0/ Some thoughts & numbers on the $XPL token sale

1/ Fundraising details

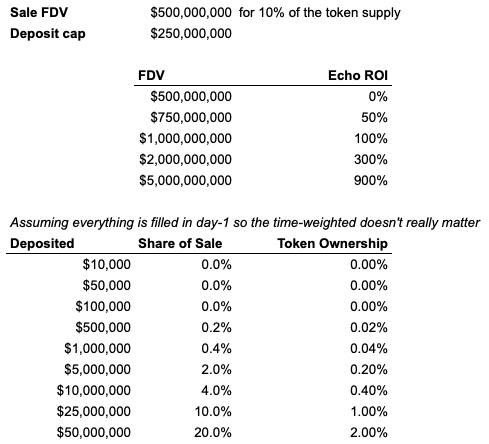

• Selling 10% of $XPL at $500M FDV

• Deposit cap is $250M

• $50M deposit cap/person

• KYC required (accredited only +12mo vesting for US)

• $USDC $USDC $USDS $DAI accepted on ETH mainnet

• Veda is the vault infra provider

• Vault is locked for at least 40-d following the public sale

• All stables are converted to USDT

2/ Earning "units"

• Units -> time-weighted share of total vault deposits

• Final # units determine your allocation in the $XPL sale

• Any unused allocations will be made available for purchase, pro-rata, for others.

Keep in mind that deposit cap is different than the % of $XPL being sold. Refer to the model above to guestimate your allocation.

3/ Thoughts

• $50M cap is not effective: I don't see the point of doing this instead of just a private round/pre-deposit deals via @turtleclubhouse or @roycoprotocol

• Positioning itself as an L1: "Hot recent launches" like Bera only sustained in the $2-3B range, so IMO a $5B valuation at the open is already a pretty bullish scenario. This isn't PumpFun, and there's no metrics yet on payment volume, etc.

• @SplitCapital is offering 18% for $5M via @WildcatFi. His cost of capital is $900k/year, which is very good considering that even at a measly $800M-$1B FDV range he'll be up 60-100% + there'll be a lot of OTC and PB infra that can provide hedging

10

14.04K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.