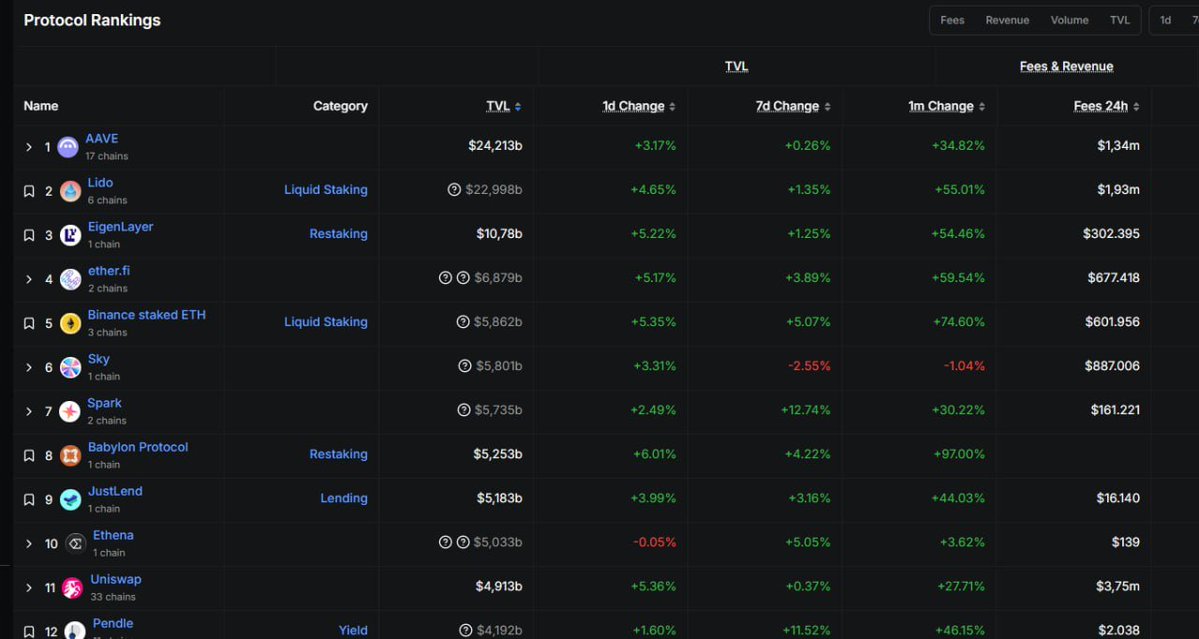

$AAVE's TVL has grown strongly, will Defi Summer come back?

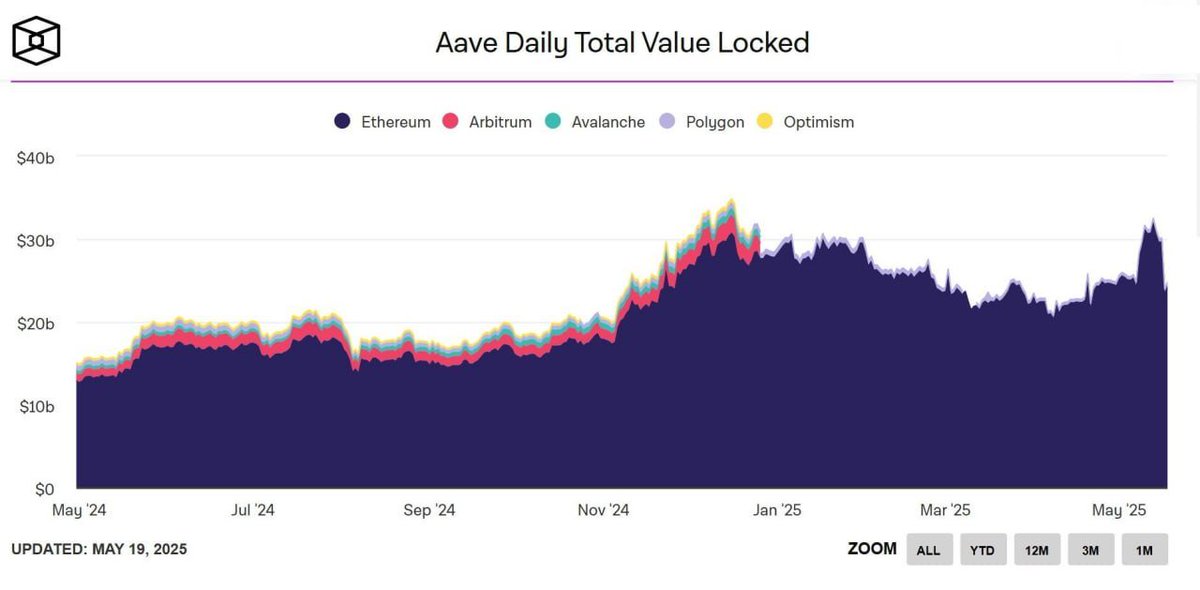

$AAVE's total value locked (TVL) has surpassed $LIDO, up 50% from a yearly low of $20 billion reaching an ATH on May 12 with $40 billion, reinforcing its position as the leading lending protocol on Ethereum and the second-largest decentralized application according to TVL.

This recovery marks strong confidence in Ethereum's DeFi ecosystem, which saw a decline in activity earlier this year. At the time of writing, $AAVE is generating more than $1 million in daily transaction fees, suggesting that active protocol usage far exceeds passive capital deposits.

$AAVE is proving its superiority in both the product and the token's price line despite the sloppiness of Ethereum and the "aggressiveness" of the Solana ecosystem.

Currently, $AAVE is fluctuating at a price of $260, leading to the growth of a series of other Defi protocols.

If Defi Summer really happens, these are the Defi projects that everyone should keep an eye on

$COW (CoW Protocol): A DeFi protocol that focuses on optimizing transactions through a "Coincidence of Wants" mechanism, which reduces gas costs and avoids front-running. It provides a decentralized exchange solution with a smooth user experience, integrating with DEXs.

$ENA (Ethena): The project develops the USDe decentralized stablecoin, which is backed by Ethereum staking assets and uses a delta-neutral strategy to maintain a stable price. Ethena aims to provide a decentralized finance solution with high yield and low risk.

$FXS (Frax Share): The governance token of Frax Protocol, a hybrid (partially collateralized) stablecoin system with FRAX as the main stablecoin. FXS is used for voting, staking and profit sharing, supporting FRAX price stability through algorithmic mechanisms

$PENDLE: DeFi protocols that allow tokenization and future yield trading. Pendle separates yield from staked assets or provides liquidity, creating a market for buying and selling yields or hedging.

#DeFi

Show original

11

43.37K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.