This token isn’t available on the OKX Exchange. You can trade it on OKX DEX instead.

USDS

USDS Stablecoin price

0x820c...21dc

$1.0011

+$0.0000000000030029

(+0.00%)

Price change for the last 24 hours

USD

We can’t find that one.

Check your spelling or try another.

Check your spelling or try another.

How are you feeling about USDS today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

USDS market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Network

Underlying blockchain that supports secure, decentralized transactions.

Circulating supply

Total amount of a coin that is publicly available on the market.

Liquidity

Liquidity is the ease of buying/selling a coin on DEX. The higher the liquidity, the easier it is to complete a transaction.

Market cap

$116.28M

Network

Base

Circulating supply

116,150,538 USDS

Token holders

17697

Liquidity

$527.12K

1h volume

$191.08K

4h volume

$756.56K

24h volume

$1.88M

USDS Stablecoin Feed

The following content is sourced from .

If you're in the YT trenches, this is art.

Pendle Intern

If you think you've seen a zero-to-hero trade, let me introduce you to 0x327.

This user:

- Started farming @sparkdotfi 2 weeks ago (69% into the program)

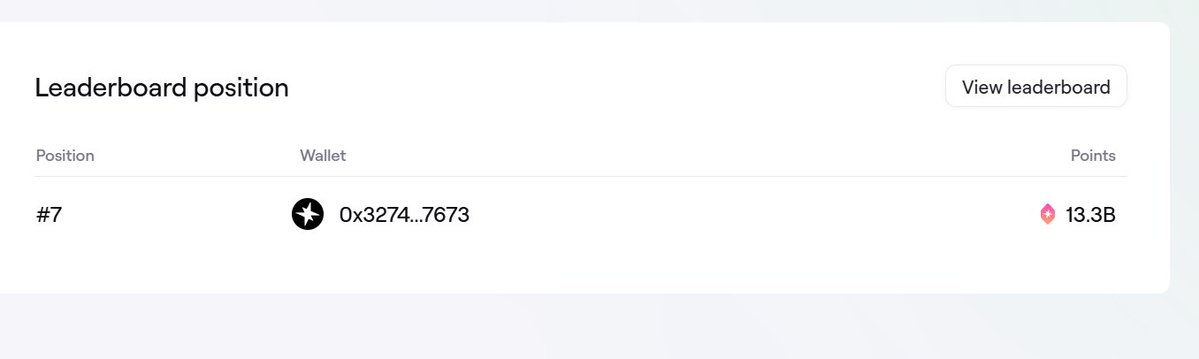

- Has 13.3b Spark Points (#7 on the leaderboard)

Zero or hero?

Let's break things down.

