Problem: The best way to earn defi yield (leverage borrow/lend) is a pain in the ass to access and manage. Plus, not all of the best yield sources are collateralized.

Solution: Odyssey

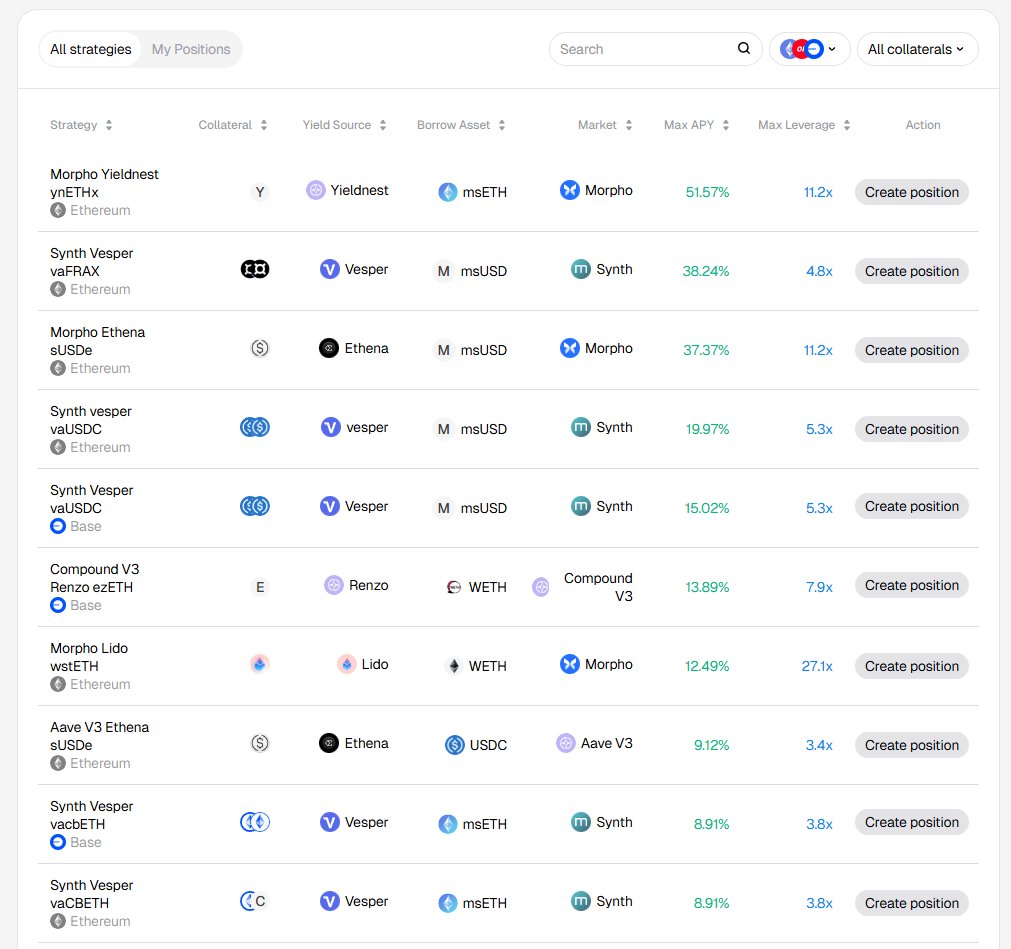

- aggregation of numerous leverage yield strategies

- one-click entry/exit

- 1st party synthetic lending + yield vaults to collateralize novel defi primitives

Here are a couple of my favorite strategies right now for ETH and stablecoins:

Best ETH yield (52%): Yieldnest + Morpho + msETH

This strategy uses Yieldnest's ynETHx as collateral on Morpho to borrow-and-swap msETH into more ynETHx:

ynETHx is a composite LRT + yield aggregator. Underlying ETH are diversified across bluechip protocols like Euler and Curve, as well as restaked into Eigenlayer to earn real ETH yield.

This strategy offers multiplied exposure to Yieldnest APY by borrowing msETH (Odyssey's 1st party synthetic ETH stablecoin) and swapping into more ynETHx on Morpho.

Earn 52% APY with potential for additional Yieldnest incentives (YND) and Odyssey points considerations.

Sleep easy USDC yield (15-20%): Vesper + Metronome + msUSD:

This strategy takes advantage of Odyssey's first party protocols (Vesper and Metronome).

Vesper is a risk-conscious, highly audited yield aggregator on Mainnet and Base. The USDC vault deposits assets into yield sources like Morpho and Convex.

This strategy utilizes Metronome Synth to borrow-and-swap msUSD into more Vesper USDC deposits.

Synth offers fixed rate borrowing, so anticipate steady APYs here.

Set-and-forget on mainnet (20% APY) or Base (15% APY) + Odyssey points on both. Odyssey activities on Base are gas-free, too.

26

3.38K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.