The US stock ETF issuer Canary has officially submitted an application for the INJ ETF!

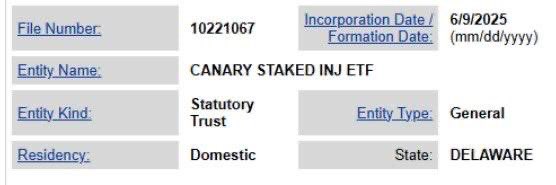

I just checked, and the US stock ETF issuer Canary has officially submitted a registration application for the INJ Staked Spot ETF in Delaware, USA. The product is named Canary Staked INJ ETF.

Unlike traditional spot ETFs, this ETF explicitly states in its terms that all incoming INJ will be used to participate in mainnet staking, directly joining the on-chain verification process, obtaining block rewards from the PoS network, and truly bringing on-chain mechanisms into the US financial system!

▰▰▰▰▰

Why did Canary choose INJ?

Canary is not new to staking ETFs. It has previously launched Staked ETFs for ETH and TRX. But this time, the choice of Injective sends a very clear signal:

🥷🏻 Injective is one of the few PoS networks that can simultaneously meet high staking yields and strong mainnet security.

🥷🏻 INJ itself has strong deflationary properties, and its token model brings additional appeal to the ETF product.

🥷🏻 The speed of ecosystem expansion is rapid, and it has already formed a real financial infrastructure effect (DEX, derivatives, oracle modules, etc.).

Canary clearly sees INJ not just as a token but as a part of the next generation of on-chain financial infrastructure!

▰▰▰▰▰

Key data (as of June 2025)

🥷🏻 The current market cap of $INJ is approximately $1.36 billion.

🥷🏻 Total supply is 100 million, of which about 58% (approximately 58 million) has been staked.

🥷🏻 At the current price, the staked portion is valued at about $780 million.

This indicates that INJ is a network with a high staking participation rate. Once the ETF is approved, it may directly impact the existing staking structure and the supply-demand dynamics of the circulating supply!

▰▰▰▰▰

Why is this important?

From the perspective of market cap and structure, Injective is currently one of the few RWA public chains that can be genuinely supported by staking ETFs! The ETF product will further increase the locking ratio of INJ, tightening the supply side and potentially supporting the coin price.

An increase in the staking rate will also enhance the security and activity of the Injective network. More importantly, this represents a trend; PoS yields are gradually being financialized, and Injective is becoming a part of this trend!

▰▰▰▰▰

Finally, this news has not received much attention yet, but for INJ, its significance may be comparable to the moment when the BTC ETF was approved. It is not just a simple transformation into a spot product but allows the on-chain yield mechanism to be incorporated into Wall Street's financial structure! This step is quite valuable!

Show original

45

59.41K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.