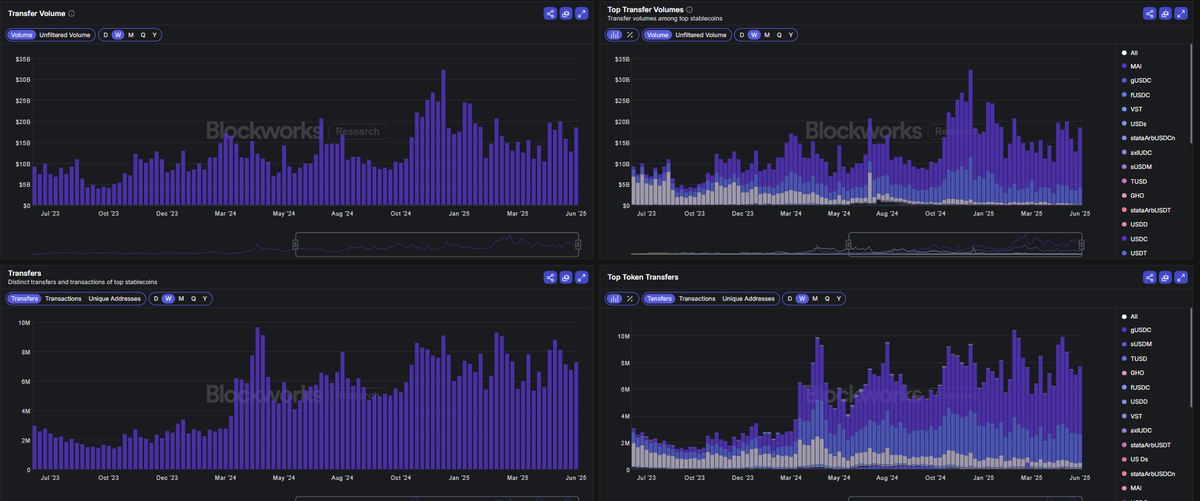

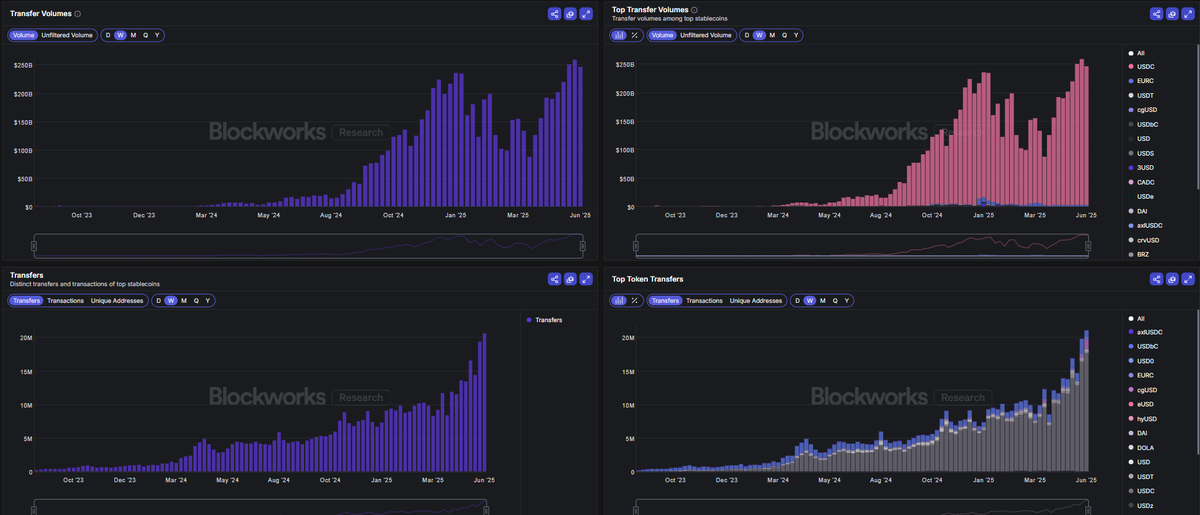

7/ Arbitrum exhibits steady transfer volumes and transactions throughout 2024-2025, predominantly fueled by $USDC and $USDT, while Base demonstrates remarkable year over year growth, largely driven by $USDC, with $EURC ranking second

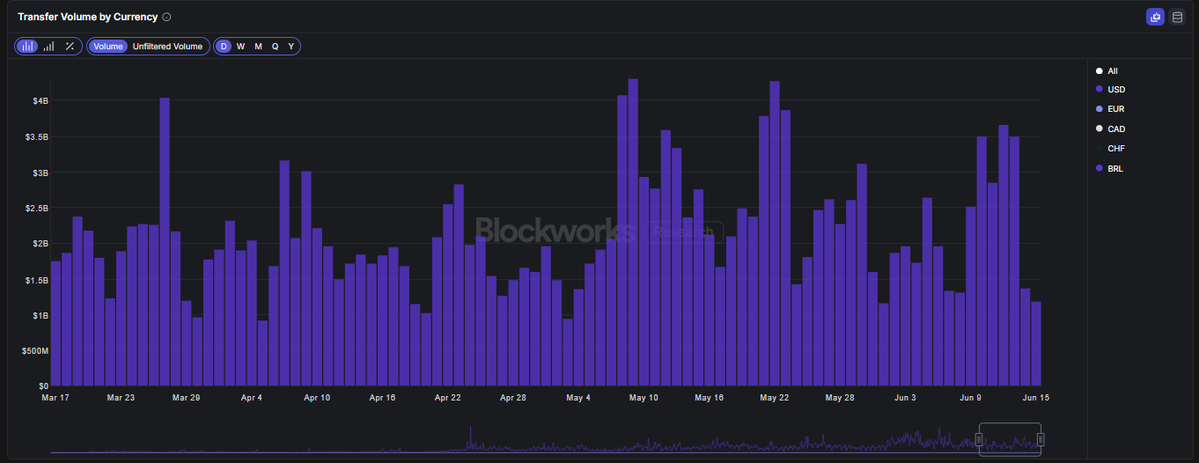

8/ On Arbitrum, nearly all volume is USD-denominated stablecoins, whereas Base features significant EUR-denominated volumes, though the bulk of activity still hinges on USD pegged assets.

9/ A preview of these insights is available above. For the full dataset and more detailed charts, check out the Arbitrum & Base dashboard, exclusive to @blockworksres subscribers

1

3.93K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.