✍️ Little Beaver lands on Binance|Create a new star of Sui ecological staking

Sui ecology blooms in many places, @HaedalProtocol Little Beaver landed on Binance spot on May 21, which is more ecological.

Binance, which is used by 300 million people, must register one:

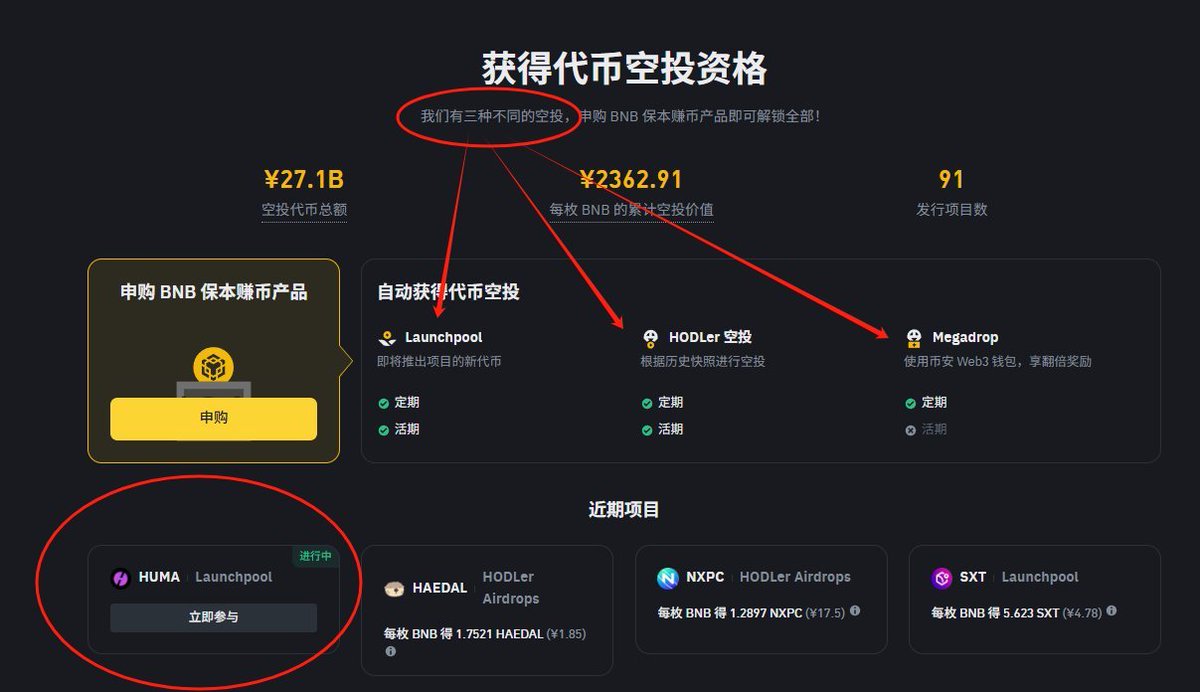

For Binance HODLer, the benefits are even more long-lasting, and all users who use BNB to subscribe to CPI (regular and/or current) or on-chain earn-to-earn products will receive airdrop distribution.

DetailsBenefits:

The following is a detailed analysis of Little Beaver's Haedal's core mechanism, competitive advantages, comparison with similar projects, and a discussion of its potential value 👇 to BNB holders

1️⃣ Overview of the Haedal Protocol project

Let's not talk nonsense, Haedal allows your SUI to earn income while "locking" and using it freely like cash, which can be called a Defi protocol that "has both fish and bear's paws".

Haedal Protocol focuses on two core functions:

(1) Liquid staking: Users can stake SUI, the native token of the Sui network, in exchange for the liquid staking token haSUI. haSUI can not only earn staking rewards, but also be used in other DeFi scenarios (such as lending, trading, and liquidity mining) to achieve the flexibility of "staking and flowing" funds.