👇

___________________________________

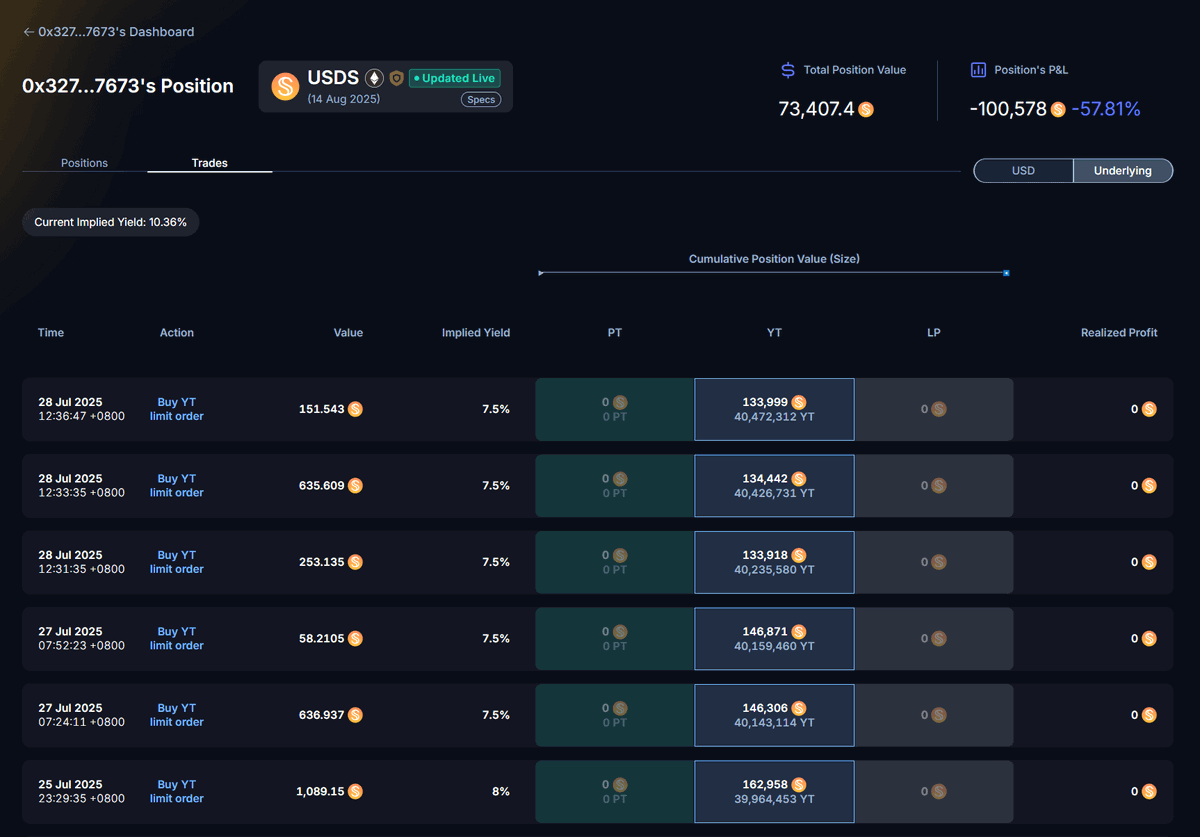

0x327 has ~$40.5m in USDS exposure on a $174k spend.

Something to note - he/she is a CLINICAL trader and their entire position is filled using limit orders.

That means they've filled their entire $40.5m position with ZERO price impact and EXACT Implied APY pricing 💅

___________________________________

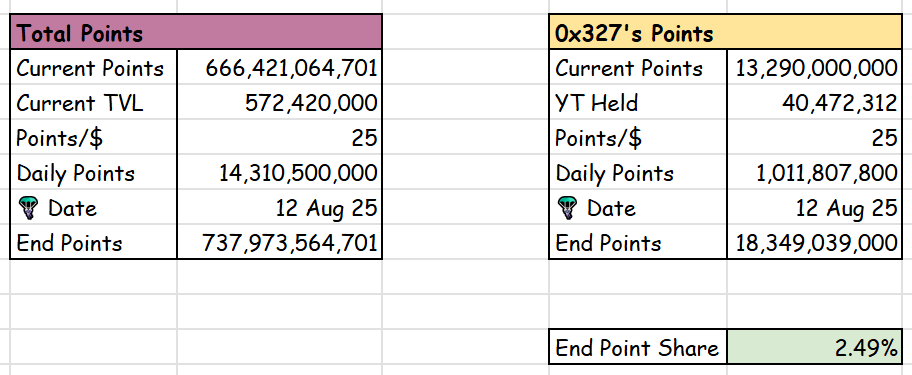

Since we're close to 🪂, its preeeeeeeeety easy for us to predict how many points there'll be in total.

It's also easy to predict how many points 0x327 will have based on his current position.

Intern's guess?

About 2.49% of the final $SPK 🪂.

___________________________________

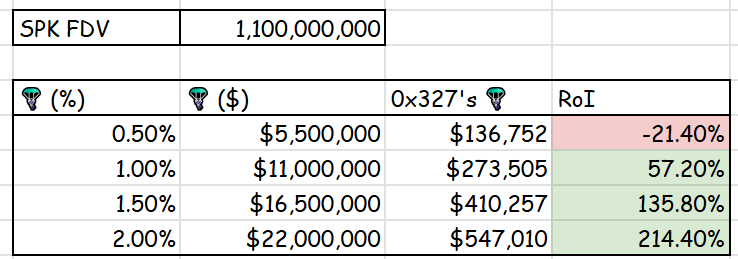

Based on $SPK's FDV of $1.1b, we can project our good lad's RoI depending on different 🪂 allocations.

0.5%? zero

1.0%? hero

1.5%? Hero

2.0%? HERO

My personal thoughts? I'm thinking something starting with 'h' +/- a capital letter.

NFA NLA NMA MDMA

Pendle

Stablecoin Market Flashes Hard-To-Ignore Bullish Signal, What It Means

Stablecoins are supposed to be boring, but right now, they might be sending a big signal. In the past week alone, over $3 billion in the stablecoin market have left exchanges.

