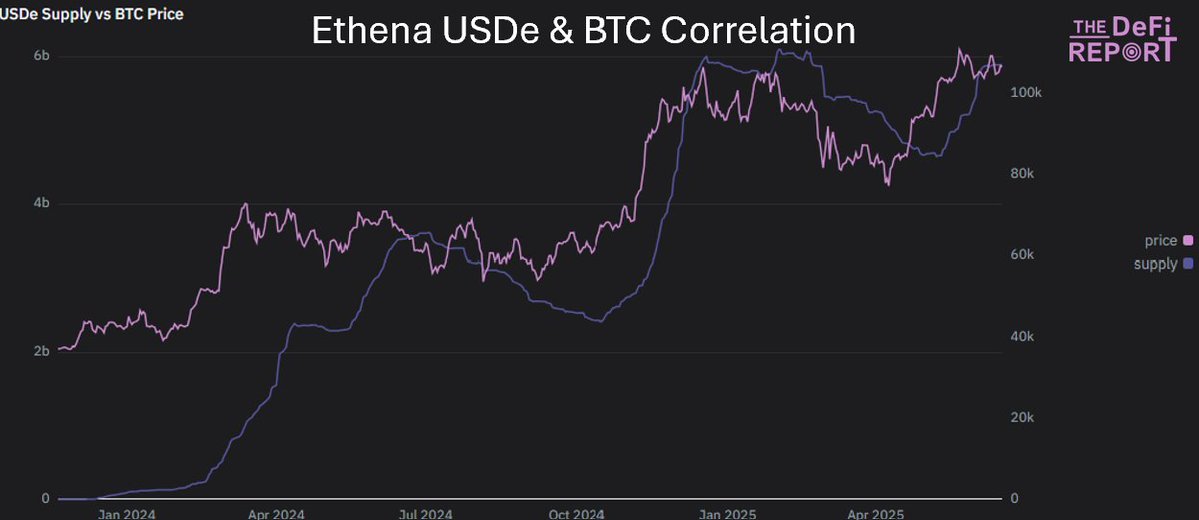

Fascinating correlation between @ethena_labs USDe supply and the price of BTC

It shows the "risk on" relationship between the crypto markets at large and the growth of USDe (now the 3rd largest stablecoin)

Bullish BTC price action --> more onchain activity --> staking yields increase --> perp funding rates increase --> yield on USDe increases --> more users swap into USDe (which earns yield via perps funding + staking), increasing the supply

----

We're sharing a deep dive on Ethena and the USDe yield-bearing stablecoin with readers of @the_defi_report on Friday.

If you'd like to have the latest research hit your inbox when it's published, you can sign up below 👇

If you'd like to have the latest research hit your inbox when it's published, you can sign up here:

0

1.11K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.