📊 In the current context of high global interest rates and assets seeking a "safe haven," RWA is transitioning from early experimentation to mainstream application.

We have just released a research study on the tokenization of real-world assets from a global perspective, systematically outlining three key pathways:

🔹 Tokenization of government bonds: This has become the most liquid category of real assets on-chain, with institutions like BlackRock and Goldman Sachs driving the maturity of the ERC-1400 standard;

🔹 Tokenization of real estate: Pilot REITs in Hong Kong and Singapore, and the on-chain of equipment revenue rights, while the mainland is focusing on digital property rights confirmation and "new energy real estate";

🔹 Digitalization of carbon credits: Solutions from Ant Group, Sui, and others have taken the lead in DvP mechanisms and green bond issuance, with compliance standards still needing to be unified.

The report also conducts a horizontal comparison of regulatory pathways between Hong Kong and the mainland, outlining the real landing costs of offshore SPVs, cross-border data white lists, VASP, and other institutional interfaces, and provides a breakdown of the adaptability of mainstream RWA token standards.

The ten-thousand-word report is authored by Web3Caff Research researcher @Hanghan40488295, systematically analyzing the evolution path, regulatory framework, and landing bottlenecks of global RWA.

📖 Free preview is now open:

1/📖 Web3Caff Research RWA track's latest research report is officially released!

Written by Web3Caff Research researcher @Hanghan40488295, this 25,000-word document systematically analyzes the tokenization practices of three types of real-world assets and the global institutional competition.

📂 Free preview is now available, with 8 key recommendations to bookmark.

🔗 Read the full article:

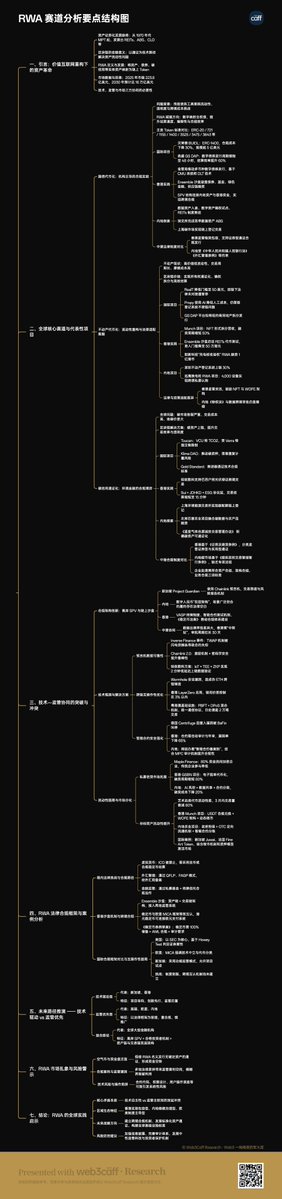

🧵 Attached structural diagram👇

1

2.85K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.