At first glance, this looks like money leaving crypto. But when you zoom out, the data tells a very different story.

Supply Is Growing Even As Stablecoin Reserves Drop

In the past 7 days, more than $3 billion worth of stablecoins have been pulled off centralized exchanges.

That means users are moving coins out of Binance, Coinbase, and other big platforms and putting them somewhere else.

Stablecoins leaving exchanges- Source: Ali

Usually, when stablecoin leave exchanges, it’s seen as a sign that people are not planning to sell crypto soon.

Instead of keeping coins ready to trade, they’re moving to wallets or DeFi apps, or even withdrawing to cold storage.

This trend has now continued for six weeks in a row, one of the longest withdrawal streaks in 2025. But here’s the twist: while coins are leaving exchanges, the total supply of stablecoins is going up.

Rise in Stablecoin supply- Source: DeFillama

Right now, the total stablecoin supply is $268 billion, the highest it’s been all year. That’s a 5.2% increase in just 30 days.

So more coins are being minted or issued, even though fewer are staying on exchanges. It shows that people are still bringing money into crypto, just not leaving it idle on trading platforms.

Ethereum Still Dominates, but Capital Is Moving Across Chains

Ethereum remains the main home for stablecoins. In just the past 24 hours, $691 million worth of stablecoins were added to Ethereum.

That’s more than all other chains combined. This means users still trust Ethereum for DeFi, trading, and yield farming.

Stablecoins moving to protocols- Source: Ted

But it’s not just Ethereum.

Other chains like Aptos, Tron, and Arbitrum also saw stablecoin inflows. These networks are often cheaper and faster than Ethereum.

Many users are bridging coins to these chains to access low-fee trading, new token launches, or early DeFi opportunities.

For example:

Aptos has become popular for fast swaps and new apps.

Tron has long been used in Asia for low-cost USDT transfers, especially in peer-to-peer markets.

Arbitrum, an Ethereum Layer 2, is used heavily for perpetuals and yield farming, thanks to platforms like GMX.

When stablecoins move into these chains, it usually means users are preparing to trade, earn yield, or rotate into risk assets. And that is bullish for the broader crypto market.