(2) Haedal Market Maker (HMM): This is an Automated Market Maker (AMM) module that optimises the trading efficiency of haSUI through the protocol's own liquidity and provides users with additional income.

2️⃣ Haedal's core strengths

(1) The "win-win" mechanism of liquid staking: Haedal solves the pain point of locking assets through haSUI.

(2) Innovative liquidity management of HMM

Haedal's HMM (Haedal Market Maker) is another highlight of the program, which is different from traditional AMMs (such as Uniswap's x*y=k formula):

Dynamic liquidity concentration, protocol own liquidity, low fees and high returns are all highlights of improving returns

(3) On the shoulders of the Sui giants

The Sui ecosystem is expected to grow rapidly in 2025, with TVL and user activity continuing to rise, and Haedal will directly benefit from it as a core infrastructure.

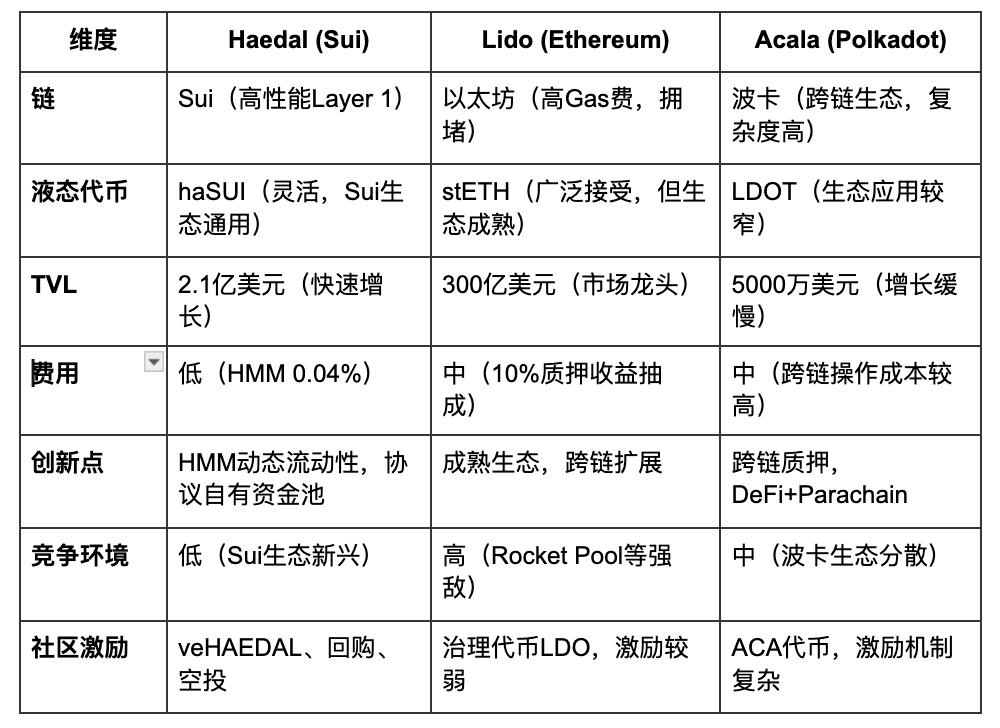

3️⃣ Comparison with similar projects

To better understand Haedal's competitiveness, let's compare it to Lido Finance on Ethereum and Acala (Liquid Staking Module) on the Polkadot ecosystem

It can be seen that the competitive environment is low, the fees are low, and the liquid token is more flexible

4️⃣ Back to $Haedal value to Binance $BNB holders

To put it simply, the Binance HODLer airdrop is a continuous bonus for Binance holdings, and you will get the airdrop if you have $BNB, which is also a lying earning.

How can I benefit? You can view this image

In the end, @HaedalProtocol stands out in the Sui ecosystem thanks to HMM's innovative mechanism.

For BNB holders, Haedal's HODLer airdrop is not only a "free lunch", but also an opportunity to participate in the Sui ecological dividend.

#Binance #SUI #HaedalProtocol

Show original

63

32.51K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.