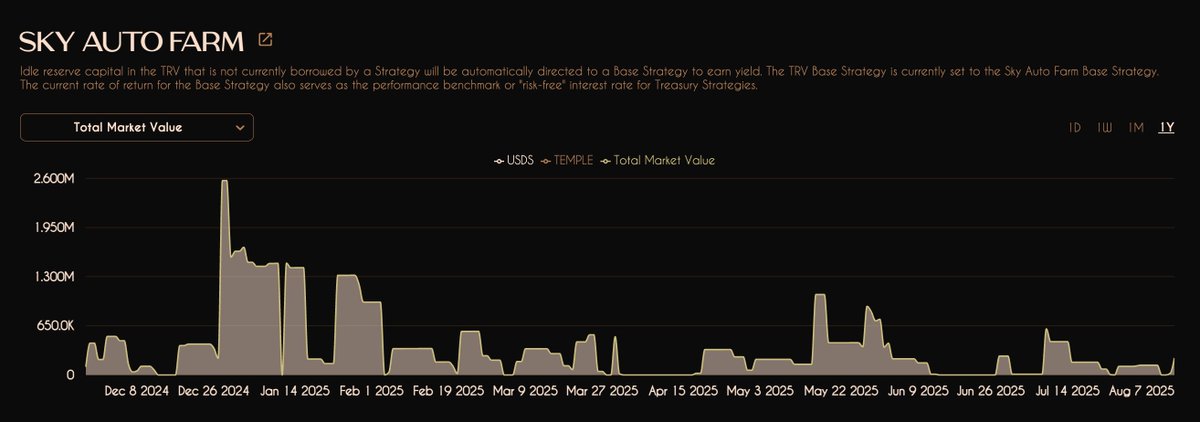

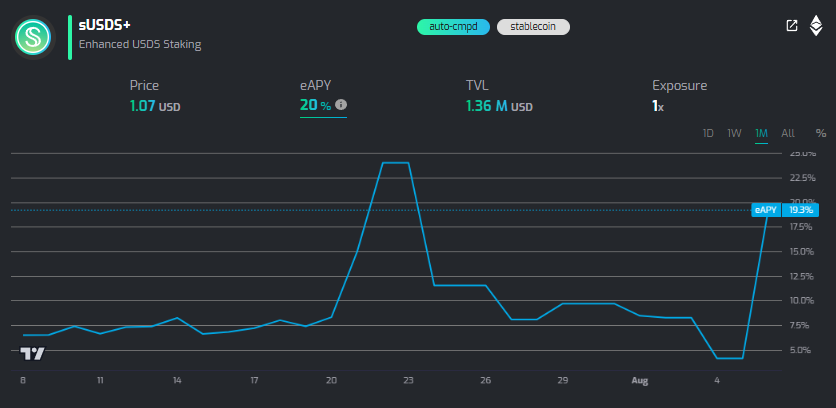

Yield-Bearing Stablecoins Are Winning the Liquidity Wars

One major reason stablecoin supply is rising is the growth of yield-bearing stablecoins. These are coins that pay you extra yield (like interest) just for holding them.

Right now, USDe is leading this trend. It has added $2.73 billion in supply since July 18. That’s more than USDT and USDC during the same period.

USDS and USDFalcon, two other yield-bearing coins, are also growing fast.

Yield generation using stablecoins is the new alpha- Source: The DeFi Investor

This is the first time in crypto history that yield-bearing stablecoins are growing faster than regular ones.

Why is this happening?

People want to earn passive income without moving into risky tokens. Holding USDe, for example, might pay 5–10% per year, way more than a savings account. It’s also easier than trading or staking.

This is the bullish shift: instead of selling crypto, traders are deploying capital more smartly, choosing stablecoins that work harder for them.

And with DeFi platforms like Pendle offering even higher yields on these coins, users now have many ways to earn without leaving the stablecoin world.

Big Picture: China Joins the Race, Stablecoin Market Outruns Visa

Outside of crypto, governments and big companies are also waking up to stablecoins.

China is testing its first stablecoin, launched through Hong Kong. The goal is to create a regulated, dollar-pegged token that can compete with US-led coins like USDT and USDC.

As Hong Kong sets up rules for stablecoin trading, China is clearly looking to expand into global digital finance.

China is Getting Into The Stablecoin Game- Source: FT

This could change how capital moves in and out of Asia. It also shows that stablecoins are now seen as tools for economic power, not just crypto trading.

At the same time, stablecoins are outpacing traditional payment systems. In 2024, stablecoin transfer volume hit $27.6 trillion. That’s more than Visa ($13.2 trillion ) and Mastercard ($9.76 trillion) combined.

Stablecoin Popularity – Source: Paul | X

Stablecoins have only existed for 11 years, while Visa and Mastercard have been around for over 60 years. This proves one thing: stablecoins are growing much faster, and they’re here to stay.

Even as billions in stablecoins leave exchanges, it doesn’t mean the market is scared.

Instead, it shows a new kind of strategy: move coins to safer or higher-yield places, take advantage of on-chain opportunities, and wait for the right moment to act.

The post Stablecoin Market Flashes Hard-To-Ignore Bullish Signal, What It Means appeared first on The Coin Republic.

USDS price performance in USD

The current price of usds-stablecoin is $1.0011. Over the last 24 hours, usds-stablecoin has increased by +0.00%. It currently has a circulating supply of 116,150,538 USDS and a maximum supply of 116,150,538 USDS, giving it a fully diluted market cap of $116.28M. The usds-stablecoin/USD price is updated in real-time.

5m

+0.00%

1h

-0.11%

4h

+0.04%

24h

+0.00%

About USDS Stablecoin (USDS)

USDS FAQ

What’s the current price of USDS Stablecoin?

The current price of 1 USDS is $1.0011, experiencing a +0.00% change in the past 24 hours.

Can I buy USDS on OKX?

No, currently USDS is unavailable on OKX. To stay updated on when USDS becomes available, sign up for notifications or follow us on social media. We’ll announce new cryptocurrency additions as soon as they’re listed.

Why does the price of USDS fluctuate?

The price of USDS fluctuates due to the global supply and demand dynamics typical of cryptocurrencies. Its short-term volatility can be attributed to significant shifts in these market forces.

How much is 1 USDS Stablecoin worth today?

Currently, one USDS Stablecoin is worth $1.0011. For answers and insight into USDS Stablecoin's price action, you're in the right place. Explore the latest USDS Stablecoin charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as USDS Stablecoin, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as USDS Stablecoin have been created as well.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.